It's likely to be a rough day for shareholders in API (LON:API), as they announce that the protracted company sale process has now fallen through (incidentally just to emphasise, if it's not obvious, where I put in a link, as in the last sentence, this clicks through to the relevant announcement on investegate.co.uk, or to something else relevant, e.g. a previous comment).

This follows an ominous announcement on 25 Jan 2013, when API stated that indicative proposals from potential buyers of the company had been below the then market price of 90p, and also the sales process sounded like it was unlikely to continue. I've been sceptical about this sale process for some time now, as stated in previous comments here. It was taking too long, and the pension deficit was likely to be an impediment to a takeover. Also, risk/reward was all wrong after 25 Jan, with the upside capped at below 90p, yet downside from the process falling through.

API also issues a trading update today, which is a very mild profits warning, saying that results for y/e 31 Mar 2013, "are likely to be marginally below previous management expectations", but, "will demonstrate substantial year on year improvement". The outlook sounds mixed. So I suspect these shares are likely to take another lurch downwards today. There is no dividend yield to cushion the fall either, although clearly they will now need to introduce a dividend, after all paying divis is what companies exist to do! (something that management often forget).

I'm not terribly interested in chasing this one down, unless it gets really cheap, because we now know that it's a company nobody wants to own! Its large shareholders want out (they pressed for the sale process in the first place), and nobody in the trade or private equity seems to value it at a worthwhile premium. I might get interested at 50p, but probably not much higher than that, but let's see where the price settles & then take a view. My commiserations to friends who were in this one - I suspect the damage is done, so if I held then I'd probably park this in the long-term, hasn't really worked out, section of my portfolio, or just dump it & move on.

Recruitment group Harvey Nash (LON:HVN) puts out a positive trading update, saying that results for year-ended 31 Jan 2013 are, "expected to be slightly ahead of expectations, which were upgraded in Nov 2012, and that it intends to recommend an increase in its final dividend of 10%".

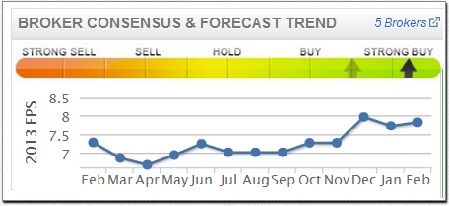

Here is the one for HVN, so you can see the jump in forecast EPS to 8p in Dec 2012, which is what their trading statement is referring to. A rising trend in forecast EPS can be a precursor to favourable trading news, so it's a useful indicator.

HVN shares have jumped up 8% to 72p this morning, so that puts them on a PER of just under 9. They had net debt of £14.1m at 31 Jul 2012, which is fairly material at 19p per share. However, they report today that this turned into a net cash position of £4m at 31 Jan 2013. This seems to be mainly due to seasonal working capital movements, as trading cashflow alone would not be anywhere near enough to have caused an underlying reduction of that extent.

Overall it looks priced about right to me now. Smaller recruiters don't command high valuations, although the dividend yield at HVN is still quite attractive, given that they should pay out 4.4p for the year, so that's a very good yield of 6.2%. I'd be tempted to buy on any dips, just for the dividends.

What next? Micro cap 2Ergo (LON:RGO) intrigues me, although I sold my shares recently, because I needed money to buy something else with more immediate upside, Clean Air Power (LON:CAP). It was horribly illiquid though, and I had to take a price of 12p (when the quote was 13p, and the offer was 15p) to shift just a couple of £k worth of shares.

RGO has scaled back its operations to two key product lines, so it's very much in last chance saloon, with the Directors using their own money to heavily back its last, massively discounted fund-raising. Despite this, the products look good, and relate to electronic discount coupons for smartphones, which can be redeemed using a touch terminal at the till point. Clever idea, but hasn't really taken off. If it does, then expect RGO's market cap to multi-bag from here.

Previously they had said that they expected to reach profitability in 2013, but that has now slipped to, "in the year ending August 2014". They have £800k left in the Bank, but do have unutilised bank facilities - which is strange, as I'm surprised any Banks would lend to a loss-making minnow like this, so I wonder if Directors have any personal guarantees in place? Would be a nice sign of commitment if they did, on top of putting in £700k of their own money into the last Placing - nothing focuses the mind like having your own money on the line, which is one of the things that intrigues me about RGO. For the moment it stays on my watch list. The contract wins they mention today look pretty insignificant to me, so no big breakthrough yet.

Well done to shareholders in London Capital Hldg (LON:LCG), a small spread betting group, as they announced yesterday that they have received takeover approaches from three competitors! The shares have shot up from 34p to 54p. I'm kicking myself on this one, as it came up on one of my value screens a couple of weeks ago, I researched it, and almost bought some, but held back due to competitive worries, and ongoing legal & compensation problems.

However, it is a reminder that there is still value out there, lurking undiscovered amongst the laggards which have not participated in this big rally in smaller caps over the last 6 months. I shall be writing another stock screening article shortly which will try to find such laggards.

Incidentally, I always Tweet when new articles are published, so by all means follow me on Twitter @paulypilot to get an alert & link to all new articles I write, and our gracious hosts here, @Stockopedia on Twitter. Some people are dismissive of it, but if you use Twitter as a tool to focus in on relevant stock market people & organisations, it is a terrific source of bang up-to-date news & opinion. Very useful indeed to investors.

Youu know that a management have no idea what to do, when they abandon an existing brand name and replace it with something new & completely meaningless. Such was the case with Yellow Pages, or Hibu (LON:HIBU) as it is now called.

It's been obvious for years that the equity was worth nothing, due to extreme levels of debt, and an underlying business in terminal decline due to the internet. However, they stated as much in an IMS yesterday, which talked about restructuring the debt. Buried within this announcement was a statement that little or no value will be attributed to the existing shares, i.e. they are worthless.

Despite this, some lunatics are still trading the shares, but I do want to emphasise to readers that HIBU shares are almost certainly worthless gambling chips, and the market cap of £8m is a nonsense. I just wanted to flag this up to readers, so you don't get sucked in.

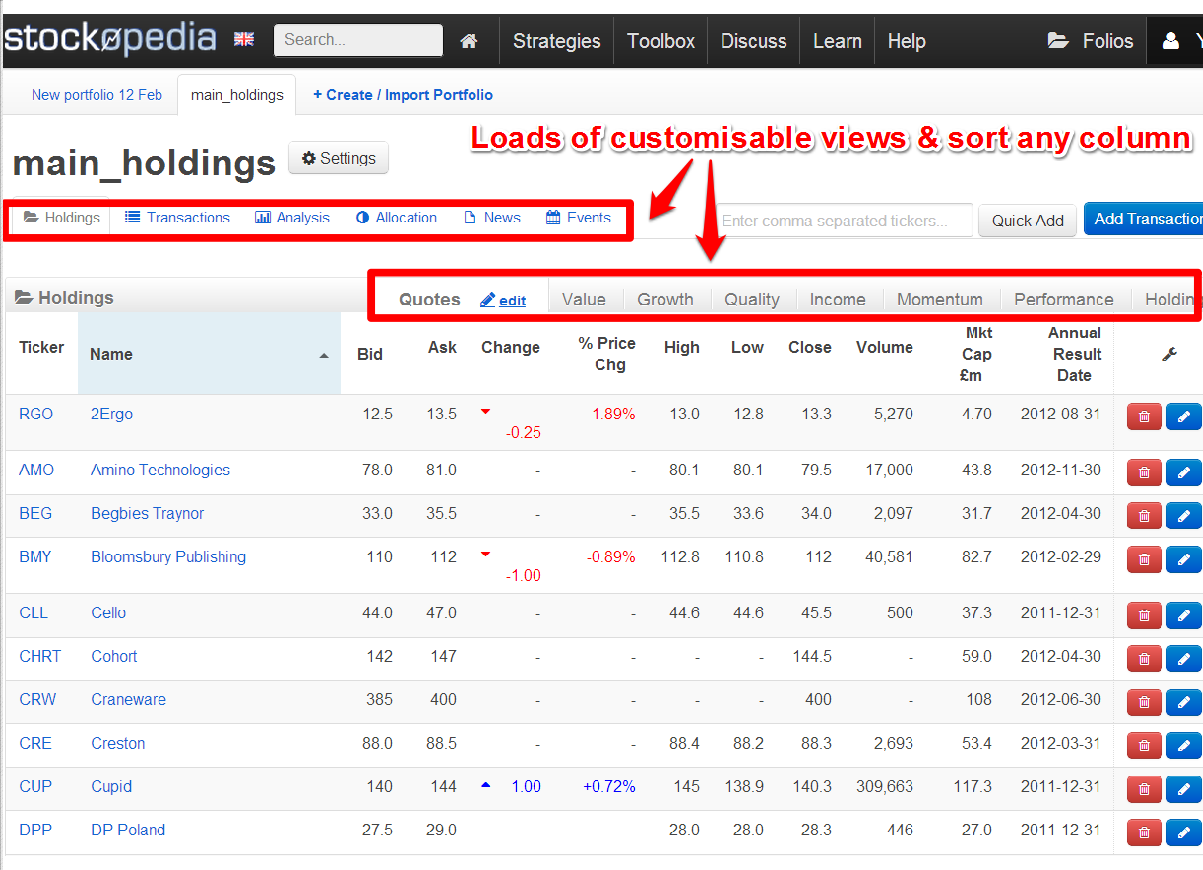

I'm not obliged (or even asked) to promote anything about Stockopedia, so when I do mention features here, I'm doing so because I like them! There are tons of useful tools buried in the site, and I found one yesterday that is worth mentioning, as it's very useful & not something I've found elsewhere.

If you go to "Folios" on the top menu, and then click on "+Create Portfolio", you can build a list of your shares just by keying in the EPIC codes, separated by commas. So only takes a few seconds to set up. You then get a portfolio list, which not only shows share prices, but also has a load of other customisable views, and can be sorted by any column. So here is my basic Watchlist (called "main_holdings", but it actually contains lots of things I do & don't hold!):

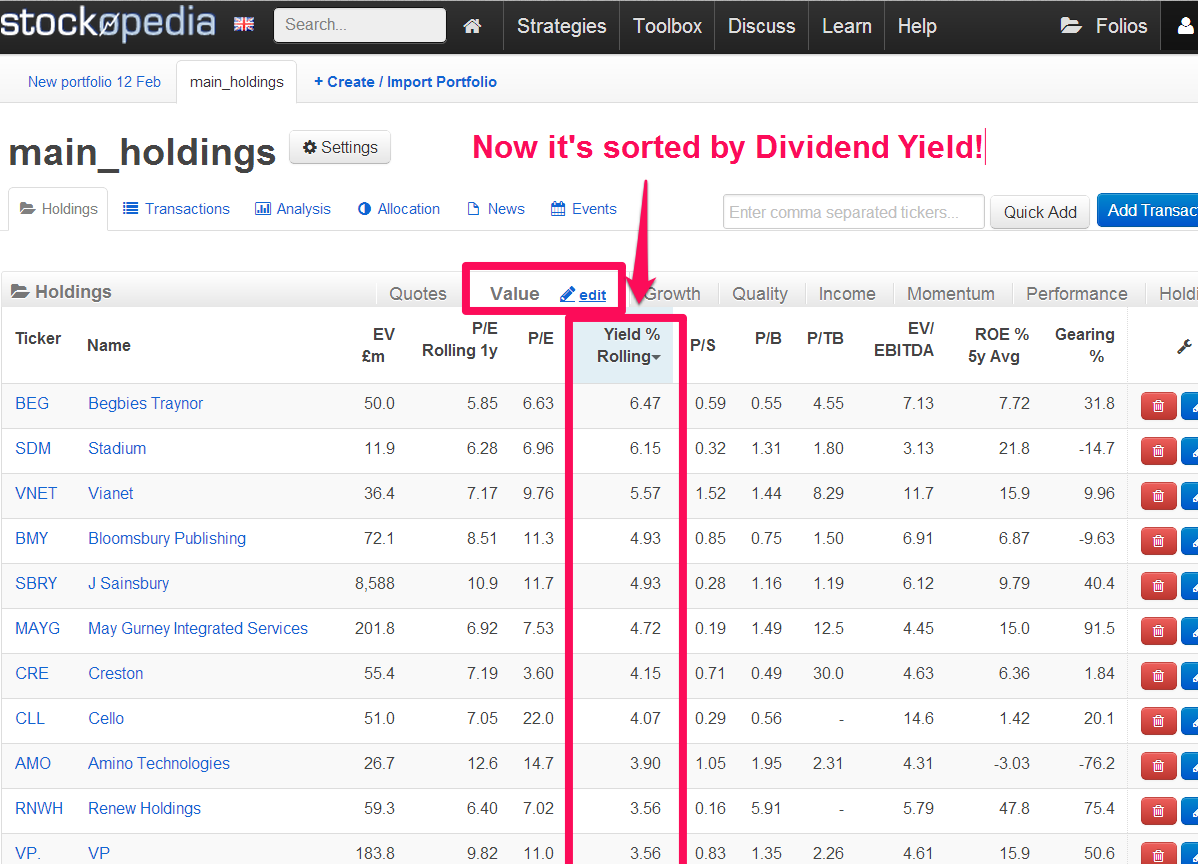

Now I've clicked to view my Watchlist by forecast dividend yield (can be any field you want, on multiple pre-set, or customised screens):

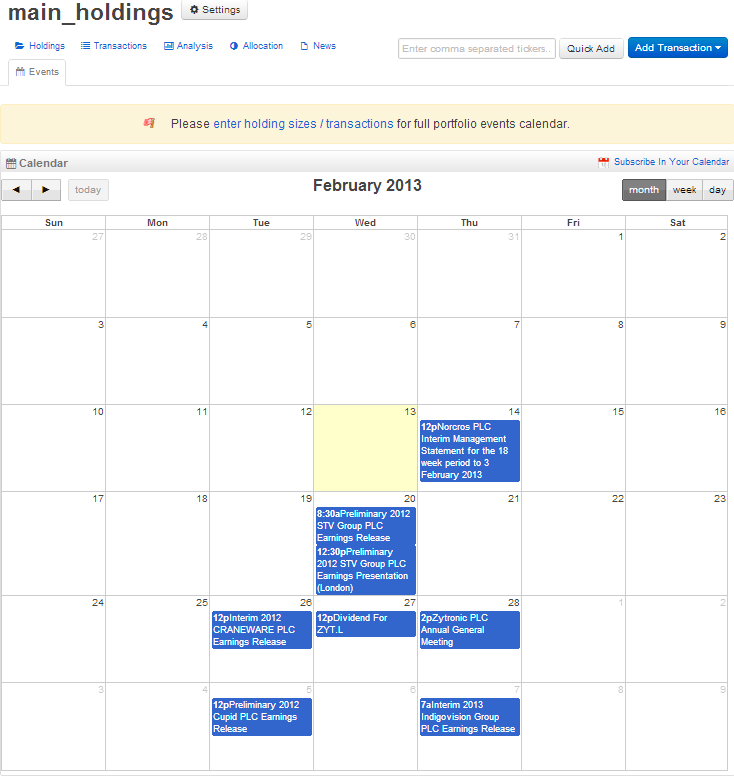

Here's my favourite bit! If you click on "Events", it gives you a calendar of forecast announcements for your portfolio (this can be imported using an ical file, but I couldn't get it into my Google Calendar):

Pretty nifty, huh?! So I know to look out for Norcros (LON:NXR) results tomorrow, which is one of my favourite value shares.

That's it for today, fairly quiet on the results front, so thought I'd mention some other useful ideas.

Bracing myself for a deluge of 31 Dec 2012 results, which must be imminent!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in CAP and NXR. Paul has no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.