Norcros (LON:NXR) issues a planned IMS (Interim Management Statement) covering the 18 week period to 3 Feb 2013 (which is the bulk of H2, since their year-end is 31 Mar 2013). They are the maker of Triton showers, and Johnson Tiles & adhesives, with operations in the UK and S.Africa. I am an enthusiastic holder of Norcros, and believe the company has excellent value & recovery characteristics, especially when you work out how strong normal cashflow is, once one-off factors are stripped out, and the large depreciation charge added back.

There seem to be a lot of positives in today's IMS. Group revenue is up a surprisingly large 15.1% in the 18 weeks in constant currency terms, but that dropped to a still impressive 10.8% in reported sterling terms (the difference being due to a weaker S.African Rand). Not bad going when they describe conditions as "subdued", so clearly NXR is gaining market share strongly - a very good sign in my opinion, as that effect is likely to be multiplied once the economy recovers.

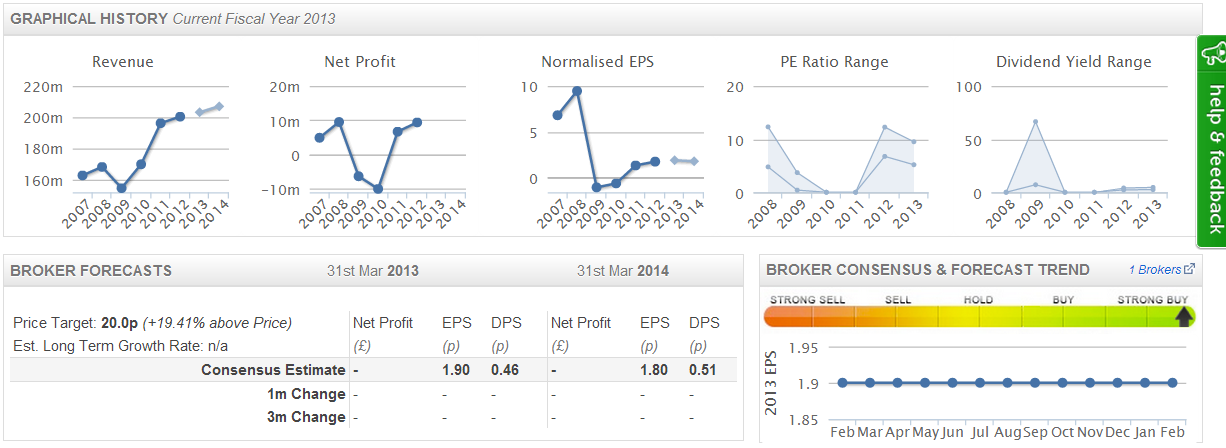

The outlook statement says that they, "should continue to make progress in line with market expectations for the current year". Market expectations are for 1.9p EPS, but that forecast hasn't changed throughout the last year, as can be seen by this snippet from the Stockopedia StockReport on Norcros:

I particularly like the 5 graphs above which enable you to instantly understand key long-term trends in Revenue, Profit, EPS, and valuation.

As the 1.9p EPS forecast hasn't changed for a year, and given today's strong IMS, I would have thought that NXR is likely to out-perform this target. Their interim results showed underlying EPS up from 0.9p to 1.1p, and given that they achieved 1.9p underlying EPS for the last full year, it doesn't make sense to forecast unchanged EPS for this year, given that they were 0.2p ahead at the interims, and trading strongly in H2.

So I suspect that the full year results to 31 Mar 2013 are likely to be ahead of the 1.9p forecast, although perhaps they want to keep something in the back pocket until preliminary results are announced in mid to late Jun 2013?

The pension deficit at Norcros should also now be reducing, given that Gilt yields have risen in recent months, and in any case they own more in freehold property than the deficit on the pension fund, so it's a red herring in my opinion. Furthermore, net debt is only 1.1 times EBITDA, so could be cleared within say 2 years, and they have ample headroom on borrowing facilities. There might even be some acquisitions?

In my view Norcros could be looking at, with operational gearing and an economic recovery (which is already underway, based on Mervyn King's suprisingly upbeat commentary yesterday), EPS rising to say 3p in the next year or two, and a PER of 12 would be justified, therefore that implies a share price upside to 36p in (say) 2 years, compared with 16p now. Hence why this share is a long-term hold in my personal portfolio. It also throws off a 4-times covered dividend yielding 2.75%, forecast to rise to 3% next year, so a satisfactory income while we wait for the shares to (continue to) re-rate. All rather pleasing, I'm happy to leave this in my portfolio for the foreseeable future.

VP (LON:VP.) issues an IMS covering the same period as Norcros's, i.e. H2 to date (with a 31 Mar year-end). They are a niche equipment hire company, and I was impressed with management when they presented at a recent investor evening organised by Equity Development. Incidentally, the slides from the companies who presented that evening (for VP Group, Tracsis, and Regenersis, all interesting companies) can be viewed on ED's website here, and are worth a look.

VP is a boring, steady company that consistently performs & raises its dividend, and is reasonably priced. So ideal for tucking away in a pension fund for 5 years or more, in my opinion. As you would expect, their IMS today is reassuring, saying that full year profits are expected to be in line with market expectations.

Here is the same snippet of info on VP Group:

VP has also, "secured a number of LNG contracts in the Asia Pacific region which will contribute in the new financial year". At 338p the shares are on a forecast PER of 10, and dividend yield of 3.6%, so still quite attractively priced. There is some debt of course, as there always is with tool hire businesses, and I'm never quite sure how to treat debt in valuation terms. Do you add it all to mkt cap, and look at EV? Or do you treat is as a revolving item, and providing it's within sensible limits, then ignore the balance sheet amount, and just account for the interest cost, then value the shares on a PER basis only?

Hmmm, not sure, but I lean towards the latter. A moderate amount of debt is necessary to buy the equipment that they hire out, and is covered by the asset value, so it's really only the interest cost that matters. So a multiple of 10 times EPS looks quite good value to me, for a well managed niche business with fairly good profit margins.

There seems to be a problem with the news announcements this morning, so I'm having to scrabble around to find news on different websites. Also this means I can't put in the usual links to investegate, which is annoying, but I'll add them later this evening when the glitch has been corrected.

Shares in industrial chains group Renold (LON:RNO) are down 24% to 21.5p at the time of writing, on an IMS for the 4 months to 31 Jan 2013. Underlying group revenue is down 8.7%, and they have cut some costs. Operating profit in H2 will be, "broadly in line with the first half".

They achived 0.8p EPS in H1, so that implies a full year figure of 1.6p EPS, against market forecast of 2.73p, so that's a fairly significant profits shortfall. So the current price is about 13.4 times this year's likely earnings, not really cheap, unless you think they can drive profits back up?

They are conducting a review of operations, which usually ends up with closures, job losses, lots of exceptional costs & write-downs. So it looks potentially messy to me, and an industrial chains maker just doesn't interest me. Also they have too much debt, and a whacking great pension deficit, and doesn't pay dividends, so it looks a very unappealing share to me, and I'll make a note not to bother looking at it again, as it's a waste of time from my point of view.

Tristel (LON:TSTL) an infection control & hygiene products, has also warned on profits, its shares being down 24% to 22p. Their endoscopy business has seen a, "sharper than expected decline", and this has resulted in an underlying loss of £0.6m for the 6 months to 31 Dec 2012. However, they do say that they are confident of a profitable full year outcome to 30 Jun 2013, so that implies H2 will make profits of at least £0.6m.

This could be a good entry point if you like the business, as the outlook statement says that they, "look forward to a strong second half, and further growth in 2014 and beyond".

I don't know Tristel well enough to be able to comment any further, but it looks worth another look, with the market cap down to £8.8m, and the problems of H1 apparently being temporary - that is generally the best time to catch a falling knife, i.e. if you are confident the problems that triggered the fall are passing. It's all about looking fowards, and not obsessing over hiccups which all businesses (especially smaller ones) inevitably face.

A lot of friends are saying to me that they're nervous about the market overall, given that we've had such a good bull run, especially in smaller caps, for the last 6 or 7 months. I agree that we're probably overdue a correction in the short term, but as Mervyn King said yesterday in his latest speech on the state of the economy, we are now in a, "slow but steady" economic recovery. In particular, he noted that underlying GDP growth in the UK was actually 1.2% in 2012, for manufacturing & services, and that the only reason the headline figure was flat is because of a sharp contraction in the construction sector, which is a factor that is not likely to repeat in 2013. Indeed, with housebuilders now in rude health, it could go the other way (Mervyn didn't say that last bit, I did!).

So it is entirely logical that the market is now starting to price in future growth, as opposed to worrying about further contraction. It's just a question of sorting the wheat from the chaff, and holding good stocks that are likely to out-perform, in my opinion, and top-slicing things that have risen a lot, and ditching things that have got ahead of themselves.

I'm trying not to open any new positions, as I'm already geared, and want to see that gearing come down because markets have been so buoyant - this is vital to be able to withstand any corrections, without being forced to close geared positions (spread bets & CFDs). Generally gearing is a nightmare, but in a bull market it can dramatically enhance the returns. However, as I discovered in 2007-8, it can also cause disaster in a bear market, especially if you are in large geared positions, in stocks where liquidity dries up.

Hence why these days I am careful not to over-size individual positions, and usually don't buy more than about 5-10 times the normal market size, as at least that way you can get out if something goes wrong, either with the company, or the economy overall.

Right, gotta dash, see you same time tomorrow & every weekday.

Best wishes, Paul.

(of the companies mentioned today, Paul has a long position in NXR, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.