Pre 8 a.m. comments

Good morning! Fairly quiet for results today, although my eye has been drawn to a trading update from Solid State (LON:SSP). They say that sales and pre-tax profits are in line with expectations for the year ended 31 Mar 2013.

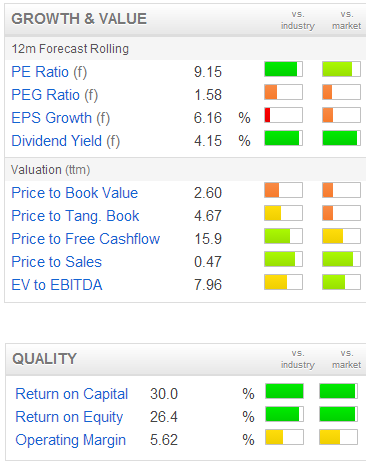

As you can see from the Stockopedia "Growth & Value" table on the left, there are some good strong green bars (indicating top quintile in both absolute & sector relative terms) in the key areas of PER, dividend yield, and ROCE/ROE.

For me, that is always my instant glance as to whether the shares are worth looking into further, which in this case they are.

Also, a positive or at least "in line with expectations" trading statement is always a good starting point for researching whether to buy some shares, as you have at least got certainty over current trading, which reduces the risk of a profits warning, at least in the near future.

They have also done what appears to be a good value acquisition, paying £900k cash for Q-par Angus Ltd. It had turnover of £2.25m and post-tax profits of £214k for the year ended 31 May 2012, so the acquisition price of just £900k looks to have been a good deal. It is said to be earnings enhancing, which of course any profitable acquisition will be, if paid for in cash!

They conclude the trading statement by saying that order intake "remains strong". Looks to be an interesting potential investment, I might do some more work on this over the weekend.

Johnson Service (LON:JSG) issues a positive-sounding AGM trading update. Key points are that trading has been in line for the first four months of the year. They remain confident for the full year. It's got too much debt for my liking, so for that reason doesn't meet my investing criteria.

Post 8 a.m. comments

One thing that's generally struck me, is that whilst we've had a fairly indiscriminate move up in many shares in the past year, in order for those price rises to stick, then companies have to deliver solid trading results. So we're seeing some quite sharp pullbacks in share prices where results do not live up to expectations.

All the more reason to take some (or all) money off the table where shares look fully-priced, in my opinion. It's all about weighing up risk/reward, and in my view unless I can see a realistic 100% upside on the share price with a 2-3 year view, then there's no point in buying (or holding). Things on stretched valuations, where out-performance against broker forecasts is needed to support the current price, are potential accidents waiting to happen. Why run the risk, when there are selectively still good companies out there on modest valuations?

Also there's a lot to be said for moving into cash (in part) after a very strong run in many shares. We don't have to be fully invested all the time, although personally I find it incredibly difficult to be anything other than fully invested, because I keep finding interesting companies to invest in.

I mentioned yesterday that Synectics (LON:SNX) looked fully priced, and its Chairman seems to agree, as he's just sold 500k shares at 410p. The announcement has some guff about institutional demand, and not intending to sell any more, but bottom line is that a sale is a sale, and Directors don't usually sell if they think the shares are cheap.

Another share that I've been pondering is Snoozebox Holdings (LON:ZZZ). I liked the concept a lot, and wrote about it shortly after they Floated last year here. However, I later got cold feet when the market cap rose to levels which seemed unjustified for a business that was essentially a start-up.

It's all gone a bit wrong with a profits warning, and management changes recently. So I've been thinking about revisiting it now the shares are much lower.

The trouble is, it's almost impossible to value with incomplete information. The market cap is still around £25m, so a fair whack for a loss-making company with a business model which is (so far) unproven.

Also, I've been wondering whether the impressive-sounding events market is really so good after all? It's a considerable amount of time, effort & cost to erect a Snoozebox portable hotel just for a few days at a Festival or sporting event, only to then dismantle it all again. Will the revenues be enough to cover all that work? As someone pointed out on a bulletin board, it might be easier just to buy a fleet of motorhomes, and drive them to the site, and rent them out?

Where Snoozebox might work is the longer term & semi-permanent installations, for say building sites, armed forces, etc. I'd certainly be interested in seeing an up-to-date broker note on Snoozebox, if one is available, but at the moment don't have enough information to consider buying any shares in it. The market cap is probably still too high, given that serious question marks now hang over the business model's viability.

Interim results to 28 Feb 2013 from Character (LON:CCT) look a bit scary. The share price has barely moved, so a poor H1 must have been anticipated. Even so, turnover being down 31%, and moving from a profit of £5.6m to a loss of £1.9m demonstrates what a volatile business they have.

The outlook statement states;

We remain comfortable that forecasted sales are currently on track for the calendar year as a whole. This should not only re-establish the profit margin but also underpin the overall Group's performance and lead us to achieve current market expectations for the financial year ending 31 August 2013.

Although checking broker forecast consensus for the full year, it seems to be for a small loss. Combined with this company's history of having periods of significant under-performance from time to time, would make me nervous if I held. It's difficult to see any upside on the share price based on current forecasts, indeed this looks to me like a potential accident waiting to happen, so I'll be steering clear.

I've trawled through a lot of other announcements, but not found anything else worthy of note, so I'll sign off for the day, and see you just before 8 a.m. again tomorrow.

Several people have told me that they find it difficult to find my latest reports. There are several options:

- Follow me on Twitter @paulypilot as I Tweet when articles are published each morning.

- Bookmark this page, which shows my latest posts (scroll down).

- Bookmark the most active discussion threads page on Stockopedia.

- Check the Stockopedia home page, and scroll down to where my latest report is usually in a section on the right hand side.

Regards,

Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.