Pre 8 a.m. comments

Good morning! I'm trying out a new idea of posting a report just before 8 a.m. for the most time-sensitive couple of results (assuming the investegate news feed is working properly, which seems a largely random factor at the moment). Then I'll carry on typing & publish the full report as usual around 10 a.m..

(follow me on Twitter @paulypilot to be notified as soon as articles are published every weekday. We're aiming to get an email notification service set up through Stockopedia in the future)

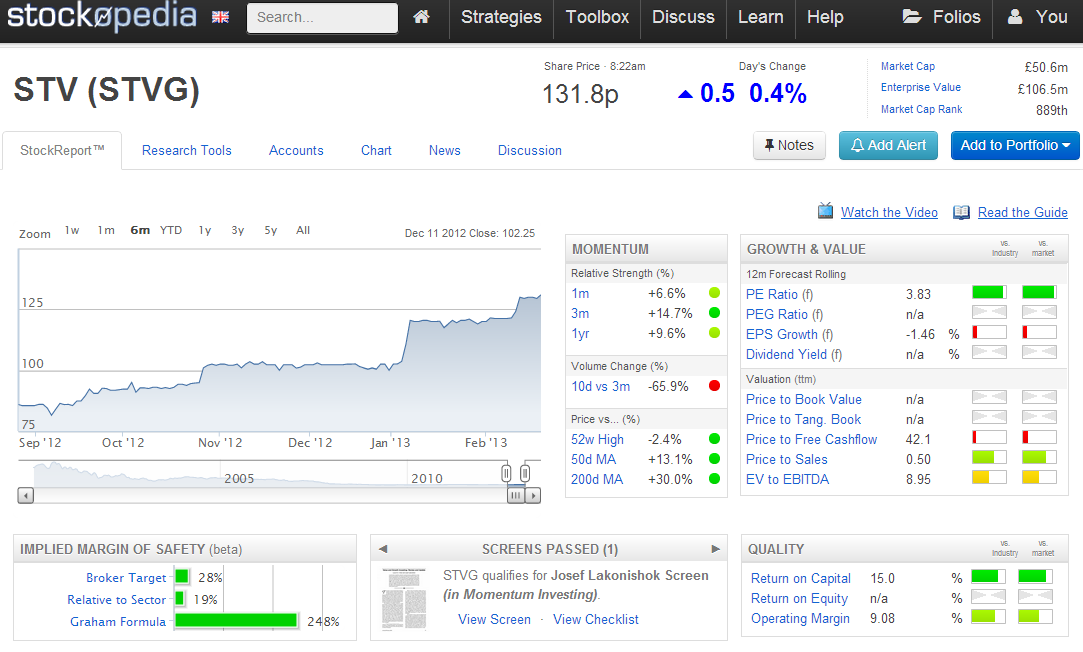

The most important results this morning for me are STV (LON:STVG) final results for year ended 31 Dec 2012, as I hold some in my personal portfolio. At 131p a share, the market cap is £51.2m, as there are 39,050,000 shares in issue. The attraction here is the very low PER (forecast at just 3.8, based on 34.4p EPS), but that is tempered by considerable net debt, and there's a pension deficit too.

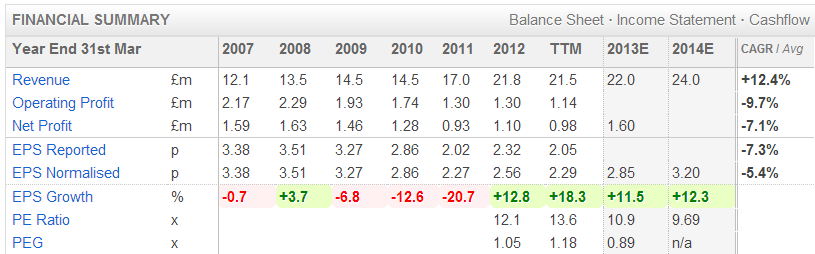

STVG's results look encouraging, and I could certainly see them driving an increase in share price from today. Operating profit is up 14% at £17.1m, and adjusted EPS has come in at 32.5p. Whilst that's below the 33.8p and 34.4p forecast EPS figures that I can find online for market expectations, it's near enough, and puts them on a PER of just 4.

The most pleasing & important figure is that net debt has reduced 17% to £45.3m. That's a big reduction, and should continue, given strong cashflows. I also note that the pension deficit is coming down rapidly too, and has fallen from £23.0m to £17.7m (net of deferred tax).

Note how the 4 key indicators on the StockReport for STVG flash a warning signal over debt in the "Bankruptcy Risk - Altman Z-score" indicator.

Z-scores are a way of predicting financial failure, so at the very least it's a signal to investigate the balance sheet & ensure you are comfortable with debt.

Or for risk-averse investors, it's a signal to stay away completely.

I tend to ensure that shares with higher risk Z-scores are only ever relatively small positions in my portfolio, so that if something awful did happen, it would not be too great a loss. Personally I'm satisfied with the debt position at STVG being OK for the time being, since it's falling pretty rapidly. But it is a risk factor to consider.

On the back of these figures I'll be sitting tight on my STV (LON:STVG) shares, indeed might nip in and buy some more today. It seems to me as if there should be a good 50% upside on the current share price, with 200p seeming a sensible level to aim for, which would be a PER of 6. The key drivers being good trading, and substantial falls in net debt and pension deficit. They also make noises which suggest a dividend could be reinstated in the not-too-distant future.

Tanfield (LON:TAN) should be an interesting one today. It operates two divisions, both of which have looked to be in trouble - the main business being manufacture of aerial platforms, which has been loss-making since 2007, and trendy but loss-making electric vehicles division, Smiths.

The shares do however have a large & excitable private investor following, so are prone to rapid & sudden moves up, from time to time. I suspect they might put in a spike today, as their trading update indicated the aerial platforms business reached breakeven in Oct 2012, and should be profitable in 2013, driven by replacement demand. Net cash had reduced to £2.2m by 31 Dec 2012, but they have a debt facility available (it doesn't say how much).

The bit that might put a rocket under the share price today is news of "a number of approaches" from "credible parties" who have expressed an interest in acquiring Tanfield's aerial platforms business. There is no indication of what sort of price might be involved. At the moment Tanfield is valued at £25m, or 20p a share, which given its poor trading track record, of massive losses for the last 5 years, it's difficult to imagine anyone would be prepared to pay very much for it. But who knows? I suspect traders will take the price up a fair bit today speculatively.

Interim results from Netcall (LON:NET) look pretty good, with revenue up 12% to £8.2m, and adjusted EPS up 39% to 1.32p (full year forecast is for 2.45p this year, and 2.7p next year). So at 37p the PER is 15.1, falling to 13.7.

They also have net cash of £8.2m (significant relative to their market cap of £45m), but care is needed here as I notice that creditors includes £4.7m of deferred income (i.e. the liability for where customers have pre-paid for services not yet delivered). Therefore in my view one should always deduct deferred income from net cash, to arrive at a true cash figure which actually belongs to the company itself, which in this case would more than halve net cash to a true figure of £3.5m.

In my view these shares are high enough, but trading is good & the outlook positive, so they might have scope to go a little higher?

Post 8 a.m. comments

I'm surprised at the muted response to STV (LON:STVG) results, but have bought a few more myself at 128p. (since started moving up).

Incidentally, if STV Group, or their advisers happen to read this, please could you ensure that your future results statements are not so wide, as they are almost illegible when printed, even in landscape, on A4 paper. A small detail, but it matters. Thank you.

Looking at the daily movers, Printing.com (LON:PDC) has fallen 15% at the time of writing on publication of a trading statement. This company often comes up on value filters, because it has such a high dividend yield, but there isn't any profits growth, and paying all your earnings out as dividends is just a policy decision, which can be reversed at any time, so it's not something I usually hang my hat on. I like to see dividends covered at least 1.5 times by earnings, preferably more, since businesses need to retain some earnings in order to finance growth.

Their trading statement today indicates that trading in H2 (Oct 2012 - Mar 2013), "has proved softer than anticipated", and that with increased marketing & development spending, "it is now likely that the Company will be materially behind market expectations in the current year" (my bolding). Not good. Material usually means at least 10%, but when it's unquantified like this, I tend to assume the worst.

Looking at this table of historic data, it seems to be a small business, not really going anywere. Turnover is rising, but profits seem stuck around £1m p.a., so really you wonder why it is Listed at all?

The only reason to hold the shares is the high dividend yield which is being held at the same level as last year, so at 2.55p that means a dividend yield of 9.4% at the current lower share price of 27p. They say;

At this juncture, also taking into account the Group's Balance Sheet, the absence of debt together with the underlying cash generation, the Board intends to recommend the payment of a final dividend at the same level as the previous year

I am tempted, as a yield knocking on the door of 10% is very attractive, it's just a question of whether that is sustainable, and I have my doubts. That said, looking at the table above, they've never missed a dividend, although it was cut from 3.15p to 2.55p in 2012. If PDC shares drop further to nearer 20p, then I'd throw caution to the wind & buy some.

Sweett (LON:CSG) announces that its order book has exceeded £100m for the first time in its history, and is up £10m from Nov 2012. This might be worth a closer look, as it's on a low forecast PER, and high forecast dividend yield, but there is quite a bit of debt. Anyone care to run their slide rule over the numbers. My brain is a bit frazzled at the moment, too many figures whirling around.

I've had a quick look at interim results to 31 Dec 2012 from Centaur Media (LON:CAU), but can't really make much sense of them, because their forecast earnings rely on the seasonally stronger H2 period to 30 Jun 2013. They do say that the full year is expected to be in line with their expectations.

I don't like the look of their balance sheet, which is top-heavy with goodwill, and becomes negative once that is stripped out, so it's not the type of thing that would interest me.

That's it for today. Good to see that early birds who read my 8 a.m. report had an opportunity to nip into STVG at 128p in the first 10 minutes of trading, they are now 136p to buy! So proves the value of doing the pre- 8 a.m. report I think.

Regards, Paul.

(Of the companies mentioned today, Paul has a long position in STVG, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.