Pre 8 a.m. comments

Good morning! Radio 4 is reporting that a bail-out deal has been agreed for Cyprus, which involves large bank accounts being raided by up to 40%. Well that's going to do wonders for confidence in the banking system isn't it?! Apparently accounts under E100k will not now be hit, but surely the damage has been done, in that they originally intended to hit those accounts too. It's like a burglar telling you that they intended burgling your house, but changed their mind at the last minute! You wouldn't sleep soundly at night, you would redouble your efforts to protect yourself & your assets.

The only rational course of action now is for anyone with liquid assets anywhere in Southern Europe is to get them the hell out! So there must surely already be a massive capital flight going on, or maybe the money is long gone anyway? It strikes me that the end game for the Euro is capital controls being imposed in all the weaker Euro countries, and of course by imposing capital controls, they will effectively be creating new currencies - Cyrprus Euros, Greek Euros, Spanish Euros, etc, which are no longer convertible at par. Instead the free market will determine what the exchange rate is. People who left money in the weaker countries will be the losers as they devalue, and as usual Germany will be the winner. They may have lost the war, but they are sure winning the peace.

The sooner the Euro, and the EU, are consigned the dustbin of history, the better, in my opinion. Both fit into the category of "seemed like a good idea at the time", but have just been poorly executed. Eurozone crisis after crisis has meant that the whole continent has failed to recover economically from the 2008 financial meltdown, when we should have been in a robust recovery by now if imbalances had been resolved through exchange rate adjustments. After funding unimaginably vast bail outs previously, the refusal to pump another E6bn into Cyprus on reasonable terms might turn out to be the straw that broke the camel's back?

I have been watching the drama at Cupid (LON:CUP) with interest. A ferocious attack by bears saw the share price collapse further on Friday, down by more than half, closing at 49p, on continued allegations against the company's business practices. There has been some hair-raising bulletin board comment on advfn over the weekend, so it's not surprising that Cupid are threatening to wheel out the lawyers in a more strongly worded rebuttal this morning.

Their denials have struck me as lukewarm in the past, but Cupid come out with all guns blazing this morning. So it looks like some commentators might need a season ticket at the High Court at this rate!

I'm comfortable that all comments here from me have been reasonable, evidence-based, and fair comment. Interesting to note that the crux of Cupid's defence this morning is to blame scamming activity (where users of dating websites are bombarded with contact from people claiming to be interested in meeting them for dates) on third parties.

Cupid also state that they are trading well, with revenues 20% ahead of last year, and has over £9m in cash. I shall watch form the sidelines with interest, but do not have a long or a short position here.

Post 8 a.m. comments

My attention has been drawn to results from Vislink (LON:VLK), which has reported a return to profits, and 2.5p EPS (versus consensus forecast of 1.75p). Nice out-performance, although the shares have slipped 6% to 31p (with 114m shares in issue, that gives a market cap of £35.3m) at the time of writing, probably because their order intake fell 5%.

Vislink also pays a 1.25p dividend (which is unchanged from last year), and has £8.1m net cash, almost a quarter of the market cap. Looks interesting. They make video equipment for the broadcast and security markets. They say that events like the Olympics and Diamond Jubilee boosted results, and that their products are used in two thirds of outside broadcast events globally, pretty impressive stuff.

Their outlook statement is too vague, just saying that markets are challenging but they are confident. Not really good enough, the market needs some red meat in outlook statements, otherwise you cannot value a company, since valuations rest on expectations for future earnings.

Just been discussing Vislink with a friend, and have decided to take the plunge & have bought a few shares at 30.5p in the last few minutes, on the basis that they have an ambitious turnaround plan targeting £80m sales & £8m profits, plus they have a strong balance sheet, pay a decent dividend, and are on a PER of 12 times EPS just reported, which strikes me as reasonably good value, if earnings are likely to continue growing.

Just as an aside, a friend commented last week that I sometmes contradict myself in these morning reports. There's a reason for that (aside from lack of coffee)! It's because it's a live Blog, where I just report on things as I find them. So as with Vislink above, initially the outlook statement in their results seemed unsatisfactory, but then I found the comments in the main narrative where they reiterate their target for £80m turnvover and £8m profits. I think it's better to report this way, rather than going back and changing previous comments.

Next I've been looking at the results from Spaceandpeople (LON:SAL), and most impressive they are too. This share has come up on my value screens quite often, so has been on my radar for some time. They are a niche business that operates kiosk and general space in shopping malls - so the traders selling sweets, jewellery, etc in the wide open spaces within shopping centres.

This has never struck me as a terribly exciting area, but reading today's results I'm changing my mind. They have delivered sparkling results, with basic EPS up a very impressive 39% to 8.5p, and the dividend increased by 21% to 3.5p. The shares have responded well, up 11% to 95p.

As usual the ridiculous Bid/Offer spread of 91p/100p means that I'm not even going to try to buy shares in it, which is a pity because I really do like the look of this company. It now looks like a straightforward international roll-out. They already operate in the UK and Germany, with other countries being targeted, including India.

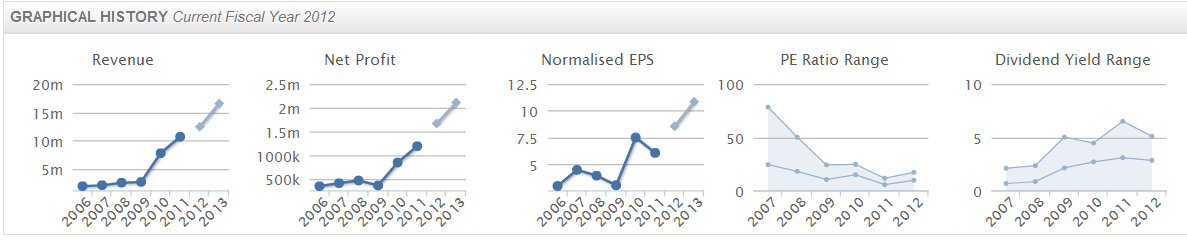

There is a very nice progression in turnover & profit, with no bumps in the road:

So Spaceandpeople (LON:SAL) very much looks like a classic Growth At Reasonable Price ("GARP") share to me. I like it a lot, so pity there isn't any room in my portfolio for it.

They say that "the first quarter of 2013 has started very positively and we look forward to another year of success". I can't see anything wrong with the accounts, all looks nice and clean.

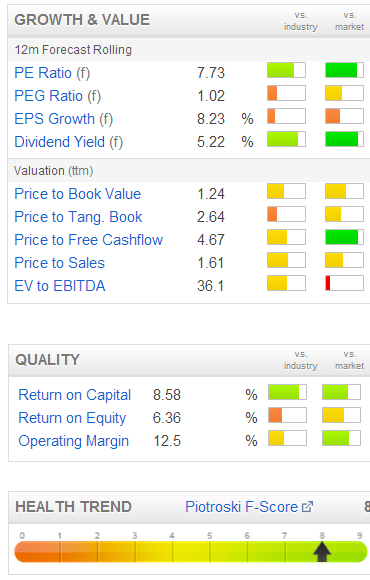

The shares look excellent value at a multiple of only 8.7 times this year's forecast EPS of 10.9p.

What next? Oh yes, I dialled in to the conference call last week for a company called Fairpoint (LON:FRP). I have ruled out this company in the past, as they operate in the personal insolvency space, i.e. managing IVA arrangements for people with debt problems. This is a rather tainted area, as I recall a few years ago there were problems with several Listed companies in this area whose shares collapsed after the banks decided to reject their high fees.

So I asked management directly about this, in the Q&A at the end of the conference call, and they briefed me on the issue, namely that in 2007 a protocol was agreed whereby high fees (c£7k per case) were roughly halved, and that IVA companies are now paid by keeping the first 5 instalments paid by the debtor, and 15% of all subsequent payments. That strikes me as a fair & reasonable fee structure, so I'm happy to invest in Fairpoint on that basis, and have indeed bought a small number of shares in it at 110p.

The latest figures for Fairpoint look very good. The balance sheet is sound, and it is a massively cash generative business relative to its market cap. Profits were up 90%, partly driven by cost cutting, and also from extra earnings from work on the mis-selling of payment protection by banks, which is expected to run for 3-5 years.

It generated £12.6m cash last year, of which £2.7m was an exceptional VAT reclaim, so £9.9m ongoing. Yet the market cap is only £46m. That looks too low to me. They employ 6 insolvency practitioners to oversee a call centre which manage client's IVAs. It sounds like a proper business, not some spivvy operation, and regulatory changes in this sector are regarded by management as largely complete. I still have nagging doubts about investing in a business that profits from other people's problems, but on the other hand you could say that about lots of things, e.g.medical companies, utilities companies, etc. The fees seem fair & the business above-board, and helping people out of debt is actually a pretty positive thing to do.

There's also a cracking 5% dividend yield at Fairpoint. So it ticks all the value boxes for me - low PER, high yield, and sound balance sheet. Management sounded serious & sensible to me, and I got detailed, matter of fact answers to my questions, which is reassuring. I am going to do more research on it, so for the moment have only bought a few shares in it, but may buy more if I like it after digging deeper. Any views from readers on the company would be veryhelpful, please comment in the comments.

I see that the rebuttal earlier today from Cupid (LON:CUP) has had the required effect, and they are today's biggest riser up 70% to 83p, although still well below Friday's pre-crach price. It's funny the way percentages work, in that you need a much larger % gain to recoup a certain % fall.

Finally, and in the interests of balance, since I'm always ranting on about wide spreads, and market makers, a former broker explained to me recently the view from the other side, i.e. how the market makers see things. Their problem is that retail demand for small caps is usually a one-way street - i.e. either a wave of buyers or sellers hits a small cap stock, but less often a balance of buyers & sellers, so they need to protect themselves with wide spreads, to give them room to square their book.

I can see that is a reasonable issue, but the answer is just to let everyone become market makers, by opening up all small caps to all through an electronic order book, and allow existing market makers to quote prices if they want to, and if they don't want to then just have the house broker only providing quotes in return for a fee from the company. It all just needs opening up. Closed shops never work, and that is effectively what the SEAQ system is.And SETSqx doesn't work, because hardly anyone has the facility to put in orders, because people use predominantly cheap online brokers.

Nearly lunchtime now, so I've run out of steam for today.

See you same time tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul today went long of VLK, is also long of FRP, and has no other long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.