Good morning! For the avoidance of doubt, I won't be doing any April Fools today, as Twitter is so full of them, I've had to turn it off. So that should mean a lot more work gets done today!

Getech (LON:GTC)

This £20m market cap (at 65p per share) data provider to oil exploration companies has this morning released its interim results for the six months to 31 Jan 2014. I've been wary of this share since the company warned on profits on 17 Feb 2014. As I explained in my report that morning, the operational gearing (i.e. high margin sales, on a fixed cost base) is such that the reported decline in sales would have a savage impact on profit. My figures indicated that a drop in profit from £1.4m to somewhere in the £250-500k area was likely for H1 this year.

It's even worse than that, with revenue of £3.1m (down 22%) delivering a profit of £233k, down 83% on H1 last year (£1.4m profit). That's a basic EPS of only 0.6p, so at this run rate full year EPS would only be 1.2p. Put that on a PER of say 15, and you only have a share price of 18p. The current share price is actually 65p, so the market is factoring in nearly a 4-fold increase in profitability from the run rate in this set of interims. I fail to see how that is prudent.

On the positive side, Getech has a good Balance Sheet. The working capital position is strong, with £5.6m in current assets, against only £2.3m of current liabilities, so a ratio of a very healthy 243% there. Long term creditors are negligible at £88k. Working capital includes net cash of £3.6m, which has supported an increased dividend, up 10% to 0.44p, although providing the final dividend is maintained or increased, it looks on track to deliver 2.1p forecast full year divis - a reasonable yield of 3.1%. Although I wouldn't hang my hat on an uncovered dividend like this one.

So, lousy figures as expected. What is the outlook like, as that is crucial for the valuation? There is a fair bit of detail in the outlook section, but the key paragraph (in my view) says this;

We start the second half of our year with strong cash balances and a substantial pipeline of sales opportunities. More importantly, the feedback from meetings early in 2014 suggests that not only do clients remain interested in our major products, but they now have budget available to spend. The oil price has been, and is currently, above the corresponding prices last year and we do not see signs of it weakening. As such, we are optimistic that the trading performance in the first half represented a short term market-related issue...

... We remain confident about our medium and longer?term prospects.

These things are always subjective to interpret, but in my opinion the above comments lack enough certainty to justify taking a risk on this share. I would therefore be looking for a significantly lower price to tempt me back in. Why take the risk, with what sounds like an uncertain level of future profitability? Companies which rely on a few, large customer contracts, have inherently unstable profits, hence are very difficult to value, and high risk. Therefore I try to avoid such companies, unless there is very strong growth likely to happen. In this case I'm surprised the share price hasn't fallen further than down 2% this morning to 64p. Existing holders must be confident about a recovery in profitability, so good luck to them.

Corac (LON:CRA)

Corac has a long history of operating at a loss, trying to commercialise a new type of gas compressor. More recently they bought some other engineering companies, which looks like a sensible strategy to hedge their bets - i.e. bolt on some profitable busineses so that the losses from the historic blue sky project don't look quite so bad.

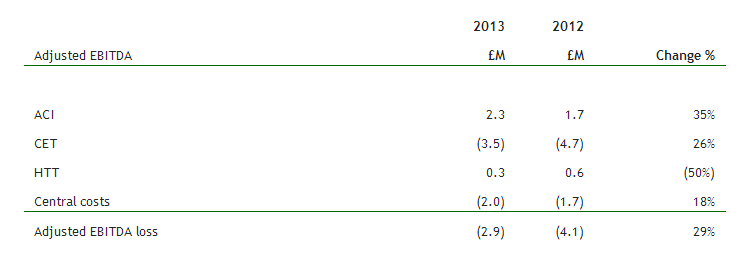

A £10.8m fundraising was completed in Dec 2013. Preliminary results for calendar 2013 are published today. The table below, taken from these results, shows the breakdown of performance by division;

So this shows an improving overall picture, although I see they quote the dreaded EBITDA - a flattering picture of profitability, since it assumes that capex is paid for by the tooth fairy! A more detailed table then shows the operating loss which is £4.3m, a good bit worse than the £2.9m EBITDA quoted above.

I was expecting to find a load of capitalised costs in the cashflow statement, but actually they only spent £42k on capex in the year, and no intangibles were capitalised. So in this case, unusually, EBITDA probably is a fair reflection of underlying performance.

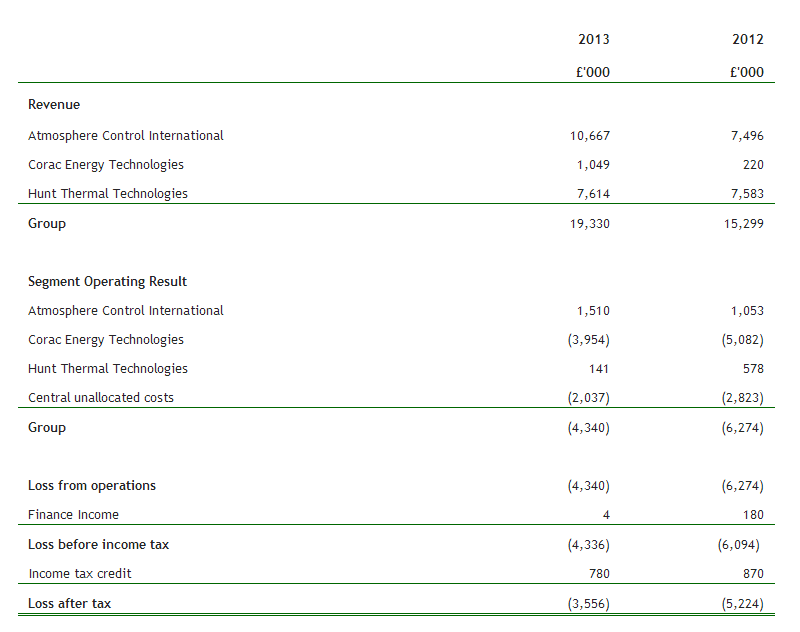

This table below is probably a better breakdown of the performance of the three divisions;

So it seems to me as if there is one decent bit of the group, the Atmosphere Control part, which made a £1.5m profit. The other parts look marginal (HTT) and very weak (CET). If I were investing here, I would want to see a credible roadmap for the CET project reaching profitability soon.

Central costs of £2m look very high to me, for a bit of a rag-bag of small businesses. Again, if I were investing here, I'd want to ask some tough questions about what those costs are, and how they are earning their keep.

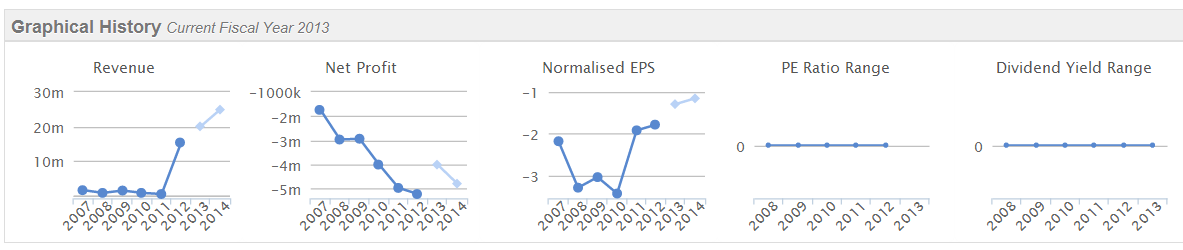

Since the latest fundraising, the Balance Sheet looks strong, with net cash of £13.7m, being probably about three years' at the current cash burn. I think the clock is ticking here in terms of credibility though - this company needs to deliver some proper results from all the money that has been sunk into its projects. I see from the bottom section of the Balance Sheet that it has raised £56m from shareholders in total to date, with arguably not a lot to show for it so far in terms of commercial success - see the Stockopedia graphical history below;

Access Intelligence (LON:ACC)

There's not a lot else happening today, so I've had a quick look at results from this £7m mkt cap (at 3p per share) software tiddler. It supplies software for compliance & legislation-driven areas, including the public sector. So it sounds not dissimilar to larger competitor Ideagen (LON:IDEA).

ACC announces results for the year to 30 Nov 2013 today. Turnover is up 4% to £8.4m, most of which (£6.1m) is recurring. It traded just above breakeven (£77k profit) at the operating level (before a £2.6m impairment charge, which is non-cash so fine to ignore that).

It fails my Balance Sheet testing though, with negative net tangible assets, and current assets at only 78% of current liabilities, which is below my comfort level of about 100% for a software business.

There is no dividend. Noteworthy is that this company spent a very high 49% of revenue on R&D in 2013. Generally I like companies that spend a lot on R&D, as that tends to drive future growth, if the money is spent wisely. So it might be a micro cap that is worth looking into in more detail perhaps?

The outlook statement doesn't really say anything. If there is some future sign of decent growth, then I might look at it again. Trouble with micro caps is that they are so illiquid, and hence have a prohibitively large bid/offer spread. However, if you spot one with good growth & turnaround potential, the rewards can be very large in percentage terms. Very high risk though.

That's it on specific company news.

On another matter, I think it's time that private investors' interests were better served in company fundraisings. All too often existing shareholders are shut out of fundraisings, which seem to increasingly be done via Placings. Speed and lower cost are often given as the reason for that. However a number of recent fundraisings (e.g. Seeing Machines (LON:SEE) and Synety (LON:SNTY) ) have also included an Open Offer for existing shareholders, but for an absolutely derisory number of shares. This is wrong. Yet there's not really anybody fighting for private investor interests in the City, when these deals are being struck.

Therefore I've come up with the idea of publishing some guidelines on company fundraisings, under the auspices of ShareSoc (the UK individual shareholders association), and then scoring company fundraisings against these guidelines, and publishing the results.

So, if you have any views on this, please feel welcome to add your thoughts to this new discussion thread on Stockopedia that has been set up for this purpose. I'm also going to talk to some brokers about this matter too, and see if the guidelines can be agreed with them, so that fundraisings become compliant with whatever guidelines ShareSoc decide are the right ones to have.

I'm just an ordinary member of ShareSoc, so can't speak for them, but thought I would at least start the ball rolling with this idea.

That's it for today, see you from 8am tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.