Good morning!

Feel free to send in requests and I will cover what I can.

Thanks,

Graham

Filta Group (LON:FLTA)

- Shares price: 100p (+8%)

- No. of shares: 27 million

- Market cap: £27 million

I'm flagging this up as it's new to me and is another fairly recent flotation (November 2016).

According to its website, the core product is FiltaFry, which enables 5,000 food establishments to recycle their cooking oil. Two other subsidiaries are involved in providing refrigeration door seals, and general maintenance of refrigerators and air conditioning units.

Sounds like a "boring" industry which Peter Lynch would approve of!

Unfortunately, the company generated a loss last year (£200k), on revenue of £10.1 million. Adding back finance costs, AIM admission costs, and "special bonuses" to shareholder-directors, gets you an "underlying" operating profit of £1.15 million.

Today's update is concise but encouraging:

"We have enjoyed a strong start to the year with revenues for the first 4 months, on a constant exchange rate basis, over 25% ahead of the same period last year, with all of our business lines, franchise development, fryer management services and Company-owned operations contributing to the growth.

The statement mentions new customers secured last last year, who are going to provide a full-year contribution in 2017, and describes how most company revenue is recurring in nature.

Overall, looks to be the type of boring stock which can often turn out to be a good investment.

I can see a broker forecast from April suggesting that 5.9 EPS could be achieved this year. Perhaps that forecast will be revised upwards, and this might start to look decent value?

A few other small points worth mentioning: it fulfilled its promise to pay a dividend in the first half of this year, and has pledged to pay interim and full-year dividends going forward.

It operates a franchise model - that's something that always gets me interested, because it means potentially high returns on capital (if you can get the franchisees or banks to put up the capital to fund local operations).

The balance sheet is no fortress but it looks ok, equity of £3.4 million or £0.9 million excluding non-current assets. £4.4 million of cash offset by £1 million in bank loans.

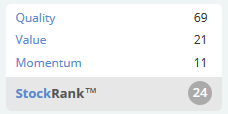

I'm tempted to dig a bit deeper into this. The StockRank isn't any good yet, perhaps due to the short history on the market, and lack of reported profits yet (Value) and the weak share price movement so far (Momentum):

Haynes Publishing (LON:HYNS)

- Shares price: 181.5p (+11%)

- No. of shares: 15.1 million

- Market cap: £27 million

This share has been covered frequently at Stockopedia, and not only in these reports but also with a great write-up last month at this link.

I covered it before with the share price at 117p and 138p, so arguably I should have been participating in this rally, but I didn't have enough confidence in long-term demand for the company's core products: manuals for automotive repair (DIY and professionals).

A wholesale restructuring and a refreshed management team have turned it around:

The Group has seen strong second half trading from its European operations and benefited from a lower cost base in North America and Australia following the restructuring announced in May 2016. Like-for-like profit before tax and exceptional items for the 12 month period, excluding exchange rate movements is expected to be up to 15% ahead of the prior year.

So 15% LfL growth rate on last year's £1.9 million adjusted PBT works out at £2.2 million in adjusted PBT, before the effect of exchange rates.

Including exchange rates and acquisitions, adjusted PBT is up a stonking 40% (since the foreign revenues translate to a lot more GBP now). So that's about £2.7 million in PBT.

Elsewhere, gains on some freehold property disposals are set to pay for some miscellaneous exceptional costs this.

Even after the rally, therefore, the rating seems pretty reasonable here at a £27 million market cap. It has done well to transition many of its services online, and demand for its products remains firm.

It does have an accounting pension deficit of £21 million (see that Interim Report), so that's likely to have an impact on cash flow available to shareholders unless interest rates can rise.

Pension deficits aren't considered very important in valuation, because companies can take their time paying them off (and pension fund trustees don't want to take so much cash out of an operating business that they kill the company). But I'd still be inclined to conservatively add a decent chunk of a pension deficit onto a market capitalisation, for a fuller sense of valuation.

But well done to those who have been holding Haynes through the recovery. I can see it rising a further from here and potentially having much more stable results in the years ahead, without all the large exceptional costs of recent times.

Watkin Jones (LON:WJG)

- Shares price: 183.6p (-2%)

- No. of shares: 255 million

- Market cap: £469 million

Not feeling too smart today, as this is another one where I missed the boat, arguing that the share price was fairly valued last December (at 117p!)

Specifically, what I said was that since this property developer only takes on about 10-12 projects per year, there is a lot of variance in the potential outcome, so that a low rating is needed to compensate investors for taking on that risk. A cheap-ish PE ratio of about 9x seemed fair enough to me.

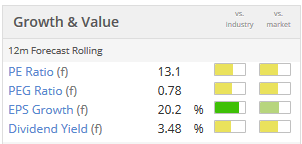

The shares have re-rated since then, to 13x, and the Value Rankhas correspondingly fallen to a lowly 31/100 (Quality and Momentum scores are still high).

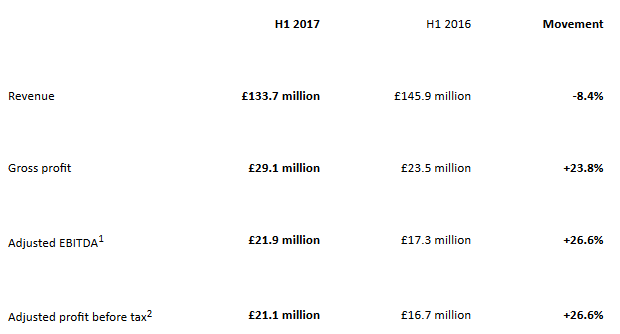

Today's interim results show revenue down but margins and PBT up. Revenues are in line with management expectations, and are forecast higher in second half:

Gross margin is up nearly 6% (from 16% to 22%), reflecting "the location and quality of student accommodation schemes in development, as well as a full six months contribution from Fresh Student Living."

Checking my prior notes, I see that WJG delivered 3,800 beds ahead of the 2016/2017 academic year, whereas 3,300 are to be delivered for 2017/2018 and 3,400 for the year after that, and 3,500 the year after that.

So that's fairly stable planned output, at a lower level than 2016/2017.

Excluding the group's other activities, therefore, growth will depend on margins achieved. On the value of the locations of upcoming schemes, on their particular features, and their successful execution.

Shareholders reading this report may well disagree with me, but I do think that developers such as WJG should have modest equity ratings. There are many forces beyond their control, and it's difficult for me at least to understand what sort of long-term competitive advantage can be achieved.

The CEO's trust along with the CFO sold nearly 20% of the company in a placing in March this year (when the shares were 145p). Unlike my stance on Haynes, therefore, I now suspect that these shares are overvalued at 180p+.

Alfa Financial Software Holdings (LON:ALFA)

- Shares price: 418p (+2%)

- No. of shares: 300 million

- Market cap: £1,254 million

Flagging this stock as having hit the stock market last Friday. It was something I mentioned pre-IPO.

This is a software company serving the asset finance industry, with banks and major car companies among the customers.

The offer price according to the Prospectus was 325p, but with the shares at 418p now, the market cap is in excess of £1.2 billion.

This is not in small-cap territory at all but I would agree with ramridge in the comments that it appears to be severely overvalued versus revenues of £73 million and adjusted EBIT of £33 million.

The selling shareholders (Exec Chairman and CEO) took a £29 million dividend before the IPO and sold £250 million of stock in the IPO itself.

Two of the co-founders sold their shares quite recently: 36% was sold for £29.4 million in September 2015, and 20% was sold for £25 million in May 2016. So these deals valued the company at £82 million and £125 million, respectively - less than ten times the current market cap.

On that basis, and on the basis of the implied valuation multiples using last year's results, this is a share I'd be really interested in betting against.

Nothing else lighting my fire today, so I think I'll leave it there.

Thanks for reading!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.