Good morning!

Helphire (LON:HHR)

This was one of my most successful investments of 2012-3, since the company delivered a remarkable turnaround, somehow persuading their Bank to write off a big chunk of debt, and raising large fresh funds from shareholders. However, once it became clear that they were copying Quindell's business model, and essentially becoming a company to facilitate fictitious whiplash claims (by acquiring an industrial-scale "personal injury" solicitors), then I sold out, at about 6.7p.

You have to be very careful in this sector, as they dress up their activities in all sorts of deliberately confusing language, but the bottom line is that the big money maker is whiplash claims. Fraudulent whiplash claims are big business, and despite the reality that few people actually suffer serious whiplash, the cost of whiplash claims is now higher than the physical damage done to the vehicles in aggregate, in car crash insurance claims. It is regarded as something like a bonus payment to car crash victims, with payments of several thousand pounds being the norm, irrespective of whether anyone has really been hurt or not. Seatbelts, air bags, crumple zones, etc, mean that real injuries are fairly rare these days, other than in the most serious of accidents.

It is you and I that bear the cost of this widespread fraud, with our car insurance premiums inflated by about £90 each, per annum apparently, to fund the cost of this scam.

The number one rule of investing, is to ask the question, "Are profits sustainable?" In the case of Quindell, and HelpHire, and others the answer (in my opinion) is "probably not". Sooner or later Governement will (and should) tackle this area, and start sending people to prison for fraudulent whiplash claims. When that happens, it will stamp out the vast bulk of claims instantly. People only lie because they think they can get away with it, and are actively encouraged to submit false whiplash claims by intermediary ambulance-cashing companies, and usually won't even be questioned about the authenticity of their supposed injuries.

HelpHire say that Q3 trading has "exceeded the Board's expectations".

Cash collection in HelpHire's historical business (which is the supply of hire cars to no-fault accident victims) has improved further, and is relatively good, at 128 days. However, margins are thin on that line of work, so it's the more lucrative personal injury stuff that is the growth area.

I look forward to the day when this whole sector is destroyed by a much needed Government clampdown on fake whiplash claims. There is no need for these parasite intermediary companies to exist at all, in my opinion. Insurance companies should just process claims themselves, and pay out promptly for the genuine claims, and prosecute people who submit false claims.

Carclo (LON:CAR)

Profit warning of the day comes from this plastics group. I've only looked at Carclo once before here, on 22 Jan 2014, where it warned on profits, and the share price fell 33% to 178p. I concluded at the time that risk/reward still looked lousy, and that has proven to be correct, with another 27% lurch down to 131p today on a confusing trading statement.

It you know the business well, then this trading update might make sense. However, coming to the company afresh, I'm left fairly bewildered. It talks about changes to demand and pricing for products, but I'm in the dark about how significant these changes are to the group overall. It concludes by saying;

Overall we expect a strong year on year improvement in trading performance despite the reduction in previously anticipated sales at CIT.

There is no mention of performance relative to market expectations, which is the crux. So I'm left in the dark - is this positive, or negative? Clarification is needed, and I suggest they find someone else to write their RNSs, as this one is a confusing muddle.

Johnson Service (LON:JSG)

There is an upbeat trading statement today from this dry cleaning company. It says;

The Group has made an encouraging start to the year and all our businesses, including the newly acquired Bourne linen business, are performing well. I am pleased that we continue to see like for like growth in drycleaning.

We remain confident in the prospects for the full year.

The shares are up 3% to 56.5p. Broker consensus is 4.1p this year (ending 31 Dec 2014) and 4.37p next year, so a PER of 13.8 and 12.9 respectively. That looks to be about the right price in my opinion, once you factor in net debt and the pension deficit. The forecast dividend yield of 2.1% is nothing to write home about. There might be some upside from a recovering economy, but I can't get excited about this share, there are probably better opportunities elsewhere.

Eckoh (LON:ECK)

There's a positive trading update here today.

Eckoh plc (AIM: ECK), the UK's leading provider of multi-channel customer service and secure payment solutions,today announces that trading for the 12 months ended 31 March 2014 saw another period of strong progression with double digit growth in both revenue and margin, resulting in a substantial increase in adjusted* profit in line with market expectations.

The share price has barely moved today, probably because the upside is already priced-in.

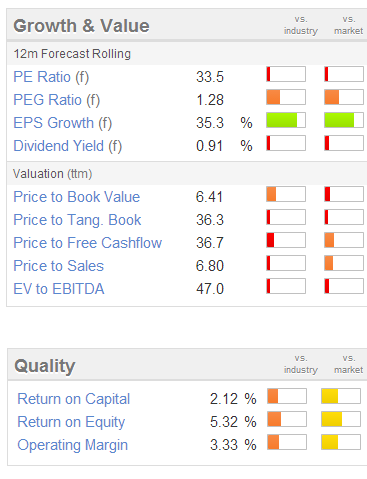

These shares look very expensive to me - nicely encapsulated by the Stockopedia valuation graphics below, which clearly highlight that this stock is very expensive, because it is delivering strong earnings growth. It looks to me like the market has gone completely over the top with the valuation here, so I wouldn't go near it at this price. It would need to be less than half the current price to begin to look interesting to me.

Real Good Food (LON:RGD)

This is a horrible share in my view. Low margin, highly indebted, and with a "serious dispute" with British Sugar. I cannot understand why anyone would entertain buying these shares, but each to their own.

An update today says that EBITDA is expected to be £3.3m for the year ended 31 Mar 2014. Net debt is around £31.5m, which they say is lower than expected.

Robinson (LON:RBN)

There is a reassuring update today from this packaging company;

I am pleased to report to shareholders that revenues in the first quarter of 2014 are up by 8% over the same period last year.

The acquisition of Madrox is now scheduled to complete in mid-June, one month later than the original timetable due to delays in the Court approval process in Poland.

The Group continues to trade in line with management's expectations.

The acquisition looks to be transformational in terms of earnings, so I can see further upside here being possible.

That's it for today, see you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.