Good morning!

A fairly quick report today, as I've been summoned to a meeting in London this afternoon. For anyone interested, I've recorded the final Day 5 video update for my charity challenge, and the video morphed into a brief SCVR (from 5:10). It saved loads of time typing actually, so if people like the idea of a video format (without me being silly), then I could maybe supplement the main reports here with a video of opinions on other news that day? Let me know what you think. Thanks again for all the generous donations!

Begbies Traynor (LON:BEG)

Share price: 41.5p (down 13% today)

No. shares: 104.6m

Market Cap: £43.4m

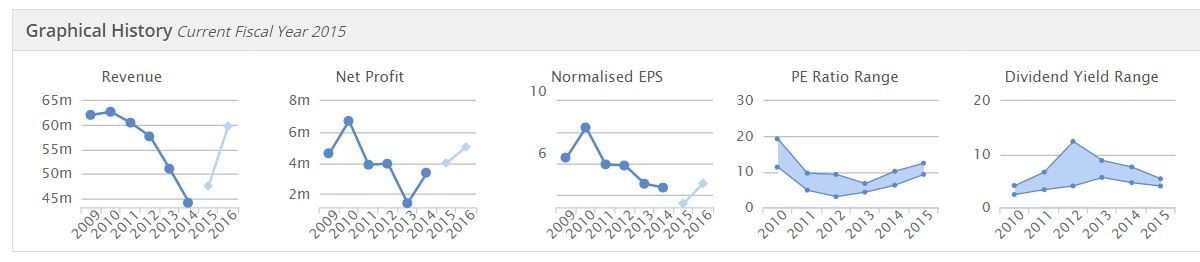

Profit warning - I doubt that anyone predicted in early 2008 that interest rates would be reduced to near zero, and left there for seven years+, but that's what has happened. As a result, insolvency practitioners have had lean pickings. The only listed insolvency practitioner is Begbies Traynor, and as you can see, their turnover has fallen dramatically, and they've only maintained profits by repeated cost cutting. Analysts are predicting sharp rebounds in turnover (some of which is from acquisitions) but not much increase in profits;

Today Begbies reports that market conditions for them remain tough - corporate insolvencies are down 14% for the year to 31 Mar 2015. For calendar Q1 of 2015 the level was the lowest since Q4 of 2007.

This has caused Begbies to issue a profit warning today, saying that despite maintaining its market leading (by number of appointments, but not by fees) position, it will now perform below market expectations for y/e 30 Apr 2015.

Other comments sound reassuring - more cost cutting has been done, the recent acquisition of Eddisons has gone well, and the group is "comfortably within" its banking facilities.

Sounding a bit like the angel of death, Ric Traynor laments that so few companies are going bust;

Valuation - broker forecast for y/e 30 Apr 2015 is currently for 3.4p EPS, jumping to 4.7p next year. I don't know how much those estimates will come down, but it would probably be safe to assume that, as the warning has come right at the end of the year, that it's not a big miss. Perhaps 3.0p EPS?

That would put the shares on a PER of 13.8 times, in depressed market conditions, which looks about right to me.

Dividends - the company is in the habit of paying out 2.2p in divis each year, so at least earnings will cover that, and assuming that remains the case then the yield would be 5.3% today - very nice, if it's maintained, and I suspect on balance it probably will be, judging from what the company has done before.

My opinion - it doesn't scream out to me as being a bargain right now, but it's not a million miles away from the level where I would consider going back in, for the eventual recovery in corporate insolvencies which is likely when interest rates eventually rise.

Fairpoint (LON:FRP)

Share price: 124p (up 2% today)

No. shares: 43.8m

Market Cap: £54.3m

(at the time of writing I have a long position in this share)

Trading update - this is a group of companies involved in consumer debt restructuring, IVAs, PPI claims, and with a recently acquired legal services business. Today's update for Q1 of calendar 2014 sounds solid, the key bit saying;

Various other details are given, but there's nothing unexpected. IVAs are continuing to decline, with the market down 23.5% in Q1 of 2015.

They're looking at other acquisition opportunities too, which given management track record of doing good deals, sounds promising.

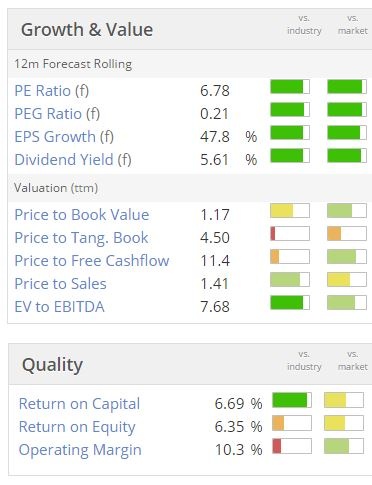

It's on a very low PER at the moment because the market perhaps still thinks of it as a declining IVA/PPI business, but actually it's gradually changing into a broader, and more sustainable legal services business. Therefore I think there is the possibility of a gradual re-rating here, for those of us who are patient.

We're paid a 5.6% divi whilst we wait, which is appealing.

On the negative side, the shares are illiquid, and some investors may not like investing in this sector.

Ascent Resources (LON:AST)

Placing via PrimaryBid.com - I only mention this, as the PrimaryBid.com website (with which I have no connection whatsoever) is a very interesting initiative which is trying to cut out the city fees, and do Placings direct to investors.

If it works, this could be an excellent thing. I believe another company also successfully did a fundraising through this new platform. Ascent say they are receiving £525,250 net of costs, from a £550,000 fundraise. So that's fees of £24,750 out of £550,000, so 4.5%, which is actually not too bad for such a small fundraise. It's certainly more efficient than doing it through a conventional broker.

I hope this platform takes off, and does deals for some proper, profitable companies, not just junior mining things. The costs of small fundraisings through the city are outrageous, and frankly it's money for old rope. So a challenger is very welcome in this space.

Johnson Service (LON:JSG)

Share price: 76p (up 2% today)

No. shares: 300.1m

Market Cap: £228.1m

Acquisition - I like this company, and its turnaround has been very good.

The deal announced today looks a good fit, but my initial reaction is whether they have perhaps overpaid a little? Also, they say it's earnings enhancing - well of course it is, because the bulk of the purchase is being paid for through debt, and interest rates are at a record low!

A Placing is being done to raise net proceeds of £21.1m, at 73p per share, so only a slight discount, which is good. The acquisition is costing about £65.4m, if you net off the cash of the acquiree against the £69.4m purchase price. That looks a full price, given it made £5.5m profit for the year ended 25 Oct 2014. Maybe there are some synergies to be had?

The boom in restaurants means that supplying their table linen, must be good business, so I like the sector they are expanding into.

Debt - JSG has got into trouble in the past with excessive debt, and I hope they are not building up more problems for the future by racking up debt again now? It doesn't look excessive yet, but if you slash earnings to reflect what would happen in the next recession, then the picture maybe wouldn't be so rosy?

There are plenty of other companies out there with far worse debt burdens, so maybe I'm worrying unnecessarily?

Hornby (LON:HRN)

Reports today that it has moved back into profit, after 3 years of losses, bravo to them!

Net debt was £7.5m at end Mar 2015.

The turnaround looks priced-in already to me, but who knows. The StockRank is very high, at 94, so it might be worth a look.

Gotta dash, meeting in London.

See you on Tuesday, and hope you enjoy the Bank Holiday!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in FRP, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.