Good morning! Here is my usual leisurely canter through the morning's small cap results & trading statements.

Daniel Stewart Securities (LON:DAN) - I note that this tiny broker has had its shares suspended due to a failure to publish its report & accounts within six months of the period end date (31 Mar 2014). Can't say I'm surprised - the market cap was only £1.8m (where it's pointless being Listed really), they posted heavy losses in four out of the last six years, there was no dividend, a lousy Balance Sheet, and a depression-inducing client list of very low quality companies - hence a poor reputation. There are too many small brokers around, and all too often they have poor reputations because they are not discerning in terms of selecting decent clients. So seeing a few of the weaker players go to the wall is a positive thing in my opinion, although obviously very unpleasant for the people concerned. But such is life in a competitive world.

Blinkx (LON:BLNX)

Share price: 30.7p

No. shares: 400.5m

Market Cap: £123.0m

Again, not a great surprise, but there's another profit warning from Blinkx. I've never really understood their business model, but it seems to be based on advertising revenues around videos online. I've kept my distance from this share, because when discussing it on Twitter, someone in the industry commented that advertisers tend to allocate a block of money to a campaign of (say) six months. If they are unhappy, they tend to let the campaign complete, but don't then renew. Hence there can be a time lag between losing clients and deteriorating financial performance. Judging from today's statement, it looks as if he was right.

Profit warning - and it looks a bad one too;

As noted in early July, revenue trends slowed considerably in the latter half of the first quarter. These trends continued into the second quarter, amplifying the effects of the seasonally slower summer months. The preliminary first half results, based on unaudited pre-close figures that are subject to change, are expected to be:

H1 2015 revenues of $102 to $104M

H1 2015 adjusted* EBITDA of approximately break-even

Cash and cash equivalents of approximately $115M at the end of the Period

Breakeven, yikes!

My opinion - Blinkx made $15.2m adjusted profit before tax in H1 of last year, so managing only breakeven for H1 this year is a disaster. The very strong Balance Sheet is a comfort - they report $115m net cash (there is no debt), which is £71m at the current exchange rate. Not bad, as that's nearly 58% of the market cap. Having said that, with the business at breakeven now, who knows where this might end? You do wonder if the controversy surrounding the company could turn into litigation, since that tends to happen in the USA, which has the potential to eat into the cash. Note that cash has fallen from $126.9m at the last year end to $115m now, although an acquisition was made during the period.

This one is now in my "too difficult to value" tray - since we don't know if they have a viable business or not. The cash pile should provide some support, but at what level, we don't know. The shares are off about 20% this morning to 30.7p.

Walker Greenbank (LON:WGB)

Share price: 205p

No. shares: 59.8m

Market Cap: £122.6m

Interim results for the six months ended 31 Jul 2014 have been published today. Turnover is up 5.4%, and what the company describes as adjusted EPS is up 28% on a fully diluted basis, to 5.0p.

Valuation - There seems to be a bit of an H2 bias to trading, so assuming that pattern repeats this year, then it looks like 12-13p adjusted EPS might be on the cards for the full year perhaps? Broker forecasts look rather low, at 10.2p EPS for this year, and 11.0p for this year, hence it looks to me as if there is a chance of out-performance here against forecasts.

Going by broker consensus of 10.2p EPS for this year, then the PER is high, at 20.1. However, if say 12.5p EPS is achieved (the mid-point in my guesstimate above), then the PER drops to a more reasonable 16.4. Still not cheap, but coming into a more sensible range.

Balance Sheet - I was having lunch with a friend yesterday, and we were discussing shares in our portfolios, so I took along my iPad, and referred to Stockopedia for each stock - on one tab I pulled up the StockReports, and on another tab I looked up my comments on the "Discuss" tab here. Even though I say so myself, we now have a really useful library of comments from me on loads of stocks. People may not always agree with my conclusions, but at least some key financial details & news are flagged up for each stock in my reports. Referring back is a quick & efficient way for me to refresh my memory about any stock I cover.

Anyway, my friend pointed out a couple of little boxes on the StockReport that I've never even noticed were there! But they are jolly useful, so I want to flag them up to readers. Here are the relevant items for Walker Greenbank;

I tend to like a current ratio of over 150% ideally, or at a minimum over 120%, so in this case the company is fine with a current ratio of 1.82 (which I think of as 182%, same thing).

All the other numbers in this section are really useful, plus are colour-coded in the same way. So I shall definitely be focusing more on this data area in future, and might start to build some screens which will help me filter out companies with weaker finances using these easy to understand fields.

My only slight concerns with the Balance Sheet are that inventories seem rather high, and that there is a pension deficit of £8.8m - which would need checking in more detail to the last Annual Report.

Outlook/current trading - this sounds upbeat, with the company saying today;

Terry Stannard, the Chairman of Walker Greenbank, said: "Total Brand sales in the first eight weeks of the second half are up an encouraging 5.4% in reportable currency (7.0% in constant currency) compared with the same period last year. This is a robust performance ahead of our key autumn selling period and reflects strong trading in the UK, where Brand sales are up 8.6%, and in overseas markets, where Brand sales are on an improving trend up 4.7% in constant currency. Manufacturing also continues to perform strongly. We remain confident of meeting market expectations for the full year and beyond."

My opinion - this is a good company in my view, and it looks to be on course to beat broker forecasts for this year, in my opinion. So there could be some upgrades to come possibly? The valuation is probably about right for the time being though.

Note that the company has an excellent performance track record, of steady growth. Although this is reflected with a fairly full share price at the moment - note that the minimum PER has been steadily increasing over the last few years, reflecting a gradual re-rating upwards of these shares. Also the dividend yield has been steadily decreasing, as the stock has re-rated. So it's not the bargain it used to be any more.

Treatt (LON:TET) - this is a supplier of fragrances and flavouring ingredients. The company today confirms that trading for the year ended 30 Sep 2014 was "in line with its expectations". Broker consensus is for EPS of 9.6p, so with the shares currently trading at 142.5p that represents a PER of 14.8, which looks about right to me. Note that there is some debt too, so the PER should not be too high for that reason.

There is a reasonable dividend yield, forecast at 3.1%.

The outlook comments sound a little wobbly to me, so perhaps some caution is needed here?

Looking to the year ahead, the level of order books across the Group are satisfactory. Whilst raw material prices are expected to remain high, which in turn may impact upon margins, the Group expects to continue to see the benefits of its strategy of focusing on selling added-value ingredient solutions to leading FMCG and beverage businesses, whilst maintaining a tight control of costs.

Avingtrans (LON:AVG)

Share price: 144p

No. shares: 27.6m

Market Cap: £39.7m

Preliminary results for the year ended 31 May 2014 are released today, which seems a very slow reporting cycle - one of my pet hates - taking four months to report the year's figures just isn't good enough. They should be announced within about 4-6 weeks of the year end.

These are rather tricky figures to interpret, due to a number of distorting factors, including a negative tax charge (thus boosting EPS), growth created by acquisitions, capitalising £1.3m costs into intangible assets, start-up losses, and a £2.6m book profit from acquiring distressed assets.

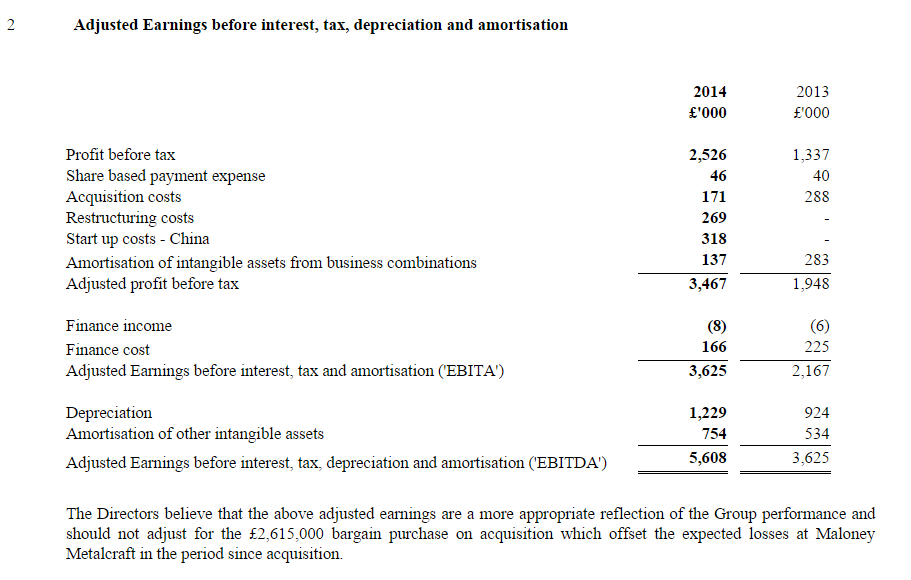

A table is provided in note 2, giving a breakdown of how they arrive at adjusted profit;

The last sentence looks a bit questionable - i.e. the company has decided not to adjust out the £2.6m profit which they call "bargain on acquisition" (strange terminology!), which seems to be negative goodwill on the acquisition of Maloney Metalcraft.

Valuation - if you accept the company's definition of adjusted EPS, then at 13.7p it puts the shares on a relatively cheap PER of 10.5.

Dividends - The full year dividends were raised 23% to 2.7p, for a yield of 1.9%.

Balance Sheet - the company passes my simple tests here, with a good overall net tangible asset position of £20.4m, and a solid current ratio of 1.52 (I'll refer to it on this basis from now on, so it ties in with the figures on the StockReport - i.e. I would have previously called this 152%).

Long term creditors are only £4.6m, and I don't see a pension deficit, which is a good thing.

Net debt of £3.6m seems modest, relative to profitability & assets, so no issues there.

Outlook - this sounds rather tentative;

With attractive structural growth markets and durable customer relationships, we remain cautiously confident about the future of Avingtrans, notwithstanding any short term issues with product mix and currency exchange rates. The world economic outlook is also broadly positive, despite current geopolitical stresses. Prospects for Civil Aerospace and Oil & Gas, in particular, are exciting.

My opinion - I've not reported on this company before, so don't know enough about it to form a meaningful opinion. The Maloney Metalcraft acquisition seems to have been problematic, which they refer to in the narrative, and offsetting heavy losses there against negative goodwill unnerves me somewhat.

It would need a lot more research, but the company seems reasonably valued, and soundly financed, so that's a good starting point. I'm generally not keen on the aerospace sector, as things often go wrong with contract disputes, etc. It might be worth a deeper look though.

That's it for today.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.