Afternoon everyone,

It's not too busy in RNS-land, and Paul is feeling under the weather, but let's see what we can do here today!

Regards,

Graham

Safestay (LON:SSTY)

Share price: 53p (+1%)

No. shares: 40.7m

Market cap: £18m

A reduced loss from this provider of "premium hostels":

Strong uplift in revenues to £7.4 million (2015: £4.0 million) reflecting demand for Safestay's unique contemporary hostel offer and full year contributions from Edinburgh and Holland Park

EBITDA of £2.2 million (2015: £0.7 million)

Reduced loss after tax of £0.5m (2015: loss £0.6m)

The concept, as one might expect, is to compete directly with budget hotels, primarily on price ("just under £20 per night").

The level of occupancy appears questionable - almost 300,000 bed nights were sold in the four hostel properties, which have 1,526 beds in total. Based on all of those rooms being available for 365 days a year, which as far as I can tell was the case, that's a 53% occupancy rate.

Edit: I've been helped by a commenter, who points out that the Edinburgh hostel is shared with university students. From the 2015 Annual Report:

The property has 272 hostel beds throughout the year,a licensed stand-alone food and beverage business trading as Bar 50 and leases 81 rooms to the University of Edinburgh for the academic year September through May. For the months of June, July and August the student rooms are converted to hostel rooms increasing the capacity to 615 beds which complements the surge in accommodation demand Edinburgh enjoys each summer.

If I adjust for this, my new back-of-the-envelope calculation is that occupancy was 65%.

According to PwC, occupancy in the hotel industry was 76% last year.

I suppose one could argue that since three of the properties were either bought or refurbished in mid- or late- 2015, that they have not yet had a chance to build up their reputations and attract repeat business. So hopefully the occupancy rates can improve to more impressive levels!

Outlook

Positive bookings trends, according to the Chairman:

We are continuing to generate efficiencies in the business by consolidating our Group purchasing wherever possible and improving our management structure. Our bookings pipeline for the coming year is encouraging with cash received in respect 2017 revenues as at 31 December 2016 up 51% over the corresponding period in 2015, which underpins my belief that the Group will continue to positively exploit the potential in the rapidly changing hostel arena.

Balance sheet

Heavily indebted, as one expects in the property sector. Loans and overdrafts of £17.4 million, plus finance lease obligations of £10.2 million.

At the end of March, it announced a restructuring with a new £18.4 million facility from HSBC, to "significantly reduce cost of debt".

My opinion

An interesting idea of "premium hostels", but with fairly low-margin work, it really needs better occupancy.

Apart from improving occupancy and further minimising costs to improve that margin, the other potential driver of equity returns is of course the leverage. A benign interest rate environment is crucial in that regard - finance costs have been greater than operating profit for the last two years, and that's been at a very reasonable cost of debt (3.7% at December 2016).

If interest rates stay low, I can see the potential for the company to get a much-improved bottom line as the current properties mature. Still quite a lot to prove, though.

Cerillion (LON:CER)

Share price: 136.5p (+2.2%)

No. shares: 29.5m

Market cap: £40m

It's in line:

The first half of the year has progressed well and results are anticipated to be in line with management expectations, with revenues of c. £7.5m (2015: £6.9m) and EBITDA of c. £1.5m (2015: £1.1m), increases of 9% and 36% respectively compared with the same period in the previous financial year.

A very brief statement. It's good to see operating leverage in the percentage numbers above, and the CEO also mentions "some important new contract wins" during the period.

This is a software provider which offers billing, pricing and customer relationship products.

I find it hard to differentiate between companies in this sector. But the financials at Cerillion do potentially look interesting from an investment point of view.

New IPO

This company listed in March 2016, at the same time it acquired its operating subsidiaries, and has a year-end in September,

So the official group numbers only show you a six-month contribution from the underlying business, and include the one-off costs of the IPO, etc.

The underlying subsidiaries generated PBT of £2.1 million in 2016 and 2015.

My opinion

A simple calculation on last year's results suggests to me that the company has a degree of operating leverage of 3.5x, so that EBITDA should grow at 3.5x the rate of revenue growth. That's reassuring, since today's numbers are in the same ballpark (EBITDA growing at 4x the rate of revenue growth). So relatively small increases in revenue could make a big difference to EBITDA, which would hopefully feed through to the bottom line.

I would need to achieve a lot more familiarity with the company's products before contemplating a purchase here, but the numbers look interesting at first glance. It has net cash (at the date of last year's annual results) and pays a dividend too.

Empiric Student Property (LON:ESP)

Share price: 110p (+0.2%)

No. shares: 501.3m

Market cap: £551m

Results for the six months ended 31 December 2016

Change of accounting reference date from June to December, which apparently suits the company better (since it is busiest around the start of the academic year in September).

The asset base has grown rapidly in recent years, e.g. with a £125 million equity raise last March! And now another £143 million of debt has been raised through two new facilities.

NAV is growing at a more relaxed pace, nudging up to 105.9p from 105.4p in June. But the total return is pretty good thanks to regular quarterly dividends (3p paid out in this six-month period).

Leverage has risen but is still within company limits. (31% actual loan-to-value, versus 35% target and 40% upper bound).

Valuation yield of 5.9%, which says to me that valuations are not too stretched versus rents.

My opinion

I've argued before that foreign students, who make up the majority of Empiric's tenants, are likely to continue to study in Britain, regardless of Brexit. Especially the ones who can afford private accommodation in prime locations such as Empiric's: I would lean heavily toward the idea that visas will still be made available to these types.

So I have quite a favourable view of the macro outlook for this REIT, and they seem to be executing quite well. Overall, looks like a reasonable proposition to me!

Plant Health Care (LON:PHC)

Share price: 27.5p (+1%)No. shares: 147.8m

Market cap: £41m

Results for the Year Ended 31 December 2016

Kudos to Paul for calling this provider of plant enhancing products a bargepole job back in September 2015, at a 98p share price.

Shares outstanding have doubled since then.

Last year, the company included in its financial highlights the following:

Revenue increased by 15% in constant currency, 9% in USD to $7.5m ($6.9m in 2014)

This year, we read:

Revenue of approximately $6.3 million; sales in the United States decreased by approximately $1.1million, due to our distributors having excess year-end inventories in the United States. Growth outside the United States was 15% in constant currency.

See how there was no mention of last year's total sales figure in the highlights this time? Quite silly really!

Also, isn't it unusual to blame distributors for having "excess year-end inventories"?

The Chairman/Interim CEO:

We were clearly disappointed by the sales performance of the Commercial segment. This was entirely due to several of our distributors having excess year-end inventories in the USA. Elsewhere, sales growth continued to be encouraging. Solid progress was made in developing sales with existing distributors and we continue to develop relationships with new distributors, with whose support we anticipate a resumption of rapid sales growth in 2017 and beyond.

I think investors would do well to apply Occam's Razor to this. While it's possible that a bad performance by distributors is to blame - which also involves blaming PHC for choosing bad distributors - it's safer to assume that PHC alone is to blame for not achieving target sales.

Incidentally, PHC lost its CEO of almost four years in November, and does not appear to be searching for a permanent replacement yet.

Outlook

The company is bullish on new technologies. PREtec means "plant response elicitation technologies":

All our established evaluation partners have extended the terms of their evaluation agreements into 2018. This, and their expressions of interest in Innatus 3G are encouraging signals for the competitive licensing process we plan for early 2018. In addition, we are targeting a revenue-generating licence for one of our PREtec technologies during 2017.

And it reckons it is cashed up for this year and next:

Plant Health Care has a clearly defined strategy, which we are implementing effectively. We anticipate that existing cash reserves, together with forecast commercial revenues and cost savings already put in place, will now fund the business at least until the end of 2018. As a result, we are confident that the next two years will see a step change in the position of Plant Health Care.

My opinion

At year-end, it had $10.1 million in cash and investments, having used up $9.1 million of cash in operating activities. So just over a year of cash left, at that rate.

Cost savings should hopefully put off the next day of dilution for as long as possible, although it looks quite ambitious for it to do so until the end of 2018. Being allergic to dilution, as I am, this would fall well outside of my risk tolerance!

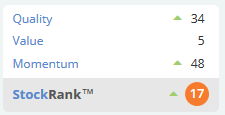

Stockopedia agrees with me on the Value at least.

That's it for now. Hopefully there will be a few more of our usual stocks reporting tomorrow.

Have a good day,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.