Good morning!

Lavendon (LON:LVD)

This is a powered access hire company (so presumably renting out cherry-pickers, scissor lifts, boom lifts, etc), with about half their business in the UK, and the rest in Europe & the Middle East.

The company's H1 trading update this morning looks mildly positive, with rental revenues up 7%. The growth came from (in descending order), the Middle East, UK, and perhaps surprisingly, France. Whilst Belgium & Germany saw single digit % declines in hire revenues.

On profitability the company says;

The growth in Group revenue across the first half of the year has driven improved profitability, operating margins and ROCE, despite the increased exchange rate headwinds on our overseas earnings. The Board's primary focus remains on improving the Group's ROCE above our average weighted cost of capital across the business cycle and we are confident of making further progress towards this objective in 2014.

...the Board is increasingly confident of delivering on its expectations for 2014.

As you would expect for a hire company, there's quite a bit of debt, reported at £99m at 30 Jun 2014, which is expected to remain at a similar level in H2.

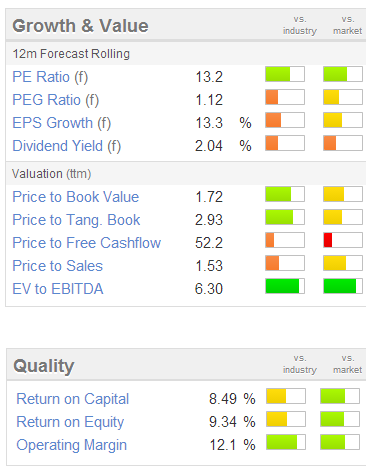

On valuation, it looks about right to me. See the usual valuation graphics to the right. With 168.7m shares in issue, and a share price of 210p, the market cap is currently £354m. So net debt is about 59p per share, which has to be factored into the valuation to some extent.

Bear in mind that companies with a fair bit of debt will in all likelihood be facing increased interest charges over the next few years as interest rates rise, depending on what hedging or fixing arrangements they have put in place. So that could be a bit of a drag on earnings in future, but will probably be more than offset by improving economic conditions.

Another worry with equipment hire companies is that they've faced limited competition in recent years, as bank lending for small companies has been so tight. That could change over the next few years, which is likely to mean smaller competitors springing up & eroding the high margins which hire companies have enjoyed in the last few years. So various positives & negatives to weigh up in this sector.

Shaft Sinkers Holdings (LON:SHFT)

There's an alarming announcement this morning from this African engineering company;

The Company has endured a challenging first half of the year as a result of previously announced issues related to South Africa and the continuing cost of litigation arising from the outstanding dispute with EuroChem.

As announced on 19 May 2014, the Company has been pursuing a number of initiatives to address cash flow issues including the deferral of non-essential expenditure, the disposal of assets and surplus property and improvements to the recovery cycle of receivables.

Since May the Company's cash position has further deteriorated to the extent that it is has engaged with various parties regarding the urgent provision of new financing to satisfy near-term liquidity requirements. Negotiations with these parties relate to various financing methods, as well as the disposal of certain assets, and are continuing with the objective of preserving value for shareholders whilst also enabling the Company to continue trading.

The above makes it fairly clear that the company is on the brink of going bust, so if I were a shareholder I'd be scrambling to get out what's left of my money. So it has to be awarded my maximum strength bargepole warning.

There's a chance it might survive of course, but why take the risk of a 100% loss?

It's not a company I've reviewed here before, because I tend to avoid overseas companies listed on AIM. Such a high proportion of them go wrong, that it's just not worth the risk. AIM generally is at least half full of rubbish, but the overseas companies seem to be particularly awful!

Mello Central

A quick reminder for tonight's Mello Central investor evening, which as usual is at FinnCap's offices in New Broad Street, EC2M 1JJ. Arrival time is from 17:00 to 17:30. The companies presenting are GLI Finance (LON:GLIF), Rightster (LON:RSTR), and 7digital (LON:7DIG).

I'll try to come along, but am snowed under with Q2 reporting work at the moment, so it depends on whether I manage to finish that in time.

Mello Beckenham

Also a reminder for this friendly investor evening on Monday. Booking details here.

Panmure Gordon & Co (LON:PMR)

I wrote about this city broker in my report here on 21 May 2014, pointing out how this share had inexplicably lagged other small brokers, which had re-rated. So here is the same chart updated to today, showing Panmure's share price having lagged behind considerably from similar sized listed brokers.

This is all the more surprising since Panmure are winning new business, and trading well.

The chart below shows Panmure's share price over the last two years (the dark line, currently at 160p). The other two lighter coloured lines are the comparative share price performance of listed competitors Arden Partners (LON:ARDN) and WH Ireland (LON:WHI). Both have come down from their peaks in Mar, but still imply a good 40-50% upside on the price of Panmure if it were to catch up with them.

This morning's trading update from Panmure is excellent;

The Company's revenues for the six months ended 30 June 2014 will show significant growth over the same period of 2013, driven by improved performance and increased investment across all of Panmure Gordon's business lines. Profit before tax from continuing operations is expected to be approximately £1.8 million (six months to 30 June 2013: £0.3 million).

That's an impressive performance, to increase H1 profit from £0.3m last year to £1.8m this year. One must temper this by recognising that it has been a buoyant period for company fundraisings, and there's no guarantee that will continue.

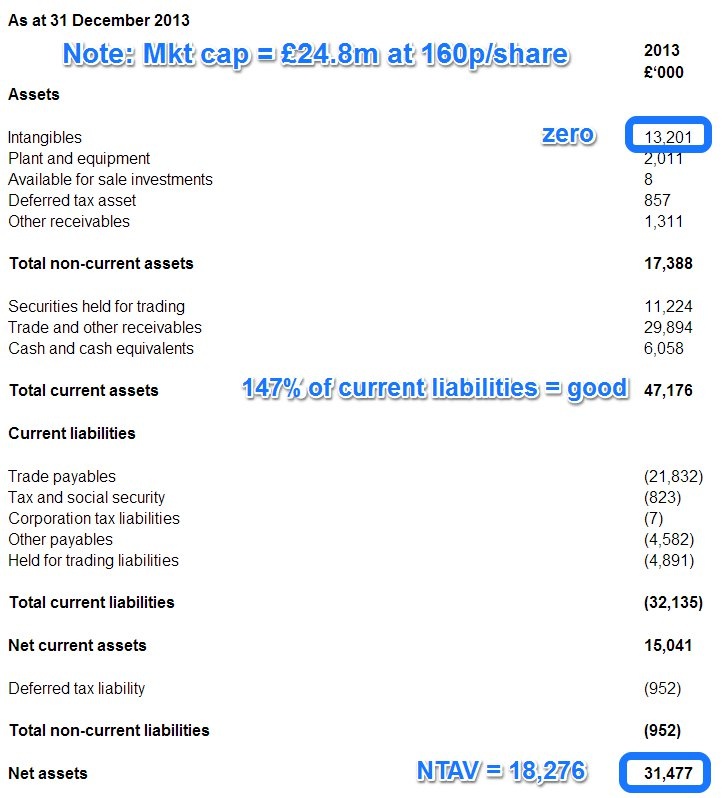

Although Panmure does seem to be in better shape now than it has been for a few years, especially since their problematic American operation has now gone. It's a big name broker, yet with 15.5m shares in issue, at 160p per share, the market cap is only £24.8m.

Moreover, the Balance Sheet is strong, with net tangible assets of £18.3m.

I have adjusted & commented on Panmure's 31 Dec 2013 Bal Sheet below;

.

.

As a shareholder, I shall be expecting a dividend at the end of this year, so the company needs to get back into the mindset of paying divis again - the last one was paid in April 2008. If they don't pay a divi, then the accusation that the business is run for the benefit of its staff will surely stick?

In the meantime though, I think it looks very good value, and is a big name broker. It's amazing that the market cap is this low really.

Bloomsbury Publishing (LON:BMY)

Today's update from this company contains rather too much detail, and not enough overview, in my opinion. Therefore, since I don't know the company in depth, it's not really possible to draw much in the way of conclusions from it.

Q1 reveues (being the 3 months to 31 May 2014) are down 9% on last year, although it is pointed out that last year's Q1 was unusually strong (up 19% against 2012). Various other details are given. Note that net cash has fallen, and is now only £2.9m, following payments of £8.6m for acquisitions.

The accounting treatment of amortisation of internal development costs for their online presence is being changed, so that it will no longer be in highlighted items - i.e. they won't be ignoring it to boost reported profit any more. Prior year figures are being adjusted with a £1m negative impact on the highlighted profit, but no impact on profit before tax.

Management comments today are;

We continue to develop Bloomsbury as a wholly integrated trade and academic publisher. This is traditionally a quiet quarter for us. We remain well positioned to benefit from a strong publishing programme, including powerful new titles from Margaret Atwood, Paul Hollywood and Tom Kerridge later this year

As a general point, I'm increasingly sceptical about highlighted items in accounts. This fashion is being abused by many companies, and you can't go far wrong by ignoring all the adjustments done to boost headline numbers, and instead just rely on old fashioned profit before tax. It's striking how overvalued many companies then look!

There might still be a place for publishers, but in the days of Amazon (in publishing now, not just retail) and self-publishing, I can't help feeling this company will be up against relentless headwinds forever. So I'd be looking for a PER of 6 or below before it would interest me now, which is a price well below a quid per share. We're a long way above that at the moment, so I'll pass.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.