Good morning!

CML Microsystems (LON:CML)

This is a small semiconductor designer & manufacturer. It's not an industry I understand at all, so that's why I've not looked in detail at this company before in these reports. The reason for mentioning it today is that preliminary results for the year ended 31 Mar 2014 have been issued, and this has triggered a 21% fall in share price to 430p, so commisserations to holders of these shares.

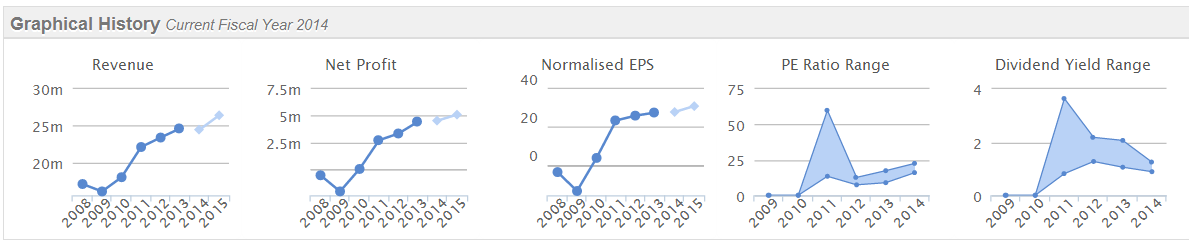

Growth seems to have ground to a halt, with turnover down a whisker at £24.4m, and profit before tax up 6% to £5.8m (note that's an excellent profit margin at 23.8%). Basic EPS is 30p, so the PER works out at 14.3, which seems a reasonable rating for a technology company (which tend to be highly rated).

The fly in the ointment is the forward-looking comments, which are cautious;

The Company was able to deliver on market expectations for a firm full year improvement in profitability although, as evidenced through the period under review, it was record first half revenues and profits that drove performance. Second half sales were affected by the previously explained and unforeseen customer events within storage markets and this, coupled with the cyclical volatility from wireless, created a headwind for revenues that will also impact the current year. In reporting on a year when we have delivered record profits, it is disappointing to now convey short-term caution but, beyond this year, the board is confident of delivering a return to revenue growth.

I'm not sure how to interpret that. It doesn't sound like temporary factors, if H2 was soft, and the current year is also expected to be soft. That sounds more like competitive issues perhaps? I wonder whether the high profit margins are sustainable, given that demand has softened?

Note that the company has some surplus land that it is trying to monetise by getting planning permission for a residential development. The Balance Sheet is very strong indeed, with £16.2m in current assets, versus £2.8m in current liabilities - so that's 579%, one of the strongest working capital ratios I've seen for a while! That includes £11.4m in cash too. Inventories look very tight, at just £1.1m, which is generally a good thing, providing they have enough to service demand.

There is a pension deficit though, which has shrunk from £6.1m to £2.7m, which would be worth checking in more detail in the Annual Report.

It's worth noting that profit is partially helped by them capitalising £4.1m in development costs, although the amortisation charge was fairly hefty at £2.6m. Therefore arguably, if you were being super-conservative, you could argue that profit should be marked down by the difference there of £1.5m to adjust out capitalisation of development costs, which is my preferred way of viewing accounts.

There's a small, but well covered dividend.

Overall, there are a lot of things I like in these figures. So it would be worth considering these shares, in my opinion, if you think that they can kickstart growth again. It would probably be worth talking to people in the industry, and ask about CML's products, and how they stack up against competitors. Is it yesterday's story, or is it a fundamentally good company that has just hit a temporary soft patch? I don't know.

Getech (LON:GTC)

This micro cap is a provider of geological data to oil exploration companies. Shareholders are having a tough year, as the company warned on profit on 17 Feb 2014, and interim results to 31 Jan 2014 were very poor (profit fell by 83% against last year's H1).

I've been pretty sceptical about this company in my reports here, and so far that's proven correct. Today the company has issued another profit warning, with the main part explaining as follows;

The Company has now built what it regards to be a very strong sales pipeline including close to £2m of leads where clients have recently given written or oral confirmation that they intend to proceed. We are therefore confident that a number of significant contracts, including several Globe renewals, will be signed in the very near future. However, with the expected cycle time to convert the sales pipeline into contracts and then revenue, the Directors believe that the Company will deliver pre-tax profit for the 12 month period to 31 July 2014 which is significantly below the market expectation.

The market cap has now fallen to about £12.4m, at 41.5p per share. It all boils down to whether you believe that the orders will come through, and are just delayed, or whether that's just the excuse that's being given for failing to deliver the expected improvement needed in H2.

I remember saying back at the time of the earlier profit warning, that the forecasts were now so heavily weighted to H2 that another profit warning was likely, as that's exactly what's happened. You see this happening time & time again when companies miss H1, but say they will recoup it in H2 - all too often it's wishful thinking, and just delaying another profit warning.

It seems to me that Getech is just too difficult to forecast accurately, as they rely on lumpy contracts with uncertain timing. That said, with the market cap down to £12m, the market isn't expecting a lot from the company. So if they can turn the order pipeline into sales, then the figures start to look better in H1 of the new financial year beginning on 1 August (as they will be up against very soft comparatives).

Tricky one. My instincts say this share could fall further, but I've picked up a small amount of stock this morning to dip my toe in the water. I'm interested to hear reader opinions on this one, so please comment away in the comments below.

Minds + Machines (LON:MMX)

I'm going to risk incurring the wrath of the strident private shareholders in this company by repeating my previous concerns that they seem to be pursuing a business model which, in my opinion, probably has little merit. It's alll to do with new domain names being issued with suffixes like .london, .cooking, .horse, etc.

This company today says;

We believe that we are at the start of a very significant new trend in the entire Internet, where small businesses and individuals will over time dramatically increase the amount of names they use online, and do so with far greater ease.

Very few people I've spoken to agree with this. The point is that nobody needs to remember domain names any more. You just put the company name into Google, and it takes you to the company's website. The domain name is irrelevant.

They're a funny set of figures for a £99m market cap company, the very late audited results for the year ended 31 Dec 2013, published today.

Turnover is only £36k! The company would have incurred a loss of about £2.8m, however a large credit of £4.1m has gone through the P&L described as "Profit on gTLD auctions". See if you can make any sense of the relevant part of note 17 which covers this issue, as I can't:

Of the applications withdrawn, 3 applications were withdrawn as a result of participation in private auction where the Group did not win the auction but received a portion of the auction proceeds. Such auction proceeds, less amounts not recovered from the Group's withdrawal of the application to ICANN are accounted for on the profit and loss account as Profit on participation in gTLD auctions and amounted to £4,120k (2012: nil). The remaining applications were withdrawn based on management's assessment of success of the application of those gTLDs. Of the application fee, those amounts not recovered from ICANN as a result of the Group's withdrawal of the application are accounted for on the profit and loss account as Loss on withdrawal of gTLD applications and amounted to £253k (2012: nil).

That's total gobbledygook to me.

The company has plenty of cash, which was reported at £21.7m ay 30 Apr 2014, following an equity raise in Jan 2014. It looks as if the domain names were not launched until after the year end, so that's probably why there is negligible turnover. The company says it will spend all the cash by the end of 2014 buying the rights to issue new domain names with the new suffixes.

I can see that some businesses might pre-emptively register domain names, so hotels & restaurants, etc, might register domains such as Savoy.london, etc, and then point them at their existing websites. On the other hand, why bother, given that anyone can just Google "savoy hotel" and go straight to their website already? Surely this company is inventing a solution to a problem that doesn't exist?

Anyway, we'll see if it works. The shares are really just for gamblers in my view. Personally until the model is proven, I wouldn't pay more than cash, so about a fifth of the current share price.

Vianet (LON:VNET)

Final results for the year ended 31 Mar 2014 have been issued today, and look OK to me, so am a little surprised that the shares are down 4p to 78p this morning.

The core (and most profitable, by far) business is the beer flow monitoring equipment for tied pubs. Whilst this is a profitable niche, it is also up against a headwind of pub closures, probably worsened by the recent Government statutory code - which was designed to help financially struggling tenants, but probably accelerated the closure of pubs by brewery groups, by introducing more uncertainty.

It's encouraging to see that the vending telemetrics division has moved into a modest profit of £0.35m, so the company seems to (at last) be gaining some traction there.

From an investor's point of view the dividend is the main attraction, at 5.7p per share. That's a very generous yield of 7.3%, but the way I read the figures, it looks like the company is struggling to maintain that level of dividend, so at some point it might well be reduced.

It's difficult to use an EPS figure, as this is distorted by a tax credit to the P&L.

I'll go through the results in more detail later today, but on an initial skim there don't seem to be any nasty surprises there, and in what must have been a very difficult year, the company seems to have weathered the storm over the Statutory Code pretty well.

There is a results presentation online here.

That's all I've got time for today.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in VNET and GTC, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.