Good afternoon folks,

I can't see anything of interest in today's RNS feed, so I'm going to circle back to look at Charles Taylor (LON:CTR), which was requested in the comments yesterday.

Charles Taylor (LON:CTR)

Share price: 243,25p

No. shares: 67.4m

Market cap: £164m

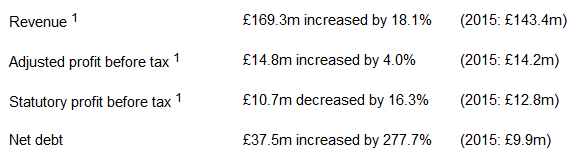

The difference between statutory and adjusted PBT is down to amortisation (£3 million worth) and "other adjustments" (£1.3 million).

There are plenty of moving parts within this insurance group; in simple terms the core Professional Services segment saw a small reduction in Operating Profit, while the Owned Life Insurers segment swung into profitability from breakeven (due to an acquisition).

Dividend continues to rise gently and the shares are currently yielding over 4%.

Reading through the various divisional performances, it sounds like a solid if unremarkable period on the whole.

I've read online that 2016 was the worst year for natural catastrophe losses since 2010 - which should have been good news for insurers (those who can afford the payouts, at least). In insurance, you want strong demand for what you're selling, and you want high premiums, and you don't get these when there are no catastrophes.

In relation to its adjusting business, Charles Taylor remarks:

The level of insured claims in the market as a result of catastrophic natural and man-made disasters increased, although the market for larger and more complex insured losses of the type principally handled by Charles Taylor, remained challenging throughout 2016. There are, however, signs that loss activity may be increasing.

So it sounds like there has possibly been a bit of bad luck for CT in relation to the specific types of event they adjust for.

Outlook: performance so far is in line with expectations, and the strategy of organic growth plus acquisitions is unchanged.

My opinion

The adjustments are as you'd expect given the company's overall growth strategy, and relate to various acquisition and set-up costs. So while it's true that statutory PBT fell in 2016, the growth in underlying PBT is certainly worth noting.

I haven't studied this company in-depth before but it looks like it could be a decent share to buy-and-hold. The strategy appears to be working reasonably well, and while I do generally prefer organic vs. acquisitive growth, I could make an exception in this case.

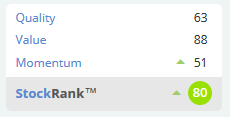

The StockRank is very good, which always helps!

Cineworld (LON:CINE)

Share price: 642p

No. shares: 269.3m

Market cap: £1,730m

This is a lot bigger than our normal mandate here at SCVR, but is another one which was requested by readers, and is a sector which I'm interested in.

Cineworld is another beneficiary of Sterling devaluation, as the constant currency revenue gain was a more modest 8.7% rise (versus the 13% depicted above). Cineworld is active in Poland, Israel, Romania, Hungary, Czech Republic, Bulgaria and Slovakia.

The operational highlights show good progress in number of customers, sites and screens. Total number of screens is up to 2,115. Another 132 screens are scheduled this year, and 441 in total over the next four years. 20% growth over four years - doesn't sound unrealistic.

Outlook

They say they are "well positioned to continue delivering on [their] strategy".

Looking at US box office sales confirms my suspicion that 2016 wasn't a terribly impressive year for the movie industry, seeing growth of 2.2%.

For what it's worth, Cineworld reckons there is an exciting film slate for 2017 with a wide variety of sequels (more predictable sources of revenue than original titles!) plus some "new titles" (although I note that the ones they mention include a Disney remake along with a well-known comic book character).

My opinion

I'd tend to agree that 2017 should produce better sales growth for the industry than 2016 did.

Checking the sales mix, it's encouraging to see 12% growth in UK "Other Income", which consists mostly of advertising income (ads shown before the main feature). It also includes the online booking fee and event hire. Apparently the advertising revenues were flat, so the other elements must have driven that 12% growth.

The UK also achieved 10% growth in Retail revenues (food and drink sales).

The bottom line is that Cineworld has more than one way to grow the bottom line!

Overall, I remain very impressed by the growth trajectory at Cineworld, both over the short-term and the long-term.

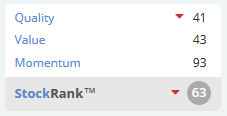

The StockRank is not as high as I'd expect, because it turns out that the Quality scores are not too high.

I suppose that makes sense, because Cineworld could perhaps be considered as a type of real estate business: fairly predictable revenues are derived from large up-front investments in cinema properties and infrastructure.

Return on equity is boosted by the considerable use of borrowings (£280 million of net debt at last count) but there is substantial net cash flow from operations which could be used pay this off if necessary - £150 million last year, versus £166 million in 2015. But cash flow is instead mostly used for reinvestment, which in turn drives the growth witnessed over Cineworld's history.

A really interesting stock and a successful company.

That's it from me. Have a great weekend!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.