Good morning! Well, I can really smell the fear in the market this morning, following on from a bit of a sell-off last night in the USA. People who bought fashionable, over-valued shares purely on hype & momentum are rightly being whacked the hardest. I think that's very encouraging, and healthy - this market has for too long rewarded reckless people making bad decisions, so it's excellent to see some sanity coming back into valuations.

Meanwhile the value shares in my portfolio are barely moving, some have even gone up. This just reinforces my view that it's a mug's game trying to ride momentum, because you never know when an upward move is going to end. Valuation always carries the day, in the long run. So any share that is difficult to value right now, or has a large speculative element to the valuation, is highly vulnerable to a big drop.

I'm short of five overvalued stocks, and that has proved lucrative, although it was scary standing in the way of the momentum at the time of opening the shorts. It's also been a good portfolio hedge, and has given me a larger pot of cash to deploy buying any bargains that crop up. So I've topped up on one long-term value position yesterday, and am scouring the market now for more bargains.

One of the best lessons I've learned, but which has taken over 15 years to achieve, is to take my foot off the gas when markets are frothy, and put some money on the sidelines, then just wait. Eventually the market will throw some bargains at you, but you can only buy them if you have cash on hand. Being fully invested all the time, or even worse being geared up all the time, is just a disaster waiting to happen (as I discovered in 2007-8). Markets favour the patient!

I'm not ready to buy into cut-price speculative shares yet. This feels like a proper correction to me, so I think there could well be much better buying opportunities ahead, as people panic sell, especially those on margin. Just look at how much large cap speculative shares have dropped from recent peaks - e.g. ASOS (LON:ASC) peaked at £70 a share, and is now under £44 a share, a 37% drop!

It's amazing how investor psychology can change, and rapidly. Investors in some of these speculative stocks have gone from feeling invincible a few weeks ago, to now worrying about whether they are going to look like fools for still holding such shares, as you cannot support the valuation even now, after a 10-40% drop in many of these things - they still look overvalued!

IPOs are under a lot of pressure now. I know of several that have been pulled, after a lack of investor appetite. So the days of racy valuations and unquestioning investors, are already over (for the time being anyway). I'm trying to short one or two of the larger, and more daft valuation recent IPOs, but it's not easy to get a borrow on them.

Bonmarche Holdings (LON:BON)

This is a value ladieswear retailer, that used to be part of the Peacocks group. It did a successful IPO in Nov 2013 at 200p, which at the time I thought looked a bit of a rich valuation, based on the figures in their listing document. However, I was clearly wrong because the share price has since gone up to 292p, and the company has today issued a very good trading update.

This update relates to both Q4 and their full financial year, ended 29 Mar 2014.

Q4 ended very strongly, with LFL* sales up 13.5%, an improving trend since the full year figure is +10.4%. As a former retailing man, I can tell you those are the sort of figures any FD would dream of. It's hard enough to get +5% sales growth in a buoyant economy, so these figures really are excellent.

* LFL = Like-for-like, i.e. stripping out the impact of store openings & closures.

Having said that, there is no mention of gross margin, and they indicate that profit will only be "slightly ahead of its expectations", so it looks like a strong performance was already baked into the forecasts. That probably explains why the shares are only up 1% this morning to 292p.

Note that online sales growth was very strong at 84.2% fo the year, but probably from a low base I imagine. Bonmarche has 263 stores.

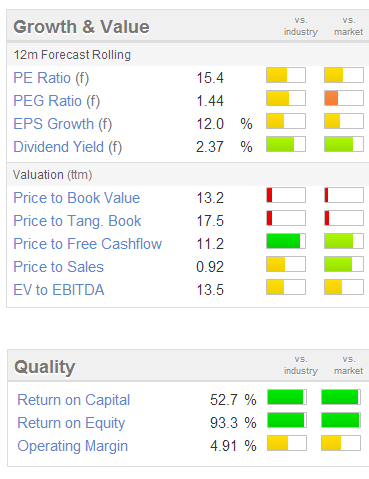

As you can see from the Stockopedia graphic on the right, it's probably priced about right for the time being, with a medium PER and dividend yield.

The ROCE and ROE figures look very high, so those would need to be double-checked. It's important to remember that all the data & graphics are only indicators, and should not be taken as gospel. There can be unusual factors that distort the figures.

Today's trading update also indicates that the stock position is clean (i.e. last season's stock has been cleared), and that the financial position is sound - although personally I like to determine that last point myself from the financial results!

Anyway, I'm looking for bargains, not things that are priced about right, so this stock doesn't interest me.

HML Holdings (LON:HMLH)

I've not come across this company before. It's a very small (£11.4m market cap at 31p per share) property management company in the South East of England. It's delivered a steady improvement in profits and EPS over the last four years, so might be worth a look for those who like micro caps - although watch out for very wide spreads and lack of liquidity - so this size of company should be a lot cheaper than larger companies.

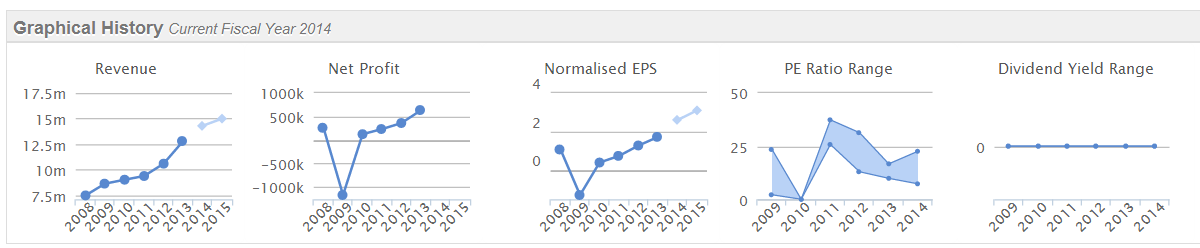

The Stockopedia graphic below shows positive trends, although note there is no dividend - but a maiden dividend is forecast for the year just ended (31 Mar 2014).

The forward PER is shown as 9.5 on broker consensus, which is probably about the right price for a small property management company. The shares have doubled in the last year, and are probably now up with events. There's a trading update today which says (for the year ended 31 Mar 2014);

...the board anticipates being able to announce earnings marginally ahead of market expectations...

We are confident that improvements in our operating efficiency, combined with a positive market environment will ensure this growth in earnings is ongoing.

Whether they will do quite so well when house prices inevitably correct in the South East, when interest rates go up, is perhaps a point to ponder? Cheap borrowings, and the Help To Buy scheme can probably keep house values artificially high for the time being though. Although whatever property prices do, the lettings market is likely to remain buoyant, as people need somewhere to live, and currently there are not enough houses to go around.

Games Workshop (LON:GAW)

The toy models shops issues a very brief trading update today, covering the period from 2 Dec 2013 to 6 Apr 2014. All it says is this;

In the four months to 6 April 2014 trading has been broadly in line with the board's expectations.

So in real English, that means slightly below expectations.

These shares have stabilised after a nasty profit warningin Jan 2014, which I wrote about here.

Broker consensus EPS forecast has come down to just under 40p, so with today's statement saying slightly below, oh sorry broadly in line, that means we're probably looking at say 37p EPS at a guess, for the year ending 2 Jun 2014. So at 520p that puts the shares on a current year PER of 14 - which is probably about the right price.

Therefore it's not of any interest to me.

There might be some upside on the turnaround plan that the company is executing, where they are increasingly moving to smaller, single person stores in order to cut overheads.

Mello Beckenham

David Stredder has asked me to remind regulars that it's the usual monthly investor evening in Beckenham this coming Monday, 14 April. So here's the usual link to book. David has a particular problem with no-shows, so if you are booked in, please do turn up, or let David know you can't come. Otherwise it causes problems with the catering.

That's it for today, and the week.

Thank you for reading, and commenting, and have a lovely weekend.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.