Good morning,

Thank to everyone who gave feedback yesterday about the formats of these reports. Paul and I each read all of the comments and we depend on feedback to help understand what works best for you, so your responses are invaluable.

For today, company news looks very quiet at first glance. This is one of those moments when micro news gets overshadowed by macro concerns - house prices, N Korea, etc.

I've been trimming my portfolio a little for reasons which have nothing to do with the attractiveness of the stocks I'm holding, so I'm in the unusual situation where I would prefer the stock market to be high rather than low (as a net seller rather than a net buyer, which I had always been up to this point).

My approach to selling has been the mirror image of my approach to buying: gradually, in small pieces, and with a tendency to cut the weeds while letting the flowers continue to bloom (using the parlance of Warren Buffett).

So I'm trying not to get too caught up in the FTSE and Forex movements from day to day. Besides, the market as a whole has been very kind to us over the past 18 months or so. It seems sort of ungrateful to complain about the 1-2% unfavourable movement here and there, when the 10-20% swings have been favourable!

Anyway, that's enough of a preamble.

Comments will be added here later this morning on:

- TT electronics (LON:TTG)

- Volution (LON:FAN)

- Orosur Mining Inc (LON:OMI)

Or if I've missed something else that you think is worth updating on, please let me know.

Thanks

Graham

Orosur Mining Inc (LON:OMI)

- Share price: 15.25p (-5%)

- No. of shares: 100.8 million

- Market cap: £15 million

Oversubscribed Conditional Subscription

This South American gold miner, dual-listed on AIM and on the TSX in Canada, is something I've kept an eye on ever since I invested in it back in 2013-2014.

Those shares have long since been sold but I like to keep an eye on Orosur's progress all the same.

Most of the readership here probably has scant interest in junior miners, since such stocks often tend to be highly speculative, difficult to analyse, and to eventually de-list or otherwise provide a negative 100% return for investors.

Orosur is the exception that proves the rule in this regard.

Back when I invested in it originally, the Price to Free Cash Flow ratio was somewhere around 3x. A new management team was on board and they had pledged to start making dividend distributions.

Orosur was special in that it was producing consistent results (c. 30,000 oz of gold per quarter from Uruguay with low operating costs), provided superb forecasts and disclosures, and consistently met or exceeded the guidance it gave to investors.

But the promised dividends never arrived, and when I realised they weren't coming, I got out.

This RNS confirms my suspicions that Orosur, despite its apparent qualities, is not so very different from the other capital-hungry junior miners on the market place.

16.7 million new shares are being issued at C$0.241 per share (14.7p).

Rationale is as follows:

The Company also announced in its operational update that it planned to commence a 15,000 - 30,000 metre drilling campaign in 2017 in Colombia, culminating in the preparation and publishing of a maiden N.I. 43-101 compliant resource report for the Anz gold project (Anz). The net proceeds of this Subscription of US$3.2 million are intended to be deployed for drilling and associated activities at Anz, and are budgeted to fund an initial 15,000 metres of diamond drilling.

Meanwhile, the free cash flow from the main gold asset at San Gregorio in Uruguay will be used to increase its mine and/or utilise its spare capacity.

And this is my problem with the miners: they never stop investing. The capex simply never ends. And eventually, if and when things don't go to plan, they need a further injection of funds.

There was a book I read at the time, How to Invest in Mining Stocks or some other similar title, by a very experienced mining analyst whose name escapes me.

Near the end of the book, he explained that it was important to time your exit from a mining stock correctly. The reason he explained was that sooner or later, they basically all go to zero. I couldn't believe what I was reading! And I never invested in mining stocks again.

So if you were wondering why we generally don't cover junior resource stocks here at the SCVR, hopefully that's a good explanation!

I haven't ruled out investing in resources forever - but it would need to be a really compelling and unusual proposition.

TT electronics (LON:TTG)

- Share price: 213.9p (-1%)

- No. of shares: 162.4 million

- Market cap: £347 million

I last covered this international, high-tech electronics business at the AGM statement in May.

Last month, it announced a reorganisation of its business units. This graphic illustrates how the group is currently organised, along with the revenues of each respective unit:

(IMS = Integrated Manufacturing Services, now renamed Global Manufacturing Solutions)

Organic revenue growth for the first few months of the fiscal year was only 1%, while total revenue growth was 10%.

But the order book was said to be strong and the company was bullish about its market positioning.

Today's half-year report confirms that the momentum is real:

Checking a little further down the statement, I see that organic revenue growth (the most valuable kind of growth) has improved to 5%. Not bad. This was driven by:

positive market dynamics and share gains in the Sensors and Specialised Components division and strong market demand in Power Electronics including some one off last time buy activity as we move production from Fullerton in the US to our Bedlington facility in the UK

Hopefully the one-off effect mentioned above is not too large!

As discussed in May, the cash conversion at TT Electronics is real, and allows them to pay a nice dividend stream.

They even got a positive working capital movement during this period, so that cash conversion came out at 128%!

The business is changing and management say they are going to become a "higher margin, higher quality business" following a forthcoming disposal:

We will continue to focus on our chosen markets in areas where increasing electrification is fuelling demand for our high reliability engineered electronics. With the requirement for more data, connected devices and improved precision coupled with the demand for reduced size and weight alongside increased packaging density and power efficiency, we feel confident in the long term growth drivers for our offerings.

Personally, I love the fact that ROIC is one of their KPIs and even though their 10% rate is still quite far from stunning, I'd be heavily biased to invest in a team such as this which is focused on improving it.

The outlook statement is mild, merely stating that management has "confidence of making further progress" this year.

My opinion

The company is carrying about £55 million of debt, so for a company of this size that certainly needs to be factored into the valuation. Edit: thanks to readers who pointed out that this would be transformed to £55 million of net cash, taking into account the proposed sale of an unwanted unit.

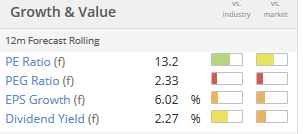

The Stockopedia computers still like it a lot and the StockRank is still good at 86.

While the ROIC and other quality metrics are fairly average, and while the rolling PE multiple is again quite average at 15.4x, this is still a stock I could justify holding within a balanced portfolio.

It's well-balanced internationally, is well-diversified among products and services in niche sectors, and has a management team which seems to be focused on doing the right things. So it gets the thumbs up from me.

Volution (LON:FAN)

- Share price: 188p (-1%)

- No. of shares: 199 million

- Market cap: £374 million

Volution is an international group of ventilation-related brands which doesn't appear to enjoy much love from the private investor community. It has zero all-time comments on some of them most-frequented bulletin boards.

Checking my files, I actually looked at it a year ago and concluded that it was a boring (in the good sense) stock, and that it might enjoy technical price support around the 150p IPO price at which its former PE backers offloaded.

Extract fans, hand dryers, etc. are unlikely to spark the imagination of investors, but if you just want to make money then these sorts of boring stocks can be fantastic.

Today's update informs us that results for FY 2017 (ending July) should be in line with expectations.

Revenue in the 12 month period was £185 million, a 20% increase (15% on a constant currency basis) compared with the prior year. This comprised 7.6% organic growth (2.4% on a constant currency basis), with 13% the result of new acquisitions.

2.4% for me is the most real, the true "underlying" growth number.

Still, you probably wouldn't expect much on that front from the mature markets served by Volution.

The outlook is fine:

Integration of the two acquisitions in the year is progressing well, increasing our exposure to the new construction markets in both the Nordics and in the UK. Whilst uncertainty continues in the UK economy as a consequence of plans to leave the EU, our increasing market and geographical diversity gives us confidence for the year ahead."

My opinion:

It hasn't shown me any red flags yet, worth a look.

I'm afraid that's all for today, as the half-year report from Rotala (LON:ROL) doesn't seem too earth-shattering.

Thanks for reading!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.