Good morning. The Futures have gone mad overnight, apparently driven by big rises in China, with the Shanghai Index up 3.7% overnight on hopes that the Chinese Govt will "introduce supportive measures". Well that's what they have just said on CNBC anyway!

So we're currently looking at a FTSE 100 opening up 106 points at 6,600. So we've had a lot of volatility lately. The other striking move is that Gold has risen $32 to $1,292, so I've no idea what's going on there - but presumably because of the inverse relationship between the price of Gold, and the market perception of the value of paper currencies. So expectations of more QE is probably what has pushed up the price of Gold.

So I'm looking forward to a good day on the markets here.

There are about 10 announcements that look of interest to me, mostly trading statements, so I'll crack on.

Although it's a large cap, I must mention that Gulf Keystone Petroleum (LON:GKP) have announced a webcast of their recent investor day. I'm all for this kind of thing. Investor relations is changing, and increasingly companies are communicating better with their private investors, via the web. This is great, as it levels the playing field between Institutions, which traditionally get excellent access to management & information, and private investors, who often find it difficult to get hold of broker notes, don't have time to attend meetings in person because of having day jobs, may not have the confidence to telephone Directors, let alone actually be put through to them.

So I salute any attempts by Listed companies to disseminate better information to the private investor base - e.g. through commissioned research notes (Equity Development, Edison, etc), webcasts of management results presentations, putting presentation slides onto their websites, audio/videos of results presentations & general introductions to the company, communicating with Bloggers & journalists, conference calls & webinars, attending meet the management sessions (e.g. Mello events, ED Investor Forums, investor shows), etc. These are all excellent methods of communicating with private investors.

Building a private investor following using these methods is highly beneficial, as we create the liquidity, set the price, and narrow the spread. Each private investor that is interested in a company will usually trade multiple times during the year - the smart investors will top-slice after share price rises, and buy back on the dips. The less smart investors will buy into price spikes, and get stopped out of their spread bets on the dips! Most of us probably do a bit of both!!

Without liquidity & a narrow spread, there's not a lot of point being Listed, so this is fundamental stuff, and some people in the City (e.g. FinnCap, ED, and some of the financial PR firms) have grasped it, but most haven't, and continue to largely ignore private investors - which amazes me, because it's really so obvious that both Institutions and private investors need to be nurtured to create a healthy market, and make the most of a Listing.

A share with good value characteristics that I've mentioned before is publisher Bloomsbury Publishing (LON:BMY). Their IMS today covers the period from 1 Mar to date, so just over 4 months. It has a 28 Feb year end, so this is a trading statement for their financial year to date.

It looks very good - they say that Q1 revenues were up 19% year-on-year, although I can't see anything in today's statement about profitability. The thing I like about Bloomsbury is that they seem to be coping well with the move from print to digital, with eBooks selling well. Frustratingly, they don't say anything at all about profitability, but one assumes given the strong top line, then the bottom line must be looking fairly healthy too.

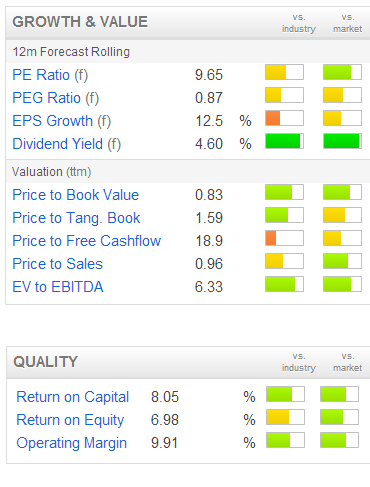

The shares look good value to me at 128p, which puts them on a PER of 9.8 times 13.1p broker forecast EPS for the year ending 28 Feb 2014. That seems a modest price, considering they also have net cash, which is reported at £8.5m at 30 Jun 2013. There's a cracking 4.6% forecast dividend yield too. I like this one, but don't currently hold any shares in it.

Spread betting outfit London Capital Hldg (LON:LCG) have issued a fairly upbeat trading statement. The spread betting companies like volatility in markets, as it drives client activity, and hence their profits. They state today that adjusted profit before tax for the six months to 30 Jun 2013 will be in the region of £3.1m, up on £2.1m for the same period last year, and their loss-making H2 last year.

Although I would question the validity of this adjusted profit figure. They have excluded £0.9m in IT costs, which I would argue are a normal part of business for spread betters, who are constantly investing in the latest IT. So to my mind, changing an IT platform is a normal cost for them, and should not be adjusted out. Similarly, they will always be adjusting their staffing levels, so the "non-recurring" restructuring costs of £0.7m are also questionable as to whether they should be adjusted out.

I'm struggling to see any point of difference for LCG, they seem to be a kind of me-too Spread Betting company with no point of difference, in a competitive market where it's quick & easy for clients to swtich providers, and where inevitably many clients fall out with their provider over margin calls.

That said, the market cap here does look pretty cheap, at about £19m. Although smaller Spread Betting companies are risky investments, as the sector has a history of companies blowing up in dubious circumstances from time to time, and that is bound to make investors wary of the sector as a whole.

Looking at LCG's last reported Balance Sheet, they had net tangible assets of £19m, the same as the current market cap, which is probably about the right price, if you want to value it conservatively. Maybe there is upside on that, if they continue trading well? Although another factor here is that the company put itself up for sale a while ago, with three competitors looking it over, but all three withdrew, so that tells you something.

A Mark Slater stock, Alliance Pharma (LON:APH), issues its pre-close trading update ahead of interim results to 30 Jun 2013.

I like the business model here - they buy up the rights cheaply to produce drugs which are near, or past Patent expiry, or which the large pharmaceutical groups don't want any more, for any reason. It's quite good margin business, and they steadily grow from acquiring more drug rights. Although the valuation has never looked especially attractive to me, so I've never bought any shares in it.

They indicate that H1 sales are up 4%, despite some problems, and that they "remain confident of the outlook for the full year". Broker consensus forecast is shown on Stockopedia as 3.66p for the year ending 31 Dec 2013, so I make that a PER of 9.8. That might look cheap, but one has to also take into account net debt. In this case, Alliance has a fair bit of net bank debt, at £21.8m last reported on 31 Dec 2012, although that's not excessive in my opinion, at about two times their free cash flow in 2012.

There is also some convertible debt, of £4.2m on the last Balance Sheet (since reduced somewhat), which seems to be converting at 21p per share. So that is causing some dilution.

The dividend yield of 2.7% is OK, but nothing to get madly excited about. As before, this one looks priced about right to me, hence doesn't really float my boat.

Centaur Media (LON:CAU) issued a mild profits warning on 15 May, and I commented here on the day, "I think the 28% fall in share price to 33.4p looks overdone actually". This was correct, as the shares have since recovered somewhat, and have been given a bit of a boost from a more reassuring year-end trading statement today.

They are up 4% to 39p, and based on today's statement I suspect these shares could continue to rise over time, with a move back up to 50p+ looking likely in my opinion.

They report that profits are expected to be slightly ahead of (reduced) market expectations. Since broker consensus is for 4.63p normalised EPS, then this means at 39p the shares are on a PER slightly lower than 8.4, which looks good value.

There is a fair bit of net debt here, but it looks under control, reported at £19.5m, which is around 1.5 times adjusted EBITDA. They indicate an increasing confidence in a positive outlook for 2014. So it sounds like they had a glitch rather than a disaster back in May.

I prefer companies with net cash, so the net debt here will probably stop me buying any shares in this (I did briefly dip into them back in May, but changed my mind when I considered the Balance Sheet in more depth, which has negative net tangible assets of £43.5m! Actually, looking at it again, the Balance Sheet is really not good at all, in fact it's pretty horrible. So I won't be buying back into this one. That said, a lot of people don't even look at Balance Sheets, so this may not stop the shares rising.

If you like growth companies, then Sinclair IS Pharma (LON:SPH) might be worth a look. It's a new one to me, but the shares have risen 12% today to 26p on a positive-sounding trading update. It's a speciality pharmaceuticals company, selling products for wound care, dermatology, oncology support, etc. It's been loss-making historically, but seems to have now reached profitability.

In a statement covering the year ended 30 Jun 2013, they state that turnover rose to £55.4m, a 4% like-for-like increase, and a whisker short of broker consensus of £55.9m turnover.

They say that net debt has reduced to £6.8m, and that "adjusted EBITDA for the full year is expected to be in line with market expectations". Stockopedia is showing 1.01p broker consensus EPS forecast for this period, so that puts the shares on a rather racy 26 times EPS.

However, growth companies are not usually valued on historic earnings, it's the future that matters. So if they achieve the 78% forecast increase in EPS to 1.79p this year, then the PER falls to 14.5.

You can't really judge growth companies without properly researching their products & markets, and I don't have time to do that today, but just thought I'd flag up the share as something that readers might want to research yourselves, if you like the look of it.

Brainjuicer (LON:BJU) is another company that's new to me. It's a £31m market cap (at 252p per share) online market research company. They had a very good track record of growing turnover & profits, until a mishap in late 2012, which brought the shares down with a bump, from which they have only partially recovered, as you can see from the three year chart below.

Brainjuicer have issused a trading update today, relating to their H1 period (the six months to 30 Jun 2013).

They report that sales are back in growth, up 4% against strong prior year comparatives, with gross profit up 6%, and overheads down. That all sounds pretty good.

They also hold net cash of £5.5m on 30 Jun 2013, and are considering how to return some of this cash to shareholders. Very nice. They say that subject to limited revenue visiblility, they believe they will meet market expectations for 2013.

Whilst I like the sound of all this, the price is not attractive to me. Consensus forecast EPS is 13.0p for this year, so at 252p the shares are trading on 19.4 times this year's forecast earnings.

The net cash of £5.5m is about 18% of the market cap, so that works out at about 44p per share, so ex-cash the shares are 208p, which brings the PER down to a PER of 16. That's still not cheap.

The forecast dividend yield is 1.36%, although there could be a special dividend on top of that as a one-off? Again, not really exciting to me.

It might be good as a longer term investment, if growth continues, but to my mind having had a hiccup in trading in late 2012, I wouldn't want to chase it up to a higher valuation in case there is another bump in the road at some point. So to my mind, this one looks fully valued. Although being an online focussed company, it might be considered high growth, and fashionable, and therefore attract a higher price? There's not enough upside in it to interest me though at this price.

There must be lots of other similar companies competing in the same space too.

I'm almost out of time now, as the 11 a.m. email is about to go out. If you would like to join the (free) email list, so you're alerted at 11 a.m. every weekday with an email containing a link to my latest report, then please click here. It's the best way to ensure you never miss a report. You only need to put in your email address & that's it. No passwords or registration is required.

See you from 8 .a.m. tomorrow, can't believe it's almost Friday already!

Regards, Paul.

(of the shares mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.