Good morning! The big one for me today is results for the year ended 31 Mar 2013 from Vianet (LON:VNET) . Regulars will know that this is one of my largest personal holdings, mainly due to the strength of their recurring revenues (about 70% are on long-term contracts), and the strong dividends that this finances.

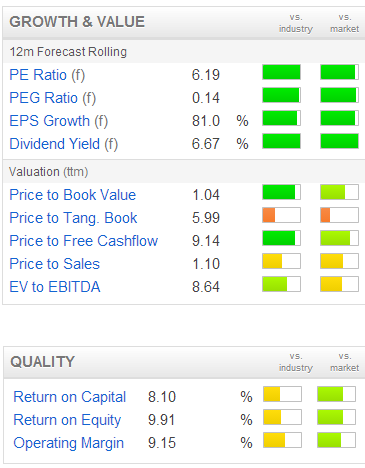

Vianet warned on profits in Feb 2013, but the results are not too bad, with pre-exceptional EPS dropping out at 9.8p, although that's flattered by a tax credit from utilisation of losses, and R&D.

The Chairman has proved good to his word, and has maintained the dividend, which will be 5.7p for the year. With the shares at 90p this gives an excellent dividend yield of 6.3%, which supports the investing case strongly. That seems to be well covered too, as dividends cost £1.5m to pay, but the business continued to generate around £3m in operating cashflow before changes in working capital.

The interminable contract delays from the small vending division have extended out even further, yet again, and I'm now taking the view that anything from this area will be a bonus, and is probably best ignored in valuation terms from now on.

There is a threat to the core beer monitoring business from the Government's proposed Statutory Code for Pub companies. Vianet say that they are challenging these proposals "as forcibly as necessary" to see them off. No doubt the pub cos are doing the same. It seems inconceivable to me that the Government would outlaw the use of beer monitoring equipment, as that lies at the heart of the landlord-tenant relationship in the British tied pub sector.

Expansion in the USA continues, and the fuel monitoring business has greatly reduced its losses. The outlook sounds reasonable, so overall at the current price I think Vianet looks good value, so I'm happy to hold for another year and collect in the big dividends.

Someone asked whether I had a chance to look at the Quindell Portfolio (LON:QPP) Annual Report over the weekend, and the answer is "no", I was too busy doing other things. Quindell is not a priority for me, as I don't like the company at all, have fully explained my reasons why in great detail, and have seen nothing to date which even remotely changes my mind. So having a protracted slanging match with Quindell shareholders is not high on my list of priorities. They like it, I don't, and it doesn't make any difference to me because I'm neither long nor short. I also find many supporters of the share completely delusional, so you can't have a rational discussion with people who are treating it more like supporting a football club than analysing a company!

Results from Eckoh (LON:ECK) look reasonable, but I'm scratching my head over the valuation, which at £33m (at 15p per share) seems on the warm side to me, given that adjusted operating profit was only £1.5m on turnover of £11m for the results for year ended 31 Mar 2013 announced today.

EBITDA is higher at £2.4m, but I don't take EBITDA at face value, because you need to find out first what costs they are capitalising (hence are by-passed when calculating EBITDA). Although Eckoh's cash pile of £8.5m is just over a quarter of the market cap, and it looks like genuine surplus cash to me, not up-front payments from customers.

The valuation all depends on what they do with the cash. They seem to have spent just over half of it on the acquisition of Veritape, announced separately today, so shareholders should carefully look at the impact of that deal, and how it will enhance earnings.

Next I've had a quick look at results from Red24 (LON:REDT). The market cap is a bit below my usual £10m cut-off at £6.7m, based on last night's price of 14p. In a bull market I'm prepared to be a bit more flexible on market cap, especially where a company is trading profitably & seems unlikely to de-List.

Their figures look alright. Turnover is up 12% to £6.5m, and pre-tax profit rose 9% to £0.94m, so a pretty healthy profit margin there. Anything above 10% of turnover arouses my interest, as that tends to mean the business has some pricing power, although if margins get too high then new entrants are attracted in to compete.

The balance sheet looks solid, and a freehold of about £800k seems to have been acquired in the year. There is £2m in cash, with a £400k mortgage on the freehold. It all looks good, although my only worry is that a business this small could be overly reliant on a small number of key clients, which is alluded to in the narrative. So that increases risk. Overall it looks reasonably good, but is probably just that bit too small for my liking.

I've had a quick look at interim results from Pressure Technologies (LON:PRES) . This is a niche engineering company which I have liked in the past. Their core business is very specialised work on making & maintaining very large gas cylinders for use in submarines, and and oil rigs. Historically it has had somewhat lumpy results, which is inherent with this type of business, so from an investor perspective there is always a risk of a profits warning.

Their figures today look good, with a 30% rise in turnover to £16.4m for the half year to 30 Mar 2013. Although the prior year comparative figures look soft. EPS is up strongly to 8.5p, and the dividend is up to 2.6p (remember these are only half year figures). The Balance Sheet looks sound, with net cash of £2.7m, and doesn't seem to be a pension deficit, which helps.

The oulook statement is low on specifics, but talks of "considerable optimism for the future", so one would need to check back and see how previous outlook statements have compared with subsequent results. After a couple of years you get a feel for how bullish or conservative outlook statements are from particular companies, but I look at so many that it's difficult to remember things like that.

Market consensus seems to be for 16.5p EPS this year, and 22.8p next year, so at 176p the shares are probably priced about right - a small engineering company is not likely to get onto a premium rating even in a good year.

It's a good steady dividend payer though, and the forecast yield is healthy at 4.5%. Overall it looks OK to me. Could be some good upside on these with a long-term view, although the wide spread & illiquidity has always put me off buying any in the past.

That's me done for today, see you same time tomorrow morning.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in VNET, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.