Good morning!

Boohoo.Com (LON:BOO)

Share price: 26.75p

No. shares: 1,123.1m

Market Cap: £300.4m

(at the time of writing I hold a long position in this share)

Trading update - today's update is for the two months to 28 Feb 2015, completing the year ended 28 Feb 2015. BooHoo is a fashion etailer, targeting teens & young adults, at the affordable end of the market. They operate in the UK, but also internationally. The company floated at the peak of the small caps market in Mar 2014, and the share price has been falling ever since! Note that it opened at a big premium to the 50p price where about half the shares were sold by management, who trousered several hundred million quid in the process. Very nice for them, but not so nice for the buyers of those shares, who overpaid, because growth expectations were much too high.

Growth has slowed, but is still very respectable, and of course is all organic too. Therefore in my view the gloom surrounding the shares is presenting us with a buying opportunity, as disappointed Institutions who bought into the IPO have been selling. Yet if you ignore the original excessive valuation, and just focus on things as they are now, my view is that this is the only sensibly-priced online retailer in the UK (the others are all ridiculously over-priced still in my view). BooHoo is also the most profitable, in terms of profit margin as a percentage of turnover. So you could argue that it's the cheapest, yet the highest quality (Asos is bigger in absolute terms, but has a lower profit margin).

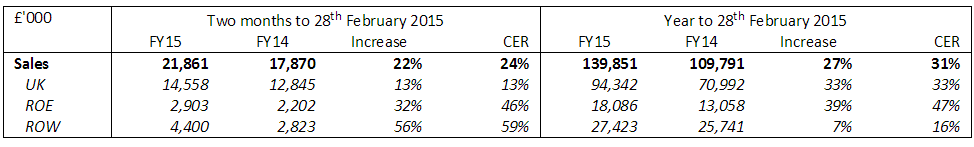

Here is the table from today's update showing sales growth for the two months, and the year to 28 Feb 2015;

Points to note;

- The rate of sales growth is slowing, but is still very respectable at 22% for the 2 months

- UK is 67.5%, Europe 12.9%, and Rest of World 19.6% of sales for the y/e 28 Feb 2015

- Price reductions in Rest of World has rejuvenated sales growth (up to 56% in the most recent 2 months)

- Exchange rates have blunted sales growth a little ("CER" is constant exchange rate)

- £139.9m sales has come in slightly below the latest forecast of £142.7m

- The gross profit margin of 61% for the year is very strong

- Net cash of £54m at the year end is about 18% of the current market cap (4.8p per share)

- The company has today announced a share buyback of up to 10% of its shares, to utilise the surplus cash, which will of course enhance EPS

- EBITDA margin is in line with expectations, at 10% of turnover, so about £14m EBITDA for the year

Some points I jotted down during this morning's conference call;

- Positive current trading comments - trading well in March 2015

- Accelerating marketing spend to c.17-18% of turnover in the short term, to boost new spring/summer ranges, but this will fall back later

- "Really good response" to current marketing campaign - reached #1 in UK on Twitter, and #5 globally on 1 March

- "Good surge" in sales when blogger Zoella reviewed the latest range on Sunday

- Very pleased with acceleration of sales in Rest of World

- Strategy is to focus on key markets

- Warehouse extension opening in April 2015

- Euro weakness likely to trim margins slightly in 2015

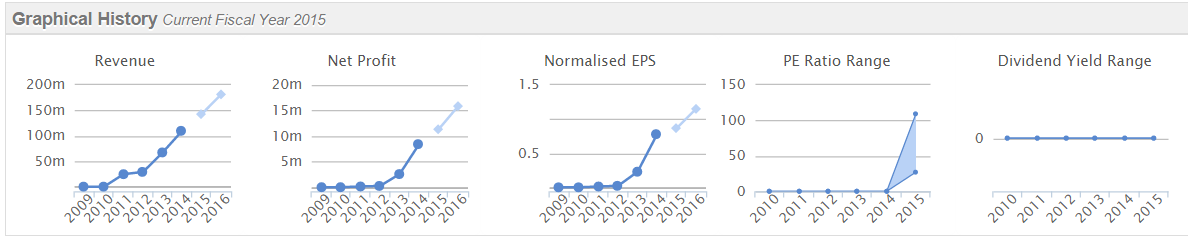

Valuation - people seem to think BooHoo is terribly expensive, but actually when you consider its excellent organic growth, and high margins, it really isn't (in my opinion). Consider the growth so far, and you can see this is an exceptional business;

EPS is forecast at 0.87p for the y/e 28 Feb 2015, and the company seems to be saying today it's in line, although no specific reference is made to EPS. That puts the shares on a PER of 30.7 times. OK, not exactly a bargain, granted! But strip out the cash, and you're actually paying 21.9p for the business (at a 26.75p share price, since 18% of the market cap is net cash). That brings the PER down to 25.2. Still pricey perhaps, but that is now the historic rating. So looking at this year's forecast, EPS of 1.15p looks reasonable, and that translates into a PER of 19.0 times (using the ex-cash share price of 21.9p again).

I suggest that an ex-cash rating of 19 times is very reasonable for a business that is still growing rapidly, and seems to have now got its pricing right, and is thus seeing an acceleration in global sales again. Jim Slater's PEG ratio says that if the growth rate exceeds the PER, then the stock is worth looking at. Here we have turnover growth still above 20%, so the PEG looks to be under 1.

Bear in mind also that during its growth phase, the company is reinvesting extra profit into marketing, to increase customer numbers. So they can really choose a profit figure within quite a wide range, depending on how aggressive they want to be in growth.

Business model - probably the main reason I am so bullish on BooHoo is because in a former life I was the FD for a ladieswear chain. We used Manchester based companies called Pinstripe and Jogo as two of our biggest suppliers. The people behind those companies set up BooHoo, so they are very experienced rag traders, with extensive supplier contacts in the UK and abroad. People say there are no barriers to entry with online fashion, but there are a lot more than you might think. It's all about getting the product & the supply chain right. Many retailers find that very difficult, so smaller retailers tend to use intermediary companies (like the ones I mentioned) to source stock. So by now selling direct to the public, BooHoo has probably got the most efficient supply chain possible, and makes fantastic gross margins - they are effectively trousering not only the retailer's margin (without the costs of a chain of shops), in addition to the wholesaler's margin. Thus the 61% gross margin achieved is really excellent. This allows BooHoo to spend heavily on marketing - which smaller, start-up type etailers cannot afford to do, to this extent. This should create a virtuous circle for BooHoo - as it gets bigger, it can afford to spend more & more on marketing.

My opinion - I am told that BooHoo and a rival site called MissGuided are dominant in online fashion for youth. It's highly competitive of course, as there are also all the High Street chains to compete with, who nearly all have an online presence too.

As things stand today, with BOO shares on an ex-cash valuation of 19 times current year forecast EPS, this looks good value to me - providing that growth can be maintained of course. Given the size of international markets, and the progress made so far, then that rating could go through the roof if international growth really gets going.

Why is ASOS (LON:ASC) rated at nearly 69 times forecast earnings? If the market is excited about growth there, despite it having slowed considerably, then surely it is overlooking the growth potential at BOO? Also, Asos talks about improving profit margins, whereas BOO is already delivering superior margins, and thowing off surplus cashflow which will enable it to buy back 10% of its own shares, and still have plenty of cash left over.

If you believe the growth will continue at BOO, then I think this could be a very good entry point. DYOR as usual, of course!

Lombard Risk Management (LON:LRM)

Share price: 12.9p

No. shares: 263.9m

Market Cap: £34.0m

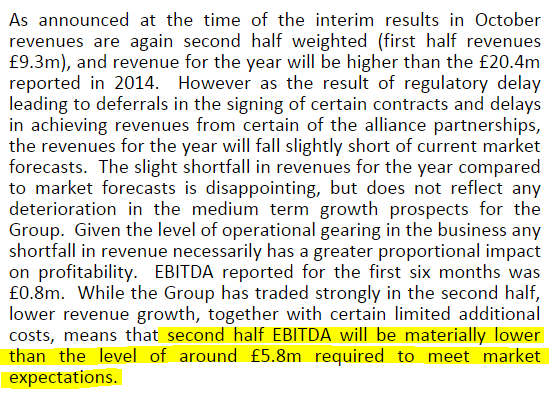

Profit warning - the company admits today that it will not meet market forecasts, as H2 has fallen short (as is so often the case when companies rely on a strong H2);

(please also note that I've finally got the hang of the highlighter tool!)

My opinion - the EBITDA performance figures that this company reports are completely meaningless, because they capitalise a large chunk of their payroll into intangible assets. So the valuation is far higher than it should be, in my opinion. Sooner or later the penny will drop with investors that this company doesn't actually make any money - that's why it only pays a tiny dividend.

Modern Water (LON:MWG)

Share price: 17.75p

No. shares: 79.5m

Market Cap: £14.1m

Final results - for calendar 2014 look really bad. Turnover fell to £2.8m, and it made an EBITDA loss of £4.5m. There was also another £12.8m in exceptional costs, but that looks mainly goodwill write-offs, so non-cash. Or at least, non-cash at the moment, but originally that would have been cash that went out of the door on acquisitions some time ago.

My opinion - as things stand, this is clearly not a viable business. It seems to have burned through approx. £5m in cash every year since 2008. There's just over a year's worth of cash left in the kitty, so if they don't deliver a much better performance in 2015, then I wonder if shareholders will be willing to flush away another load of cash in another fundraising?

It's going on my bargepole list I'm afraid.

Centaur Media (LON:CAU)

Share price: 66p

No. shares: 143.7m

Market Cap: £94.8m

Results for the 18 month period to 31 Dec 2014 are issued today. Comparatives for calendar 2014 vs 2013 are also given, which are more meaningful for analysis purposes. The results look reasonable - turnover is down 2%, but adjusted operating profit is up 2% to £10.2m (for the 12 months ending 31 Dec 2014).

Divis - are good, with a forecast yield of about 4.6%.

Balance Sheet - is weak, and it fails my simple tests, as follows;

Current ratio is low at 0.76. The main reason is a large deferred income creditor, so the company has received money up-front from subscribers to its magazines, but has already spent that money in advance. For this type of business, I wouldn't normally be comfortable with a current ratio below 1.0.

Net assets of £86.8m becomes negative when you write off intangibles, at -£23.1m. I wouldn't normally invest in any company with negative net tangible assets.

My opinion - the weak balance sheet rules it out for me, but it looks a reasonably good business. Although it looks ex-growth, maybe even declining in the long term? So probably not one to get excited about.

Restore (LON:RST)

Share price: 260p

No. shares: 82.2m

Market Cap: £213.7m

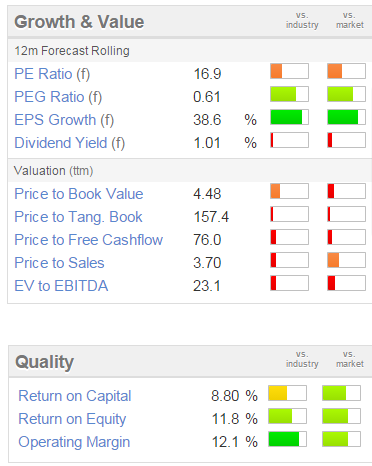

Full year unaudited results for calendar 2014 are out today. They look good, but you have to bear in mind this group is making lots of acquisitions, which flatters the figures. I'm not convinced the shares deserve a premium rating, as there's not much sign of organic growth.

Net debt has risen to £30.9m at end 2014.

Dividends - are minimal, with a yield of 1%.

Balance Sheet - the trouble with companies which grow by repeated acquisition, is that the balance sheet gradually worsens as it fills up with more & more goodwill. In this case, Restore's balance sheet has turned negative for net tangible assets, of -£1.9m. Now you could argue that doesn't really matter, as it generates an increasing flow of earnings, a lot of which is based on recurring revenues.

Valuation - given the increased debt, and that growth is mainly coming from acquisitions, therefore the existing (mature) businesses probably shouldn't be on a PER of more than about 12, then I think it's looking a bit too expensive, on a fwd PER of 16.9;

My opinion - it's too expensive for me.

All done for today.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in BOO, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.