Good morning!

They're testing the fire alarms here at the Yas Viceroy Hotel in Abu Dhabi, so that's forced me to do today's report a bit earlier. I still haven't visited Ferrari World yet, so that's on the agenda for this afternoon. I'm looking forward to going on the 150mph roller-coaster ride!

Judges Scientific (LON:JDG)

There's a new video of a recent investor presentation at Mello, by David Cicurel of Judges - here is the link to PIWorld.co.uk. This website is terrific - set up by an investor friend, to provide video presentations for companies of interest. So it's well worth visiting, and joining their email list, to be notified of new videos posted.

Waterman (LON:WTM)

Share price: 87p

No. shares: 30.8m

Market cap: £26.8m

(at the time of writing, I hold a long position in this share)

Interim Management Statement (trading update) - today's update covers the bulk of H2. This company has a 30 Jun year end. It reads well:

The Group's trading performance has remained in line with the Board's expectations with revenue during the first nine months of the year to the end of March 2016 10% above the prior year period.

As a result, the Group remains on target to exceed its previously declared financial objectives to triple adjusted annual profits before tax to £3.3m over the three year period to 30 June 2016.

All good stuff. The company has been saying for a while that trading conditions are good, with several more years of strong performance expected. So it shouldn't be a big shock to anyone that the company again confirms today that everything is fine.

On operating profit margins, the company says:

As previously announced, the Board's future aspiration is to increase the Group's adjusted operating profit margin towards 6% by 30 June 2019 compared to the 3.3% delivered in the last financial year ending 30 June 2015. The Board continues to anticipate that the results for the current financial year will show a significant increase in adjusted operating margin, consistent with delivery of this new aspirational target.

Without wishing to pour cold water on this, I should point out that Waterman has one significantly loss-making division. Therefore simply eradicating the losses there would automatically achieve most of the target margin improvement for the group overall.

So to a certain extent, I feel that perhaps management set themselves targets that should be fairly easy to achieve? Not that it really matters - improved financial performance should feed through to a higher share price.

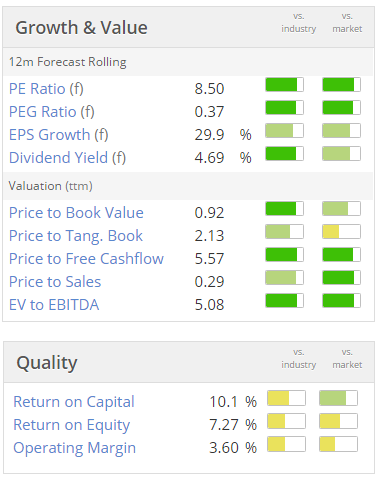

Valuation - it looks really good value:

Also, note the StockRank of 98 is outstanding.

Smashing dividend yield too, as you can see above.

On the downside, we do have to recognise that Waterman operates in a cyclical sector. So at some point it will face a downturn in earnings. Personally I don't see that being an issue for several years, at least, because there is so much infrastructure spending going on. Low interest rates seem here to stay, so why would things suddenly grind to a halt?

One final point, the group also says today that cash collection has been better than expected:

Cash collection has remained strong and the Board now expects that the Group's net cash at the year end will be above the current market forecast.

My opinion - I really like it. Not necessarily as a hold forever, but as a cyclical investment that is in the right point of the cycle. So it's seeing good earnings growth, and margin improvements, and looks cheap. The decent divis make it an attractive share to hold, in my opinion.

This was one of the shares I "tipped" as being worth a look at the UK Investor Show recently, so I'm relieved that the trading update has been positive!

Andrews Sykes (LON:ASY)

Share price: 310p (up 4.2% today)

No. shares: 42.3m

Market cap: £131.1m

Results y/e 31 Dec 2015 - it's ridiculous to be releasing 2015 results in mid-May 2016. What on earth is the FD thinking? I used to get audited results out in 6-7 weeks of the year end, for a similar sized (albeit private) business, in the 1990s. So this is very sloppy, in my view.

Having said that, the figures look terrific. This is such a good business, it's just a cash machine - churning out large free cashflows every year. 2015 appears to have been a very good year, with EPS up to 25.6p (2014: 22.0p). So at just over 300p, the shares are currently on a modest PER of just over 12.

Note that nearly all earnings were paid out in dividends.

It has net cash of £14.6m, and the balance sheet is excellent.

Outlook comments sound cautiously optimistic:

The group continues to face challenges in all of its geographical markets but our business remains strong, cash generative and well developed, with positive net funds. The mild and wet weather in Europe experienced in the fourth quarter of 2015 continued into the first quarter of 2016, thereby presenting both opportunities and challenges. Our business in the Middle East continues to perform well but we are mindful of the current political and economic issues that surround the region. The board is therefore cautiously optimistic for further success in 2016, always being mindful of the favourable or adverse impact that the weather can have on our business.

There is some talk of investing in new products which are less weather-dependent, but I think it's best to regard ASY as a mature company, which is a terrific cash cow.

My opinion - this is a lovely business, and very reasonably-priced. So there's a good chance of a significant re-rating, in my view, up to perhaps 400p?

Bear in mind the unusual ownership structure, with only a small free float, which some investors don't like. Although the majority shareholder has looked after minorities well to date, with generous divis for example.

Vertu Motors (LON:VTU)

Share price: 59.75p (down 1.2% today)

No. shares: 397.3m

Market cap: £237.4m

Results y/e 29 Feb 2016 - excellent results from another car dealers, following on from smashing results yesterday from Cambria Automobiles (LON:CAMB) .

There's probably not a great deal to choose between the various small cap car dealers. They're all priced about a PER of 10. They all seem to have sound balance sheets too.

The only question is where we are in the cycle. The other issue, is that the cycle seems to have fundamentally changed. People are now generally entering into personal leases, rather than buying outright. This creates a guaranteed replacement cycle of 2-3 years. Although perhaps more importantly, it means more vehicles are being serviced at the main dealers (you have to, under the terms of the personal leases) - good for profits, for companies like Vertu.

So that could mean we're in a new normal now, providing interest rates remain low.

I'm quite tempted to buy some of these shares actually, given that the price has fallen a fair bit from recent highs. What do readers think? Are any of you tempted to buy into car dealers? If so, which one? Comments in the comments below!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.