Good morning! The oil price continues to plummet. I was discussing this over lunch with other investors yesterday, and the striking thing we noted is that supposed experts, commentators, economists, etc, pretty much all failed to predict that the price of oil was about to collapse. How can this be? So what exactly is the point of employing such experts, if they fail to predict a gigantic move in the price of oil?

The resources sector is not an area I normally look at (and on the rare occasions that I break my own rule, it nearly always ends in disaster). However, there must be value starting to crop up now, or will do shortly. Over-supply leading to a huge fall in price will inevitably increase demand, same with anything, so the oil price should automatically go back up at some point once demand begins to out-strip supply again. Therefore I'm beginning to research some potential opportunities in the oil services sector.

Begbies Traynor (LON:BEG)

Share price: 43.75p

No. shares: 91.5m (+13.1m new Placing shares to be issued)

Market Cap: £40.0m

Interim results for the six months to 31 Oct 2014 are out this morning. They look lacklustre to me, with adjusted profit down from £2.3m last time, to £1.9m in H1 this year. So not a disaster, but not great either.

The insolvency practitioner says that corporate insolvencies (i.e. its market) were down 16% against last year, so with that in mind the results are actually quite reasonable. Cost control and some small acquisitions have helped. It strikes me as a well run business, owner-managed effectively.

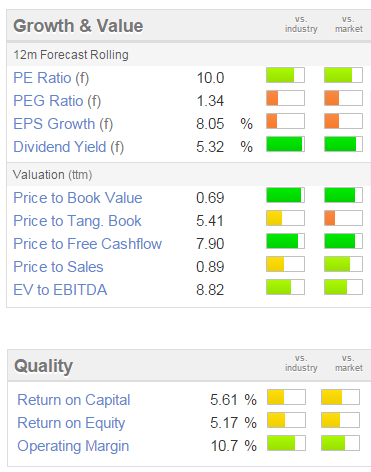

Dividends - the interim divi is maintained at 0.6p. The full year payout is forecast at 2.3p, so that's a generous yield of 5.3%, although note that the bid/offer spread could easily absorb your first year's divis, so it's probably not worth chasing for yield unless you have a good broker who can buy at nearer the Bid price than the Offer price, and/or if you intend holding for the long term.

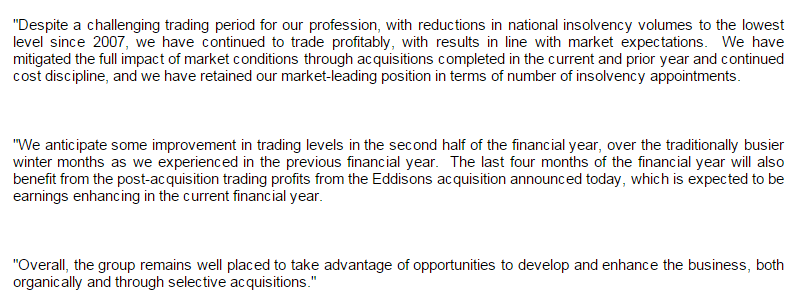

Outlook - the company today says:

I like that they specifically say they are trading in line with market expectations.

Valuation - this looks reasonable value, in my view:

Note also that BEG scores highly in Stockopedia's own ranking system, with a StockRank of 93. That gives me some comfort too.

Acquisition & Placing - also announced today is a £5.3m Placing, to fund an acquisition of Eddisons, a chartered surveyors & valuers, which looks a sensible bolt-on business (as insolvency practitioners use their services a lot), with £0.5m of cost savings having been identified.

The price of the Placing is 40.5p, which raises an eyebrow, since the discount is probably a tad too generous, thus disadvantaging existing holders who have not had a chance to participate.

My opinion - this looks a well run business, doing OK in a very tough market. At some point it will benefit from an increase in insolvencies, but nobody knows when, and we've been waiting 6 years already for normal conditions to return, but they haven't yet.

The shares seem reasonably priced, so I quite like it, but don't currently hold any.

Hargreaves Services (LON:HSP)

Share price: 600p (down 92p today)

No. shares: 32.9m

Market Cap: £197.4m

Trading update - the company confirms it is trading in line with expectations for H1, so it's a bit surprising to see that the shares are down heavily. However, there's a lot of other detail in today's update, e.g. the closure of their Monkton facility, and coal markets generally.

I've given up trying to analyse this company - it's too complicated, and there are too many unknown factors, such as future energy policy, coal prices, etc. Although as a dirty fuel, the pressure is relentlessly against coal, and hence against this company in the long run, which they accept and are very open about. So it's almost impossible to value, as you don't know how long the profits will last.

I prefer to stick to simple, small companies, which can be readily understood in about 10 minutes, and where you can be fairly sure the company will be able to continue in operation for the foreseeable future.

Treatt (LON:TET)

Share price: 140.5p

No. shares: 51.5m

Market Cap: £72.4m

As it's quiet for results today, I'll circle back to this share, which reported results for the year ended 30 Sep 2014 earlier this week, on Tuesday.

The company seems to have come in slightly ahead of forecast, delivering just under 10p adjusted EPS for the year. So that puts them on a PER of 14. It was a good increase on the prior year's figure of 8.6p.

I like the decent operating profit margin here, which is just under 10%.

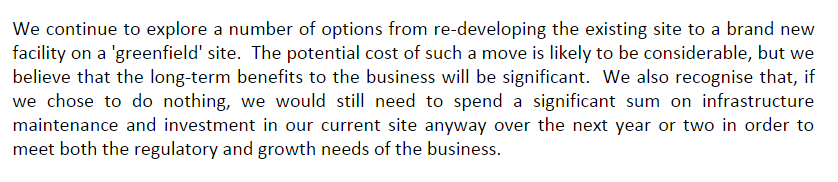

What puts me off is the narrative, where it talks of substantial capex being needed:

So it would be important to get some figures on this, and how the company is intending to finance it. Also, I am wary of disruption & unforeseen costs that such a relocation would be bound to cause.

Although, as the company points out, it has doubled profits in the last 5 years, which is good going. It doesn't scream value at me, but seems a good quality company that might be worth doing more research on perhaps?

It's the type of thing I would probably only buy if something went wrong, and there was a profit warning. I can't really see the point in buying things that look fairly valued. I want them when they're cheap!

Plexus Holdings (LON:POS)

I've been sniffing around this share, which has plunged in sympathy with the whole oil sector. They make some kind of innovative sealing mechanism for well heads, from what I can gather. It's always looked terrifically expensive, but after recent falls the price doesn't look quite so bad now.

AGM statement - I'm not sure what is reiteration, and what is new in this announcement, but I'm intrigued by the talk of doing a global roll-out for the product, which has been successfully used mainly in the North Sea so far I understand.

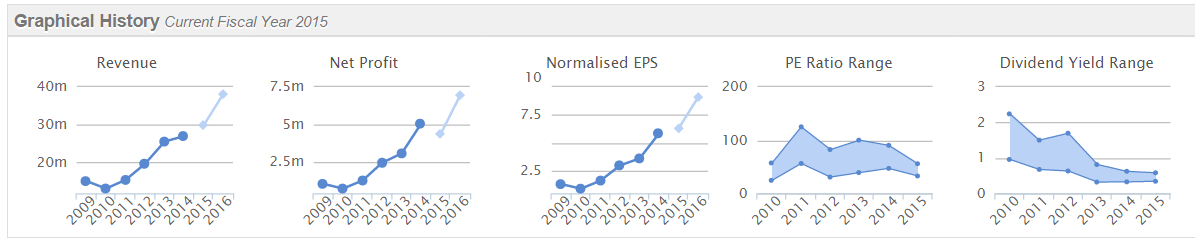

It's already profitable, and the Stockopedia graphs below are pointing in the right direction!

I appreciate they might suffer in the short term from the lower oil price, but it's not as if the industry is going to shut down, is it? So any cessation in capex will only be for the short term. Look through that, and this could be a good time to be buying quality companies in the oil services sector? Anyway, at first glance, I like the look of this one. Would welcome readers views if you know the company.

Got to dash, more meetings today.

Have a great weekend!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.