Good morning!

Chinese stocks - I've warned readers here many times about the risks of investing in AIM Listed Chinese stocks, indeed I personally have a permanent bargepole rating on them all, for a variety of reasons - the main one being that things are very often not what they seem. So you cannot rely on any facts or figures about these companies, hence they are impossible to value. There are numerous other red flags, such as constant insider selling, accounts that don't stack up - e.g. huge debtors (nearly always the biggest "tell" that something is wrong), negative cashflow despite big profits, unrealistically high profit margins, etc etc. I just treat the accounts of Chinese companies as works of fiction, it's safer that way. Which brings me on to;

Naibu Global International Co (LON:NBU)

Share price: 36p

No. shares: 58.6m

Market Cap: £21.1m

Shares in this maker of sports shoes have looked inexplicably cheap for a while, with the PER hovering around 1. That's nearly always a sign that things are not what they seem. I can only think of one situation where a PER of 1 turned out to be the bargain of the year, and that was Trinity Mirror, as I explained in 2012, here, when the shares were just 25p (they 8-bagged in the year or two after that). In all other cases that I can remember, a PER of 1 usually means there's something badly wrong.

I've only reported explicitly on Naibu once here, because it has always been under my blanket bargepole rule for Chinese stocks, so there wasn't much point in reporting on the figures. As I explained in my report from 5 Aug 2014 the only point with Naibu that was intriguing, was that it had started paying dividends - which of course made it look as if the company was genuine. At the time people doubted whether the dividend cash would actually be paid, but it was, twice I think? So I was still slightly unsure about whether Naibu could be genuine after all? I was 95% sure it wasn't, but the divis kept a 5% window of doubt open.

That window has slammed shut today - the interim results are out today, and follow the usual pattern of high profits but negative cashflow. Despite the large cash balance, the company has cancelled the interim dividend. The reasons given look ridiculous to me - that the cash is required for capex to build factories, despite there being no reason for doing so - 80% of production is currently outsourced, and the company makes about a 20% operating profit margin. So there is no valid reason at all to build their own factory.

My opinion - With the dividend passed, I think the game is up now, and these shares have an intrinsic value of zero in my opinion. I think the motivation for the previous dividends was probably an attempt to pump up the share price, to allow more insider share disposals at a much higher price. The market didn't buy that, and the share price remained weak despite the divis, so they've now been cancelled. The next logical step is for the shares to de-list, and investors are highly likely to receive absolutely nothing in the future in my opinion. I could be wrong, but why take the risk, when the evidence is now so clearly pointing towards my view being probably correct?

I'm not saying that all Chinese stocks are dodgy, but enough are to make it too risky to bother trying to sort the wheat from the chaff. This table, courtesy of AIM journal, shows the lamentable share price performance of AIM Chinese companies since floating. Bear in mind that the period covered was a boom market for small caps, where most things rose 50-100%, so for so many of these to be negative is very poor. I think this table will look a lot worse in a few months time. Most of these stocks will de-List in the coming months/years in my view, so they are all going on my bargepole list.

The spikes up on the chart below were caused by tipsters flagging up the "bargain" shares - very much a case of them not being able to see the wood for the trees I'm afraid. One has to be a bit more shrewd in this game than to just take numbers at face value. Lots of accounts are wrong, and often deceptive, and the fact that they've been audited doesn't make much difference. You have to question everything, and if it doesn't look right, that's often because it's wrong.

Boohoo.Com (LON:BOO)

Share price: 43.13p

No. shares: 1.12bn

Market Cap: £483.1m

BooHoo is an online fashion retailer. The market cap is larger than I would normally mention, but I'm going to cover it here because in my view it's a good company, and if things go well then I reckon the shares could be a good long term investment. Although the rating is high, so it comes with an additional risk warning.

It got a brief mention here in my report of 4 Aug 2014, in the section about ASOS. People are always looking for the next ASOS, and I think this could be it. In some ways it's a better business than ASOS, in that it makes a higher operating profit margin, and is growing more rapidly in % terms.

I know the people behind this business, as in my days as FD of a ladieswear retailer, two of our major suppliers were Manchester-based "Pinstripe" and "Jogo" - they were good people to deal with, importers from India, who we found reliable and trustworthy. The stock they supplied was cheap & cheerful, and sold well. I'm talking 12-20 years ago now (scary thought!), but they have obviously spotted the potential to cut out the retailer altogether, and supply direct to the public.

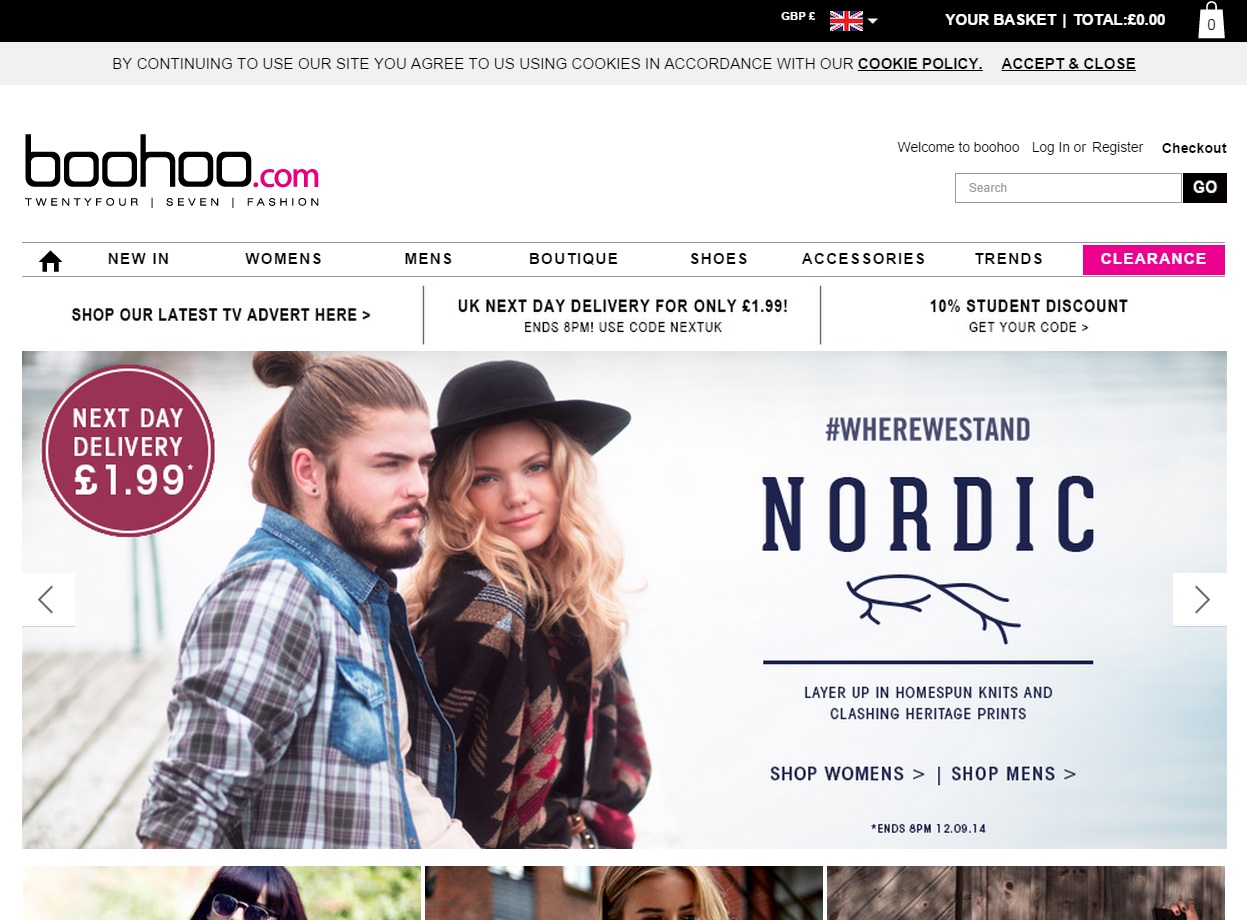

The BooHoo website is good, and as with all online retailers, I've tested it out by ordering some goods, and everything worked as it should. The product was good for the price. The target market is probably the under-40s, especially lower down towards the teenage & student market.

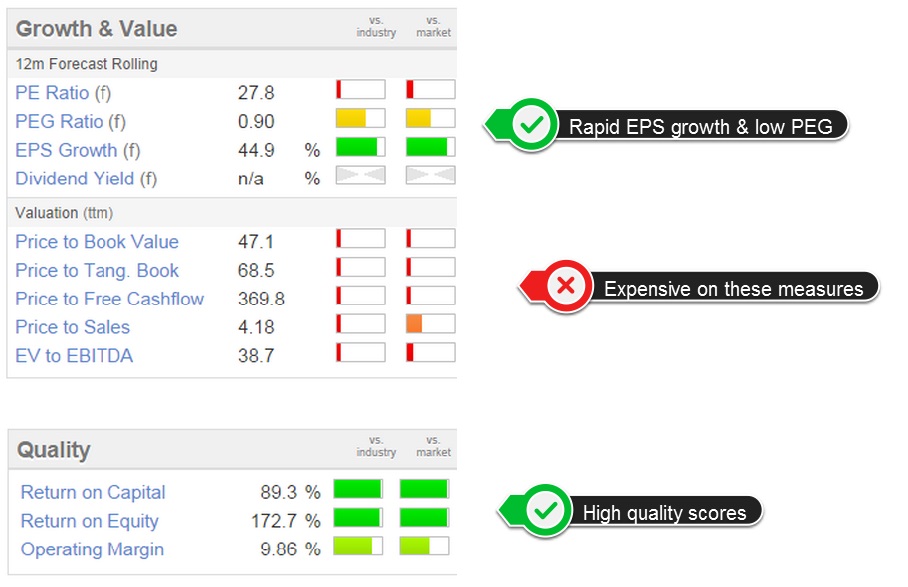

It's a recent float, so you would imagine it was hideously over-priced, and indeed did look so at first glance. However, I think what the market has missed is that the international growth is kicking in nicely, and the business is already decently profitable. It's not actually particularly expensive on next year's forecasts. See the usual Stockopedia valuation graphic below, with my comments added:

So it strikes me as a risky situation where the high (but not outrageous) forward PER is based on the company delivering very rapid growth. I got cold feet a few weeks ago, when the market wobbled, and I partially sold, but today have decided to buy back (at about the same price), since there is now the considerable benefit of an up-to-date trading statement.

Half year trading update - published today, this reads very well to me;

Revenue for the half year is approximately £67m, up 31% compared with the same period last year or 36% on a constant currency basis (CER). Revenue growth during the first half has continued to accelerate in line with management expectations with second quarter revenue growth of 37% or 41% CER up from 24% and 28% respectively in the first quarter. Improvement in growth was seen across all regions during Q2 with the UK up 50%, the Rest of Europe up 61% CER (50% reported) and the Rest of the World up 8% CER (0% reported).

The Company confirms that it continues to trade in line with expectations for the full year to 28 February 2015.

These are pretty impressive growth rates, and remember it's not some tiny start-up, they are forecast to do turnover of £157.5m this year, and make a £13.8m net profit (a profit margin of 8.8%, which is better than ASOS achieved last year at 5.3%, and ASOS is only forecast to make 3.4% this year).

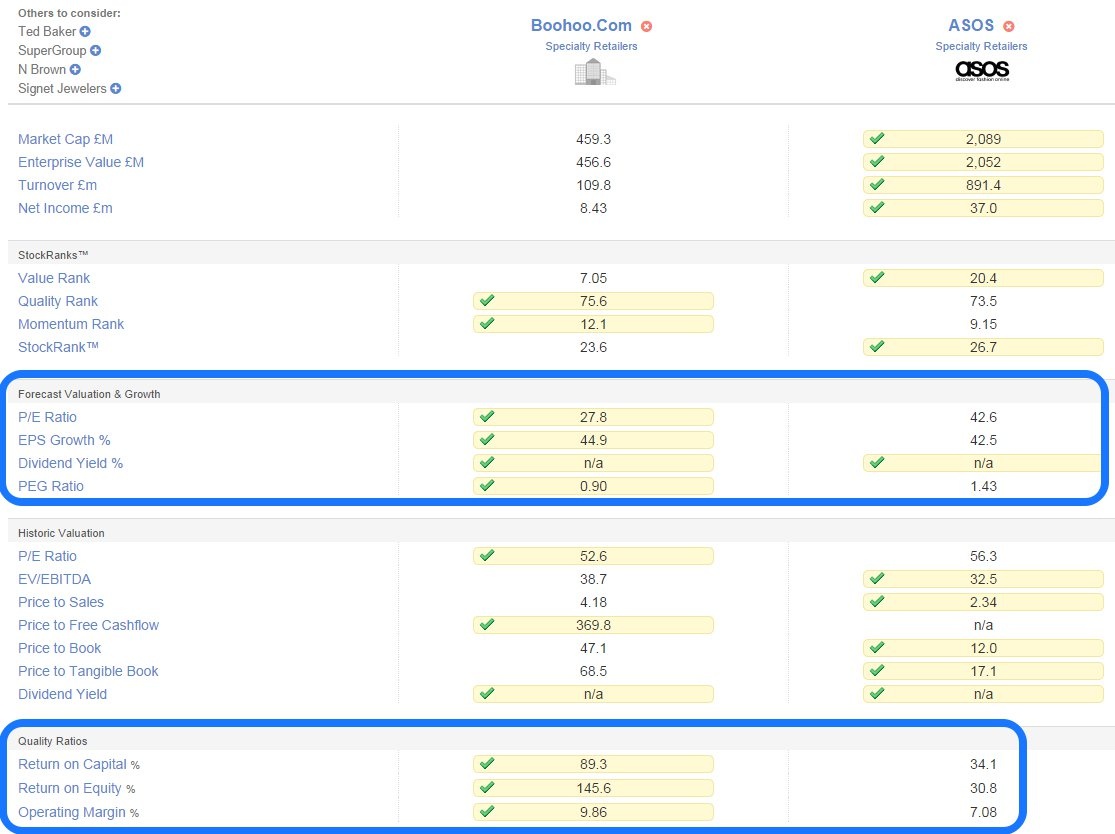

Valuation - ASOS is on a forward PER of 42.6, much higher than BooHoo at 27.8, yet I argue that BooHoo is a better growth story at this point in time. So there's a mispricing here in my view, potentially. Also bear in mind that during its rapid growth phase, ASOS went to a stratospheric rating, a PER of over 100, which was complete madness, but who knows the same lunatics could latch onto BooHoo and chase this up to a mad valuation too?

My opinion - It looks very interesting to me, especially with current news that it's trading in line with expectations.

Comparison Tool - Stockopedia has a nifty tool under the "Toolbox" menu above, called "Compare Stocks", which I find handy to compare key measures of two or more companies. I've run this tool for Asos & BooHoo, and the results confirm my view that BooHoo scores more highly on all the Quality measures, and is also cheaper on the key forecast Valuation measures (which I've ringed below);

The Stock Market Show

Ed has roped me into doing one of my spiels on the Stockopedia stand at this investor show tomorrow (13 Sep 2014) in Islington Design Centre. I'll be rambling on about small caps for an hour, and trying hard to sound intelligent! I really enjoy chatting to readers at events like this, so hopefully put some names to faces there tomorrow.

I'll have to sit down with a bottle of Aldi Chilean Merlot tonight, to plan what on earth I'm going to talk about tomorrow!

Motivcom (LON:MCM) - A recommended cash takeover bid has just been announced, priced at 148p. This company was on my watch list, after reading the Annual Report on a train, and thinking it looked quite good value, but not good enough to justify opening a position (as there have been some profit warnings).

The bid is only a 20.8% premium to the closing price last night, which is low for a takeover bid. If I were a shareholder, I'd want to know why the Directors have recommended this lowball bid? Surely there must be more than 20% upside on the shares from the company remaining independent?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.