Good morning!

Norcros (LON:NXR)

The bathroom fittings company issues an IMS this morning covering the 18 week period to 2 Feb 2014.

Most of it sounds negative, but the only sentence that really matters concerns how profits are going to be against market expectations, and on that score the company ticks the right box, saying;

Nevertheless, with our strong brands, leading market positions and continued self-help initiatives focused on market share gain in both our home and export markets, the Board remains confident that the Group should continue to make progress in line with market expectations for the current year.

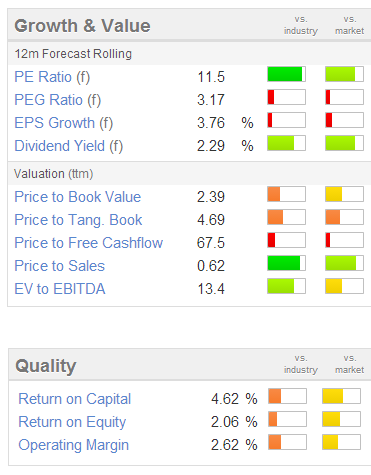

Broker forecast consensus is for 2p EPS for the current year (ending 31 Mar 2014), so at about 23.5p the shares are currently on a PER of 11.5, which is one of the cheapest ratings you'll find for a reasonable-sized, cyclical business. There is a large pension fund, with a significant deficit, but that doesn't seem to be holding back share price rises elsewhere, e.g. AGA Rangemaster (LON:AGA) has a horrendous pension deficit problem, which the market has completely ignored, taking their shares up to a forward PER of 14.2, despite the fact that on the current deficit reduction plan, all their profits until about 2020 are likely to be swallowed up by the pension fund.

Norcros is in a much better position that Aga, having to pay only around £2m p.a. to top up the pension fund, which is about 10% of the cashflow the company generates. Norcros also has freehold property which covers most of the pension deficit, so the way I look at things the two largely offset - since one is a long term asset, and one is a long-term liability.

Luckily, I spotted the opportunity here and was buying when they were about 10-12p, so it's been a strong performer in my portfolio, out-performing the FTSE SMALL CAP INDEX XIT (FTSE:SMXX) as you can see from the two year chart below;

As expected, NXR was affected by the sharp weakening in the South African currency in recent months, as about 40% of their group turnover is achieved by their subsidiaries there, so highly significant to the overall group result. So the key performance statistic for me is LFL sales in constant currency, which is -0.5% for the most recent 18 week period, and rather surprisingly this represents a slight deterioration in the trend, which was +1.5% for the 44 week period to date. That might make the market a little nervous perhaps - the underlying trend should be improving, not softening slightly.

The comments indicate that demand is picking up from the trade (housebuilding, etc), but that consumer demand remains weak, which I suppose makes sense because real incomes have not yet begun rising in the UK (which is the bulk of their turnover), although economic trends are moving in the right direction on that front.

Details are given about the various divisions. Triton (market leader in electric showers) looks steady, Johnston Tiles seems very weak, and the jewel in the crown is currently newly acquired Vado (high end taps, etc) which reports sales 12.5% ahead year to date. So it looks as if Vado has saved the bacon this year, so hats off to Norcros management for paying a sensible price for what has turned out to be an excellent acquisition.

It will be interesting to see how the market reacts to today's statement. The soft sales trends might disappoint some investors, but to my mind the only sentence that matters is the one I quoted above - that profits are in line with expectations. Everything else is background noise in my opinion. Perhaps some investors were expecting a profit warning, given the S.African Rand weakness? The fact there hasn't been one, is of course positive.

There is a 2.3% dividend yield, four times covered, and the prospect of further cyclical recovery driving higher earnings over the coming years, therefore I find the PER of 11.5 a reasonably attractive price at this point in the cycle.

There is a 2.3% dividend yield, four times covered, and the prospect of further cyclical recovery driving higher earnings over the coming years, therefore I find the PER of 11.5 a reasonably attractive price at this point in the cycle.

Sure there is a pension deficit, and some net debt, but in my view those are partially offset by freehold property assets, and do not represent any danger to the group.

Net debt is manageable at about 1.5 times EBITDA. I am hoping to see an operationally geared increase in earnings over the next couple of years, so hopefully that might drive EPS up towards nearer say 3p, and you could then put it on a PER of 12-15, so that implies a share price in the 36-45p range, useful upside against the current price of 23.5p.

For that reason I'm happy to continue holding, but obviously that's just my personal opinion, and you may disagree after having done your own research. Do please feel welcome to add your views in the comments section below, I'm always grateful to readers who add any points that I've missed, or who have a different perspective.

PuriCore (LON:PURI)

This is an interesting turnaround situation. The market seems to have overlooked the fact that PuriCore refinanced its weak Balance Sheet, which is now strong, and has net cash, in early 2013. Also, they have been diversifying into new products and geographies. For me the most telling sign was that a Director spent a remarkable £450k buying shares recently, which when on that sort of scale is usually a pretty good indicator of good things in the pipeline.

Today they have announced a Middle East distribution contract for their wound care products. It looks reasonably useful extra business, with $9m turnover targeted in the first three years, with deliveries starting this quarter. I await the next set of results with interest.

Pressure Technologies (LON:PRES)

There's an impressive-sounding trading update today from this group, which has been on a roll lately. The key paragraph in today's update says;

Sales prospects across the Group are very strong and Pressure Technologies is performing in line with the Board's expectations at this stage of the year. The Board is confident that the outcome for the current financial year will be at least in line with market forecasts.

Their shares have risen 27p to 610p on the back of this announcement. Broker consensus forecasts are for 28.4p EPS this year, and 37.6p next year (it's a 30 Sep year end), and it sounds like they are heading for a beat against this year's forecast. So assuming 30p EPS perhaps, then the shares are probably up with events on a PER of 20. That seems a fairly rich valuation now.

The valuation also looks very high for an engineering group on a PSR basis, being about double last year's turnover. Personally I think that's now looking a bit stretched, so you would need to be very confident of continued out-performance to stay in these shares. Personally I would bank the profit and move on at this valuation if I held. Lovely company, but now fully (or over-) priced in my view. All good things come to an end, and it's important to know when to sell as well as knowing when to buy.

There are two other trading statements from Inland Homes (LON:INL) and Renold (LON:RNO) that I'll circle back to later, but for the moment have to dash, as I have more company meetings in the City today.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in NXR and PURI, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.