Morning,

I am likely just to cover H & T (LON:HAT) today. Without further ado:

H & T (LON:HAT)

Share price: 270.75p (-0.6%)

No. shares: 37m

Market cap: £100m

(Please note that I currently have a long position in H & T (LON:HAT).)

This remains my largest holding (25% of my portfolio - I do not recommend that others run such a concentrated portfolio as this).

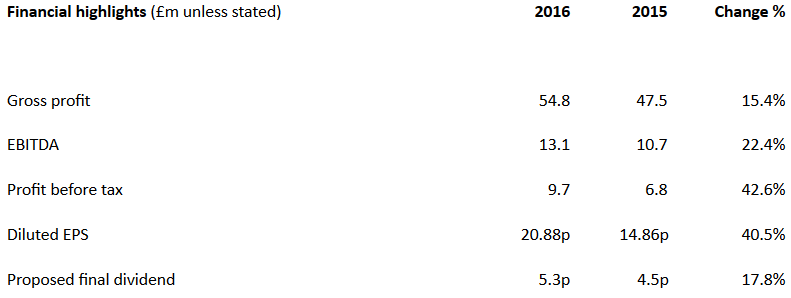

I am pretty happy with these results:

The pledge book is now 6% bigger at £41 million, despite the number of stores having reduced to 181 (from 189).

But the biggest change in the KPIs is the gold purchasing margin having increased from 15% to 26%.

Even though I'm a goldbug, and fully anticipate that the gold price will be a long-term tailwind for H&T, I'm also really excited by the opportunities created by the company's move into related financial services: personal loans, FX and buyback (pawnbroking for electronics, basically).

In that regard:

- the personal loan book is now worth £9.4 million (up from £4.2 million).

- the volume of buybacks is up to £8.5 million (from £6 million).

- FX gross profits almost doubled to £2.7 million (from £1.4 million).

So the sources of income have become more diversified, though they all rely on the company's core financial competencies.

Note that the loan book is something of a wild card - it's far from clear how big it could eventually get, and what its profitability might eventually be.

It generated interest worth 92% of its size in 2016, but 40% of this was lost to impairments (customer defaults). So the margin after defaults came in at 55% of the average size of the book - still highly encouraging. That margin should gradually reduce as the book gets bigger.

Net debt is up by a few million to £5.4 million - this is to be expected when the pledge books/loan books are growing. The CEO has said previously how he wished the company's net debt was higher, because it would be a side-effect of having found more profitable opportunities!

In terms of regulation, today's statement reiterates that all H&T personal loans are below the FCA's interest cap on short-term credit - "in reality, the vast majority are significantly lower than the cap". While regulatory risk never completely goes away, this environment looks quite benign to me.

And the core pawnbroking operation is always going to have modest interest rates anyway, relative to unsecured lending.

Outlook

There is some easing of the competitive environment; the wider economic uncertainty and fall in the value of sterling is supporting the gold price and, as such, demand for our products is strong. The Group is well positioned to take advantage of these conditions with a diverse set of products, developing distribution channels and consumer recognition.

My opinion

I remain very happy with the prospects here, and believe that the valuation should still allow for plenty of upside.

Looking through the CEO's notes, I note the following:

The Board believes that while there is still opportunity in Pawnbroking for H&T the market is shrinking and in order to maintain our position we must develop new channels for customer acquisition particularly through brokers and online.

An increased focus on the online channel is to be expected in the years ahead, as services migrate online as much as possible.

But physical locations remain hugely important - from a jewellery retailing point of view, as well as providing convenient locations where items can be inspected.

It's a shame if the overall pawnbroking market is shrinking, of course. The most important thing from my perspective is simply that H&T remains the biggest and most attractive pawnbroker in the market, and the default choice for the most potential customers.

According to the CEO:

"The Group is evolving into a provider of alternative credit services to serve an increasing customer base.

Sounds good to me.

Of course, if you don't have a view on the price of gold, or if you are bearish on it, you might want to proceed with more caution here

By my calculations, half of the increase in gross profits in 2016 was due to the increased gold price.

But for a company which has been around for well over 100 years, which is number one in its niche, which has recently survived one of the harshest competitive environments ever faced in its industry, and which is now growing a variety of related income streams, I think the current share price of 13x trailing net income remains a modest valuation.

(Please note that this is just my opinion - always do your own research! And also please note that I might change my opinion, and I might buy or sell shares in H & T (LON:HAT) at any time and for any reason.)

Paul Scott adds the following comment:

Reasonably priced & financially strong, but do you really want to own shares in a pawnbroker? I don't!

(This section by Paul.)

Rex Bionics (LON:RXB)Share price: 4p (down 69% today)

No. shares: 25.5m

Market cap: £1.0m

Funding & strategic review update - just a short comment on this one, to close the file.

I met this company when it floated on AIM and it was abundantly clear to

me right from the offset that we were being asked to make a donation, rather

than an investment. However, because it was a wonderful project (developing

devices which enable a wheelchair user to be strapped in, and stand up &

walk using power assistance), I tried not to say anything too negative in

these reports.

Anyway, today's update is basically saying that the company's time as a

listed company is almost over. It can't raise the necessary funding. However,

there is one lifeline whereby a new investor has offered fresh funding, by

investing into a new company that would own the old company. The new investor

would therefore be diluting existing holders, but no indication is given in

today's statement as to what the level of dilution would be.

Existing cash will only last until end April 2017, so I think it's safe to assume that the existing shares are now worth very little, or nothing at all.

My opinion - this was an admirable project, but it never should have listed

on the stock market. This was a charitable project, to develop a product which

is of potentially great social benefit, improving the lives of disabled

people, but this is not a viable business.

I think projects like this should be funded privately - perhaps by

philanthropists, or by Universities via grants, etc. The stock market is just

the wrong place for this. If I want to make charitable donations, then I'll do

so. However, if something lists on the stock market, then it has an army of

hangers-on, creaming money off for themselves - so Directors, NEDs, brokers,

PRs, etc - therefore not enough of the money invested actually makes it through

to product development. I wonder what percentage of investor money in Rex was

basically wasted, paying such hangers-on? A fair proportion, I would

guess.

I very much hope this project survives & does well in private, preferably charitable status ownership. It was heart-warming to see the product demo, where a young disabled athlete rose up in the device, and talked about how it had improved her life. Sadly though, that doesn't make a good investment. Therefore it needs funding from charitable sources, not commercial ones.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.