Good morning! I'll try not to get too distracted today, and get a report out a bit earlier.

Norcros (LON:NXR)

Share price: 15.75p

No. shares: 594.9m

Market Cap: £93.7m

Interim results - for the six months to 30 Sep 2014 are issued this morning, for this bathroom fittings group.

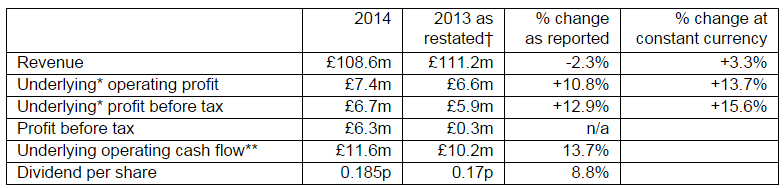

My first impressions are positive. The headline figures look strong, and I particularly like that, after years of restructuring, the figures are now becoming clean - i.e. statutory profit (after all costs, whether exceptional or not) is now close to adjusted profit. Also, look at the cash generation! Remember these are only six month figures, so annualise them, and you get a lot of business for a £93.7m price tag, in my opinion.

The company seems to have shrugged off currency issues - some people were worried about the depreciation of the S.African Rand, but as I've mentioned here before, it doesn't really matter because if both sales & costs are in the same currency, then it's only the profit which is translated at a different rate. Since Norcros's S.African operations make very little profit, the currency impact is therefore insignificant on group profit.

Interestingly, the company says;

...assuming no further devaluation of the Rand in the year, this strong constant currency growth should start to convert to Sterling growth in the second half of the year.

Outlook - the all-important outlook statement looks consistent with the last trading statement, saying;

With our strong brands, leading market positions and continued self-help initiatives focused on market share gains, the Board remains confident that the Group should continue to make progress in line with market expectations.

I've bolded the key words, because that's really all that matters. Every outlook statement should refer to market expectations, and how the company's performance compares with them, which this does, so that's fine.

There are interesting comments about the main UK business;

UK construction activity and an improving UK housing market continue to drive the UK trade sector recovery, and we have seen strong evidence of this across all our UK businesses. However, the UK retail sector remains subdued with consumer confidence still weak.

Taxation - EPS has previously been flattered by brought forward tax losses, but that seems to have washed through now, so the tax charge now looks more normal, although at 25% it's a bit high - looking at note 6 that's because deferred tax comprises the bulk of it. I've always struggled with deferred tax - it's something to do with timing differences between the accounting treatment and tax treatment of various items, if I recall correctly.

Bank facilities - there is plenty of headroom, with a total of £100m facilities provided by HSBC and Lloyds Bank, good to July 2019. Note how facilities are starting to be granted for longer periods now, an encouraging sign of the banks perhaps beginning to move towards what used to be normal lending.

Net debt at 30 Sep 2014 was only £20m, a good reduction from £26.9m six months earlier, showing that the business is now generating proper cash. There is a large depreciation charge (of £6.0m p.a.), so the EBITDA figures at Norcros are excellent - c. £20m p.a..

Pension deficit - it's a very large pension fund, so the deficit can swing up & down considerably. A decrease in the discount rate to 3.9% has been the principal driver for a doubling of the deficit from £21.8m to £40.6m. The actuarial deficit is likely to be considerably bigger, due to different assumptions.

The key issue is the level of over-payments required. At the moment the company is paying just over £2m p.a. into the pension fund, but I feel it's safest to assume that might need to increase somewhat.

Pension funds need to be seen as long-term liabilities. Talking to one FD (of another company) earlier this year, he said to me, "Look, the pension fund is a 30-year liability. So we have to accept that a certain amount of profits will be absorbed by the pension fund". Therefore one needs to adjust the PER accordingly - I knock off one or two points from the PER that I'm prepared to value Norcros on, to take account of the cash outflows into the pension fund.

The deficit should of course fall, and may even be eliminated, when interest rates rise, as the discount rate (used to value future liabilities) will rise, hence reducing liabilities. Although there are other moving parts too.

Balance Sheet - is fine, it passes my simple tests. The current ratio is healthy at 1.6. Remember that the company has a fair bit of freehold property too, which gives added strength, and keeps banks happy - because it's an asset that cannot disappear.

Valuation - broker forecasts are 1.9p for this year (which might be a bit of a stretch, but the company says it's in line), and 2.0p next year. So that puts the shares on a very modest PER.

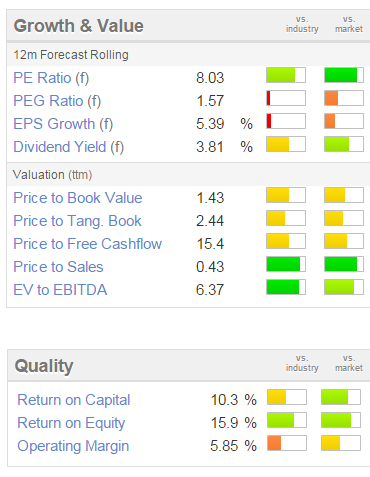

The quality scores are middling, but if you strip out the near-breakeven S.African business, then the UK part of Norcros (about 60% of turnover) is much higher quality than this would suggest. I remain of the view that disposal of the S.African businesses would be a sensible move, to create a smaller, but higher quality group.

Dividends - there's good progression here, with the interim divi up 8.8%. The full year yield is just shy of 4% - not bad considering it's increasing each year, and once the UK consumer starts spending, then who knows, it could rise considerably over the long term?

Forecasts - I've just heard that Numis have reiterated their existing forecasts (1.9p EPS this year, 2.0p next year), and have a 30p price target on the shares.

Numis comment;

Norcros trades on an annualised 2015 P/E of 8x and yield of 3.8% (3.3x

covered) compared to 15.4x and 2.7%, respectively, for the merchants and materials

peer group.

My opinion - I really like it, and it's a core long-term holding for me. There really hasn't been any fundamental justification at all for the share price declining this year from a peak of 25p to 15.75p now. It's just fallen on negative stock market sentiment.

Therefore in my view this is a buying opportunity at the current valuation, for the patient investor that likes buying unfashionable but cheap shares. As always that is not a recommendation, it's just my personal opinion, so please DYOR, and any contrary opinions are always welcome - in the comments below.

Volex (LON:VLX)

Share price: 65p

No. shares: 90.3m

Market Cap: £58.7m

I turned negative on this electrical cables maker about a year ago, because it was obvious that their turnaround plan was not really getting anywhere significant, and that they had a problem level of bank debt. The company then did a rescue refinancing by issuing more equity at 75p, but they only got it away at that price by paying fat underwriting fees. The fundraise was nice for the bank, as it got them off the hook.

Interim results - for the half year to 5 Oct 2014 are issued today, and look disappointing to me. There's an increase in profitability, from $1.6m to $3.5m, but that's on turnover of $220.9m. So it confirms my view that this company is actually a low margin manufacturer, up against a lot of competition, and possibly won't ever return to the juicy margins it made in the past. Perhaps it was a case of Apple (a major customer) over-paying for products in the past, but having now realised and corrected that error?

Balance Sheet - despite the fundraising, Volex still has net debt of $5.6m. That's manageable, but it's not a particularly strong position, particularly as it is actually debt of $29.2m offset by $23.6m cash. It's easy to window-dress the cash figure for the Balance Sheet date, but that might not be reflective of the underlying cash figure throughout the year.

The current ratio is 1.4, which is OK, although note there is another $30m in long term liabilities. Profitability looks small against the Balance Sheet figures.

So overall I would say that the financial position looks stable, rather than strong.

Outlook - is light on specifics, all a bit waffly really isn't it?

We are starting to see the benefits from the Volex Transformation Plan. Our focus on working more closely with our customers has delivered strong growth in sales and improved margins in the first half.

We have made important investments in people and infrastructure and continue to remain focused on delivering the procurement benefits within our plan that are expected to feature more strongly in the second half and beyond.

With the Group's well invested, global manufacturing footprint, high quality customer base and our commitment to continuous improvement, the Board has confidence that the company will deliver further sustainable growth in both sales and profitability.

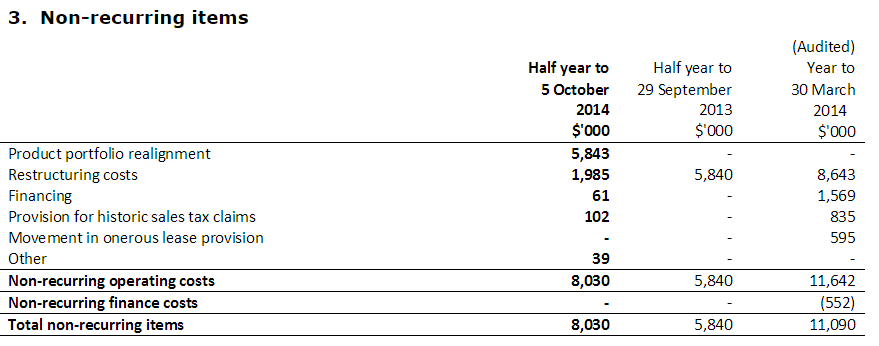

Non-recurring items - I'm concerned at the size, and recurring nature of non-recurring items at Volex!

Just because you call a cost non-recurring, doesn't stop it being a cost. Including all costs, the company's losses actually got worse, with a pre-tax loss of $5.8m this H1, compared with a loss of $4.1m in H1 of last time.

I'd bet on this company reporting non-recurring items every year from now until kingdom come.

My opinion - as you might have gathered, I'm not convinced by the turnaround narrative here at all.

It's a very difficult company to value. If I'm wrong, and they do improve profitability strongly, then the shares could go up nicely. Trouble is, there's not really any credible evidence of that happening yet (if at all).

I suspect these shares might continue to drift, with the odd blip up when it gets tipped somewhere. The company promotes itself well in the City, but the figures are not showing a proper turnaround to any meaningful extent, in my view.

T Clarke (LON:CTO)

Share price: 50.75p

No. shares: 41.4m

Market Cap: £21.0m

This is a building contractor, mainly in electrical, for large scale building projects, such as office blocks.

In the past I've been rather dismissive of it, because my main job here is to report on the figures, and flag up risks. So this company has issues with a pension deficit, problems with its bank facility, problem contracts, a possible cut in the dividend in the offing, all sorts of things have gone wrong. I was therefore overall negative in my last review of the company here on 8 Oct 2014.

Project wins - an announcement today details £75m of project wins in London. Certainly when you go round central London, there are cranes everywhere. A veritable building boom is underway in the capital. The RNS today lists the projects, which are impressive. It's interesting that we are seeing poor quality post-war buildings often being pulled down to make room for modern office blocks.

This section today from T Clarke's announcement really made me sit up & take notice;

" This reinforces our very strong position in the London market. As the market tightens, clients are keen to secure the best teams to work on their projects. We are delighted that our long-standing reputation for delivering exceptional quality services has been rewarded with being selected for some of the most significant projects in London.

Our in-house engineering expertise and directly employed skilled resources are paramount to our clients and I am pleased that our collaborative approach and attention to detail have been recognised as we look forward to commencing our onsite activities on these projects next year."

Note those words, "As the market tightens". So I decided to do a bit more digging, and have made a few phone calls to better understand the business.

Because they mainly do the electrical fit-outs of completed or refurbished buildings, then this company sees an economic upturn about 18 months later than building companies. It appears that such an upturn is now kicking in. Therefore what excites me is that the company could see a gradual return to the much stronger profit margins which it saw prior to the financial crisis.

Moreover, it has pricing power, as electrical contract work can be quite complex, and is not something that you can just hire a load of migrant workers to do - because they won't hold the necessary qualifications, permits, or experience. This company appears to now have increasing pricing power, and that should feed through into much improved operating profits.

Staff wage increases are also an issue in this sector - apparently some construction workers are seeing pay rises of 15% in London. I am told that T Clarke directly employs its staff, many of whom are long-serving, so it has staff loyalty, which helps mitigate such pressures - i.e. the company looks after its staff in a downturn, and the staff reward that loyalty by sticking around in an upturn.

Therefore this is now a very interesting situation, where you have to weigh up the historic negatives, reported on in my report of 8 Oct 2014, with a much more upbeat-sounding outlook.

My opinion - this share must be seen as high risk, and normally I wouldn't touch anything like this, but the upside potential now looks quite interesting. It's certainly going on the watchlist. The shares are up 20% today, so it has clearly caught the eye of other people too. I like companies with pricing power, and T Clarke seems to be getting into a sweet spot where it holds greater pricing power. With their last interim results published on 5 Aug 2014 the company said;

Whilst there are positive signs of improvement and we expect to see continued opportunities for growth next year we still maintain it will be late in 2015 before we begin to see the benefits of the recovery translating into improved margins.

The Group is seeing early signs of a return to an environment where sustainable growth can be achieved, although there still remain pockets of the market where unsustainable bidding practices by others continue.

We are already seeing far less fixed price bids being demanded by clients and more opportunities to negotiate and lock in our resources

So three months on, and with £75m of new contract wins, things seem to be progressing well.

Interesting. Have any readers looked at this company? If so, pls share your views below in the comments.

Ab Dynamics (LON:ABDP)

Share price: 170p

No. shares: 16.8m

Market Cap: £28.6m

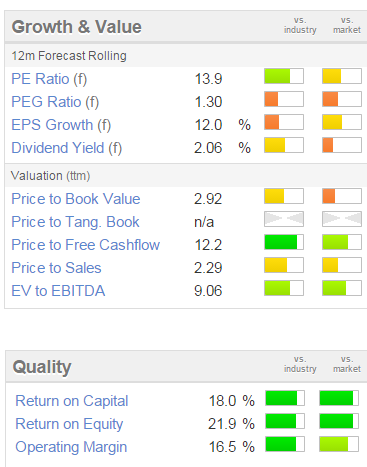

Final results for the year ended 31 Aug 2014 are published today. They look good. Turnover up 14% to £13.9m, and profit before tax up 43% to £2.7m.

The company had net cash of £4.9m, although some is earmarked for a new factory, targeted for completion in Q3 2016.

The shares are very illiquid unfortunately, with a rather wide spread.

Dividends - 2.5p in total is being paid for the year (1p interim, 1.5p final divis), for a yield of 1.5% - worth having, but only just. The bid/offer spread could gobble up 1-2 years divis.

Outlook - the key excerpt says;

Since the beginning of the new financial year, trading has been in line with expectations with significant visibility provided by our existing order book for the remainder of the year.

They're only 2 months into the new year though.

My opinion - this looks a good little company, on a superficial review of the figures. It seems to have reported figures well ahead of broker consensus, which was for 10.4p EPS, but has come in around 12-13p (diluted & non-diluted respectively), which looks a good result.

Might be worth a deeper look perhaps?

Swallowfield (LON:SWL) - there are three potential warning signs in today's AGM statement from this company;

The board is pleased to report that trading in the first four months of the year is broadly in line with expectations.

1. So in other words, they're slightly behind expectations.

The timing of these new strategic projects, the phasing of new contract wins, and the natural seasonality of some of our key customers will, as in previous years, see a significant weighting of our full year profits to the second half year.

2. These type of comments about timing & seasonality are often a precursor to a profit warning in H2.

At this early stage of the year, and whilst market conditions remain challenging, we anticipate full year profitability will be in line with current market expectations.

3. Challenging market conditions leaves wiggle room for a profit warning later in the year.

My opinion - it looks a low quality company, making only a wafer thin profit margin. Not of any interest to me.

Idox (LON:IDOX) - has published an in line trading statement today.

My last report of 8 May 2014 has more detail. Could be potentially interesting, but the Balance Sheet is poor.

Given the rather weak Bal Sheet, I think the valuation currently looks about right (at 39.5p per share)

Regards, Paul.

(of the companies mentioned today, Paul has a long position in NXR, and no short positions

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.