Good morning!

Next Fifteen Communications (LON:NFC)

Share price: 203p (up 2.3% today)

No. shares: 65.6m

Market cap: £133.2m

Interim results to 31 Jul 2015 - this is a group of marketing & PR agencies. I'm impressed with today's interim results, although it's important to remember that most of the top line growth has come from acquisitions - turnover being up 18.4% to £61.8m in H1, of which organic growth was 4.1%.

Three agencies were acquired during the period - "Encore, Incredibull and Animl acquired during period and performing to expectations". Who thinks up these names (and are they in the right job?!).

Net debt - has increased considerably, from £1.4m a year ago, to £8.9m at 31 Jul 2015, although that doesn't strike me as a problem, as it's only slightly more than 6 months EBITDA.

Operating profit margin - is good, and improved, at 11.7% of revenue, at £7.2m. Mind you, people businesses are coming under increasing pressure to give pay rises & bonuses to staff, so there may not be much scope to extend profit margins further, perhaps?

Outlook - the all-important forward-looking comments today sound positive, and reassure on full year expectations;

As stated earlier, the Group has made a good start to the financial year ending 31 January 2016. Current trading is encouraging with good activity levels across the Group and the benefit of recent acquisitions coming through. Despite increased investment, the Group is on track to meet expectations for the full year.

"Good start" is an odd description, considering they are almost three-quarters of the way through the financial year now!

Note that the financial year was moved from 31 July to 31 January, so there was an odd 18-month period to bring that about - hence why the prior year comparatives look unusual, with high turnover of £158.5m.

Balance sheet - overall I'd say this is a tad on the weak side, but given the good level of profitability and cashflow, I don't see this as a particular problem.

Although net debt of £8.9m looks reasonable, note that gross debt is a good bit higher, at £19.7m, partially offset by cash of £10.8m. Companies often scramble to collect in cash for the year end date, to minimise the net debt reported figure. So it's important to look at gross debt, of £19.7m in this case, which is probably the worst-case cash position, as opposed to the year-end net debt, which is probably the best-case position!

So there's a good argument for perhaps taking the average of the two, which would be £15.3m here, and use that figure as a more conservative estimate of the typical level of net debt throughout the year, when calculating Enterprise Value. If you use the year-end balance sheet to value the company on an EV basis, you might well be over-valuing the equity, by using a suppressed year end net debt figure.

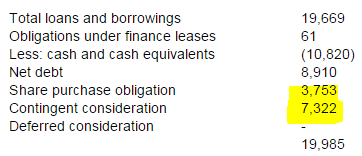

Note 11 is interesting, as it lumps in additional creditors into a higher £19,985k net debt figure;

As the above are specific obligations, I'd be inclined to value the company on the basis that it actually has net debt of £20.0m, not £8.9m.

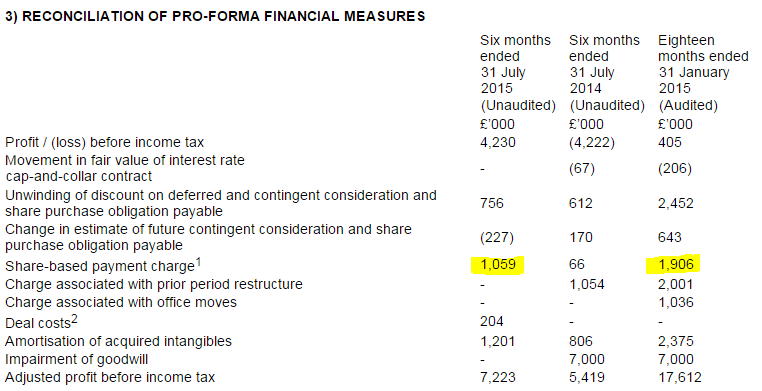

Adjustments to profits - you have to be careful with PR companies, as they often over-PR their own figures, and hence the adjusted figures can be misleading, and not reflect the commercial reality.

In this case, there is a reconciliation of adjusted to statutory profits, given in note 3 (see below). On the positive side, it's good to see restructuring costs have stopped. The main item I have an issue with, is the share-based payment charge, as this is usually just another form of employee/Director remuneration, so should be treated as a standard cost by investors, and not ignored by being adjusted out.

In this case however, an explanation is given, which sounds as if this relates to a particular deal, rather than being general staff benefits;

1 This charge relates to the acquisition of the 20% minority interest in Bourne whereby performance shares were issued as partial consideration, a transaction whereby a restricted grant of Brand equity was given to key management in Bite Communications Limited and The OutCast Agency LLC (2015: Story Worldwide, MBooth and Bite NA) at nil cost which holds value in the form of access to future profit distributions as well as any future sale value under the performance-related mechanism set out in the share sale agreement. This value is recognised as a one-off share-based payment in the income statement.

If it is indeed one-off in nature, then I can live with that being adjusted out.

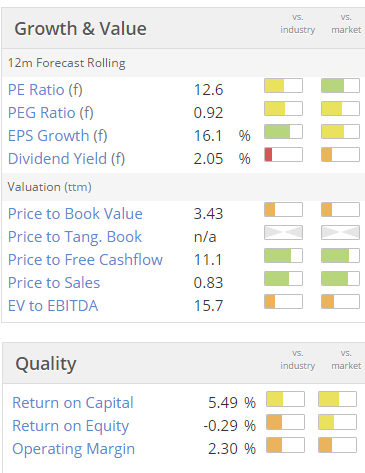

Valuation - despite the shares having risen a lot (almost tripling in the last two years), the valuation measures below still look quite reasonable. The divi yield is a tad on the low side, as you often find with companies that are growing by acquisition.

My opinion - overall, I quite like it, but not enough to rush out and buy any shares in it, as I feel the big rise has probably already happened, and I've missed it. You have to remember that this type of company is very cyclical - as customers switch off, or greatly reduce marketing & PR spend when the economy goes into recession.

Therefore, it's important that the valuation doesn't get too high during the good times, otherwise you'll end up over-paying. The key question therefore is, where are we in the economic cycle? If we knew the answer to that, then things would be a lot easier.

Flybe (LON:FLYB)

Share price: 82.3p (up 6.5% today)

No. shares: 216.7m

Market cap: £178.3m

(at the time of writing, I hold a long position in this share)

Trading update - I was scratching my head this morning, trying to work out if this was good, neutral, or bad news. Thankfully, a broker note came through shortly afterwards, saying largely the same thing, so that made me feel less of a nitwit!

The Directorspeak says;

"Flybe's turnaround continues, with our third successive quarter of revenue, capacity and passenger number growth, against the very competitive market provided by other airlines and road, rail and ferry services. In our second year of transformation, Flybe's performance in its core business is on track. We are also determined to finish redeploying our surplus Ejet aircraft."

The "very competitive market" comment sounds like it was laying the ground for a profit warning, but thankfully none has been issued, with the "performance in its core business is on track" comment seeming to me as a confirmation that the company is meeting market expectations. I would have preferred them to say so directly.

A few stats are given, which mostly seem positive, although I didn't like the 2.2 basis points fall in load factor to 78.3%. This is the bums on seats measure, so it effectively means that Flybe planes are still flying with too many empty seats (just over 1 in 5 are empty). I'm not an airlines analyst, but in my simple terms, this must mean the company still has too many inefficient routes where they can't fill the planes as needed.

Revenue per passenger is up 2% though, so that looks to have offset the drop in load factor.

My opinion - I don't see any reason to change my view, that this is an interesting turnaround situation. It's clearly not performing as well as other airlines, as it's only forecast to make a tiny profit of £4.5m this year, on turnover of £632m. However, once the old fuel hedging (at expensive levels) has worked through, and the surplus E195 jets have finally been disposed of, then a reasonably profitable business should emerge.

Moreover, the balance sheet is very strong, so there are no solvency issues here. For that reason, I'm happy to sit and wait for the turnaround to gather pace, whilst accepting that it's been slow & hesitant to date.

In the back of my mind, I've got a target of 120-200p for this share, but have no idea how long it's going to take to get there (if indeed it does get there).

Proactis Holdings (LON:PHD)

Share price: 102p (up 8% today)

No. shares: 39.5m

Market cap: £40.3m

(at the time of writing, I hold a long position in this share)

Results y/e 31 Jul 2015 - the market clearly likes these numbers & outlook. This is a stock I'm very keen on, as it seems to have good growth characteristics, mostly recurring revenues, ambitious management, and an enviable client list.

I'm speaking to management in a few minutes actually, but then have to go out for meetings, so I won't get a chance to report back today unfortunately.

So a few quick bullet points;

- P&L figures are in line with expectations.

- 6.1p adjusted EPS seems to be the number to hang my hat on, which is a PER of 16.7 - looks OK for a growth company

- Note the tax credit of £495k (relates to recognising b/fwd tax losses, and R&D tax credit)

- I think they have normalised tax in the 6.1p adjusted EPS, but will confirm this with mgt.

- Balance sheet - weak, unfortunately. I will nag them to do a small placing! Not necessarily a problem, but I would just like to see a more firm tangible asset base.

- £2m development spend capitalised, versus £2.3m amortisation charge, but some adjusted out - need to clarify this.

- Screwfix - existing client, has taken additional services in separate announcement today, with a strong testimonial from the client.

- Accelerated payment facility - similar to what Tungsten are trying to do - in early stages of roll-out, could get interesting.

- Modest divis.

- Positive comments from brokers this morning.

- Shares are illiquid - difficult to trade sometimes.

I'll update further when time permits.

EDIT: I've just had a quick catch-up phone call with management, and am quite taken aback by their very ambitious plans to grow this into a much bigger business. Risky? Well not really - they are targeting profitable, complementary software companies in procurement, where the bulk of revenues are already contracted.

It sounds to me as if this company is likely to grow very substantially over the next few years, so certainly an interesting situation.

I hope to do a recorded CEO/FD audio interview at some point, in the not-too-distant future, on my new website.

Porta Communications (LON:PTCM)

(at the time of writing, I hold a long position in this share)

The Director buying of shares just keeps coming - in decent size too - more announced today.

Something (positive) must be up here - check out the Director buying in the last year or so, it's been large, with Chairman Bob Morton heavily buying, plus other Directors.

Got to dash now, sorry I didn't get time to report on more companies today.

Regards, Paul.

(usual disclaimers apply - positions held by me disclosed above)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.