Good morning!

We have about 20 people coming along to ShareSoc Brighton tonight, which is (just) above the threshold where it's worth doing. So I'm putting the finishing touches to my talk on small caps.

I'm dreading the train journey from London to Brighton. It's bound to be packed full of people who've thrown a sickie from work, to do some sunbathing! Summer is putting in one final appearance today apparently.

Cohort (LON:CHRT)

Share price: 315p (up 1.6% today)

No. shares: 41.0m

Market cap: £129.2m

AGM statement & Q1 update - this group of defence sector companies has a 30 April year end. So it's reporting today on the first quarter (May, June & July), although the figures given are as at 31 August, so that's actually 4 months, and not just Q1.

Anyway, the order book looks strong, and the all-important in line with expectations message is given;

The Group's order book stood at £128m as at 31 August 2016, underpinning a higher proportion of our externally forecast revenue for the year compared to this time last year.

The pipeline of orders beyond this and expected renewals give us confidence that the overall performance for the year will be in line with expectations, despite SCS's market in technical consultancy remaining a challenge.

The cash position remains healthy, although note that most of it is ear-marked for hoovering up minority shareholders in existing subsidiaries;

"The group's net funds as at 31 August 2016 stood at £14.4m. The reduction in the Group's cash position since the year end was as signalled in our final results statement, stemming from the partial reversal of working capital inflow during a very strong fourth quarter of last year.

A further £9m is expected to be spent in the rest of this financial year in acquiring a further 23% of EID, taking our holding to 80%, and the remainder of the shares (49.999%) of MCL, taking our holding to 100%.

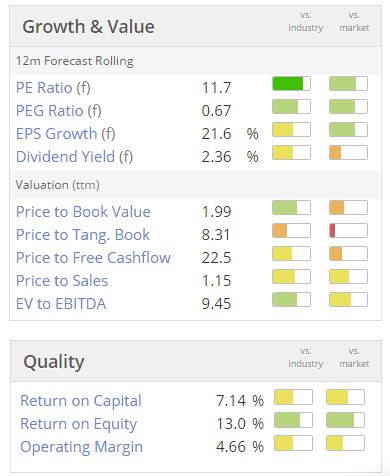

That all sounds fine to me. Also, note the valuation is hardly demanding;

My opinion - it looks good value to me. Although I'm not madly keen on this sector, as contracts can be lumpy, leading to the ever-present risk of a profit warning. Or, something might go wrong with a major contract.

Mind you, at the current valuation, the risks seem priced-in, and overall I could see maybe 20-30% upside from the current price, so it's tempting.

Flowtech Fluidpower (LON:FLO)

Share price: 130p (up 0.6% today)

No. shares: 43.1m

Market cap: £56.0m

(at the time of writing, I hold a long position in this share)

Interim results, 6m to 30 Jun 2016 - this was one of my post-Brexit bargain purchases, at 102p, and it's bounced nicely from there. There was never a particularly valid reason for it to have fallen sharply, in my view.

Since joining AIM in 2014, FLO has made 6 acquisitions. Growth reported today has mainly come from acquisitions. Some key figures for the 6 month period;

Revenue up 28% to £27.4m

Underlying operating profit up from £3.4m in H1 2015, to £4.06m (up 19%)

Net debt has risen substantially though, to £14.1m

Dividends are quite good here - the forecast yield is 4.5%. The 5% rise in interim dividend looks consistent with the full year forecast divi.

Outlook comments are interesting, but reassuring, despite difficult market conditions;

Low global confidence and economic uncertainty is influencing many industrial sectors, particularly in the UK. We do believe this hiatus to be short term, and remain confident for the future.

As we previously indicated, the Group operates in a "live" pricing environment and it is increasingly certain that input prices for many core product lines will increase in HY2 and early 2017 on the back of the sterling downgrade.

The Board is confident that we will be able to maintain overall margins by a mixture of selling price increases and supplier support.

The fluid power sector as a whole has come to expect a heavy bias towards US Dollar and Euro denominated supply lines and the macro economic situation is well understood by the sector's decision makers.

Trading is in line with management expectations despite some disruption over the immediate post Brexit vote period.

Overall, we remain positive that we can deliver results in line with market consensus forecasts and are confident about the future.

Our acquisition pipeline remains dynamic and the Group is now established as a very credible option for investors and owner managers across the sector who wish to exit their position.

Valuation - the PER is only 8.4, based on forecasts which the company is effectively confirming above. That seems good value to me, although of course the significant net debt has to be taken into account for valuation purposes.

Balance sheet - overall looks OK to me. Intangibles are high, but even after writing off all intangibles, the NTAV is still positive, at £6.4m

My opinion - I like it. This group has a good niche position, distributing a wide range of essential maintenance parts for hydraulic equipment. So the key success factors are having the right products in stock, and being able to deliver products to customers very quickly.

The nature of the business is that good margins can be made, and FLO also seems to be doing a good job in bolting on complementary acquisitions. The balance sheet is under control, and there's also a nice divi. The forward-looking comments seem encouraging too.

Therefore it's a company I like, and on the back of these interim figures am happy to continue holding for another 6 months.

FinnCap has put out a supportive note this morning, with minor tweaks to its forecasts, but not affecting EPS for this year or next. FinnCap notes that FLO is priced at an unwarranted discount to its sector.

Goals Soccer Centres (LON:GOAL) - this one might be worth a fresh look. I've had a very quick skim of its interim results today, and it seems to have turned a corner;

LFL sales are now positive again, in the last 11 weeks.

The balance sheet looks tons better, after a recent fundraising.

This share is starting to look potentially interesting, in my view. I wouldn't be surprised if somebody bids for it, as there's an obvious fit with a company like Sports Direct, which is on the shareholder list already, I believe.

I'll have to leave it there for today. See some of you tonight, and everyone else tomorrow.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.