Good morning! The situation at Silverdell (LON:SID) appears to be slowly improving, as far as I can tell from the extremely limited information provided to shareholders. This has to be one of the most bizarre situations I've ever seen. The group's shares were suspended without warning on 2 Jul 2013, and a two sentence RNS was issued on that day containing the dreaded words, "pending clarification of the Group's financial position", which is almost always terminal when that phrase is used.

However, a statement on 16 Jul 2013 then said that only part of the group (Kitsons) was in Administration, and that discussions with HSBC had reached a "satisfactory outcome".

On 24 Jul 2013 it was announced that Silverdell was buying back the business & certain assets of Kitsons from the Administrator in a deal capped at £8m, funded by bank facilities.

Today's announcement confirms that HSBC has agreed to provide an additional £5m facility to finance the acquisition of Kitsons, up to 31 Jan 2014. So that's good news. Encouragingly it also says that contracts & operations are being moved across "with minimal disruption".

The last sentence confirms what I've been saying for a while, namely that the shares are likely to likely to resume trading at some point in the not too distant future, but will probably open down at least 50% (my guess is 4-6p), and that there will almost certainly be a deeply discounted Placing & Open Offer:

The Group is currently assessing the impact of the administration on its trading performance and therefore the capital requirements of the business for the remainder of FY2013 and for FY2014 in order to work towards lifting the suspension from trading of the Group's shares.

In these bizarre circumstances, where a large chunk of the Group seems to have fallen into Administration by accident (these things can happen - if important legal documents gather dust in someone's in-tray, instead of being acted on), then a fund-raising from equity holders is now a near certainty.

It is vital that the interests of all existing shareholders are respected - so retail investors MUST be given the opportunity to invest in the next fund-raising on the same terms as Institutions. Yes, it costs more to prepare the relevant documentation, but I think the group will have another legal action on its hands if they go down the route of offering cheap stock to Institutions only, through a Placing.

I don't mind Placings where they are c.10% of the existing equity, and at a small discount. But where they are at a deep discount, and are large relative to the existing number of shares in issue, then they are very damaging to existing shareholders' interests. In this case it's likely to be both - i.e. at a deep discount, and highly dilutive, so existing shareholders must be given fair access to the new shares through an Open Offer.

If I were a shareholder here, then I would contact FinnCap to make this point, in order to protect my interests. Luckily though I managed to side-step the problems here, as something just didn't feel right at the 10 Jun 2013 meeting with management (inconsistent & unconvincing messages about the financial position mainly), so I sold my shares the next day. A lot of friends are in this stock though, so I hope it works out for you, which it is increasingly looking like it will - providing you take up your allotment of cheap shares in the next fund-raising.

I also note from today's RNS that both the existing CEO and FD are still in place. Somewhat surprising in the circumstances, I would have expected at least the latter to have gone.

Quindell Portfolio (LON:QPP) issue a trading update today. It appears to address one of the key concerns about the group, namely its ability to collect in cash. Average debtors days reduced from 6.5 months to 4.8 months, comparing 31 Dec 2012 with 30 Jun 2013, which on the face of it looks impressive.

Maybe I've misjudged this group? Time will tell. I'm not convinced that they can maintain the bumper profits currently being made, but we'll see. In the short term at least, this announcement certainly seems to allay one big question mark over Quindell though.

Murgitroyd (LON:MUR) issues a trading statement today for the year ended 31 May 2013 (that seems a very slow reporting cycle) as follows:

The Board can confirm that trading for the second half of the financial year has been such that the underlying trading result for the full year is anticipated to be broadly in line with market expectations and remains confident about the future prospects of the Group.

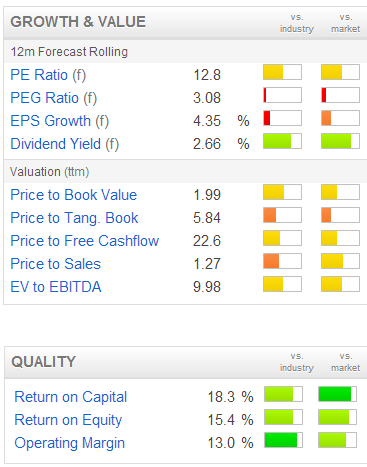

So slightly below forecasts then. Broker consensus is for 37.9p EPS, up slightly from 36p last year. So say if they deliver 37p, then at 508p these shares are on a PER of 13.7. That sounds about right to me, as it's not a rapid growth situation, but has a sound track record of reliable profits, dividends, gradually growing over the long term.

I see that Murgitroyd has also been steadily reducing debt since 2008, and also that the average number of shares has remained pretty static over the last 6 years. So that gets a thumbs up too.

I see that Murgitroyd has also been steadily reducing debt since 2008, and also that the average number of shares has remained pretty static over the last 6 years. So that gets a thumbs up too.

This is the sort of company that would probably make a nice very long-term pick for a SIPP, it's a buy & forget type of share, that will probably do well, with a 5-10 year time horizon.

I note from the Stockopedia StockReport that it qualifies for the "Neglected Firms Screen", which I've just had a quick look at. I see some nice, quality companies in this screen (e.g. F W Thorpe, Cohort, Pressure Technologies), but also some value traps (Chinese companies). However, I might well have a deeper look at this particular screen over the weekend - as it has thrown up enough companies I like, to mean that I should be looking at the others which pass this screen - which is an effective short-cut to finding new stock ideas.

In the meantime, Murgitroyd goes onto my watch list for good companies which I'll look at buying on a market correction. After all, the name of the game is BLASH, so buying things at fair value is not of any interest to me, it's bargains I'm after!

Pilat Media Global (LON:PGB) announces three new contract wins. This company really does seem to be on a roll. They are an Anglo/Israeli software company, whose software is used by television companies globally, with a lot of big name clients on the books.

The striking thing about Pilat Media is the amount of cash it has on its Balance Sheet, although it is not clear what management intend doing with it, since oddly they do not pay a dividend. I imagine that the broker consensus of 2.54p per share is probably now too pessimistic for this calendar year.

Market research group YouGov (LON:YOU) is starting to look interesting on valuation grounds. Their shares have been gently sliding down over the last year, and are now close to their 12-month low, at 66.7p. Yet their trading update today sounds reasonably good:

YouGov's trading for the year ended 31 July 2013 is in line with the Board's expectations. Our revenue growth continues to outperform the overall market research sector as the benefits of our on-going investment begin to come through. Consistent with this we are seeing strong growth as planned in our global data products and services.

The Group's balance sheet remains strong with net cash at 31 July 2013 of approximately £6 million.

Broker consensus is for 4.93p EPS for year-ended 31 Jul 2013, so that puts them on a fairly undemanding PER of 13.5, which is not bad considering net cash is around 10% of the market cap, and that they are talking about growth.

I don't see enough upside on that valuation to tempt me to buy the shares, but the market will soon start focusing on 2014 earnings estimates, and at 5.6p EPS that brings the PER down to 11.9, and if you think they might out-perform against that, then upside on the current price could emerge.

Market research is also the type of cyclical activity that you would expect to do well in an economic recovery, so for these various reasons I'm starting to lean towards this share, and will put it on my watch list. Here is the three-year chart, with the comparison line as usual being the FTSE Small Caps Index:

Last but not least, voice recognition company Eckoh (LON:ECK) has put out a positive-sounding trading update. The key sentence says:

I am pleased to report that the Company has continued to experience strong levels of new business activity during the first Quarter of the new financial year and that current trading remains in line with market expectations.

At the end of the statement the Board states its...

...confidence that the growth seen in recent periods will continue in the current financial year and foreseeable future.

So all sounds good. Trouble is, the good news is already baked into the price. Broker consensus is for 0.85p EPS this year, and 1.05p next year, so with the shares at 24.5p this morning, the PER is almost 29 times this year, and over 23 times next year's forecasts. That comes down a fair bit if you strip out the net cash, but even so it doesn't look cheap.

I really struggle to pay high multiples for any share, it's too risky if something goes wrong. This might mean missing out on some good growth companies, but there we go.

Right, all done for today. Thank you for reading & for comments which are always welcomed in the comments section below.

See you tomorrow as usual.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in PGB, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.