Paul and I are going to try having two separate articles, on days when we are both writing.

Here is the link to Part 1, where Paul covers BOO, VCP, LVD, PUB

Audioboom (LON:BOOM)

Share price: 2p (-6%)

No. shares: 638m

Market cap: £12.7m

Key points from this podcasting platform's Q4 update:

- Unique file requests (i.e. how many times people listened to something on the platform) are up by 42% to 145 million, compared to Q3.

- Number of unique users has doubled compared to a year ago, now at 58.6 million

On the financial side:

Overall 2016 revenues are expected to exceed £1.3 million, an increase of more than six fold compared to last year, and ahead of market expectations. The rate of growth in 2016 has continued to accelerate from H1 to H2, with Q4 revenues of more than £630,000. This rate of revenue growth has continued post year end, with over £1.1 million already booked for advertising campaigns in 2017.

When something is starting from a very low base like this, the fact that the growth rates are explosive is not too important me - there is no alternative, or the company won't go anywhere!

However, I must admit that the operational metrics sound quite good. The others, less so:

Due to acceleration in audience

acquisition costs and higher recruitment fees to acquire USA commercial

head count, the Company expects its EBITDA loss for the full year to be

greater than market expectations. The Company has taken steps to reduce

costs through new ad-serving and bandwidth partnerships which it expects

could achieve cost savings of approximately 40% for 2017 over 2016 in

this area. Additionally, UK annual headcount has been reduced by

£465,000 to allow the Company to focus on its growth opportunities in

the USA.

The year-end cash balance was c. £710,000.

Clearly, then, this is not an instance of self-funding growth, since growing the audience base is increasing the rate of losses.

Slashing UK headcount sounds worrying - is the company caught between two stools, the US and the UK? It's never very encouraging to see a company spreading to a new jurisdiction, without having first achieved success at home.

Also, the funding discussions with the Chinese fund (for an injection of up to $8 million) have ceased. Audioboom's cash balance is now £710k.

My opinion:

I'm not very happy with the wording of the RNS. Consider this:

Further to the announcement dated 3 October 2016, the Audioboom Board has ceased to seek investment from the Chinese fund and rather focus on its core business.

That would lead you to believe that missing out on the Chinese investment is no big deal, because the funds were going to be applied to non-core activities. But the potential investment was initially described in this way (5 August):

The funds received from the strategic investment are to be applied towards accelerating the growth of the Company and not for working capital purposes.

How is accelerating the growth of the company not part of its core business? I can't find any previous suggestion that the Chinese funds were to be used on non-core business.

Looking forward, it's hard to imagine that the latest cash balance of £710k is going to be sufficient for terribly long.

At the interims, the company had £0.9 million, at which point it raised £2.55 million at 2.5p/share.

With all of those funds used up, and more, and with the share price now at 2p, more dilution is in store.

What more can I say? This is highly speculative. Considering that over £7 million was racked up in costs last year, I don't see how it can possibly get to breakeven quickly enough to spare investors from suffering a lot more dilution. And that would be the best-case scenario. A nice app, but I'd steer well clear of these shares.

Share price: 63.9p (-9%)

No. shares: 361m

Market cap: £231m

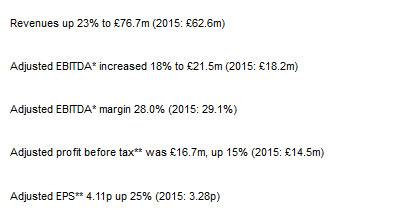

Final Results (year ended 31 October 2016)

The headline numbers look quite encouraging here, as do the statutory figures. Net income improved from £7.8 million to £11.8 million. Quite a nice result for a business which specialises in support services and software for the public sector. Most (82%) of its revenue is on a recurring basis, giving it fantastic visibility.

It's on quite a high earnings multiple, which can make it easier to disappoint some investors and produce a sell-off such as we've see this morning.

The overview mentions "generally stable markets" and "challenges in some of our smaller markets", but the outlook is very positive and it remains ambitious to grow:

The Board remains confident that the Group is well positioned in its markets and will continue to perform well in 2017 given its strong revenue visibility, order book and pipeline. The Group remains on track to achieve its target of £100m of revenues at sustainable margins in the short to medium term, through a combination of organic growth and acquisitions.

Overall, the outlook for Idox in the coming years is therefore very positive and our expectations for the Group's financial performance are unchanged.

The company remains on the acquisition trail, and is raising gross £20.5 million to buy the next target, as described in a separate RNS:

6PM Group, founded in 2004, delivers software and solutions, principally to the UK NHS.

The Acquisition offers Idox the opportunity to expand significantly its presence in the health and social care market whilst playing to the public sector efficiency and cost saving agenda.

My opinion: Looking into the footnotes, I think Idox might be paying a full price for this company. Including its debt and working capital needs, the deal values 6PM at c. £35 million. Its estimated EBITDA for 2016 is £2.9 million - I wonder what the net income might be?

Overall, I have a fairly positive view on Idox. Recurring public sector software sales are probably very dependable! It's carrying £25 million of net debt, which does not appear excessive - though I'd note the company says that if the Placing does not succeed, it will use some more debt to get the purchase of 6PM through!

Overall, it strikes me as worth looking into some more.

Share price: 37.75p (+8%)

No. shares: 675m

Market cap: £257m

Excellent update from this manufacturer of semiconductor wafers:

Since the announcement of its interim results on 13 September 2016, IQE's trading has continued to be strong across multiple markets, particularly in the photonics business. As a consequence, the Group announces that it is on track to deliver FY 2016 revenue and adjusted1 operating profit ahead of expectations. It is anticipated that revenues will reflect a double digit rate of growth year on year, and that H2 revenues will be up sequentially over H1.

In the above-mentioned interim results, revenues were up 18% and adjusted operating profit up 61%, and clearly the momentum is continuing.

The company notes that results will be boosted by the GBPUSD exchange rate, while also noting that the impact is "presentational" (since both its revenues and costs are denominated in USD).

The shares have more than doubled since the summer, and brokers are forecasting adjusted EPS for calendar 2016 and 2017 both at 2.9p.

My opinion:

There are probably not too many experts in photonics among the investor community (I am not one of them, either), but it seems like a great place to be at the moment.

In H1, the photonics segment generated a 45% growth, and IQE said that the relevant technologies "are now hitting the performance and cost points necessary for mass market adoption."

Even taking into account the debt/deferred consideration on the balance sheet (£35 million in June), the 12x PE ratio on this is looking a bit stingy to me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.