Good afternoon!

I'm planning to cover a couple of today's trading updates, plus the full year results from Spectris. Feedback is very welcome as usual - especially in helping me to understand which companies are most in demand, which will influence future reports.

Cheers,

Graham

Spectris (LON:SXS)

Share price: 2500p (+3%)

No. shares: 119m

Market cap: £2,980m

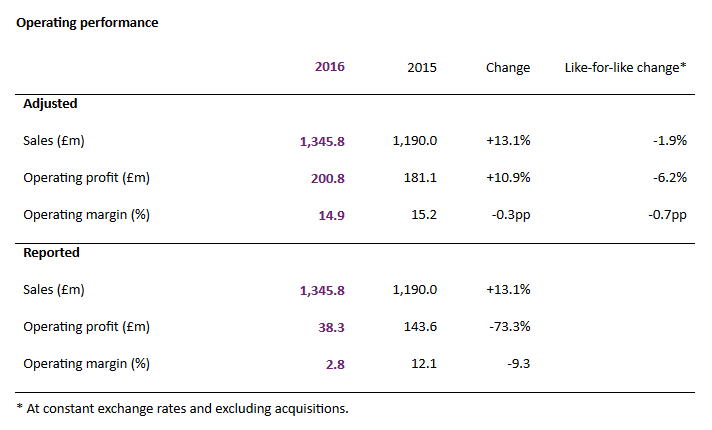

I'll keep this brief since everything seems to be going pretty well for Spectris at the moment, after a difficult year but with an improving trend in the final quarter. Like-for-like sales finished down by 2% (they had been running at -4% prior to the final quarter).

This is a global instrumentation/controls business - giving exposure to a wide range of industrial markets.

There is currently some change afoot:

Our strategy is evolving from being the supplier of products towards the provision of complete solutions (a combination of hardware, software and services) to our customers, based on our deep application and technical expertise. As our customers focus on their core activities and seek to reduce cost and complexity, they have a greater need to outsource services to a trusted, reliable partner who is able to deliver high quality technical solutions.

Project uplift: A new project, expected to cost £45 million in one-off costs, but which will result in annualised cost savings of £35 million - a highly material amount.

Results: there was unfortunately a large impairment of goodwill, creating a discrepancy between adjusted and reported results.

Impairment:

Always worth investigating impairments:

The reported operating profit included a non-cash impairment charge of £115.3 million pre-tax relating to a write-down of the balance sheet goodwill and other intangibles associated with Omega Engineering ('Omega') and ESG Solutions ('ESG'). The impairment charge arose from the recent weaker trading performance due to the challenging conditions experienced, particularly in North America, and ongoing process improvement requirements at Omega and for ESG, the continued weakness in the global oil and gas markets.

Dividend: up by 5%, made possible by 113% of adjusted operating profit being converted into cash.

My opinion:

I've always perceived this to be a very good-quality business - too large to get a good handle on without doing a lot of detailed research, but almost certainly worth considering for a diversified FTSE-250 portfolio. Diversified exposure to niche industrial services, along with a strong management culture, makes for the type of stock which retirements can be built on, in my view.

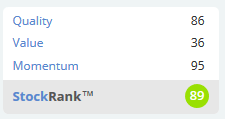

The Stockrank reflects an overall very positive perspective:

Pebble Beach Systems (LON:PEB)

Share price: 10.625p (+1%)

No. shares: 124.6m

Market cap: £13m

From the very large to the very small, this RNS brings an important element of the £VLK saga to an end.

The sale of the hardware division was completed on Feb 3, simultaneous to a name change.

On Feb 6 there was a trading update for the Pebble Beach division:

Performance at PBS was also slightly below expectations, but with a pipeline at its highest ever and an order intake for January at its highest since 2014, it is fully expected that recent levels of growth will return in 2017.

Today, we learn that notice of termination has been served on the Exec Chairman, who had received much criticism over remuneration policy at £VLK, and on other members of the Head Office team.

I'm thankful I never got tempted here - the share looked cheap from time to time, but it turned out to be a trap. Perhaps the remuneration policy was a clue that things would not turn out well for small shareholders.

Note that the restructured business is still indebted to its bank, My reading of the previous trading update is that it will still owe £10 million after receiving the deferred payment on the disposal next month. So there could still be significant financial risk here, now that a much smaller operating company is left to carry this debt.

RWS Holdings (LON:RWS)

Share price: 354p (+4.5%)

No. shares: 215.8m

Market cap: £764m

A strong statement to open today's news:

"Since [30 September 2016], the Group has traded strongly with underlying growth bolstered by favourable currency movements. We are achieving meaningful new client wins in both of our core activities, intellectual property and Life Sciences and increased levels of business from a number of our established clients. As a result, profits for the first quarter were comfortably ahead of management's expectations.

I must admit that I haven't studied this company before, but it sounds quite interesting:

RWS Group is internationally renowned for providing high-quality translation, intellectual property and language support services, which we deliver through our in-house translators, searchers and technical experts.

Excuse my ramblings, but shouldn't IP translation and search be secular growth industries in today's economy? RWS has had 13 successive years of growth in sales & profits - is that a mark of their individual brilliance as a company, or is it mostly to do with growth trends in their markets? I'd be curious to learn more.

Anyway, today's $82.5 million acquisition is for the life sciences division:

The Acquisition strengthens the Group's leading position in global Life Sciences both in the US and Europe, building upon and complementing the October 2015 acquisition of Corporate Translations Inc. ("CTi") and creating a full service offering. It also enhances the platform for expansion into Asia, building on the existing Chinese and Japanese presence of other RWS divisions.

The Acquisition also brings strong cross-selling opportunities through enhanced exposure to the important West Coast patent market and potentially bringing new clients to the wider Group. It also provides diversification to the Group (including currency) and further visibility across the value chain.

It's good to see a combination of funding sources being used: the placing, cash and a bank term loan, with most of it coming the placing (worth $50 million at GBPUSD = 1.25).

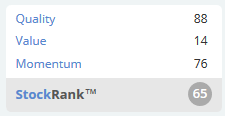

The Value Rank is not a big fan of this stock, at a PE ratio of 27x. Without going into it in any more detail, it wouldn't surprise me if this stock was in fact decent value here - specialist, niche services with huge growth momentum behind them are often worth paying up for.

Note that the shares get an above-50 StockRank despite the lack of apparent value:

Pendragon (LON:PDG)

Share price: 34.75p (-1.4%)

No. shares: 1434m

Market cap: £498m

We cover a lot of different industries here! And now on to car retailing.

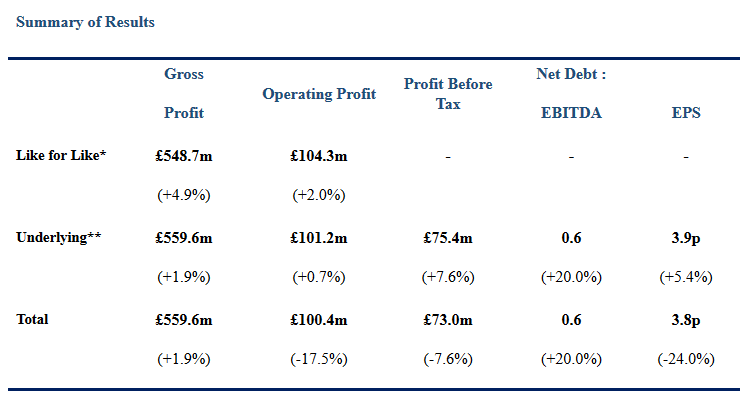

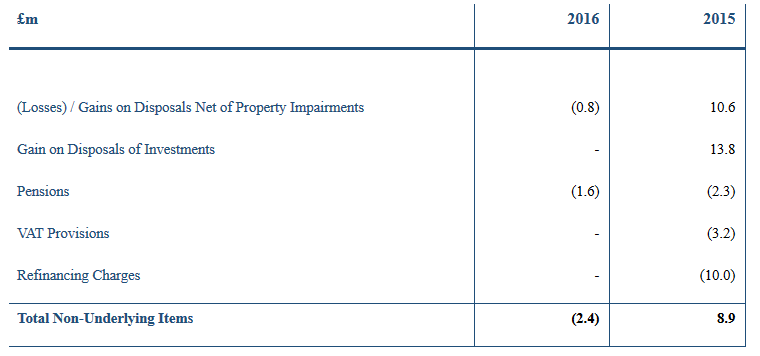

Ok, so let's see what's going on with the reconciliation of underlying to total results:

Outlook:

"We believe that we can achieve at least double digit growth in used revenue in 2017 and our aspiration over the next five years is to double our used vehicle revenue.

In order to test this, during the final quarter of 2016 we invested in inventory and adjusted our algorithms and marketing initiatives with a view to driving growth in used vehicle activity levels to test the capacity of our current footprint.

The early results of this are very encouraging. Our growth in used vehicle revenue on a like for like basis in January 2017 exceeded the increase required to achieve our growth aspirations.

We anticipate our performance for 2017 will be in line with expectations."

My opinion

Granted that this business is not in the high gross-margin bucket or the high ROCE bucket, and has a modest debt level versus operating profits (£92 million), I still don't really understand the low multiple this is trading at.

The view must be that Pendragon's 12% gross margin is vulnerable to any softness in the currently record high car market, and to the position of Sterling - there have been quite a few "cheap" car stocks lately. Maybe buying a few of each of them would be an interesting act of contrarianism!

Altitude (LON:ALT)

Share price: 81p (-9.5%)

No. shares: 46.4m

Market cap: £37.5m

This stock caught the imagination of investors over the past six months or so, ever since it turned profitable and cash-flow positive at the interim report in September, also announcing that it had successfully developed software solutions for the US "personalised and promotional products, signage and printed wearables market".

In a sign that expectations may have become mismatched versus reality, the shares are down despite investors being told that results are set to be "marginally ahead of market expectations".

There is also a progress update on the company's new trading platform and its channl.com venue, lthough it's still at an early stage:

The scale and speed of engagement will be carefully monitored and evaluated. The Company looks forward to making further announcements of continued progress as we begin to drive engagement and explore related opportunities for Channl.com

Note that it has a Value Rank of 2 (out of 100). If it achieves a full-year of profitability, I guess that might rise to something less awful!

Paul is coming back very soon, in the meanwhile thanks very much for reading and for the suggestions!

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.