Project catch-up continues, so here is a late report from Monday.

Focusrite (LON:TUNE)

Share price: 174p

No. shares: 58.1m

Market cap: £ 101.1m

Focusrite is a new share to me. It describes itself as;

the global music and audio products company supplying hardware and software products used by professional and amateur musicians around the world

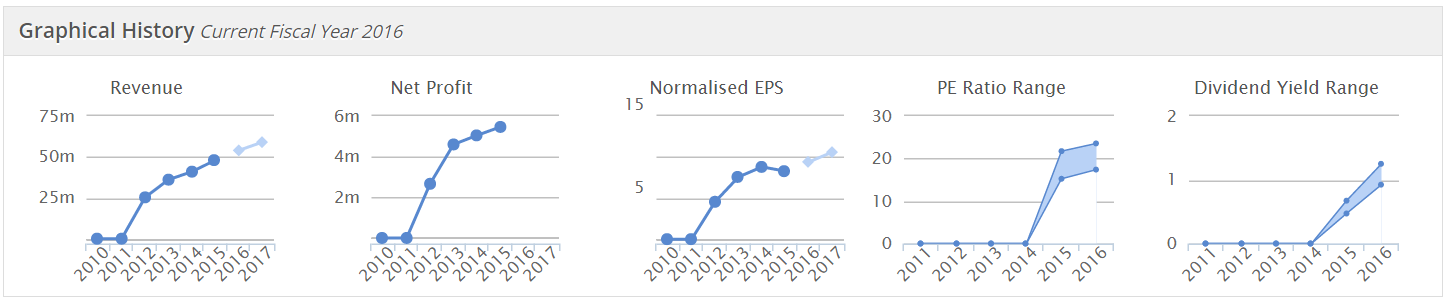

The company's website is here. It floated on AIM in Nov 2014, and looks a sensible, profitable company, with a good track record, net cash, and starting to pay divis, so it's worth having a look at;

Trading update - the company has a 31 Aug year end, so this update covers H1, to 29 Feb 2016. It says;

...in line with expectations, it will be reporting revenues for the half year of around £25.5 million, up from £23.8 million in the corresponding period in the previous financial year

That's fine, but what about what matters - profit? The company seems tight-lipped about that, talking some more about revenue, but no mention of profitability, which I find somewhat unnerving. The whole point of trading updates is to indicate how profits are shaping up, compared with market expectations, but that issue seems to be ducked in this update.

"Since the start of the financial year, new products, backed by positive industry and consumer acceptance, have continued to gain market share in our key geographies. Existing products also continue to perform well and, overall, we achieved double digit revenue growth in Q2. The Group's significant investment in R&D will ensure further new product launches and upgrades to existing products in the second half. This will underpin our consistent record of revenue growth."Shareholding structure - AIM is fundamentally flawed, in having no minimum free float. This can cause illiquidity, and worse (share price manipulation, if someone tries to corner the market in a particular share).

The share price chart of TUNE rang alarm bells with me - as the erratic price movements are very much the hallmark of a share with inadequate liquidity.

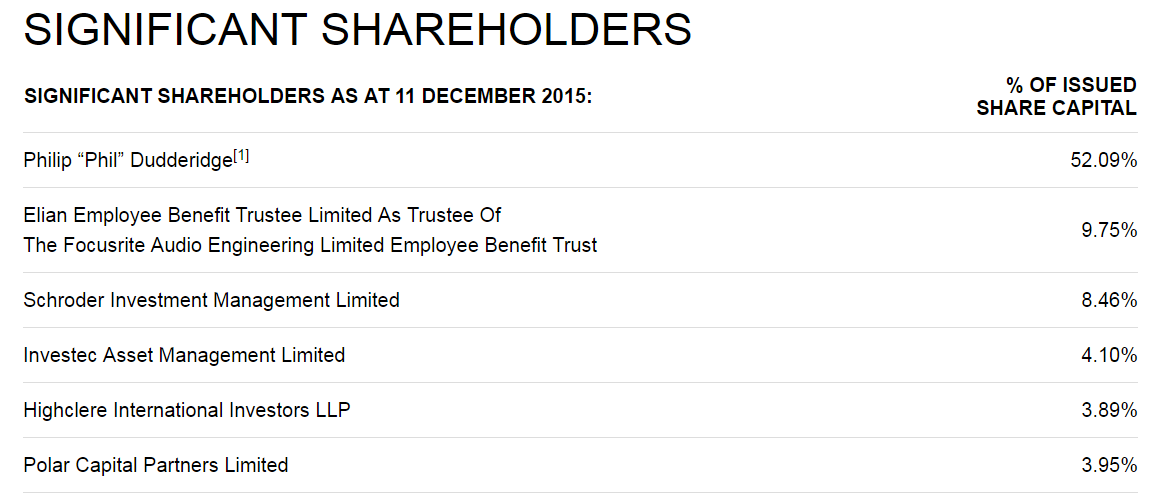

Sure enough, checking the shareholder list, from the company's investor relations website, the shareholdings are extremely concentrated, with the Executive Chairman holding a controlling stake of 52.09%.

The total below comes to 82.2%, which I think is much too high. When companies float, they need to think about liquidity, and ensuring that the shareholding structure is a bit more fragmented than this. Often companies & advisers overlook the need to get private investors involved, and then wonder why there's no liquidity in the share after it floats.

So this share is very much a case of backing Philip Dudderidge, with other shareholders basically along for the ride - he has personal control of this company, and has a long track record of building it up successfully, so I'm certainly not saying that's necessarily a bad thing.

Balance sheet - looks good, and includes £6.2m in net cash at 31 Aug 2015.

My opinion - I like the look of this company. It seems to have delivered excellent organic growth since 2009, has sound finances, strong operating profit margins, and the accounts look clean to me. Also, I like owner-managed businesses, although some people may feel the founder's 52% stake is maybe a bit too dominant?

Note that capitalised intangibles (mainly development costs) of £2.8m exceeded the amortisation charge of £1.9m, thereby giving a £0.9m boost to profits. Given the nature of the company's products, capitalising development spend seems perfectly reasonable, as indeed is the amount capitalised. So no concerns there, I was only noting the point for future reference.

It's a pity that this trading update was too vague, not giving a proper steer on how profitability is doing. The company is forecast to deliver 9.4p EPS this year, so the PER is 18.5 - not exactly cheap, but considering the sound financial position, and excellent growth track record, I'd say that valuation is justified - providing growth continues, of course, that's the crux. Once growth grinds to a halt, then the PER crashes down of course, so you have to be careful when paying up for growth.

Overall then, this is definitely one to go on the watch list. I shall review its results here when they are issued in the final week of Apr 2016. Further research is needed, to see what the competitive landscape is like, market share, etc. The company's products look innovative, and up to the minute technologically, judging from the pictures in their Annual Report & website.

Goals Soccer Centres (LON:GOAL)

Share price: 89.5p

No. shares: 58.5m

Market cap: £52.4m

Checking back my previous postings on this company, it warned on profit in Sep & Nov 2015. I was toying with the idea of buying a few shares, but the Jan 2016 update completely put me off - LFL sales down 7% - as I pointed out here it looks as if something is going structurally wrong with this business.

Results y/e 31 Dec 2015 - underlying (i.e. pre-exceptionals) profit before tax of £ 8.3m, which is within the range given by the company in its guidance on 9 Nov 2015, and reiterated on 14 Jan 2016, which was between £ 8.2 to £ 8.6m

Performance may have been poor in 2015, but the company is still very decently profitable. Also, you cannot fault the company for its excellent guidance to the market - giving a specific range of where it sees likely profit for the year, then updating when anything changes. This is terrific stuff, and certainly helps reinforce some confidence in management.

Other points;

A non-cash exceptional impairment charge of £14.5m has been booked through the P&L, which is mainly to write down the asset value of underperforming sites £ 8.2m, goodwill £ 3.1m, and two other minor items.

Pre-exceptional EPS only fell from 14.5p last year to 14.3p this year, but this is flattered by a favourable tax charge this year. Normalising the tax to 20% would reduce EPS to 11.3p. So using that figure, the PER is 7.9 - looks good value, but remember there's quite a bit of debt here to consider.

Cash generation - still very strong. Net cash from operating activities (after tax) was £ 10.6m in 2015, and £ 9.9m in 2014. So despite poor performance, this is still a cash cow.

Capex was £ 7.6m in 2015, but the company is now saying it will not open any more UK sites, since the 2015 new openings (Manchester & Doncaster) have traded behind plan.

Final dividend has been passed. Although the company says it will resume divis "when appropriate", and "subject to satisfactory trading". This is a sensible move in my view. If in doubt, conserve cash to repay debt.

There are lots of Boardroom changes, which is unnerving. The Exec Chairman is conducting a review of "all aspects of the business", so shareholders should probably brace themselves for a kitchen-sink job.

Competitive threats are the biggest worry;

The Group now faces increased competition from new grant-aided full size 3G pitches with league operators utilising and gaining a competitive advantage through lower pricing principally because they do not have to invest capital in providing their own facilities. Goals is however, a fundamentally sound, profitable and cash generative business. With investment and management focus the Board believes that Goals can return to sustained UK sales growth.

So before investing here, I think people need to get a handle on this. How many more new competitive sites are likely to spring up? Will this ultimately kill off GOAL?

Balance sheet - quality of the assets is the key question here.

As I think we've discussed here before, whilst GOAL has huge fixed assets of £ 108.5m, the property is all leasehold, not freehold. So its resale value could be quite low, we don't know.

I wonder how much maintenance capex is likely to be in future? In the past, the heavy capex has been mainly for new sites. With that now stopped, the business should throw off a decent amount of cash to reduce debt. However, if there is a backlog of repairs needed, then over nearly 50 sites, that could mount up.

Although I've just noticed that the company is planning on opening new sites in the USA, so capex will actually continue. It was just the UK where no new sites are planned.

Bank debt - the company has a non-amortising facility with Bank of Scotland of £42.5m, which expires in July 2019. Net debt was £36.7m at end 2015. That doesn't strike me as a dangerous level of debt, given the company's strong cashflows. With capex now on hold, a large part of that debt could probably be repaid from cashflows by the time the facility is up for renewal in 2019.

Banks love cash generative businesses, with asset backing. So I'm not alarmed by the debt position.

One broker suggested last week that the company may need to do an equity fundraising. That's possible, but I don't believe it's a major danger, as the company would really only need additional funds if it were about to breach banking covenants, and even then I don't think it would need much.

The danger is mainly that trading continues to decline rapidly, and what were cash cows, become millstones.

Current trading - this is reassuring;

It is pleasing to see early signs of our work so far with a return to very modest, positive like-for-like sales in the first nine weeks this year.

My opinion - I think it's starting to look interesting actually.

Although the Chairman's remarks do seem to point towards the possible need for more capital, for expansion in the USA, and perhaps rejuvenating sites in the UK? Although he uses the term "re-investment", which suggests recycling internal cashflows, rather than new external funding:

I will be continuing to spearhead the ongoing review into every aspect of the business to develop a new strategy to improve performance and returns, partly based around a re-investment program to rejuvenate and grow the business.

So I've come back to thinking that an equity fundraising might actually be on the cards. That would probably be at a discount to the current share price, which puts me off buying any shares just yet. I might have a little dabble here, it's starting to look quite good value at sub-100p in my view.

There's takeover potential too, as it's been approached before, at higher prices.

What do readers think? Comments in the comments as usual please.

There was nothing else of interest on Mon 14 Mar, so I'll sign off now. Apologies again for this report being late, but I think both were interesting companies to look at, so am glad I circled back and looked at them - both Focusrite and Goal are possible future purchases for my portfolio I think, but more work is needed first.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.