Good morning!

Mobile Streams (LON:MOS)

Share price: 16p

No. shares: 37.1m

Market cap: £5.9m

An interesting situation has arisen here - stock has been the biggest riser for the last two consecutive days, having risen from 4.75p on Oct 9th (last Fri) to 17.4p on Oct 13th (last night's close). This was triggered (as I mentioned in my report here on Oct 12th) by results coming out which seemed to show the company generating quite a decent profit (for a company with such a tiny market cap).

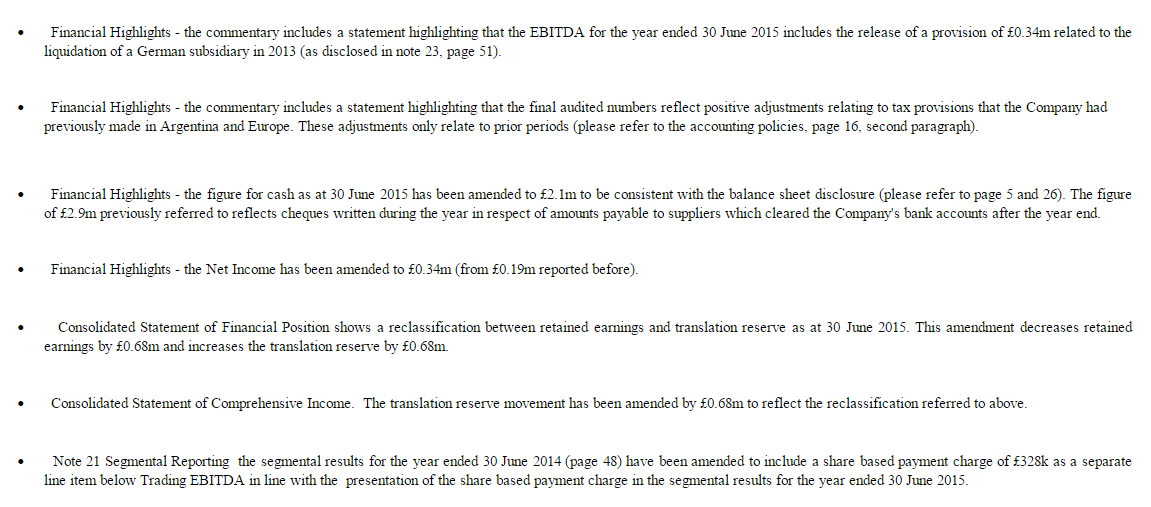

Anyway, this morning out comes an amended results statement, with the following changes having been made to the revised results announcement;

The theme of these changes seems to be, that somebody has reviewed the results statement, and decided that it buried too many material points in the notes, and that significant points (such as the first one, release of a £0.34m provision, which boosted profit) should be disclosed more prominently in the highlights, not buried in the notes.

So my questions are ;

1) Who decided that the results had to be re-released with these amendments? My guess would be the auditors.

2) Why did they not review the accounts announcement before it was released, and insist on these changes being made when the announcement was just an internal draft?

Also, as a general point, what are the rules (if any?) concerning what information the company must highlight in results statement? From what I have gathered, companies seem to have complete freedom to present results however they like - i.e. as long as the statutory results are provided, then the announcement can be embellished with any narrative and highlights sections, not to mention adjusted profit calculations, that management wish to give.

Usually the highlights section only mentions positive factors, designed to give a skewed, positive view, so that people will rush out and buy the shares. Is this acceptable? No, it isn't. Surely the highlights section should be required to mention all material points, good and bad? This looks like a sloppy area, where tighter rules are needed (and enforced).

I would like to see a simple set of principles-based rules, saying things like, e.g. prominence must be given to all material facts & figures (good or bad) which would affect an investor's perception of the results, financial position, and risks.

The other thing that this situation highlights, is the importance of investors reading the full results announcement, including all the notes. All too often, if you just skim the highlights only, you can end up getting over-excited, and buying a share at too high a price, because you've not yet found the nasties in the notes to the accounts!

Anyway, judging by the bulletin boards, this share now seems to have attracted stampeding herds of rampers & derampers, hence the share price volatility.

SCISYS (LON:SSY)

Share price: 64.6p (up 8.3% today)

No. shares: 29.0m

Market cap: £18.7m

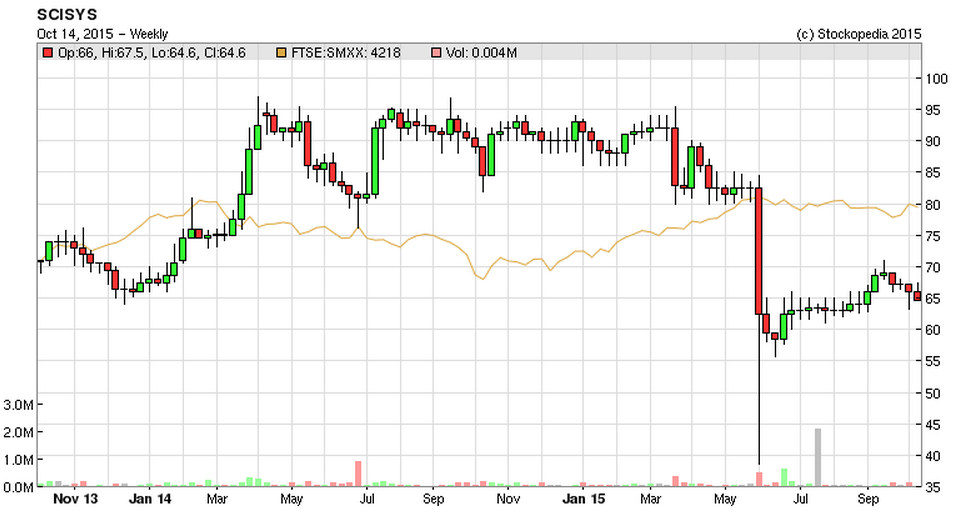

Resolution of problem contract - this company dented its reputation (and its share price!), with a profit warning on 4 Jun 2015, which I reported on here, which was caused by cost over-runs on a fixed price contract. Anyway, there's better news today, with news that it has been sorted out;

SCISYS is now pleased to confirm that it has reached an agreement with the client that has brought the project to a mutually satisfactory conclusion. This brings clarity to the uncertain position that prompted the trading update in June. Consequently, the Board is confident that the Company will achieve at least the revised profit guidance published in June. Short-term opportunities to utilise resources previously absorbed by the remedial works on the problem project will govern the extent of any performance improvement in the remainder of the financial year.

The last sentence, I assume refers to staff being redeployed?

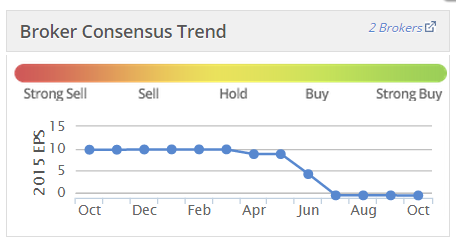

Valuation - as you can see from Stockopedia's nifty little graph which tracks broker consensus EPS over the last year, forecasts were slashed to almost breakeven after the profit warning in Jun, so this year looks to be largely a write-off, due to known factors. They might eke out a small profit, but nothing much probably.

So it's really all about next year, and subsequent years.

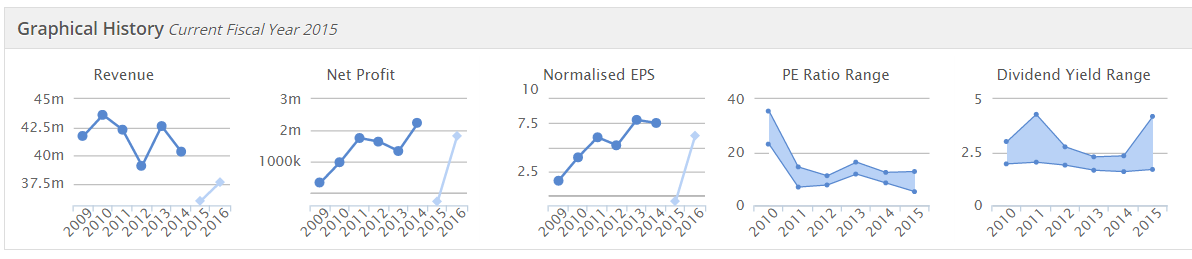

As you can see from the Stockopedia graphs below, EPS has tended to be in the 5p to 7.5p range in recent years, so the 2016 forecast of 6.2p is bang in the middle of that range, hence looks reasonable;

My opinion - I've met management here several times, and like them - they seem serious, and hands-on. Also, the company clearly has significant potential value, as it works in large organisations, often providing & maintaining their mission-critical IT. So it should be far more profitable than it actually is. I have a nagging doubt that the staff, and the company generally may have "gone native" with the clients it services, and therefore may not be maximising Its own profitability?

I've held this share personally before, and found it a complete nightmare to buy/sell, even in quite small quantities, it's so illiquid. So these days, I'm trying steer away from such illiquid stocks, especially where there are significant doubts over the company's ability to generate growth and reliable profits/divis.

Overall then, I'm not tempted to buy back in, but will need more time, and evidence of things improving, to tempt me back. A company which relies on managing large & complex contracts, just can't allow those contracts to spiral out of control. That's basic risk management, which seems to have gone wrong here. So how confident can shareholders be that other contracts are watertight? There could be other cost overruns, and contractual disputes in future.

The StockRank of 41 is uninspiring too.

Connect (LON:CNCT)

Share price: 156p (up 5.4% today)

No. shares: 244.3m

Market cap: £381.1m

Results y/e 31 Aug 2015 - it's good to see a fairly brisk reporting schedule, with these full results out 6-7 weeks after the year end. I like that, as it demonstrates that the group's finance department has good internal controls.

I summarised the main points about this share in my report here on 7 Jul 2015, when the company issued a "marginally ahead of expectations" trading update. The points in that report still stand - mainly that this share looks cheap on a PER basis, but it's cheap for a very good reason - namely that it has a very weak balance sheet, and is reliant on bank debt - which is fine in the good times, but problematic to catastrophic in the bad times.

Looking at today's results, they seem OK. Key points;

- Diluted adjusted EPS flat against last year at 19.0p, so a PER of 8.2 - looks cheap at face value.

- Broker consensus is 18.0p, so it looks like a 1.0p beat (or 1.7p beat if using undiluted EPS of 19.7p) - so a positive result against expectations.

- Profit before tax up 13%

- Diluted average no. shares has risen from 213.4m to 238.5m, hence why increased profits have not translated into higher EPS.

- Divi raised 4.1%, but 6.1% yield looks unsustainable/irresponsible to me, given high level of debt & very weak balance sheet.

- Standard EPS is much lower, at 9.3p (vs 16.8p LY), so it's worth checking the exceptional items - are they justified?

- Large cash outflow on acquisitions, of £105.7m, so worth checking when this completed, and how much it contributed to profit in the period, and for future periods.

- Pension fund - a small deficit is shown, but the notes reveal a substantial surplus - so more research needed on this point.

Balance sheet - as I've reported before, this is where it all goes wrong.

NAV is £9.2m, but take off the £174.8m intangibles, and the NTAV is hideous - negative £165.6m. What does that mean? Effectively that the bank debt is really quasi-equity - i.e. the business completely relies on bank funding to remain solvent. I don't like that one bit, but it may not bother other people.

The current ratio is also poor, at 0.71. Normally I don't like anything below about 1.2, or 1.0 in the case of companies that have little in the way of inventories, as in this case.

Net debt is reported at £153.4m, up considerably from £93.0m last year, due to the large amount spent on acquisition(s).

To fix the balance sheet - I would like to see NTAV brought up to at least zero. That would require the issuing of £166m in new shares, so 106.4m shares at 156p. So that would increase the share count from 244.3 to 350.7m, a 44% increase.

In that scenario, EPS would fall correspondingly, but I need to adjust for reduced interest cost. So operating profit would go up from £56.5m to say £62.5m (I've assumed an annual interest saving of £6m p.a.), less tax of £12.3m, gives PAT of £50.2m. Divide that by the larger number of shares of 350.7m, and you get a theoretical EPS of 14.3p. At a share price of 156p, the PER would then be 10.9, which looks about the right price for this type of business.

Outlook - sounds alright;

Looking ahead, recent trading is in line with current management expectations and we remain in a good position to build on the progress made in the year under review. We will continue to invest to support long term progress and leverage the capabilities of the Connect Group network, technology and people. As a result, the Board is confident of the outlook for the current financial year and beyond.

My opinion - I haven't considered the growth potential for the business. However, as demonstrated above, the apparently cheap PER of 8.2 is a red herring, because the company has excessive debt, and a very weak balance sheet.

However, if the balance sheet were repaired through a £166m equity raise (to bring NTAV back up to just zero), then EPS would drop to about 14.3p, and the PER would be 10.9.

So actually, the market seems to be correctly adjusting the price of this share to reflect its weak balance sheet & high levels of debt. My conclusion is therefore that this share looks priced about right, maybe even slightly cheap? (I think you could justify a PER of 12, so about 10% possible upside?).

At some point this company really needs to bite the bullet, and stop trying to ride two horses at once. Companies with weak balance sheets & high debt, should not be paying out big dividends. So the 6.1% divi yield here looks unsustainable to me - because the company won't then have sufficient cashflow to make much of a dent in its debt pile.

The obvious, and prudent course of action, is for this company to halve its divis, and redirect the money saved into debt reduction.

Walker Greenbank (LON:WGB)

Share price: 203.5p

No. shares: 60.2m

Market cap: £122.5m

Interim results to 31 Jul 2015 - I've only had time to have a very quick look at these figures, as I'm rushing to get into the City for a company meeting - am seeing the Directors of Proactis (PHD) for lunch & a briefing.

Walker Greenbank's figures look alright - reasonable growth.

- Full year expectations is confirmed in the outlook section.

- Balance sheet looks healthy, but

- Note the pension deficit in long-term creditors.

- H2-weighted trading as usual.

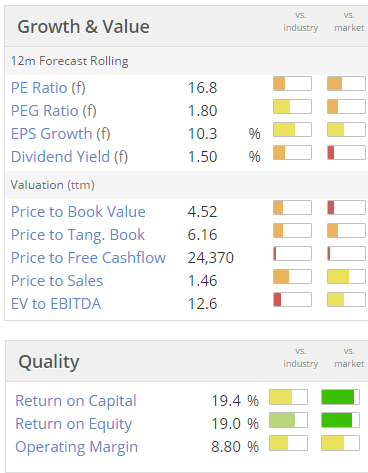

Valuation - usual Stockopedia graphics below.

My opinion - I wouldn't say this stock is cheap, it looks priced about right. However, I like this company, and think it's a quality company (good ROCE & ROE scores, and reasonable operating margin, see graphics above), and also has highly regarded brand name products - so deserves a premium valuation.

Whether we like it or not, at the moment we have to pay up for quality companies. I'm prepared to pay a PER of 16 or 17 for companies that I think have good long-term growth prospects, and are performing well.

For that reason, I've dipped my toe in with a small purchase today at 203p. It's not going to be a big position, but I'm prepared to start buying at this level, and will add more if it falls to say 180p or below.

Vertu Motors (LON:VTU)

These figures look good, as you would expect from a car dealership, which are all doing well at the moment. Although the VW issue might be causing some problems, which is why I ditched my Caffyns (LON:CFYN) shares recently, after seeing how many of their sites are VW/Audi/Skoda franchises. They're bound to suffer some damage from the emissions scandal, I imagine.

Got to dash. See you tomorrow!

Regards, Paul.

(Paul holds long positions in MOS, and WGB, and no short positions.

A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. These reports are personal opinions only, which will sometimes be right, and sometimes wrong, so please always DYOR)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.