Good evening,

Apologies for my running late today, this is due to it being Friday, and there being hardly any news of interest today, so I had a lie in.

I'm delighted to read that Tesco & Unilever have resolved marmitegate, although no details of the compromise deal have been released. I think Tesco has played a PR blinder here - setting itself up as the consumers' champion by resisting inevitable price rises from suppliers, which are being triggered by weaker sterling.

We have to prepare for the inevitable higher inflation, and therefore probably a consumer spending slowdown. I'll be sifting through the market over the weekend, making a list of things to open some small short positions on.

I'll update this on Sat or Sun, too tired now, sorry.

OK, here goes, second attempt (it's now Sunday lunchtime):

Elegant Hotels (LON:EHG)

Share price: 64.5p

No. shares: 88.8m

Market cap: £57.3m

Trading update & new management contact - this is my first commentary here on this particular company. I did glance at it when it floated, in May 2015. However, seeing as though its operations are overseas, and it was listing on AIM, that was enough to put me off - that type usually seem to go wrong. Also there's debt on the balance sheet.

I'm very suspicious of all IPOs to begin with - why does the existing owner want to sell, if things are supposedly going so well? Often there's an ulterior motive behind IPOs - the vendor wants to get out because either the price is too high, or the business model is likely to worsen in some way in future. Therefore I'm not usually interested in taking the other side of the trade from the person who knows it best (the existing owner).

Looking back at the first RNS, in May 2015, there is some interesting info. The IPO was done by Zeus Capital, and sought to attract investors with an initial dividend yield of 7%. I got caught on one of these, namely Entu (UK) (LON:ENTU) - also a Zeus float, with a big initial yield. The shares have absolutely tanked, and the divis have been cut.

So already the red flags are mounting, before I've even looked at EHG's figures.

Elegant Hotels describes itself as the;

...owner and operator of six upscale freehold hotels and a beachfront restaurant on the island of Barbados.

I like the fact that it owns freeholds. Tangible assets are always good, and to my mind freehold property is the next best thing to cash.

Trading update - this sounds reassuring;

Year to 30 September 2016

The Board is pleased to report that it expects that the Group's full year results for FY16 will be in line with market expectations.

What are those expectations then? I do wish companies would state the precise figures they are referring to, when quoting market expectations. That would save readers of the RNS a lot of time, and would prevent any confusion over numbers.

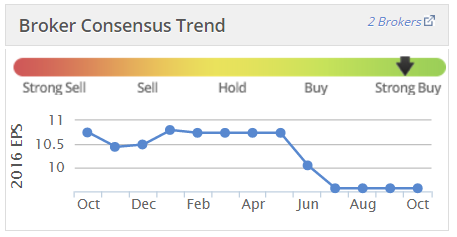

Stockopedia shows the broker consensus for y/e 30 Sep 2016 as being US$ 0.12, so that's about 9.8p. At 64.5p, the rating looks very modest indeed, at a PER of only 6.6.

Note how broker expectations have been revised down quite a bit in the last year though;

Note that this company reports in US dollars. So earnings, and the company as a whole are now worth more in sterling terms - the share price is quoted in sterling;

With the share price at a low, dollar earnings (a positive thing for UK investors), and an in line trading update last week, plus freehold property, I'm starting to get interested. More research is required.

Reliance on UK customers - I've been reading the admission document, and think I've found a snag. There is a very heavy reliance on UK customers, and with sterling having devalued sharply of late, this means overseas trips are now more expensive for UK residents;

About 70% of the Group’s revenue is from the UK. Barbados has long been a popular destination for UK travellers. Both British Airways and Virgin run daily non-stop flights during peak periods from London Gatwick (see paragraph 4.1 of this Part 1).

Guests from the UK are particularly important to the Group because their average length of stay is typically about twice as long as guests from other markets such as the USA (the second most important source market for the Group).

Oh dear. That doesn't augur well for 2017 bookings. Mind you, I read something recently which said that UK consumers rank their main holiday as being second only in importance to groceries shopping. So perhaps customers from the UK might keep going to Barbados, and just cough up the extra cost in 2017? There's bound to be some reduction in UK tourists visiting Barbados in 2017 though, so I think this means a heightened risk of a profits warning in 2017.

New site - Waves Hotel & Spa - the latest update on this sounds encouraging;

Elegant Hotels announced in August that its recent acquisition, Waves Hotel and Spa ("Waves"), is now open for business, having been extensively redesigned and refurbished after it was bought by the Group for US$18.0 million in March 2016.

Early feedback from both customers and travel agents has been positive and, as expected, the property is already proving to be highly complementary to the existing portfolio.

The Board expects Waves to be earnings enhancing for the Group in FY17, with excellent potential for further improvement in FY18 and beyond as the property develops its reputation.

New hotel in Antigua - the group has also announced that it is taking on a new hotel, owned by a third party, and under construction, in Antigua. This is being done on a management contract. Financial details have not been given, but they expect it to be profitable.

Dividends - the latest update on this is also reassuring;

As previously announced, the Board has declared - and the Company has paid - an interim dividend for the period to 30 September 2016 of 3.5 pence per ordinary share.

The Board intends to follow this with a second dividend of 3.5 pence in February 2017, representing a total of 7.0 pence per ordinary share for the year ended 30 September 2016.

That's a spectacular dividend yield of 10.9% - a yield that is so high, the market is clearly signalling that it regards this as an unsustainable payout. If the market is wrong, and this high yield can be sustained, then it's likely to drag the share price up.

The company reckons it can maintain the divi, and specifically mentions why;

The Company remains adequately resourced in the short to medium term and, with the additions of Waves and the New Management Contract and the anticipated delivery of these recent growth measures, as well as the gradual return of UK consumer confidence in the longer term, the Board believes it is well positioned to be able to maintain the dividend in the future based on its current estimates.

That wording leaves wiggle room to reduce the divi, if estimates change. Also I think it's odd that there is no mention of the fall in sterling, and the likely impact of this.

Current trading & outlook - so far, this sounds OK;

The Group is only 14 days into its new financial year and, whilst it appears UK consumer confidence is returning, the political uncertainties in the UK over the summer months are, it believes, responsible for bookings for the current financial year tracking slightly behind the same period last year.

Given these recent booking trends, the Board believes it is prudent to have a cautious outlook, with Group revenue for the current year currently expected to be broadly flat in comparison with FY16.

EDIT: Zika virus - I've just picked up on a reader comment. JohnEustace points out below that Barbados has been affected by the Zika virus. I confirmed this from a website referred to from a UK Govt website, here.

The Zika virus is mainly spread by mosquito bites, according to the above website. As I discovered this year in Greece, even if you cover yourself in repellents, you still get one or two mozzie bites. So the travel advice to "avoid mosquito bites" is close to useless!

From the small amount of googling I've done, the main problem with the Zika virus seems to be in it causing birth defects in pregnant women. There's more info here. Whether this would be enough to deter other people (i.e. everyone other than pregnant women) from visiting Barbados, I don't know.

My opinion - I'm in two minds about this share. It's a proper business, with a good track record before & after IPO. It's generating real cashflows & paying huge divis. There's also asset-backing, with NTAV at £96.5m, which looks attractive compared with a market cap of £57.3m.

On the downside, it's overseas & AIM, although management seem to have solid backgrounds. Moreover, Barbados has a British legal system. I've googled "Barbados corruption", and get conflicting results, as follows;

Barbados.org provides statistics which show that Barbados is one of the world's least corrupt countries here.

Barbados Today clearly didn't get the memo, as their interview with a former Chief Justice here declares - "We're corrupt!", and that the problem has been swept under the carpet for years.

Mind you, we're hardly in a position to talk here, after all sorts of scandals seem to surface on practically a daily basis here in the UK. So I don't think we can occupy the high moral ground any more.

The main problem with Elegant is, I think, that a decline in UK visitors to its hotels, which constitutes 70% of its business, seems inevitable now that sterling has greatly devalued against the US dollar. I suspect that current hopes for flat revenues may turn out to be far too optimistic.

For this reason, I'm not going to be buying any shares in Elegant, although it's going on the watchlist as something I might buy if it crashes on a profit warning in 2017 - which looks possible, even likely.

The share price looks to already be pricing-in future problems. However, experience has taught me that shares still drop 30%+ when the eventual profit warning is issued.

EDIT - I've had a look on Expedia, to see what prices Elegant Hotels charge, and am quite shocked by the results! Their hotels are massively more expensive than most other Barbados hotels, so it looks a fairly high end operator. They've got good reviews too from customers. Which makes me wonder how much people will be deterred by the exchange rate? After all, if you can afford to spend £10k per person for a 2-week stay at The House, then are you really going to be that deterred by paying more due to sterling depreciation? Here's the link to Expedia, which may or may not work.

A quickie to round off with;

Inland Homes (LON:INL) - results y/e 30 Jun 2016 - housebuilders are so difficult to value at the moment, because nobody really knows what the future holds for house prices. A long period of unprecedentedly low interest rates has driven an asset price boom. Mortgage availability has been steadily improving in recent years, and the latest deals look extremely cheap. Government has further stimulated demand for new houses through its Help To Buy scheme. Although I note that part of that scheme will soon be dropped.

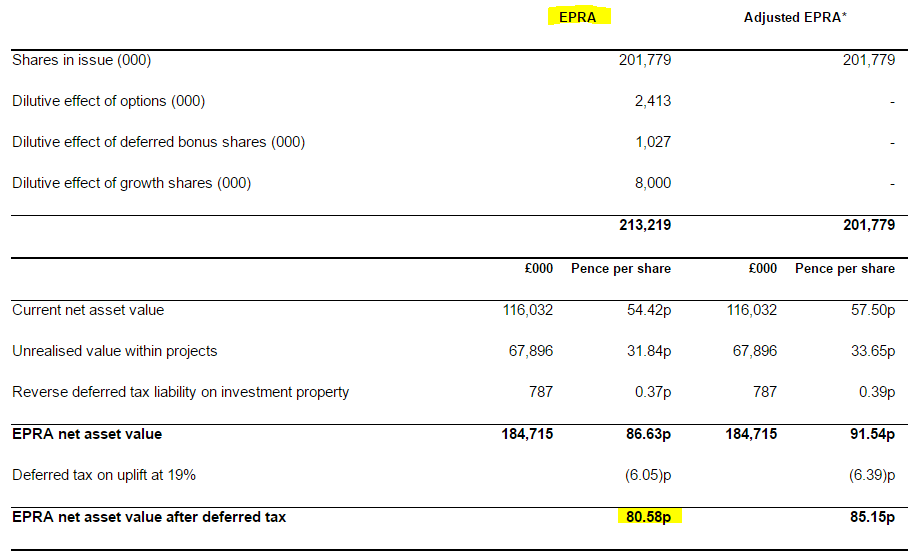

EPRA valuation of net asset value can be useful, trying to find a reasonable valuation for property companies, as it boosts NAV up from cost prices of projects, to estimates of their current worth. This table provides EPRA valuations for Inland Homes. I'm most comfortable with the highlighted figure, which takes into account dilution from share options, and tax.

The share price is currently 61.6p, so that's a useful discount to the 80.58p EPRA valuation figure above.

Most property companies learned the lessons from the GFC in 2008, and have built up their balance sheets, taking on much less debt than in the last cycle. So they should be much better placed to survive the next recession.

Inland's balance sheet look fine to me.

It's been very profitable too, making £32.9m profit before tax on turnover of £101.9m. With a slowing economy though, and all the other issues we have at the moment, I wouldn't want to bet on profits being sustainable at that level. That's why housebuilders should never really be valued on a PER or yield basis - the sector is too cyclical.

My opinion - I think this sector is just best avoided. There are too many uncertainties, and I think the risks have increased after sterling's large recent falls.

That's it, see you in the morning!

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.