Good morning! It's going to be a quiet week for me this week, as I'll be home every day in Hove, so we'll be back to early starts here every day. As opposed to constant trips to London for company meetings in the previous 3 weeks, which was informative, but takes up a lot of time.

I'm currently engrossed in the trading statement webcast from Software Radio Technology (LON:SRT), a £36m market cap technology company providing marine tracking beacons. What an excellent innovation from such a small company, to communicate so well with investors and analysts by the CEO giving a briefing by video on the internet, accessible to all. You can even ask questions live. Excellent stuff! I'm very much supportive of this kind of initiative, which levels the playing field so that increasingly private investors are also getting the same quality of information as Institutions, which is how it should be.

After all, it's private investors who set the share price, and create the liquidity in the shares, and narrow the bid/offer spread. So companies & their advisers that ignore us, are not really thinking.

SRT has an excellent story to tell, and it all sounds very interesting, but it's too speculative for me. I generally like companies that are already producing good, sustainable profits, and are reasonably priced. Rather than, as in this case, companies that promise to make profits in future, but where the share price requires you to pay up-front. You need to do a lot of research for this type of growth company, to be sure that the likelihood of them hitting profits targets is high enough to justify being asked to pay up-front for it with a toppy rating. Even then, things can go wrong, so it's not for me.

Where there is a large speculative element to a company's valuation, then personally I feel happier with a sub-£20m market cap. Happier still nearer to £10m market cap.

I should also add that SRT today announces a small acquisition of a company called GeoVS, which has developed 3D marine imaging software. The £955k purchase price has been satisfied by the issue of 3,083k new shares in SRT. Although it doesn't add any earnings at this stage, just costs, expected to be £400k in H2. So I would imagine that will make it harder for SRT to meet full year expectations. In the webcast their CEO says the £400k loss in H1 on just £3.2m turnover is as expected, so they have a lot to do in H2 to hit broker consensus of £14.1m turnover and £3.1m pre-tax profit for the year to 31 Mar 2014.

I'm not going to pre-judge it, but I will point out that companies which need to achieve big increases in sales & profits in H2 to meet forecasts, often fail to do so.

Once again no doubt this week will be dominated by the shenanigans in the USA Government, over the debt ceiling & partial Govt shutdown. What a ridiculous state of affairs, that politicians could inflict such potentially disastrous (in)action on the country, and indeed the world. So we can probably expect another week of volatility.

Tristel (LON:TSTL) has announced good results for the year ended 30 Jun 2013. Although it should be noted that they had already informed the market of improved H2 trading in their trading update on 22 Jul 2013. Although I note that H2 delivered £1.1m in adjusted pre-tax profits, as against £0.9m forecast back in July.

As always, it is becoming essential to check what the adjusted items are, as companies generally are abusing EPS and adjusted profit to such an extent these days, that you really can't take the headline figures as being reliable any more.

I read in the papers over the weekend that one company (I think it was Rentokil?) had reported exceptional items in something like 32 consecutive results statements! I can think of many small caps that also report exceptional items with every set of results. So at some point you have to wake up to the fact that some of these companies are not actually making much, if any profit at all, they just massage the figures to make it look as if they are!

In the case of Tristel, I note that they have adjusted for £2.2m of non-recurring items in the results announced today. That's highly material, as it takes them from a £1.75m loss on the face of the P&L to a £0.5m adjusted profit in the headline bullet points.

I've done some more digging, and it looks reasonably OK in this case - the £2.2m "non-recurring items" are non-cash, and are mainly impairment provisions against investments, goodwill, and fixed assets, which you can see in note (i) to the cashflow statement, and total £1.2m. Another £120k is disclosed in note 4, as being related to writing down the value of stock, and also mentions redundancy costs. Well, redundancy costs are a cash cost, so can't really be disclosed as non-cash.

Overall though, it looks reasonably sensible, in writing down legacy assets on the Balance Sheet, so I can't get worked up other this. Although it does somewhat undermine the "non recurring" nature of such provisions when note 4 also cheerfully mentions that further provisions have been made in the current year! So non recurring costs that have immediately recurred! Hmmmm.

In the current year further provisions have been made against slow moving inventory totaling £199,000.

Overall, I can't really get excited about Tristel from these figures. It looks OK though, and I note they have a solid Balance Sheet, and pay a dividend. It's just difficult to see any spark of excitement about the future, and on the historic figures the valuation doesn't look a particular bargain to me. The outlook statement is "cautiously optimistic", which doesn't get any excitement going either.

Maybe I'm being too harsh, but it would certainly be an interesting company to get along to a meet the management evening, so we could get a bit more flavour about what the company does, and the opportunities it has for the future. Remember that my reports here are just fairly cold, and brief reviews of the numbers, so I haven't looked into the story in any great detail for most companies, that's up to you dear readers!

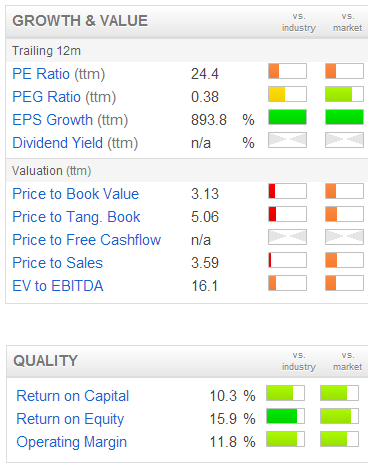

YouGov (LON:YOU) was last mentioned here on 14 Aug, when I flagged that it was looking potentially interesting.

It has issued results for the year ended 31 Jul 2013 today. They look fairly good. Turnover is up 8% to £62.6m, and adjusted operating profit is up 7% to £6.0m. I see that they have rounded up the 9.6% operating margin to 10%. I bet if it had been 9.4% they would have used a decimal point, instead of rounding it down to 9%!

Adjusted EPS is reported at 5.6p, so as usual I'll go through the rather painful process of working out what costs they are trying to ignore. The figures are pretty material in this case. Basic EPS is only 2.1p, yet they massage this up to 5.6p in the adjusted numbers, which clearly makes a massive difference to how you value the company.

Also I note there is a negative tax charge for the year, which seems odd. Looking at note 3 to the accounts, that is mainly due to a £1.13m adjustment in respect of prior years, which goes in YouGov's favour, turning a £490k tax charge into a credit.

The main adjustment in arriving at adjusted profit & EPS, appears to be the £3.3m amortisation of intangibles. That would be fine if it was just goodwill amortisation, which I am happy to ignore. There are also exceptional costs of £1.2m (versus £0.5m last year) which are adjusted out.

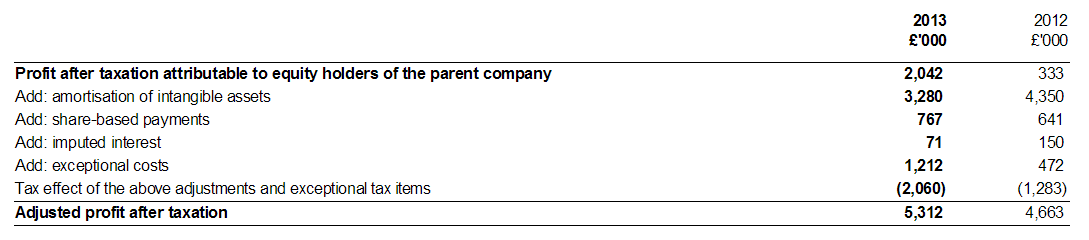

I've just found a reconciliation from reported profits to adjusted profits in note 5:

Looking first at the amortisation charge, as that's the really big adjustment, actually NONE of it is related to goodwill, as they don't seem to amortise their goodwill at all. It's shown at £38.8m on the Balance Sheet, and subject only to an annual impairment review.

So the £3,280k amortisation charge is actually concerning no fewer than six categories of costs which they capitalise - being: consumer panel, software & development, customer contracts & lists, Patents & trademarks, Order backlog, and Development costs.

They capitalised £1,879k of "internally developed" costs in the year, and also capitalised another £1,759k of "separately acquired" costs.

So the inescapable conclusion I have to reach here is that these are very aggressive accounting treatments, and hence in my opinion the adjusted profit & EPS figures are greatly exaggerating the true underlying performance of the business, and should be disregarded.

So on that basis, with 2p per share being the more accurate figure for the company's performance, I think the share price at 72p looks far too high. Clearly the market is happy to rely on the adjusted profit figures. Well I'm not, so this one is coming off my watch list.

The cashflow statement often provides a quicker route to spot this issue of companies capitalising costs that probably should be expensed. In this case the £6.9m cash generated from operations is then almost halved by £3.6m in "purchase of intangible assets" - which is just another word for internal costs. So the true cash generation is only about £3.3m in reality.

I'm not saying they are breaking any rules in presenting the numbers in this way, just that it's a very aggressive form of accounting, which in my view leads investors up the garden path, in thinking that the business is much more profitable than it really is.

The stingy 0.6p dividend (a yield of under 1%) is consistent with 2.0p diluted EPS, at just over 3 times dividend cover. The Balance Sheet looks pretty solid, with current assets at 156% of current liabilities, which is a comfortable position. There is only £3.4m in long term creditors, mainly deferred tax, so that's fine too.

There is one other litmus test I use to confirm whether a company is presenting its performance figures in an overly aggressive way, and that's Director selling of shares. Sure enough, there's been about £1.7m banked through Directors selling in the last 18 months, and no Director buys. I rest my case.

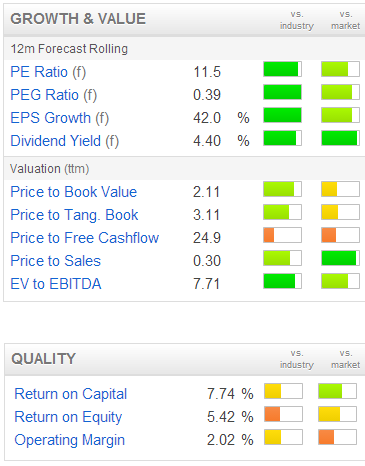

McBride (LON:MCB) has issued an IMS timed to coincide with its AGM. It doesn't sound great, with group revenue down 3%, although they say that overall, full year expectations remain unchanged.

I wrote a review of the company here on 5 Jul, and re-reading it, all sounds relevant still.

So the bottom line is that there's a good dividend yield here, but it seems to be a mature, and capital-intensive business. There is some debt, and a pension deficit too, but neither look to be a serious problem.

I'll stick my neck out here, and say that my guess is that, sooner or later, this company could warn on profits again, which might provide a better entry point? They're just in a very competitive space, and it's difficult to see where profits growth will come from.

That's it for today. It's becoming increasingly clear that the "adjusted" profits figures presented by many companies are becoming far too misleading to just accept without question. From now on, I shall be drilling down into every company's profit adjustments, to ensure they are fair and reasonable.

The biggest issues seem to be ignoring costs that are capitalised, as well as ignoring their amortisation. You can't ignore both! You either account for performance on a cash basis, or on a P&L basis after amortisation. There is only one type of amortisation that can validly be ignored, and that is amortisation specifically attributable to goodwill on acquisitions.

Companies that lump in a load of other costs onto the Balance Sheet, and then try to adjust out the amortisation charge will be named & shamed here, because it's presenting a deliberately misleading view of the results. If you capitalise a cost on the Balance Sheet, then you have to accept that there will be an amortisation charge through the P&L. Ignoring that amortisation charge, at the same time as capitalising more of the same costs, is not acceptable, because it inflates profits artificially.

I think a new accounting standard is needed on this, as the situation is getting out of hand now, and inevitably is leading some investors into overpaying for performance that is not real, through their reliance on inflated adjusted EPS figures.

Some adjustments are fine, for genuine one-offs, or historic factors that genuinely won't recur. However, I think companies have pushed too far on the adjustment issue, and it's time that investors started pushing back.

See you tomorrow, from 8 a.m..

Regards, Paul.

(of the companies mentioned today, Paul holds no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.