Good afternoon!

I am writing this from the 23rd floor of the Hilton in Warsaw. I've come here with friends just for 2 nights, so a welcome break. The 4am start this morning however was not a good idea. I was going to post a picture from my hotel window, but luckily just realised in time that you can see me in my pants reflected in the window! Not something I would wish to inflict on you. I'm not a Labour MP, after all!

Thankfully there are no results, and only a couple of trading updates in my universe today.

The market has certainly felt pretty buoyant this week - lots of things in my portfolio seem to have woken up, with decent share price increases. Let's hope it continues. After all, the market does have to "climb a wall of worry" to go up.

Acal (LON:ACL)

Share price: 254p (up 3.7% today)

No. shares: 64.2m

Market cap: £163.1m

Trading update - this sounds good:

Trading since our last update on 12 February 2016 has been better than our forecasts. Underlying earnings for the full year are therefore expected to be slightly ahead of our expectations.

Broker consensus for y/e 31 Mar 2016 is for 16.8p EPS. So "slightly ahead" probably means about 17p-ish. That gives us a PER of 14.9.

A positive comments about margins too:

Gross margins continue to be strong and ahead of last year, demonstrating the value of our differentiated offering.

Outlook comments also sound positive:

New business generation was strong in the second half of the year with a number of new large customer contracts being won. These are expected to generate revenue towards the end of this new financial year and into subsequent years, driving the Group's organic growth rates in line with our expectations.

Acquisitions - upbeat comments here too:

The three acquisitions made this year, Flux in November 2015, Contour in January 2016 and Plitron in February 2016, are all performing well and as expected.

My opinion - as the company has grown by acquisition, I would want to see the figures for y/e 31 Mar 2016, to check that the balance sheet is not becoming stretched.

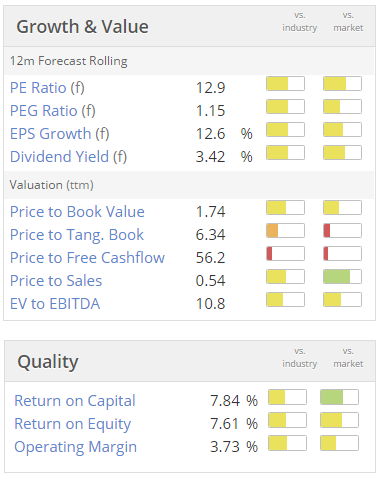

With earnings coming on stream from the recent acquisitions, forecasts for 2016/17 are increased, hence the forward PER below reducing to 12.9. Notice from the colour-coding, that Acal is average on pretty much everything. The margins are quite low, although I think they are trying to focus on higher margin products.

I can't really see anything particularly exciting about this share.

Begbies Traynor (LON:BEG)

Q1 Red flag alert report - these are always worth a read, to see what trends the insolvency accountancy firms is seeing.

Today's report focuses on Brexit, saying that UK exporters are not in good shape, despite the lower pound, to cope with the uncertainty.

Although quite why Begbies think that the UK will struggle to negotiate trade deals, I have no idea. As a large net importer, surely we will be in a strong negotiating position? If in doubt, we can just slap on import tariffs, and recycle the funding into export subsidies.

Brexit doesn't worry me in the least. Business will carry on as before.

Victoria (LON:VCP)

Talks for another acquisition are off, although the company says it is looking for other deals.

The share price has certainly done spectacularly well here, but a reader pointed out that debt levels are rising considerably, so that's worth checking.

I feel I've missed the boat on this one, so won't be revisiting it.

£C21

Profit warning today from this micro cap CCTV company.

I gave up on this one a while back - it's too small, and orders are too lumpy, something which bedevils this sector.

Costs are being stripped out, and the company feels more confident about H2 in the current financial year.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.