Good morning. Apologies for today's report being a little later than usual.

dotDigital (LON:DOTD) is an email marketing software company which has been mentioned here before several times by myself, and also Marben100 and StrollingMolby. They presented to investors at the ShareSoc Tech Seminar in the spring of this year, and I remember being impressed with their growth, and a very impressive client list. Although I did have some concerns over the longevity of this type of product.

They have issued a positive-sounding trading update this morning, which has boosted the share price by 12% to 17.88p. The statement says that the company has looked at a number of potential acquisitions, but not found anything likely to create shareholder value. Instead they plan spending up to half their cash pile of £6.1m on driving accelerated organic expansion.

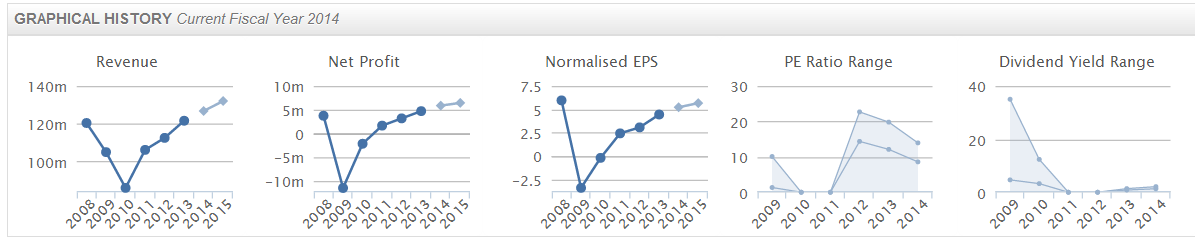

In the core division, turnover grew by 28% to £12.2m for the year to 31 Jun 2013.

As with most software companies, they quote EBITDA, in this case for the full year ended 30 Jun 2013 they expect to be "slightly ahead of the current market forecast (of) £3.8m". Last year they capitalised £1.2m in intangibles, so assuming no change, then profit as I would look at it (i.e. taking out amortisation charges, and adding back capitalised development spending) is probably around £2.6m. Take off tax, and you're in the £2m ballpark. So the £50m market cap after today's rise in share price is an earnings multiple of around 25. That seems very pricey to me, even allowing for the net cash, and the fact that the company has a good growth track record.

It might well grow into this rating over the next year, but personally I don't like paying too much up-front for growth, so the price is too high for me to take it any further. Also, I still have a nagging feeling that email is a bit old hat. Personally I unsubscribe from as many email lists as possible, as so much time is wasted every day constantly reading & replying to emails, it must take up about half my working time at a guess. Other people must surely feel the same, so I think there are better ways for companies to communicate with their customers other than email (e.g. social media). Email just strikes me as a scatter gun approach, where the vast majority of marketing emails sent are never read.

Industrial fastenings group Trifast (LON:TRI) issues a positive IMS today. There are no figures given, and no indication of how they are performing against market expectations. However, they do say that trading in Asia, Europe, and the USA continues to be strong.

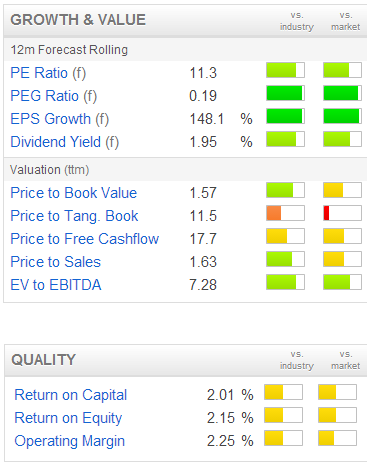

Broker consensus is for 5.22p EPS this year (ending 31 Mar 2014) and 5.66p next year, which gives a reasonable PER of 10.9 and 10.1 respectively. This type of business is probably never going to achieve a premium rating, but with economic recovery beginning in Western economies, you could see the PER rising to say 12-13, so there's a bit of potential upside here possibly.

Dividends are poor, having been cut in 2008/9, and passed altogether in the two subsequent years. However dividends resumed in 2011/12, and a payout of just under 1p is forecast for this year, giving an unexciting but well covered yield of 1.7%.

Looking back in our archive here, I last commented on Trifast's results in Jun 2013 and was impressed with their strong Balance Sheet. So altogether, with the PER now dipping to about 10, this one is beginning to look slightly interesting. It's just such a boring business though, fastenings. It's always going to be very competitive, and low margin, so maybe a PER of 10 is about right? I'm in two minds about this. On balance, think I'll put it on the watch list, and maybe look to grab some cheap on a market correction, but I'm thinking in terms of a sub-50p share price, to have enough margin of safety.

Latchways (LON:LTC) is a lovely business - high margins, niche products, a steady dividend payer, and with a rock solid Balance Sheet, I get a warm glow whenever its figures come up for review! Today's IMS does not disappoint. Although it's phrased cautiously they conclude by saying that growth is expected in H1, and a stronger H2 (their year end is 31 Mar 2014). The outlook sounds good:

Looking forward, despite the prevailing economic weakness in our core markets, we are well set to continue to deliver profitable growth.

So I definitely like it still, but what about the price? The shares have risen about 30% this year, and at 1315p per share that is now 17.6 times current year broker consensus forecast EPS, dropping to 15.9 times for next year. To my mind that's probably about as high as these shares should go for the time being. Although the dividend is reasonably attractive at a 2.95% forecast yield for this year, rising to 3.2% next year.

I can't really see any upside on the current share price, but will keep it on my watch list as the type of thing that I would pounce on if they issued a profits warning, and a cheap entry price became possible.

Accumuli (LON:ACM) might be worth a look. They have issued an "in line with management's expectations" trading update today. I last looked at this company on 25 Jun 2013, and couldn't really come to a conclusion from a quick look, as it needed more research.

The same is true now. Historically they have been loss-making, but based on forecasts the PER is now looking reasonable. So one would need to ascertain how reliable those forecasts are, and dig through all the historic RNSs, to get a handle on what events have occurred here.

I believe they disposed of some IP to Juniper Networks in the USA, then did an acquisition (presumably using some or all of that cash).

If any readers have the time, it might be worth checking it out & put some thoughts in the comments section below, as I'm running on slightly reduced mental capacity today!

PV Crystalox Solar (LON:PVCS) is a very unusual special situation, in that Chinese dumping of solar panels below cost price has fairly effectively killed off a lot of the European sector. PVCS were insulated from this to a certain extent, with long term supply contracts fixed at much higher prices, which are now coming to an end.

They have disposed of their German facility to management, and are holding on to some manufacturing capacity in the hope that conditions might change. The EU has back-tracked from imposing anti-dumping duties on the Chinese, instead imposing a minimum price (set too low according to PVCS), and an import quota.

I don't see much likelihood of PVCS surviving long-term, so all that is left is the cash pile, and a 7.25p return of cash to shareholders, which is in the pipeline. So at 11.2p the shares really give you a cash return of 7.25p, and a 3.95p option on some part of the business becoming viable in the future, or there being an additional cash return at some point.

It looks fairly finely balanced to me, with not enough potential upside to make it worth getting involved. I did some rough calculations on net current assets, less an estimate for shut-down costs & losses, and it drops out slightly below the current share price. Hence not of any interest to me.

That's all for today, see you at the usual time tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.