Good morning! 5-a-side soccer centre operator, Goals Soccer Centres (LON:GOAL) has announced a trading update for the year ended 31 Dec 2013. They have 43 soccer centres in the UK, and 1 in the USA. The company says that trading was in line with expectations. Sales rose 3% to £33.5m, with LFL sales up 2% (i.e. stripping out the impact of new sites and any closed sites).

Bank debt has fallen from £54m at 30 Jun 2012 to £46m at 31 Dec 2013, although that is still prohibitively high for my liking. They had to put new site openings on hold whilst the debt was reduced, although the company is now talking about resuming growth - how is it going to fund that though? A Placing looks likely in my opinion, and would be a good thing, to strengthen the Balance Sheet by reducing debt.

It's a good, cash generative business, but has too much debt in my view. Also the shares have had a very good run recently, and are now almost 200p, valuing the company at about £100m, with debt being almost half as much again.

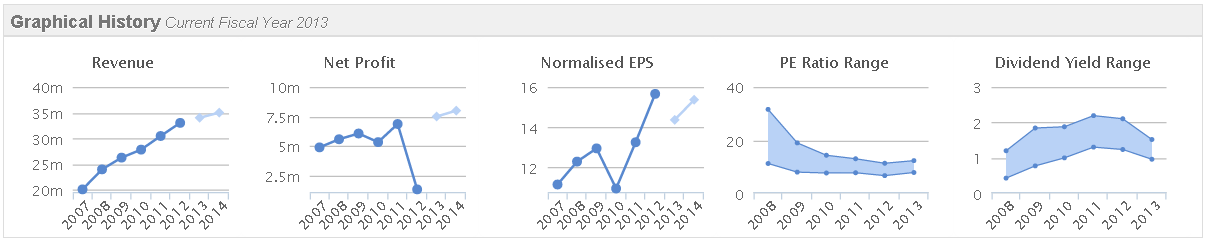

Broker consensus is for 14.4p EPS for 2013 (which they have today confirmed they are in line with), and 15.4p next year. That puts the company on a PER of 13.7 for 2013 earnings, and 12.8 times 2014 earnings. That would be fine if the company was debt-free, but it isn't. The debt of £46m equates to about 87p per share, which in simple terms takes the PER up to nearer 20. If valuing it on a debt-free basis, you would have to adjust earnings to strip out interest cost, which would increase EPS by roughly 25%. So making that adjustment the debt-free PER would be about 15.8 (EV of 284p, divided by forecast EPS * 1.25 = 18p), so not cheap considering there hasn't been any significant growth for a while (see graphical history below);

The dividend yield is only 1%, and in my view they would be better off not paying dividends until the business has reduced its debt to more sensible levels. The market seems to have priced in growth from new sites, but to my mind the price is now high enough, and the shares are too risky for me. That said, there must be considerable expertise in the company now, in how to set up & run these soccer centres, so if you like the roll-out potential then it could be worth a speculative flutter, but should be treated as high risk.

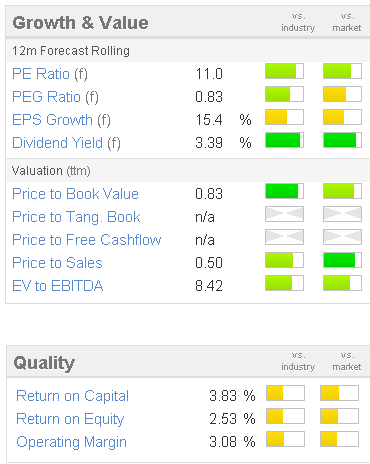

Marketing communications company Communisis (LON:CMS) has issued an in line with expectations trading update for the year ended 31 Dec 2013. Noteworthy is that international expansion has accelerated, with about 18% of revenues from overseas sources in 2013, compared with only 7% in 2012. That's quite interesting, and could be a catalyst for a higher rating for these shares possibly, as investors may be prepared to pay more for more exciting growth.

Marketing communications company Communisis (LON:CMS) has issued an in line with expectations trading update for the year ended 31 Dec 2013. Noteworthy is that international expansion has accelerated, with about 18% of revenues from overseas sources in 2013, compared with only 7% in 2012. That's quite interesting, and could be a catalyst for a higher rating for these shares possibly, as investors may be prepared to pay more for more exciting growth.

Broker consensus is for almost 4.8p in 2003, so at 61.5p this morning they don't look expensive, on a PER of 12.8. There is some debt, but the company says it is lower than expectations at net debt of £25m. That's still a bit on the high side, given forecast profit of £9m this year. Indeed when I last reported on this company on 1 Aug 2013, I noted that their Balance Sheet is still weak, even after an equity fundraising, with NTAV of negative £26.8m. There is a pension deficit here too.

Given the weak Balance Sheet, this one is too risky for me, but we're in a bull market where investors are increasingly ignoring risk and pricing in upside with certainty, indeed many investors are not even bothering to look at Balance Sheets at all! So the shares will probably go higher for as long as this bull run lasts, but it's not for me. The outlook statement sounds positive, with a strong pipeline, and the LloydsTSB contract kicking in on a full year basis in 2014, so that should underpin forecast EPS of 5.5p for 2014.

Given the risk from a weak Balance Sheet, I think it's probably priced about right, but in a bull market it could have another 10-20% upside in it this year, possibly? The dividend yield is reasonable, at about 3.3%.

I've been reviewing today's interim results from marketing insights group, Ebiquity (LON:EBQ). This is a new company to me, it somehow slipped through the net last year. I like the sound of their activities, but only have a vague grasp on what they do. Their mission statement says;

Our mission remains "to help our clients to improve their business and brand performance, and to do this by providing them with a wide range of data-driven insights into their own performance, and their competitors' performance, enabling them to make better informed decisions.

This might sound like flannel, but I'm increasingly of the view that clever use of social media for example will be a critical success factor for many businesses in the future. Hence there is a big opportunity for agencies in this area I reckon, especially in an improving economy where the brakes are probably starting to come off for client spending on this type of service. It's a competitive area though, with numerous similar agencies.

Although you always have to be particularly sceptical when reviewing the accounts of any company in the marketing space, as they can't help themselves but to put the maximum possible positive spin on everything, including their own results! That's the case here, with the Chairman declaring that, "These are outstanding results ...", below the headline bullet points. Errr, I'll be the judge of that thank you!

In my view these are good results, not outstanding. Their definition of underlying EPS increased by 18% to 3.1p for the six months to 31 Oct 2013. There seems to be an H2 bias to trading, judging from last year's actual results, and this year's forecast to 30 Apr 2014 being 9.75p EPS. At 120p that puts the shares on a PER of 12.3, which seems reasonable to me.

They also confirm trading is in line with expectations, in the meat of the outlook statement, once you've cut through the waffle, saying (my bolding);

As the world's economic prospects improve and brands once again focus on how to achieve competitive advantage, we are well positioned to continue our exciting growth story. We remain confident that we will meet management expectations for the full year.

I was starting to get excited about this share until I looked at the Balance Sheet. It's the usual story with this type of company I'm afraid - dominated by Goodwill from acquisitions, and with too much debt. If you strip out the £51.5m Goodwill, and another £12.7m in other intangibles (mainly purchased, so this would need to be checked to see if they have any resale value), then net tangible asset value (NTAV) is negative to the tune of £21.2m. That rules it out of my investing universe - I don't usually invest in anything with significantly negative NTAV. Also the bank debt is too high relative to profits, in my view.

Pity, as I like their activities & it looks like an interesting growth company. Maybe I'm too conservative, but as a general point, I like to be able to sleep at night, knowing that there is no possibility of my portfolio having any major losses, other than the occasional 20-30% hit on a profit warning, which is unavoidable I'm afraid. A soundly-financed company can survive a profits warning, whereas a company with a lot of debt & a weak Balance Sheet can end up on a knife edge for survival after a profit warning - so the share price tends to be hit a lot harder if highly geared companies disappoint.

Edit: As another general point (i.e. not specific to any company) bear in mind also that the unprecedented lenience being displayed by Banks over the past five years towards heavily indebted companies probably won't last forever. Historically, more companies go bust in an economic recovery than a Recession, because resumed growth stretches their working capital to breaking point, whereas they just about muddled through the Recession. Also, crucially the Banks know they can get better asset realisations, and hence have a lower write-off once the economy is recovering - that was a big lesson they learned from the 1990-92 downturn, when the Banks were extremely trigger-happy at putting companies under, but regretted it as they achieved very poor asset recoveries. So be prepared for more highly geared companies failing this year than last year, as Banks pull the plug, or force them to do an emergency equity fundraising at a deep discount. I'm not suggesting any of that is relevant to Ebiquity, but just wandered off on a tangent when talking about debt.

Ebiquity shares seem very illiquid for a £73m market cap company. The reason is possibly because the three largest shareholders hold about 50% of the shares, so not a great deal in free float. 25% is held by the largest shareholder, VS&A Communication Partners, which sounds like another marketing company. So it looks as if Ebiquity is really an Associate company of theirs, which makes me a little uneasy. A strategic review was carried out in 2013, which sounds as if they were thinking of taking it private, but have now decided to remain Listed. Again, that doesn't fill me with confidence, so I won't be taking this share idea any further. Again though, in a bull market the shares might do well, who knows?

I'll look at t few more things here, before I have a conference call with a small cap management to discuss their results. Foam maker Zotefoams (LON:ZTF) has issued a broadly in line (i.e. slightly below) expectations trading update for the year ended 31 Dec 2013.

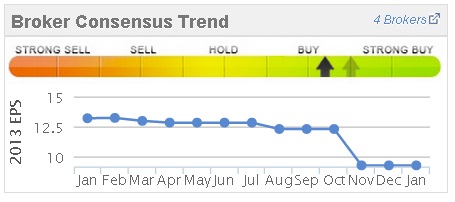

I last reported on this one on 23 Oct 2013, when they warned on H2 profits (see broker downgrades in October on the Stockopedia graphic to the left), due to de-stocking by European customers.

I last reported on this one on 23 Oct 2013, when they warned on H2 profits (see broker downgrades in October on the Stockopedia graphic to the left), due to de-stocking by European customers.

At the time it seemed to me that the shares still didn't look cheap, despite a 10% fall to 170p per share. It bounced a little, but has since drifted back down to 171p, although given that European economies now seem to be recovering, along with the USA and UK, one should perhaps start to factor in a bit of a trading recovery?

So they look set to make about 9p EPS for 2013, which means the PER is 19, still pricey. However, if you assume a decent bounce in trading for 2014, broker forecast is for 12.5p EPS, then the PER comes in at a much more reasonable 13.7.

It looks quite a good quality business - with a reasonably good operating profit margin, and was profitable every year through the downturn of the last five years. It has also maintained its dividend, increasing it slightly in three small steps from 4.5p in 2007 to 5.2p last year. So the 3.0% forecast dividend yield is not to be sniffed at, and likely to be sustained, especially if you assume that this could be the low point in the earnings cycle, and an operationally geared recovery could be about to happen?

Interestingly, their pension deficit is almost cleared, so overpayments of £55k per month are due to end in Sep 2014. It also has a nice solid Balance Sheet, so can be seen as relatively low risk. That combined with a valuation that is now starting to look reasonable, the divi yield, and recovery hopes, mean I'm more positive on this stock than ever before. The upside is probably not exciting enough for me to buy any yet, but it's certainly going on the watch list.

Businesses which disappointed in 2013, but are fundamentally sound and should recover in 2014, are one of the few places where reasonable valuations can now be found, and this is a good area to be hunting for value & GARP in my view. The momentum-driven, highly rated stocks that are so popular now will no doubt provide plenty of banana skins for investors in 2014, if they disappoint in any way. I'd rather search through the bargains to find quality, than chase fashionable stocks up to higher & higher prices, and then wake up one morning to find the stock has dropped 50% pre-opening on a disappointing statement.

Plant Health Care (LON:PHC) issues an in line with expectations trading update for calendar 2013. It has a history of heavy losses, and raised $20m in fresh funding in April 2013. I can't see any forecasts, and it's track record of losses is so awful, that it's not of any interest to me. Clearly they must have a persuasive story though, or investors would not have stumped up the fresh funding last year.

That's it for today. Thank you for reading, and see you tomorrow, nice and early!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.