Good morning!

ShareSoc Seminar

Last call for this investor event, which is tonight!

There are still a few places left I am told. Kick-off is 4:30pm this afternoon, location is FinnCap's offices in London (map link). Booking details are here, but you'll have to be quick!

I can't attend unfortunately, which is a pity as I would have been interested in hearing from Idox (LON:IDOX) in particular, which is starting to look potentially interesting in my view. So any feedback from the seminar would be useful.

AGA Rangemaster (LON:AGA)

Share price: 181p (up 19% today)

No. shares: 69.3m

Market cap: £125.4m

Recommended offer - I reported here on 17 Jun 2015 that Aga had announced a potential takeover approach from US firm Middleby. AGA shares rose 28% to 133p at the time, and have risen another 20% today to 182p as a cash offer at 185p is announced by Middleby.

This is a cracking deal for AGA shareholders, at a big premium - 77% above the share price just before the potential offer was first announced, and an 87% premium to the preceding three months. Nobody can complain about that!

As I mentioned in my earlier report, what is all the more surprising about this generous takeover deal, is that AGA has certainly the largest pension fund, relative to its market cap, that I can recall ever seeing. So it would have probably been the last company I would have expected to receive a takeover approach (since big pension funds in deficit would normally deter a bidder in the first place, and the pension fund trustees could block any deal).

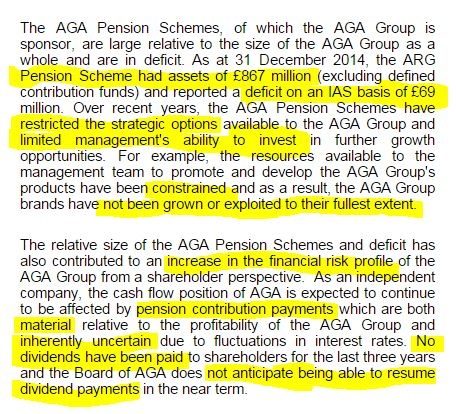

Indeed, section 4 of today's announcement mentions how AGA's pension schemes have constrained the business, increased risk, and prevented the payment of dividends:

New pension settlement - section 10 of today's document details the agreement reached between Middleby and the AGA pension trustees. The deal involves an immediate payment of £10m by Middleby, another £10m by 15 Jan 2016, and £2.5m p.a. for 6 years after the 3rd anniversary of the acquisition.

Given that the market cap at the takeover price is just over £128m, then the immediate and Jan 2016 payments into the pension scheme combined (£20m) are 15.6% of the amount being paid for the company. Not bad really. Then the further payments could be seen as being funded by AGA itself perhaps?

Middleby has also given two capped guarantees over additional funding, if needed, by the pension scheme.

My opinion - this takeover deal is a bit of a game-changer. It shows that huge pension schemes are not necessarily an impediment to a takeover deal. Agreement has been reached with the trustees here, which has allowed Middleby to proceed with the takeover.

The pension fund trustees will no doubt be pleased that AGA now has much more secure funding behind it, being part of a larger American group, so you can see why they would be receptive to doing a deal.

Given that this deal is going ahead, perhaps we should be looking differently at other companies with pension deficits, and revaluing them upwards, since takeover deals are not now off the table, after all? There could even be some bargains around at companies with pension deficits?

Carr's (LON:CARR)

Share price: 168p (down 1% today)

No. shares: 89.7m

Market cap: £150.7m

Trading update - this is an agricultural & food-focussed group, which I've not looked at for about 18 months, so will quickly refresh my memory first. Looking back at my report from 14 Jan 2014, I thought it looked boring & low margin, and priced about right at 160p.

That looks to have been a fair assessment, as the shares have only gone up 8p in the 19 months since then, plus divis of course, but they're nothing to write home about at a yield of about 2.2%.

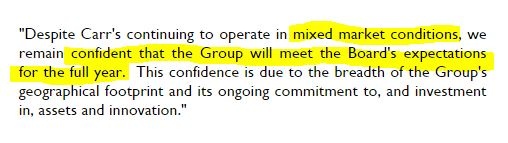

Today's update covers the 19 week period to 11 Jul 2015, but this seems to be quite near the end of H2, given that the next year end is 29 Aug 2015, so it should mean the full year figures are nearly in the bag, I imagine. The key part of today's update says:

Valuation - broker consensus is for 13.8p EPS this year, so that's a PER of 12.2. I'll need to check the balance sheet first, to see if that is reasonable or not.

Balance sheet - this looks alright to me.

Net assets - are £94.6m, with intangibles of £10.5m, so NTAV comes out at £84.1m - this is clearly a capital-intensive business.

Current ratio - looks good, at 1.67

Long term debt - total long term creditors are £38.8m, of which £27.9m is long-term bank debt, but that looks manageable to me, given the level of profitability (operating profit of £15.4m in the last full year). Plus bear in mind that cash and short term bank debt roughly cancel out within working capital.

Long-established groups like this can, sometimes, be a gold mine of hidden assets. So I've had a quick look at the last Annual Report, and note 10 (page 60) shows land & buildings (presumably freeholds) with a net book value of £28.5m.

Pension scheme - the 2014 Annual Report indicates that the group paid £2.3m in over-payments into the pension scheme in the year, but that such payments end on 31 Dec 2015. So it looks as if the actuarial deficit has been almost fixed. The accounting valuation shows a small pension fund surplus of £2.1m in the most recent accounts, so this issue is probably alright.

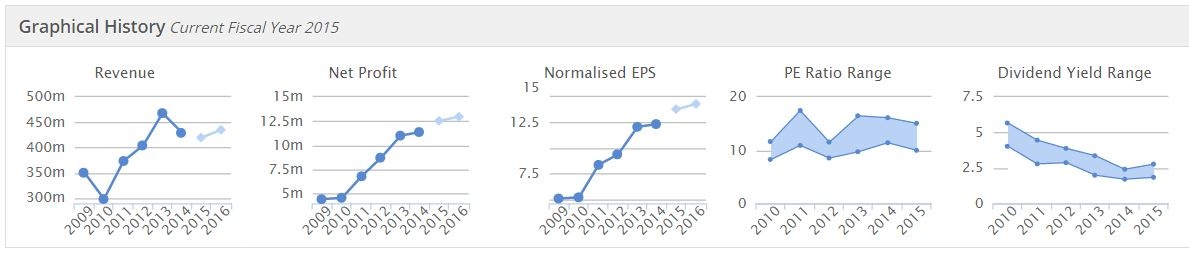

My opinion - this is a tricky one. Boring yes, but it's soundly financed, has a great StockRank of 96, and a good historic track record, see the Stockopedia graphs below:

Overall then, I wasn't expecting to like this stock, but actually it looks potentially interesting - worthy of some more research anyway.

Today's video

There's a bit of a backlog of shares that I wanted to mention, so I've recorded a 17-minute video today to catch up. This covers the following recent trading updates/ results:

0:00 - Begbies Traynor (LON:BEG)

9:46 - Manx Telecom (LON:MANX)

11:33 - ISG (LON:ISG)

15:28 - Next Fifteen Communications (LON:NFC)

16:48 - NetDimensions Holdings (LON:NETD)

All done for today, see you in the morning!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions. A fund management company with which Paul is associated may hold positions in companies mentioned.

NB. These articles are just Paul's opinions. They are NEVER recommendations or advice. Please DYOR)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.