Greetings from Prague! I grabbed some cheap flights for a long weekend, and soon regretted it - the Easyjet flight was heaving with stag parties - who started off a little noisy but perfectly good natured, but who then proceeded to treat the aircraft like a flying pub, and were soon shouting, singing & pacing about in fancy dress. Being stuck in a confined space with all that nonsense going on is not my idea of fun, so Easyjet to a destination popular with stag parties - never again!

What is wrong with people in the UK? Why can't people just enjoy a drink & a laugh, instead of turning into shouty, sweary, aggressive monsters after a few pints? Whenever I go out in European cities, there's hardly any of that aggression in the air that you find in British towns & cities. Things need to change.

Anyway, I'm flying back to the UK tonight (hopefully the stags went home yesterday, or if not, then at least should tonight be too hungover to disturb me quite as much), and have extended my hotel room until 6pm so that I can write this report at my leisure, potter round Prague a little more after lunch, and then back to good old Blighty.

Latchways (LON:LTC)

Share price: 830p (down 2.6% today)

No. shares: 11.2m

Market Cap: £93.0m

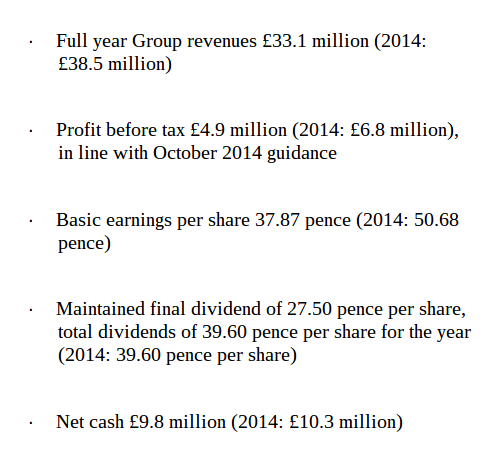

Final results y/e 31 Mar 2015 - I noticed that shares in this specialist safety equipment company were rising last week, as punters anticipated a turnaround at this company, following two profit warnings last year.

The headline bullet points today look reasonable - although turnover and profit are well down on last year, this was already known, so the company seems to have produced results in line with, or slightly above lowered expectations. Note also the strong cash position, and maintained dividend (although not well covered now).

Valuation - at 830p per share, the PER drops out at 21.9 times, which is clearly too high, if current performance is maintained. Therefore the market is pricing in an earnings recovery, so the outlook comments today are probably more important than the actual results.

Outlook - the following comments from the company today sound encouraging, but there's little concrete evidence of a significant turnaround. In particular I don't like the "too early to judge" comments about the new sales staff.

The other thing to consider is that taking on more sales staff has an up-front cost, so if they are not able to boost sales, then profits could get worse due to these costs, if the downside scenario plays out.

Broker consensus is for 51.6p EPS in the current financial year, so that's a PER of 16.1 times, IF the turnaround is successful in delivering the forecast 36% increase in earnings this year.

My opinion - I don't see much attraction at the current price. The market is asking me to pay up-front for a turnaround in performance this year which is not yet convincingly on track. Sure, there's a chance the company might come storming back, and beat current year forecast numbers, but given that it's been struggling now for around two years, I wouldn't want to pay in advance for the chance of that happening.

On the upside, the company has a fantastic balance sheet, and is still decently profitable, despite lower turnover. So those factors nicely protect the downside.

If profit warnings come in threes, then we have one last one to come. So I'll sit on the sidelines for now, and wait to see what happens. A purchase now would be too speculative in my view, as with turnover down about 20% from the peak, and profits more than halved, there is clearly something wrong - most likely to be competitive pressures. That needs looking into before buying these shares could be considered safe.

If it was priced at about say 10 times this year's forecast earnings, at about 516p, then I think it would look interesting. But at 830p, there is too much upside potential already priced in, in my opinion.

Majestic Wine (LON:MJW)

Share price: 418p (down 4.9%)

No. shares: 70.6m

Market Cap: £295.1m

Results for 52 weeks ended 30 Mar 2015 - these are not great results - turnover is slightly up (2.3%), but underlying profits are down from £23.8m to £20.9m. The reason seems to be essentially due to increased distribution & admin costs, but gross profit only slightly up, hence the shortfall in profit opening up.

Exceptional costs of £695k termination payments, and £1,767k acquisiton costs further worsen profit to £18.4m (vs £23.8m last year).

Outlook - current trading for Apr & May is said to be in-line with management expectations.

Strategic review - the new CEO, Rowan Gormley, has only been in post for 10 weeks, and says today that investments need to be made to reinvigorate Majestic Wine, which will suppress profits in the short term.

Naked Wine - the difficulty with analysing this share, is that Majestic took a radical change of direction, when it bought an internet crowd-funding wine business, called Naked Wine. Majestic paid £50m cash up-front (using bank debt), with a further £20m in shares contingently payable in future. Unusually, the founder CEO of Naked Wine became the CEO of the enlarged group, and divis have been stopped until 2018.

Altogether, a very unusual turn of events. But we're in a bull market, and perhaps surprisingly, the market reacted positively to this change of direction.

For calendar 2014, Naked generated turnover of £74m, but made an EBITDA loss of £3.3m, although that is after customer acquisition costs of £4.9m.

It is expected that Naked will break even in the current year to Mar 2016, with strong growth thereafter, so it's an interesting, but very surprising acquisition for Majestic.

My opinion - I don't really know how you value this share. It's effectively a slightly tired wine retailer, which is obviously struggling a bit against competition from the supermarkets, but is still decently profitable. Yet attached to that is a growing online business - not just retailing wine, but crowd-funding the production of wine through "angels".

If the online business really takes off then the group could attract a premium price as a go-go growth stock. Yet the downside is protected considerably by the conventional retailing business.

It's priced at about 17 times forecast earnings. I suspect there is likely to be a kitchen-sinking of loss-making shops, etc, by the new CEO. Risk has increased due to the debt taken on to buy Naked.

It's too early to tell whether the change in direction was inspired, or a mistake.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.