Good morning!

London Value Investor Conference

This is the Rolls Royce of investor conferences, and I've been fortunate enough to attend for the last two years, and will be there again this year, next week in fact, Wed 20 May. There are only 6 tickets left! We've been given a special discount code: STOCKOPEDIA-LVIC which will get you £120 off.

There are some terrific speakers, as always, including Jonathan Ruffer, Charles Brandes, Richard Oldfield, Simon Denison-Smith, David Shapiro, and the last session is Q&A with Neil Woodford. The full schedule is here.

It's not cheap, but it's a real quality event in my view. I'll have my press hat on, so will be scribbling down some notes, and will publish a couple of articles here for talks which inspire me on the day. As it's a full day, that will mean unfortunately there won't be a SCVR here on Weds next week. Hopefully my reports from the LVIC will more than make up for that though.

Here is a link to my previous reports from the 2014 & 2013 LVIC, which are worth a recap. Jon Moulton's talk in particular was brilliant last year, and had a lot of relevance for those of us who like to meet management of companies in which we invest.

Anyway, on to what's happening today. It's quiet, so I'll circle back to a couple of announcements I overlooked yesterday from Ideagen (LON:IDEA) and Robinson (LON:RBN) at the end of today's report.

Tribal (LON:TRB)

Share price: 139p (down 8% today)

No. shares: 94.8m

Market Cap: £131.8m

AGM trading update - by the way, in case anyone doesn't realise this, the blue headers are clickable links to the relevant announcement. So if you right-click and select "open in new tab", then you can refer to the source document on investegate.co.uk .

Clearly this has been perceived as a mild profit warning, as the shares are down 8%, so let's have a rummage. Tribal is a "leading provider of software and services for education management" - a nice clear description of their activities in today's announcement.

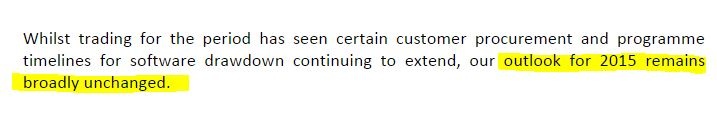

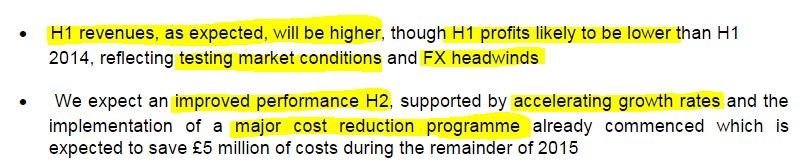

Doesn't sound too bad at all;

So of course that actually means the outlook is slightly below. I guarantee to buy shares in the first company which uses the phrase "slightly below" instead of "broadly in line", as I think that would demonstrate refreshing clarity and openness.

Additional detail is given on divisional outlook, none of which seems significant. The word "stable" is used twice, which sounds reassuring, if unexciting.

Net debt - has risen to £25.7m at 30 Apr 2015 (prior year £13.4m) reflecting deferred consideration payments for an acquisition. "Seasonal working capital movements" is also given as a reason why debt is higher this year than the same point last year - how does that work then? Surely seasonal movements are eliminated when you compare the same date one year with the prior year?

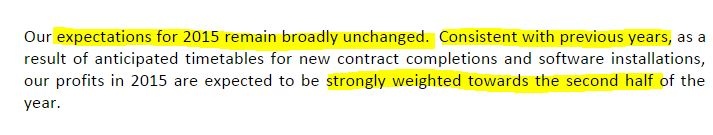

Outlook - the dreaded 2nd half weighting comment appears, but this is tricky to interpret, as if that is the natural seasonality of the business, then it may not be anything to worry about;

My opinion - looking back at last year's results, H1 produced an adj operating profit of £5.6m, and the full year was £14.5m, therefore H2 was £8.9m profit. Fair enough, that was a 39%:61% split of profits H1:H2, so there does seem merit in what the company says above.

However, it does introduce a degree of doubt.One broker has already reduced their profit forecast by 8% for both 2015 and 2016 this morning, on a precautionary basis, which seems sensible to me. Nobody likes H2-weighting being flagged, especially when combined with only "broadly in line" performance. That's code for - we're probably going to have to warn on profits again later this year, but we're not sure yet.

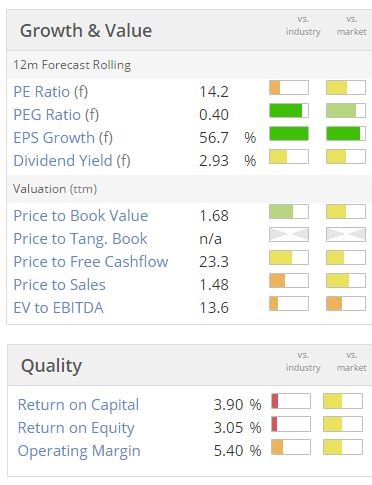

The shares have hit a new 12-month low this morning, but the valuation on a fwd PER basis is starting to look potentially attractive, at 10.3, as the 8% share price fall today offsets the forecast reduction of 8%.

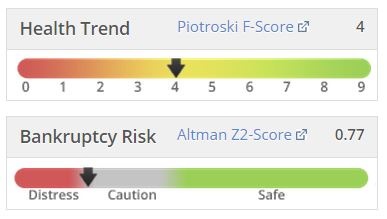

Note that the Piotroski F-Score and the Altman Z-score are both flagging potential issues. I would never make any decisions solely based on these indicators, but they are worth glancing at, as they are telling me to dig a bit deeper in this case.

Overall - this is not the first time that Tribal has put out a hesitant trading statement, so I'm wary of getting involved here. If it had a bulletproof balance sheet with pots of net cash, then I'd be happier about having a punt on it, but with a weak balance sheet, personally I'm inclined to steer clear and wait to see what the interims look like when they are published in mid-August.

Small caps are generally so expensive at the moment that it's difficult to find many shares at a reasonable price, unless you take the plunge after a minor setback. That then opens up the risk that a minor setback is the thin end of the wedge for more serious problems.

Brammer (LON:BRAM)

Share price: 354p (down 12% today)

No. shares: 129.4m

Market Cap: £458.1m

I've decided to start reporting on some companies between £250-500m market cap, which I've previously ignored, and drop off some of the tiniest, most illiquid & speculative companies right at the bottom end - as I think this will be more useful to readers. After all, what's the point in being briefed about tiny companies that are too illiquid to buy or sell?

As I'm looking at these companies for the first time, please bear with me, and treat my comments as just a very quick scan, not in depth research.

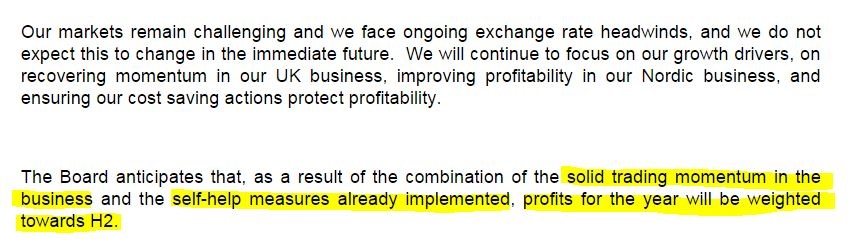

AGM trading update - shares in this "pan-European added value distributor of industrial maintenance, repair & overhaul products" have dropped 12% today, so it must be a profit warning. This has broken the previously strong up-trend since Nov 2014.

Today's update covers the first four months of this calendar year. There's lots of detail, but the key points seem to be these;

A new E120m debt facility has been agreed, but that was already announced on 30 Apr 2015.

Reading through the detail, the currency impact has been significant - and is helpfully quantified - each 1% movement in the Euro affects profit by £0.3m. Reduced demand from the oil & gas sector, especially in Nordic countries, is also mentioned as a factor for the weaker profits in H1 this year.

Outlook - this is a cop-out! They don't mention market expectations at all, unless I've missed it somewhere else in the announcement;

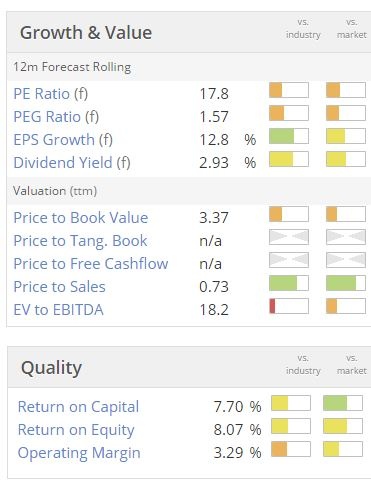

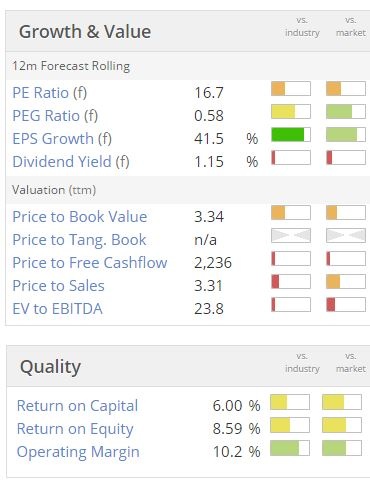

Valuation - the shares don't exactly look a bargain, given that they're facing various headwinds. But I suppose it all depends on what you think the future holds? Currency movements are swings & roundabouts in the long run, and European economies are maybe now recovering at long last?

Balance Sheet - isn't great. Net assets of £155.7m reduce down to only £37.2 once you remove goodwill, and taking out other intangibles turns it slightly negative for NTAV, at -£2.8m. It's big enough & profitable enough for that arguably to not matter very much, but it needs to be factored into the valuation of the shares - i.e. I would want a lower PER than 17.8 to reflect the relatively thin balance sheet.

Note that there's a pension deficit too, shown at £38.6m on the most recent balance sheet - not necessarily a deal breaker, but I'd want to dig into the detail to assess the risk.

Dividends - not bad - the yield is about 3%, but I like the history of 14.5% p.a. compound increases in the divis in recent years, although the growth rate has slowed to about 5% recently.

My opinion - I don't know anything about the company, or its prospects, so cannot give an informed view. All I can say is that from reviewing these figures, and the "challenging markets" it operates in, it's difficult to see any immediate upside from 354p per share.

Longer term, who knows? It could benefit from a European recovery, and exchange rates might move in its favour.

Restore (LON:RST)

Share price: 270p (down 1.5% today)

No. shares: 82.2m

Market Cap: £221.9m

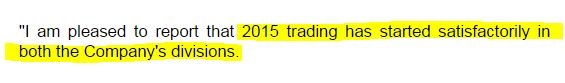

AGM trading update - more detail is given, but the key sentence says this;

They are over a third of the way into the full year, so it's a bit more than "started"!

My opinion - this group is growing mainly by acquisition, and has issued a lot of new shares over the last few years - the share count was 9.33m in 2009, and has risen every year since, to 82.2m now.

Also, there's some debt involved - net debt was £30.9m when last reported, which is about 3 times pre-exceptional operating profit - which is getting a bit warm in my view.

I hear that management are very good, but it's difficult to see any reason to rush out to buy the shares at this valuation, which looks to me about right, or maybe a tad too high perhaps?

Tyman (LON:TYMN)

Share price: 306p (no change today)

No. shares: 169.6m

Market Cap: £519.0m

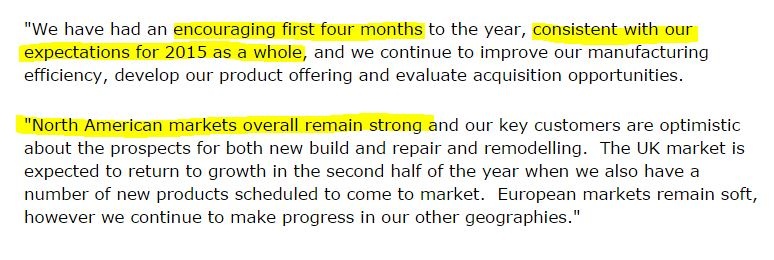

As part of my new push into small-mid caps, let's look at another one! I've never heard of Tyman before, but apparently it's a "leading international supplier of components to the door and window industry".

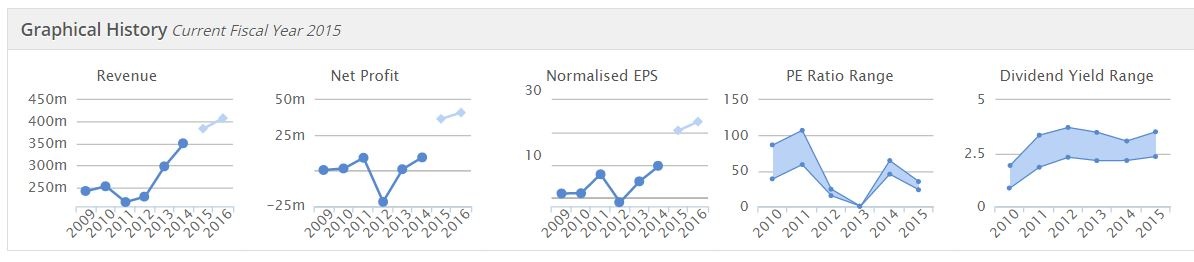

Looking at the historic performance graphs, the company doesn't seem to have made much profit between 2009 and 2014, but analyst forecasts are for a big increase in profitability this year and next, so I'd be interested to find out what has changed to make that likely?

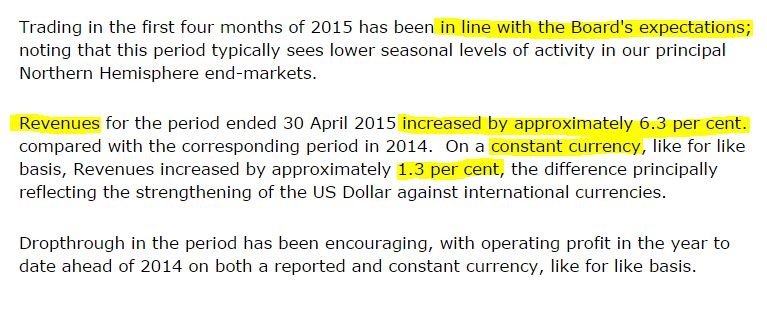

AGM trading update - it's a calendar financial year, so this update covers 1 Jan to date, ie. most of H1. The main bit says;

Note that they seem to have benefited from currency movements, unlike most companies reporting at the moment. I've noticed that happening lately at companies which mainly operate in the USA.

Having a look through their 2014 Annual Report, sure enough the largest subsidiary, AmesburyTruth, operates in North America.

Although note that there has been a big move in the other direction in the last month, with sterling having strengthened considerably against the dollar, from £1=$1.46 to £1=$1.575 at the time of writing.

It would probably make sense for Tyman to change their reporting currency to US dollars, as over half their business, and most of their profit seems to come from the USA & Canada.

Cost synergies of at least $8m are expected in 2015 from rationalising facilities.

ERA - this is the UK business, and these comments are interesting;

This is surprising, as the UK housing market is buoyant, and there have been update trading updates recently from both Entu (UK) (LON:ENTU) and Epwin (LON:EPWN) . Maybe they are eating some of ERA's lunch?

Balance Sheet - they say is strong, which always makes me suspicious, as companies which claim to be financially strong usually have weak balance sheets!

Well what do you know?! Sure enough, Tyman's balance sheet is stuffed full of intangibles. Net assets were last reported (at 31 Dec 2014) as £309.0m, but goodwill of £254.4m, and other intangibles of £101.3m, mean that net tangible assets are actually negative, at -£46.7m. It always pays to check these things.

The other intangibles of £101.3m is mainly "acquired brands" and "customer relationships", so those can safely be written down to nil.

The current ratio is strong, at 2.37, which includes £39.3m of cash. But long term creditors are large, at £176.2m, with the biggest item being £128.0m in borrowings. These borrowings are split about half and half between bank borrowings, and private placement notes (unsecured, with $55m due in 7 years, and $45m due in 10 years, with a coupon of 4.97% and 5.37% respectively).

I like that type of debt structure, as it reduces reliance on the whim of the bank manager.

The debt levels are quite high, but manageable by the looks of it.

Dividends - not bad, it's forecast yield is just under 3%, and has been rising strongly since divis began in 2010.

Outlook - sounds fairly upbeat;

On the other hand, Tyman is a bigger group of businesses, and has more geographic spread, which should reduce risk.

This sector is highly cyclical, and in a bad recession this type of company often comes close to, or actually does go bust. Note that the share price of Tyman in early 2009 bottomed out at only 8p, so clearly they were close to going bust at that point.

Will we see a recession as bad as 2008 any time soon? Probably not, but who knows?

Overall, I think Entu & Epwin look to be more attractive in both valuation & dividend yield terms.

Ideagen (LON:IDEA)

Share price: 38.5p

No. shares: 174.3m

Market Cap: £67.1m

Trading update - this was issued yesterday, and as promised I'm coming back to have a look at it, as it slipped through the net yesterday.

It's difficult to argue with this!

Valuation - broker consensus is for 2.08p EPS for y/e 30 Apr 2015, so that's a PER of 18.5, which looks rather high to me for a group of very small businesses (turnover is only forecast at £14.2m for the year just ended).

EPS is forecast to rise again to 2.73p in the current year that has just started, so a PER falling to 14.1 this year, if it performs in line. Even that sounds a bit toppy to me.

Outlook - this sounds very positive;

My opinion - I just can't get excited about this company. It's growing through repeated acquisitions, and doing that trick where you buy private companies cheaply, and then get a higher rating on the group. That somehow seems a bit artificial to me.

However, based on yesterday's update, it sounds as if things are going really well, so I look forward to having a good rummage through the full figures, when they are announced in mid to late July. Maybe there is more here than I realised?

Robinson (LON:RBN)

Share price: 152p

No. shares: 16.4m

Market Cap: £24.9m

AGM trading update - they saved the reassuring bit until the last sentence!

Performance at this packaging group has been rather variable of late, reflected in broker consensus yoyoing up and down;

Big variations in estimates too - from 10p to 20p, and now about halfway.

My opinion - on current forecasts the PER is 10, and the divi yield is 3.37%. That looks about the right price to me, given that it's operating in a very competitive sector, supplying packaging for food products mainly.

The shares have been very illiquid when I've tried to deal in this one before, so I won't be revisiting it unless the price becomes so cheap that it's a total no-brainer. I don't think it's there at the moment.

That's me done for the day, and the week.

Wishing you a pleasant weekend.

Regards, Paul.

(as mentioned above, Paul has long positions in ENTU and EPWN, and no short positions. A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.