Good morning,

Today I have Xaar (LON:XAR), Haynes Publishing (LON:HYNS) and Sutton Harbour Holding (LON:SUH) on the menu.

In Part 1, Paul is covering Impellam (LON:IPEL), Communisis (LON:CMS) and Parity (LON:PTY). Click here to read.

Onwards!

Share price: 433p (-1%)

No. shares: 77.8m

Market cap: £337m

There has been a delayed reaction to this statement from the inkjet technology company, as the shares have been dropping and recovering as I've been typing!

The Board now

expects total revenue in the second half of 2016 to be similar to the

£44.5 million recorded in the first six months of the year, before

taking account of revenue delivered by the acquired EPS business which

contributed to the Group from 1 July 2016.

Checking back to the outlook at time of the H1 results:

In the shorter term, despite increased competition in the ceramic tile

sector, the Board anticipates revenue growth in the second half of 2016

compared to the first six months of the year, before the addition of the

newly acquired EPS business which contributes from 1 July 2016.

So the anticipated revenue growth in H2 has not materialised.

But, more important than sales, the company reassures us today that: "The Board's expectation for

overall full year earnings remains unchanged."

The key element remains the Ceramics division:

"initial demand for Xaar's new 2001 and 2001+ printheads is strong following the launch of those products in September. Longer than expected customer printer re-designs and manufacturing ramp up, combined with the competitive pressures we have previously highlighted in this sector, are expected to result in lower Ceramics sales in the second half of 2016 than previously anticipated.

I'd give the company credit for acknowledging that it is finding the competition to be increasingly tough in ceramics. Too many companies pretend that events are entirely outside of their control, rather than admitting that they are finding it a challenge to compete with their peers.

Again, at H1, it said "this is an increasingly competitive global market and pricing has inevitably come under pressure."

The other divisions are doing better: Packaging sales are ahead of expectations, there is high demand for the new Thin Film printheads, royalty revenue is about the same.

My opinion:

I have a bit of history with these shares, buying and selling them at various times in recent years.

Overall, I like the business. This comes with a few reservations - for example, its objective is to reach sales of £220 million by 2020. Besides how difficult that will be (revenues last year were £93.5 million), I much prefer to see objectives stated in terms of return on capital, operating margin or even just plain old net income. Anything except sales (or EBITDA)!

As we can see from today's update, sales can slip in such a way that earnings are undamaged. And in 2015, Xaar's revenue fell 14%, but the adjusted operating margin remained quite high at 22%, so that in the end it was a reasonable result once you excluded some restructuring costs.

On balance, there is probably no need to rush into the shares at the current price, given the mixed picture across the company's various divisions and the c. £19 million PBT forecasts (vs. £336 million market cap).

It's worth keeping an eye on, though. The market has a fantastic track record of getting Xaar wrong, on the upside and the downside, so there are likely to be further opportunities!

(Also worth noting from a separate RNS today that Xaar is ramping up investment in 3D Printing, In Nottingham and Copenhagen - a potentially lucrative growth opportunity).

Haynes Publishing (LON:HYNS)

Share price: 117.5p (+0%)Market cap: £18m

This publisher of technical manuals has been trying to revive itself for the past several years, as financial results have been less than inspiring - revenues creeping lower and the company swinging into statutory losses for the last two years running.

So today's news is a bit surprising: this struggling business is going on the acquisition trail! The £2.4 million purchase is rationalised as follows:

The acquisition of OATS complements Haynes' professional offering by

providing HaynesPro customers with comprehensive information on

lubricants as part of its technical database. It will further strengthen

the relationship between Haynes, parts distributors and oil companies.

It sounds reasonable, but wouldn't it make more sense to do this from a position of success and financial strength? Net funds were sitting at £0.5 million in May.

The consideration has been financed through a combination of cash and

borrowing, funded through an increase in the Haynes UK bank overdraft

facility.

The deal appears to be a signal of positive ambition from J Haynes, son of the founder of the company, who stepped into the CEO role in March of this year (having previously served as Chairman).

My opinion:

The various restructuring charges have taken a heavy toll on results, but their result has been to outsource printing and distribution - almost certainly a wise move!

Haynes family members retain large stakes, so perhaps external investors should take this acquisition as a cue to worry a little less about the £15 million pension scheme deficit (£31 million of assets against £46 million of liabilities).

Indeed, a flat dividend has been paid over the past three years (7.5p annually). Management and the board certainly aren't panicking.

And I can see why some bottom-fishers might be tempted. £2.5 million of (pre-exceptionals) operating profit was generated last year. Paying 7x this amount, at the current market cap, is superficially attractive.

I haven't seen much evidence yet that the core business has troughed out, however, so I'll probably stay away.

Sutton Harbour Holding (LON:SUH)

No. shares: 96m

Market cap: £24m

Interim Results for the six month period to 30 September 2016

This is a special situation, as the company is under Strategic Review, and might end up being sold. It owns a number of unusual assets, including a leasehold on Plymouth Airport (closed since 2011). How that land might eventually be used will dramatically affect SHH. According to today's update:

The final Department for Transport Review of the viability of re-opening the former Plymouth Airport is still awaited and the Group will update investors as soon as it is available... The Plymouth and South West Devon Joint Local Plan will be subject to an independent Government Inspector's scrutiny at the 'Examination in Public' ("EiP") currently scheduled for Autumn 2017.

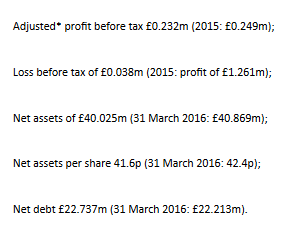

A long wait might be in store here. The only attractive element to this complicated saga is the considerable discount to NAV (£24 million market cap versus £40m NAV).

I hope you like receiving your SCVR in two parts, when Paul and I are each at the wheel!

Until tomorrow,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.