Good morning!

I'm back in the UK, having flown back Sat/Sun on the "red eye" overnight BA flight. I used most of my Avios points to upgrade to a flatbed, thus enduring somewhat mitigated discomfort. The brand new Dreamliner 787 really was impressive though. Twin-engined, wide-bodied, and very much a step-change downwards in terms of engine roar. I was impressed with the push in the back acceleration on take-off, but with so little engine noise, did have an anxious few moments wondering whether the pilot had put his foot down enough to achieve lift-off. I need not have worried of course.

24 hour airport operation must surely only be a matter of time. Tough luck to the NIMBYs who bought houses under the flight path, in the full knowledge that planes make a loud noise. I like seeing planes take off & land, so would happily live under the flight path. Something like a 787 glides in almost silently, like a giant, graceful eagle, so anyone who objects to that should move elsewhere.

I'm going back to Abu Dhabi in early Dec 2016, to the same hotel, the Yas Viceroy. I've stayed in lots of top hotels, but have never before experienced such an astonishingly high level of service. Nothing was too much trouble, and the staff were all so courteous and happy.

I only paid for a standard room, but 2 upgrades later, I was in the Presidential Suite, on the 1st floor, directly overlooking the slow corner of the F1 track. Where else can you conduct your ablutions in pole position?

Every now & then, one would hear a blast of high octane exhaust gases, and I could raid the minibar and enjoy myself watching fast cars roar past. The Manager told me that our suite was booked by the same customer every December, for the Grand Prix, and he pays a £5-figure sum for the peak 4 days. All the furniture is removed, and it is used as a hospitality area for his friends.

So it was a remarkable treat for me, paying next-to-nothing to enjoy the same suite. Here's half of the living room, that doesn't overlook the F1 circuit:

Here's a panoramic shot of 180o of the living room. See the F1 racetrack on the left:

Sadly, I missed Eurovision, but will crack open the duty-free vodka and "enjoy" it with friends later this week, on catch-up.

Late report for Thu 12 May 2016

A sense of nagging guilt about having a duvet day on Thursday last week overcame me last night. So I filled in the gap by writing a SCVR for Thu 12 May 2016 here. It threw up 2 lousy companies, and 1 potentially interesting one - XLMedia (LON:XLM) .

I have an aversion to overseas companies which list on AIM, as so many have something wrong. However, XLM looks quite interesting, and it's going on my watch list. Mind you, I would only ever risk a small amount of capital on an Israeli AIM-listed company - position sizing is everything.

Avanti Communications (LON:AVN)

Share price: 88.9p (up 3.9% today)

No. shares: 147.4m

Market cap: £131.0m

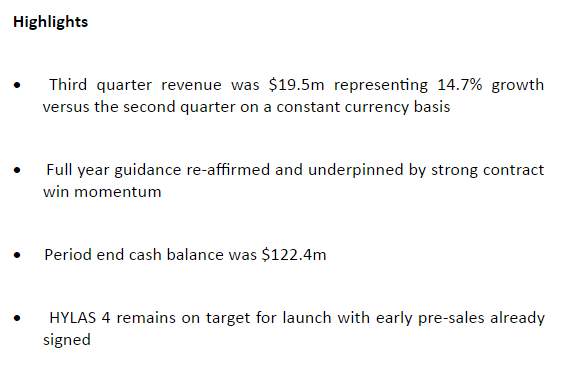

Q3 2016 trading update - looking at this highlights here, one could be forgiven for thinking that things are going well at this satellite operator:

I'm suspicious that the company refers to sequential quarter-on-quarter growth, and not the more usual comparison with the prior year. So I'm going to check to see what the company said this time last year.

By deduction, I calculate that Q3 turnover last year was $17.8m (taking the Q3 2014/15 YTD figure of $48.9m, and deducting the 2014/15 H1 turnover of $31.1m). So this year's Q3 turnover figure is up 9.6% on the prior year Q3.

That's a lousy result, because the company desperately needs to increase revenue hugely, in order to get anywhere near breakeven.

Outlook - as always with this company, it's more jam tomorrow:

Guidance for approximately 50% growth in continuing business revenue on a constant currency basis in the full 2016 financial year is re-affirmed. This guidance is underpinned by the strong and ongoing contract win momentum, with an element of revenue that we had expected to be recognised in the third quarter, moving into Q4.

EBITDA - last year, the company reported positive Q3 EBITDA of $1.6m.

This year, the company reports a fall in Q3 EBITDA to only $0.4m, yet it reports this as if it's an improvement (and omits to mention the deterioration against last year!) How misleading:

EBITDA was $0.4m due to the growth in revenue above the Group's largely fixed cash cost base.

In fact, the entire announcement seems completely delusional. The elephant in the room is debt - Avanti is clearly heading for disaster, due to its extremely expensive debt mountain.

Balance sheet - Avanti has financed its satellites through very expensive junk bonds, of $645m, yielding 10%. So the interest bill on that is obviously $64.5m p.a. The problem is, that the company is not generating any cash to service those interest payments. Q3 EBITDA was negligible, at $0.4m.

Therefore, unless there is a dramatic increase in revenue & profit, this company will inevitably go bust. As things stand, the equity is clearly worth nothing, and it looks an absolute slam-dunk short. The trouble is, funny things can happen - shorting this share is a very crowded trade, and you can get horrendous spikes up with heavily shorted shares.

My opinion - it seems almost inevitable that the bondholders will end up owning this company. It is not generating any cash, and hence will not be able to service the interest on its debt mountain, let alone repay any capital, due in 2019. So this is a zombie company. There might perhaps be a debt for equity swap at some point, all but wiping out existing equity holders, as happened at Afren for example, shortly before it went bust.

I was talking recently to the CEO of a company which re-sells satellite capacity, and he told me that there is relentless downward pressure on pricing. Therefore, companies like Avanti are seeing greater usage of their satellites, but the unit price is falling, largely negating the benefit of increased usage. This is confirmed from Avanti's own figures - although of course they don't flag this point, because their announcements are just PR puffery, designed to mislead, not inform, in my view.

You only have to look at the capacity usage stats - Avanti says it is within the 25-30% range in Q3 this year. The same stat last year was "at the upper end of the 15% to 20% band in Q3 2015, having increased from the 10% to 15% range in the same period in the prior year."

So, despite a big increase in usage, Q3 revenue only grew 9.6% Y-on-Y. The reason has to be a big fall in the price charged, not mentioned today of course by the company. I seem to recall the CEO of the satellite services reseller mentioned above telling me that prices are falling something like 20% p.a.. So Avanti has to grow its volumes by a considerable amount, in order to just stand still.

Avanti needs a massive step change upwards in revenues, to get anywhere near being a viable business.

Overall, this looks a total dud. Insolvency looks inevitable, it's only a matter of time before it runs out of cash, and the bondholders wipe out equity holders.

You would have to be completely out of your mind to buy this share, in my view. The company is the living dead - due to its insurmountable debt pile. This is not mentioned in today's announcement. Instead the company makes this appallingly misleading comment:

Balance sheet

Period end cash was $122.4m. Avanti has additional consented credit capacity of $71.0m. As planned, the Group has made good progress towards securing additional liquidity. Several different facilities have been offered and the most attractive is in documentation.

No mention at all of the $645m 10% bonds!

The company does indicate that revenue is likely to rise considerably:

We are intensely focused on increasing utilisation of our existing capacity and driving sales on HYLAS 4, such that we will see a very significant growth in revenue in the medium-term with a de minimis increase in Avanti's cash cost base."

That's great, but turnover needs to go up by a colossal amount, to start generating enough cash to service the interest on its debt. With price deflation ongoing, and technology rapidly advancing, this is a terrible business model - huge up-front costs, to put a satellite into orbit, which will probably be obsolete in a few years' time. No cashflow, and an ever-growing debt mountain. This is probably the worst share on the UK market, and that's saying something.

I see that two of the worst companies on AIM have had their listings cancelled today. So good riddance to both Phorm, and Litebulb. Both were absolutely terrible companies.

Phorm in particular destroyed a remarkable amount of shareholder value - the accumulated deficit on the P&L was over $317m in the last accounts published.

Only a few hundred more terrible companies to go, and AIM might start to look more sensible. It's a pity that so much junk has been floated on AIM, because it dilutes the perception of the several hundred good companies on the market.

£EVRH

A new listing on AIM today. This company is a "creator of virtual reality content".

I wonder how long it will be before they run out of cash?

Seeing Machines (LON:SEE)

Announces a deal to develop its technology for automotive use, with a separately funded company.

No financial details are given. The excerpt below suggests to me that SEE is probably only going to have a minority stake in the newco. Still, at least this approach mitigates cash burn. Presumably the newco will be accounted for as an associate:

...signed a term sheet with a US-based investment firm with extensive experience in automotive technologies, for investment into a separately funded company solely focused on commercialising Seeing Machines' technology in the automotive market. Seeing Machines would retain a significant equity stake in the new company.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.