Good morning!

This market certainly feels buoyant at the moment. It's the GARP (growth at reasonable price) shares in my portfolio that are really zooming up. My value shares aren't budging much, so it's definitely growth that the market is most interested in right now.

The trouble is, quite a few of my GARP shares have now become GAFP (growth at full price), or even GAHP! So what to do next? Should I sell things once they become fully valued, which feels the logical thing to do? - but very often turns out to be a terrible mistake, as good growth stocks can continue rising for a long time, long after they start to look fully priced. The growth can mean that companies beat broker forecasts by a lot, so things you thought were fully priced, were actually still cheap - it just hadn't yet been reflected in results or forecasts.

It's a tricky balancing act. In my view it's just a question of carefully re-appraising each individual share. Is the growth potential real? What could go wrong? As several interviewees in my audiocasts have said - top-slicing a bit of your holding (say 20%-ish) when the price has risen a lot, works well - because you keep your core holding, but have banked a bit of the profit to reduce risk. Also you then have a pot of cash to buy back on any dips.

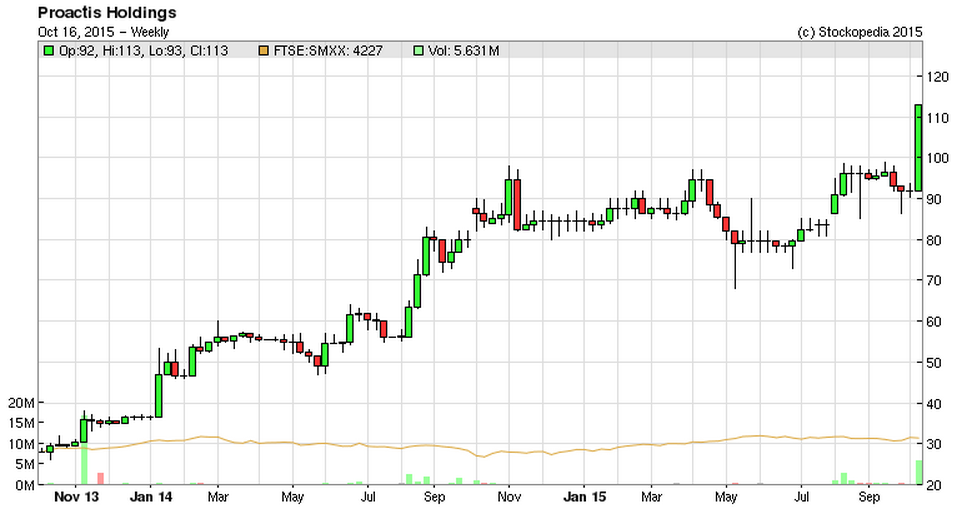

Proactis Holdings (LON:PHD)

Share price: 116.5p (up 13.7% today)

No. shares: 39.5m

Market cap: £46.0m

(at the time of writing, I hold shares in this company)

I see that Proactis Holdings (LON:PHD) shares have shot up today, to 116.5p, which is quite surprising. A reader asked me for feedback after my meeting with the CEO & FD earlier this week, so I'll give my thoughts about it here. I came away very impressed. It's a share I've held for a while now, and see as a core long-term holding in my personal portfolio.

Proactis (website here) is an acquisitive software group, which has made 3 small bolt on acquisitions in the last couple of years, all of which have gone very well. The strategy is to build a suite of software products all addressing various aspects of procurement - so it's about spend control for clients.

Proactis already has 500 "blue chip"clients, a good spread of public and private sector. Crucially, the churn rate is low, mgt said it's only about 5%. Therefore a very high percentage of revenues are contracted, so recurring, hence the risk of a profit warning should be very low. New clients added on top increase the recurring revenue further. There are also cross and up-selling opportunities which grow recurring revenues further each year.

Acquisitions - the next steps are more, and bigger acquisitions. It's clear that the company is at advanced stages with potential targets. I'm fairly relaxed about this, as the criteria for target companies are the same as the existing group - i.e. they will only buy companies with big recurring revenues, and which are already profitable.

Inevitably there will have to be Placing(s) to fund further acquisitions, that's obvious from one look at the rather weak balance sheet. Although I do take on board the argument that companies such as this, with contracted, recurring revenues, can legitimately stretch their balance sheets further than other companies - since the income side of things is so reliable.

That's why I'm surprised that the share price has gone up today, as I would have expected buyers to wait for the next Placing to buy stock.

Supplier network - the other part of exciting growth potential is likely to come from the roll-out of Proactis's supplier network product. This is being trialed with Screwfix. It's not dissimilar to what Tungsten (LON:TUNG) are trying to do. However, whereas Tungsten are using a sledgehammer to crack a nut, with a hugely expensive, slow & complex on-boarding process, Proactis has taken the completely opposite approach.

So Proactis are targeting SMEs, of which they already have about 1m on their system, being the supplier base of Proactis's blue chip clients. The plan now is to open up this supplier base into a network - which is simple and easy to do - the suppliers set themselves up (i.e. enter all their own standing data online), in return for an annual fee of just £50. If there's a, say 20% take-up rate, then that's an additional £10m p.a., very high margin, income from Proactis. So transformational stuff, if it works.

Why would suppliers want to join the network? It would give them access to a dashboard, where they can see what stage their invoices have reached within the client company (i.e. their and Proactis's customer). This would avoid the need to ring up, email, etc, to chase invoices. It will all be done electronically, as well as actually rendering invoices electronically. The £50 annual fee is deliberately low, to make it a no-brainer for suppliers to sign up.

Accelerated payment - is the next step, and is ready for trial launch. This is the same concept that Tungsten dreamed up, but have executed so badly, so far. Proactis are doing the same thing, using an external finance provider, and it's ready to go. Suppliers press a button to get paid instantly, in return for giving away a discount on the invoice.

The finance provider believes that the take-up rate could be about 10% - remember these are SMEs, who are very often starved of cashflow - and if so, would be nicely profitable.

My opinion - Proactis shares are not cheap, but nothing good is at the moment. However, with 6.1p adjusted EPS just delivered, the PER is slightly under 20 - so not outrageous for a company with growth potential.

I don't want to get too excited about it, as that proved disastrous with Tungsten. However, this company is a lot more sensible, because it's already profitable, not burning cash like there's no tomorrow. So you can (just about) justify the valuation on the existing business, and the growth is thrown in more-or-less for free.

We don't know what the take-up rate will be for the supplier network, and accelerated payment services. Also planning several, large acquisitions, could put a lot of pressure on management, and if they get it wrong, opens up risks.

Overall though, management here seem to know what they're doing, and have very ambitious growth plans underway. You can meet management too, as David Stredder cornered them getting into/out of a cab in London yesterday (!), and persuaded them to come along to Mello Beckenham on Monday, 19 October. Usual info on how to book, here. The other company presenting is Judges Scientific (LON:JDG) so it should be a packed event, as two popular companies coming along.

Connect (LON:CNCT)

As a quick update to my report earlier this week on this distributor/logistics group. The company's advisers have been in touch, and asked if I would meet with, or speak to their FD, to run through the points I've raised about their weak balance sheet.

Naturally, I agreed, so we're trying to find a mutally convenient time to discuss. I will report back to readers how we get on.

As a general point, I'm always more than happy to engage with companies & their advisers, to discuss anything in these reports, especially if they think I've got the wrong end of the stick. At the very least, I'm happy to put both sides of the story. Worst case scenario, we can agree to disagree.

Rightster (LON:RSTR)

Share price: 10.5p (unchanged today)

No. shares: 367.6m

Market cap: £38.6m

Strategic review & offer period - reading between the lines, it sounds to me as if existing big shareholders have probably refused to pour more cash into this basket case, so it's put itself up for sale.

As the Chairman of a listed company said to me recently about small caps, "You don't get a good price by advertising that you're for sale. You let them come to you, and persuade you to sell!"

This bit, saying that the company;

...has commenced a formal strategic review of the options open to the Company to maximise value for Rightster shareholders. The strategic review will be wide-ranging and the Rightster Board will consider all strategic options available to the Group including a strategic partnership, acquisition(s) to increase the scale of the Group, corporate divestitures, a sale of the Company or a new debt facility to continue to invest in the Company.

That says to me that they're desperate, and will consider anything. Which is hard to reconcile with a market cap that's still high, at £38.6m, for a company which has conspicuously failed to demonstrate that it has a viable business model.

Maybe a white knight (from silicon valley perhaps?) will come along with bulging pockets (i.e. full of money), and boundless optimism?

My opinion - I believe that the stock market is the wrong place for blue sky companies. The failure rate is astronomical. They often only come to the stock market because venture capital or private equity have rejected it, or won't pay anywhere near as much as the vendor wants.

I've repeatedly warned readers here about Rightster being very expensive, and very high risk, so hopefully nobody here got caught on it.

Nothing else to report on today, so I'll knock off for the week now - some friends want to meet me for drinks after work in Canary Wharf, so I need to get a haircut before making an appearance.

Have a smashing weekend, and see you back here on Monday!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in PHD, and no short positions.

A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. these reports are purely personal opinions only. They are never advice, nor share recommendations. The onus is on readers to DYOR)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.