Good morning!

There's very little news today. As usual, when the alarm goes off at 7am, I reached out of bed for my iPad, and had a quick read of the RNS to see if there's any interesting news - and since there was hardly anything today, treated myself to a lie in!

Mind you, I will say that these quiet summer days do throw up some excellent trading opportunities - with volumes light, there are plenty of fundamentally good companies seeing their shares drop 10% or even 20% for no particular reason. Or at least, over-reactions to maybe slightly bad news. I'm spotting one or two nice little profitable trades to do every day at the moment, where clumsy sellers try to offload into a quiet market.

I should mention that I'll be on holiday next week in Spain, taking advantage of the weak Euro, but these reports will continue, but they might be a little shorter than usual, and have fewer graphics in, as they're not so easy to do on my Chromebook. Realistically, there will also be the headwind of holiday hangovers to battle against - TripAdvisor says that the hotel I'm staying at does particularly good jugs of sangria, so am looking forward to that!

Ed's New Year NAPS - I commend this article (by the boss!) to readers - Ed used StockRanks to pick a selection of 20 stocks at the start of this year, and he's published the results so far - showing a superb 29.5% return in just over 6 months!

Ed has rebalanced the portfolio, and in this article runs through which stocks are out, and which are in.

I think this approach confirms that the StockRank system works, and that it can save us a huge amount of time by giving us a ready-made shortlist of shares which are likely to perform better than average.

Although as I've demonstrated in these articles (by weeding out problem stocks such as China AIM stocks), a degree of human intervention is sometimes necessary and beneficial. Or you can take a completely mechanical approach, and have no human intervention at all - each to their own!

It's a really good article anyway, so well worth a read.

Grafenia (LON:GRA)

Share price: 19.4p

No. shares: 47.6m

Market cap: £9.2m

Trading update - this small online printing company says that;

Post the last market update, trading continues to be broadly in line with the Group's internal budget.

Surely every market update will be "post the last market update"? So I'm not quite sure what the point is of the first five words above. Broadly in line = slightly below, as usual.

Brokers are forecasting 1.8p EPS for this year, so if we assume it might be say 1.7p, then that puts the stock on a PER of 11.4. That looks too expensive to me, for a small business that looks ex-growth, and seems to be just chugging along in the slow lane.

That said, it generates plenty of cash, and has paid generous (albeit shrinking) dividends over the years. The forecast divi yield for this year is 8.3% - probably unsustainable though, as it will be paying out pretty much all earnings.

Two new formats that the company is trying, Marqetspace, and Nettl, seem to be making some progress, although no mention is made of profitability from those new activities.

My opinion - I suppose the bull case is that the company is trying out new ideas, and one or more might take off, whilst the legacy online printing business generates enough cash to pay a generous divi.

It doesn't interest me - the trouble with something this small, is that you lose so much on the Bid/Offer spread, that usually at least the first year's divi is already squandered before you've even received it. Also, if something goes wrong, then it can be impossible to sell without taking a huge haircut. So personally I try to avoid micro caps unless there is a very compelling (i.e. potential multi-bagger) reason to get involved.

Lavendon (LON:LVD)

Share price: 187p

No. shares: 169.6m

Market cap: £317.2m

(at the time of writing, I hold a long position in this share)

H1 trading update - shareholders probably breathed a sigh of relief yesterday, when this equipment hire group (specialising in aerial platforms such as cherry-pickers) updated the market, because two other equipment hire companies, Speedy Hire (LON:SDY) and HSS Hire (LON:HSS) had both put out quite nasty profit warnings recently.

The bullet points sound very bullish, but the revenue figures look uninspiring to me - revenue from rentals was only up 1% in H1, with a very slightly better trend in Q2 than Q1, but nothing to write home about.

Although the company does say that margins & ROCE have improved too.

Outlook - the company doesn't explicitly mention performance against market expectations, which is disappointing.

It's interesting to compare the Directorspeak this time last year with this year. Last year (on the back of revenues up 7%) they said:

Board increasingly confident of delivering its expectations for the year

and this year they say:

Board remains confident of delivering further progress for the year

So I think it's fair to say that a "further progress" comment isn't as strong as "confident of delivering its expectations". There again, the figures aren't as good this year - revenues only up 1%, against being up 7% at the same point last year.

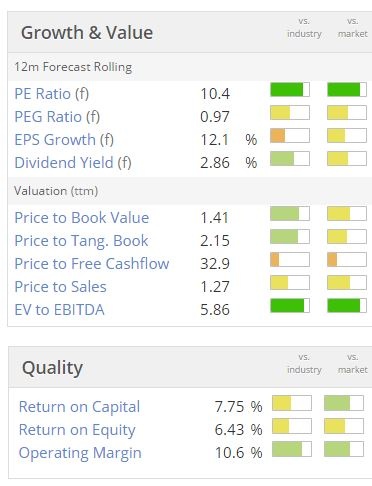

Valuation - this looks reasonable. I focus on PER of course, but also Price to Tangible Book Value is important for equipment hire companies. Most seem to be about 2 times or just above, which looks fine to me. I'm reluctant to pay much more than that.

My opinion - I've bought a few of these shares this week, mainly as a short term (a few weeks or months maybe?) trade. The reason being that the shares did a nice whoosh up a few weeks ago from 180p to peak at 210p, as traders saw a chart pattern they liked. However, the recent SDY and HSS profit warnings probably put the willies up them, and it came back down to 180p.

So my rationale is, that now we've had a reassuring (if unspectacular) trading update from the company this week, then the same traders might well return to take it back up again? Plus I think it's looking pretty decent value on fundamentals too, and as a cyclical company, should be well placed to benefit from this growth stage of the economic cycle.

DX (Group) (LON:DX.)

Share price: 84.7p

No. shares: 200.5m

Market cap: £169.8m

Trading update & appointment of joint broker - Numis has been appointed as joint broker, so presumably that means the company wants to raise some additional equity? DX has a weak balance sheet, with negative net tangible assets of -£11.6m, which seems to rely on a relatively small amount of bank debt, plus deferred income - i.e. up-front cash payments from customers (which are accounted for within cash obviously, but also as a creditor).

So maybe the cash position has got a bit tight, or they might want funds to make an acquisition? DX was brought to the market by a private equity firm, Arle Capital. Investors need to be so careful when buying shares being floated in order to provide a PE firm with an exit - they nearly always leave behind too much debt, over-price the float, and are obviously selling for a reason - usually because the prospects are not so good.

Sure enough, shares in DX have disappointed. I think the jury is also out on where they actually make their profits. Parcels delivery is highly competitive, and low margin. So how come DX produces such a high margin? My belief is that the declining service provided for solicitors is what's generating the big profits, but a fund manager that I discussed this with, who holds this stock, insists that is not the case. So I'll do some more digging when the next set of figures come out.

Anyway, the financial year end was 30 Jun 2015, and the company commented yesterday as follows:

Against a challenging backdrop, the Group's performance in the second half of the financial year has been satisfactory, with cash generation remaining strong. Full year results are expected to be in line with current market expectations.

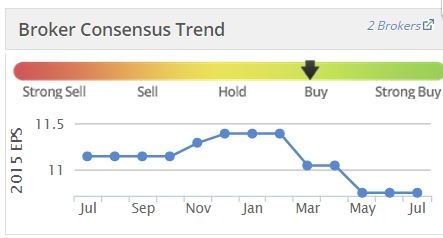

Clearly that sounds encouraging. Although the bar has been set lower in the last few months, to enable them to step over it:

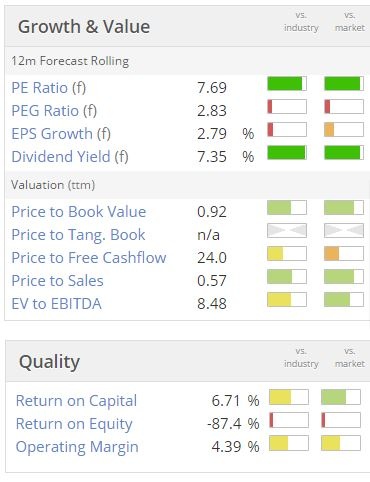

Valuation - on the face of it, this stock looks remarkably cheap, with a divi yield almost as high as its PER:

My opinion - something doesn't feel right about this. Why are the shares so cheap? I remain of the view that, for whatever reason, current levels of profitability are probably not sustainable. That's what the market is telling us too, by valuing this company on such a cheap PER.

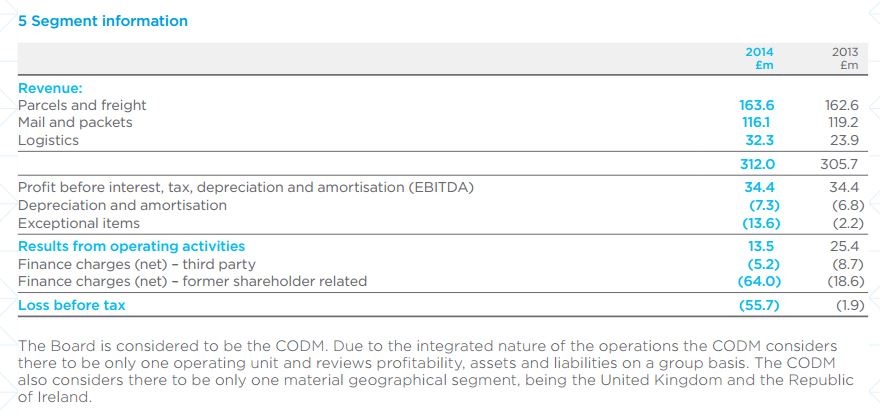

Looking at the last Annual Report, the company mentioned "a number of challenges, including the structural decline of the mail market", but says that "the vast majority of DX's revenues is in the growth area of parcels". I have italicised the word revenues, because revenues are very different from profit! So rightly or wrongly, I remain of the view that most of their profit probably comes from the declining mail & packets division (especially DX Exchange), and not from the parcels division.I've skimmed through the whole of the 2014 Annual Report, and can't find any clues as to the profitability of the parcels vs the mail & packets activities of the company. Note 5 gives the revenue split, but not the profit split, as they state that the company operates as a single operating unit, hence no divisional split of profitability is required:

So with mail & packets being 37% of turnover (£116.1m out of £312.0m), and probably a considerably higher proportion of profits (because I suspect the core DX mail service for solicitors, etc, is likely to be much higher margin than their parcel delivery services), but being in permanent structural decline, then it is clear why the shares are on a low PER.

All done for the week! Have a super weekend. My next report on Monday will be from sunny Spain!

Best wishes, Paul.

(of the companies mentioned today, Paul has a long position in LVD, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. These reports are just Paul's personal opinions. They are NEVER advice, or recommendations).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.