Good morning!

FDM Group (Holdings)

This morning sees the return of this Brighton-based IT company, which trains and hires out IT consultants. It's a fantastic business in my opinion, and one that I am familiar with because it has previously been stock market listed in the UK. The IPO has been priced at 287p per share, and the proceeds are being used to cash out for the Private Equity backer of the MBO a few years ago.

When the seller is PE, you can be virtually certain (in my opinion) that the offering will be significantly over-priced, and that you'll probably end up regretting having funded their profitable exit. After all, if it was great value, they wouldn't be selling!

Things are further complicated in this case, in that the founder/CEO, Rod Flavell, who is still in situ, conducted what I considered to be an opportunistic and unethical buyout of the company in 2010 for just £28m. We woz robbed at the time - from memory the buyout price was a PER of about 6, which was ludicrously under-priced for a decent growth company. Minority shareholders (a number of large ones I liaised with at the time) were left in no doubt that if they didn't accept the buyout offer, then there would be trouble - management effectively put a gun to shareholders' heads and implied - sell up or else we'll walk.

Here we are just four years later, and they are bringing it back to market at a valuation of more than 10 times the buyout price, confirming what we shareholders knew at the time, that we were having an exciting growth company snatched from our hands at a disgracefully low price, with undue pressure being put on shareholders to sell.

Therefore I consider this company uninvestable, as having been shafted once by this management team, there's no way I'll be letting them do that again. Who's to say they won't do exactly the same thing again (i.e. buy it out at a depressed price) if the share price tanks in the future? So, lovely company, but horrible management, in my personal opinion.

Software Radio Technology (LON:SRT)

Results for the year ended 31 Mar 2014 have come in as expected, with £6.1m turnover and a loss before tax of £1.5m. Although forecasts were guided much lower after a series of profit warnings. If you look back six months then forecast turnover of £14.1m was more than double the actual result published today.

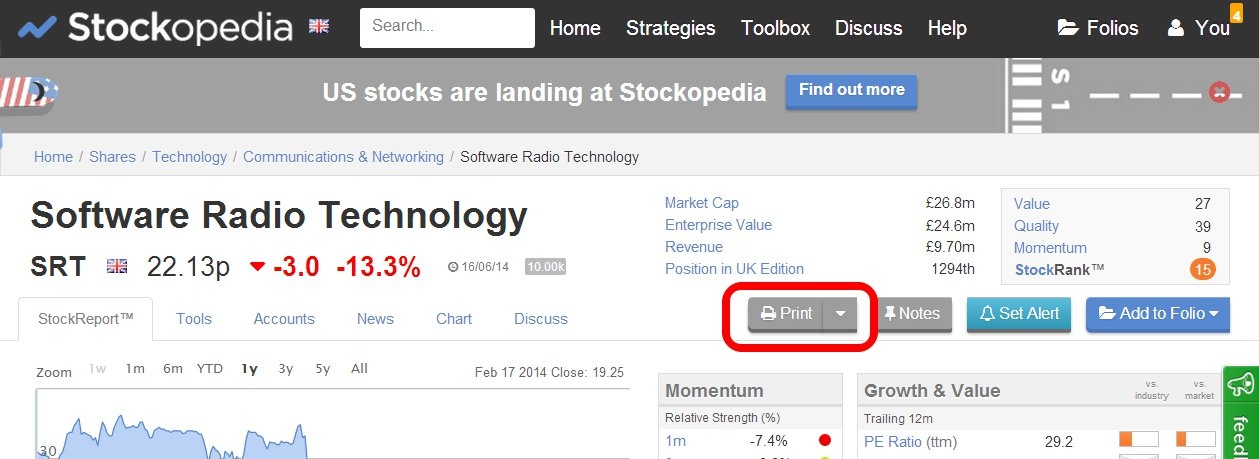

See the screen grab below, where I have highlighted the "Print" button which allows you to access historic monthly Stockopedia StockReports - really useful if you want to look back at how the valuation measures & broker forecasts have changed.

As far as the narrative is concerned, it's more of the same really - jam tomorrow, which is what this company always says. I don't think that will wash any more - the market needs to see real turnover & profits, not talk about future profits.

If you like the company, then these comments on the order pipeline do sound interesting, if they manage to deliver on them (although personally I always take market opportunity statistics with a pinch of salt, as usually only a small fraction of that figure does turn into actual orders);

We currently have active and validated AIS project and mandate market opportunities with a potential future value to SRT of approximately £200 million. With visibility of these opportunities improving, we can break these down regionally: North America: £17 million, South & Central America: £24 million, Europe & Russia: £9 million, Middle East: £38 million and Asia: £130 million. These are all sales opportunities which are in progress, but due to the nature of government driven regulations the exact timing remains challenging to predict. In the first month of this financial year we announced a Frame Order worth US$6.7 million derived from one project opportunity in the Middle East.

So if you think this is credible, then the shares might be worth a punt perhaps?

Although I also note that some caution re competition is mentioned today;

In the future we expect to see more competition entering the market. We have long expected this and it is why we have continued with an aggressive technology and product development road map to create innovative, high quality products which our customers and the end market trust. These products and solutions are all supported by attentive and reliable customer support.

Therefore, with sales having disappointed without much competition, you wonder how they are going to fare with more competition?

On valuation, the market cap at 21p per share is about £25m. That's too high in my view, as the company has not yet proven it can make sustainable profits, but instead has alternated between profitable & loss-making years in the last four years. That makes it almost impossible to value.

Also the Balance Sheet is starting to look a tad strained - in particular inventories look high at £4.2m, versus £3.5m P&L Cost of Sales for the year - having over a year's worth of inventories suggests there could be write-downs in the pipeline perhaps if those inventories remain unsold this time next year?

I note the appearance of a new £1m loan on the Balance Sheet this year, offset with £1.3m in cash, but this suggests that the cash position is getting tight. So don't be surprised if a small Placing happens, and that would probably have to be at a discount to the current market price.

Another nasty is that the company capitalises about £1.6m of product development costs each year, although the profit/loss does include the amortisation charge relating to that.

So no red flags as such, but a few amber warnings in my opinion. Above all the company needs to crack on and deliver higher sales & a decisive move into profit, as I suspect investor patience is wearing thin after several years of false starts.

Trifast (LON:TRI)

Results for the year ended 31 Mar 2014 have been issued this morning, and are very good. Underlying profit before tax is up 26%. Adjusted basic EPS is also up 26% to 5.95p.

I like this company, but the problem is the valuation, which is now getting pretty stretched. At 129p they are now on a PER of 21.7 times - a heady rating for a humble maker of industrial fastenings!

Part of the reason for the high rating is that the company recently announced what seems to be an excellent acquisition of a high margin Italian maker of fastenings. That acquisition is being funded by a new bank debt facility - I crunched the numbers in my report here on 7 May 2014.

So this company is now in a sweet spot where its equity is on a high PER, and it can therefore make earnings enhancing acquisitions of private companies on a cheaper rating, funded by debt, and thus create a virtuous circle of earnings upgrades fuelled by acquisitions and organic growth.

Including the Italian acquisition this year, I reckon Trifast could be heading for 8-9p EPS, whereas broker forecasts only seem to be currently at 7.4p. Therefore I suspect there could be more profit upgrades in the pipeline later this year. Although the share price is arguably already factored that in. This would tie in with the company's track record of regular upgrades - which is what you want - i.e. a company that under-promises & over-delivers.

It also has a very high Stockopedia StockRank of 96, which is reassuring.

On balance I think the share price is probably about right at the moment, so it's not something I would chase up in price at this valuation, and a move upwards this strong in the last two years. After all, it is only a fastenings company, so one would imagine there is limited scope for further organic growth in both sales and margins, as they must be up against thousands of competitor companies globally.

Mountfield (LON:MOGP)

This is a construction company. I've had a quick look at results published today - for the year ended 31 Dec 2013 - that's a terrible reporting timetable, we're only a fortnight away from the next interim period end! Late reporting shows sloppy financial controls in my view, so is a red flag.

There is a dramatic improvement in operating profit, which is up from £189k in 2012 to £845k in 2013.

It's the Balance Sheet that rules it out for me. Net tangible assets are negative to the tune of £4.9m. Also there is far too much debt, which seems to be mainly vendor loans which are redeemable in Jun 2016. There's also a £637k loan from a Director. So really in my eyes the company could be described as insolvent, but is being propped up by this loan funding. At some point that's going to have to be repaid, or converted into equity, so the shares are really a punt on the Directors succeeding in their plans described like this;

The Board intends to continue to grow the Group into a highly profitable, mid-sized operation that provides specialised construction services in a number of diverse but related areas. The Group's reputation has been built on its ability to undertake and to manage specialist construction services to a high level of quality and to deliver the completed project to the client on time. This will remain at the core of its strategy.

It doesn't appeal to me, unless & until they repair the Balance Sheet properly.

That's all there is time for today.

Please note that I am now taking bookings for the next Brighton ShareSoc investor social evening, next Thu 26 Jun. This is a convivial evening of drinks, a good meal, and a guest speaker, the Chairman of Synety (LON:SNTY), Simon Cleaver. I co-host the event, and try to chat to everyone, so it's all friendly & relaxed with plenty of beer flowing! Do come along it you can - the booking link is here.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in SNTY, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.