Good morning!

Tracsis (LON:TRCS)

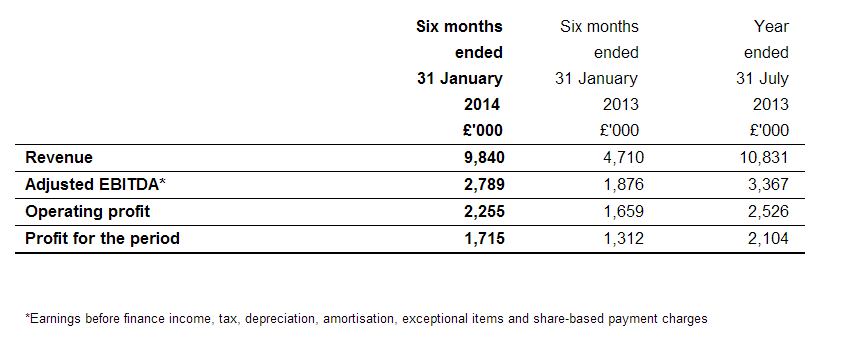

Results and trading statements from Tracsis always seem to contain good news for shareholders, and this morning is no exception. The headline figures look very good, helped by an acquisition that looks to have kicked in fully in this half year. Three performance measures are given so take your pick!

There is also a bullish outlook statement, indicating that broker consensus forecast of 11.1p EPS for this year (ending 31 July 2014) is now likely to be beaten;

The second half has started well and the full year outturn is now expected to exceed current market expectations. The Directors are confident of achieving further progress in the second half of the year, given future work flow scheduling and the strength of the sales pipeline. A number of exciting opportunities are being evaluated and 2014 looks set to be a great year for Tracsis as its overseas strategy is accelerated...

So assuming they achieve say 12p EPS this year, then at 241p the shares are on a PER of 20, so priced fairly fully already for a small cap, I would say. That said, the company has delivered consistently well in the past, so it seems to me that there is enough red meat in today's results to take the shares on another leg upwards.

A reminder too that Tracsis has an excellent Balance Sheet, with no debt, and cash of £7.6m. This protects the downside so well that you can effectively be certain that there is no risk of this company going bust in the foreseeable future. Other people might like to play fast & loose with Balance Sheets, but I don't - if you eliminate the worst downside risk (of a company going bust), then the upside tends to look after itself a lot better in the long run.

The other thing to consider is that, because Tracsis has over-delivered in the past, then its upbeat-sounding outlook is more credible than might be the case for companies which are always forecasting jam tomorrow, but don't deliver. So if management are excited about expansion possibilities, then I would say they probably have good things in the pipeline.

Framework agreements, and recurring revenues on software, plus the increasing size and geographic spread of the group, mean that my previous concerns about sustainability of profit are ebbing away.

Regenersis (LON:RGS)

Regular readers here might remember that I first flagged up the growth & value in Regenersis shares when they were just under 100p. They've since done remarkably well, rising to 358p by today, which values the group at about £178m.

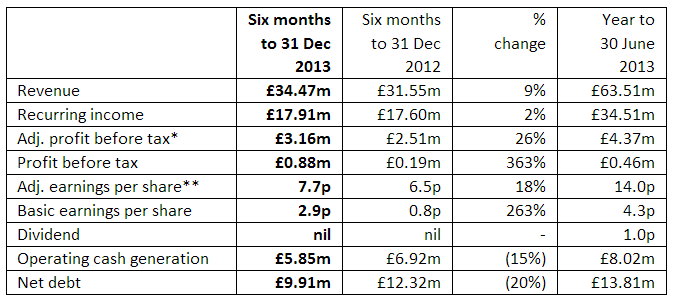

Looking at their interim results to 31 Dec 2013, published today, I'm struggling to see anything exciting there. This could be due to headwinds from currency movements, as a lot of the expansion has been into higher margin work in developing countries.

Also, I am put off by the focus of today's report to steer investors towards HOP - Headline Operating Profit, before corporate costs. This seems to me a cynical attempt to direct readers towards the most positive profit figure of the company's own definition! Whereas on conventional benchmarks (operating profit, and profit before tax), performance actually went down against the comparable period.

Adjusted EPS dropped from 8.32p to 7.64p, so these figures don't look good to me, despite all the spin.

I'm not keen on the Balance Sheet at Regenersis either, and in their shoes I would be thinking about strengthening it with another Placing. In particular I draw readers' attention to the £38.1m in long term liabilities, which is mainly bank debt and deferred consideration. This looks quite a heavy burden - it would require many years' profits to be retained within the business to pay off all of that debt. That must limit what they can pay in dividends.

Overall, at the current valuation, I think Regenersis is starting to look a bit pricey. Growth is good, but it's a low margin business really, which is carrying a bit too much debt on a Balance Sheet that has negative net tangible assets, so for those reasons it's not for me.

Ideagen (LON:IDEA)

Shareholders in this niche software company will be celebrating this morning, as it's the biggest % riser of the day at the time of writing, up 26% to 42p.

Ideagen has announced two contract wins with the NHS, for £0.4m combined value in the first year. That doesn't seem much to have triggered such a large increase in share price, but it's presumably the prospect of more NHS contract wins that investors like, as mentioned by the company in today's statement;

...These deals represent further validation of the Group's strategy and we expect to announce further NHS contract wins in the near future.

The market cap of about £50m looks pretty full now, on about 20 times next year forecast EPS of 2p, so this is well into growth rating territory now, therefore the company cannot afford to put a foot wrong at this price.

Mello Beckenham / ShareSoc Brighton

A quick reminder that it's the regular monthly Mello investor evening in Beckenham tonight.

The company presenting is Belgravium Technologies (LON:BVM), which makes rugged electronics. I've looked at this company lots of time over the years, so it will be interesting to hear an update from them.

Also, the organiser David Stredder has asked me to remind people that if for any reason they cannot come, and have booked a place, please let him know asap, as it causes him no end of problems with the restaurant if the number of attendees is different to the numbers booked.

Also, a quick plug for an investor evening that I am arranging in Brighton on 8 April. Preliminary details are here. The format will be drinks & speaker(s) [one or two AIM company CEOs], followed by a 3-course sit down meal in my favourite Brighton eatery. We're not quite ready to take bookings yet, but will be very shortly, so watch this space. It should be very relaxed & informal, and all are welcome.

Why not consider setting up your own local investor group too?

K3 Business Technology (LON:KBT)

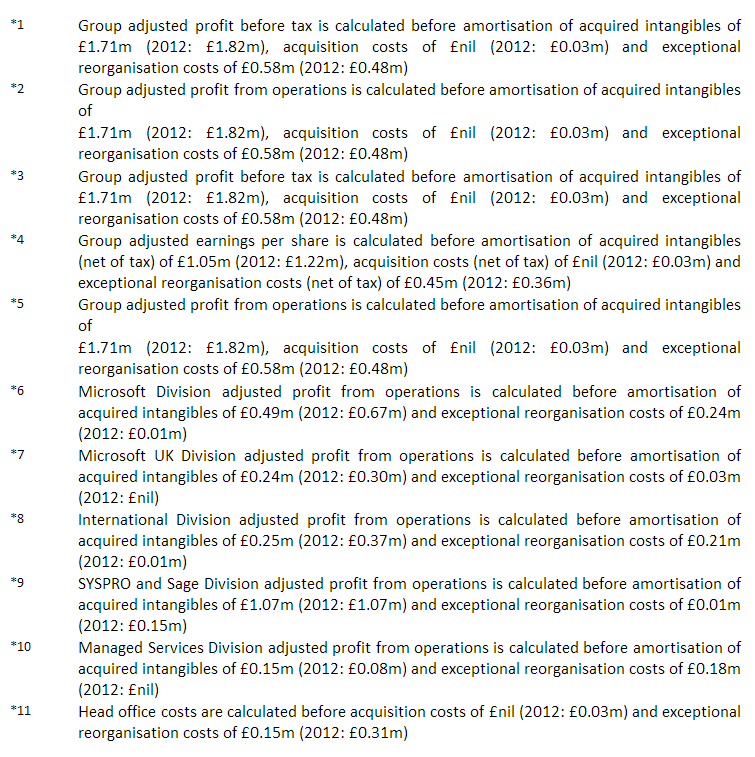

As mentioned above in the section on Regenersis, there is an increasing trend towards companies re-defining profit to pretty much whatever they want, in order to present the figures more favourably. So costs are stripped out in layer after layer, if they are considered by management to be non-recurring, or not reflecting underlying performance. Although non-recurring costs usually seem to happen every year!

As mentioned above in the section on Regenersis, there is an increasing trend towards companies re-defining profit to pretty much whatever they want, in order to present the figures more favourably. So costs are stripped out in layer after layer, if they are considered by management to be non-recurring, or not reflecting underlying performance. Although non-recurring costs usually seem to happen every year!

To illustrate the point further this morning, I have copied on the right the no less than eleven explanatory notes in today's results from K3 Bus Tech.

I'm used to ploughing through numbers every morning, but this degree of complication totally puts me off wanting to read their results at all. This is very much a case where more is less.

Also, if everyone just strips it out, what is the point of having goodwill and amortisation at all?

Anyway, I can't face ploughing through all this detail, so will just comment that K3's headline figures look as if the business is on the mend after a difficult patch, with the key items such as turnover and profit showing improvements. Companies and their PR advisers really do need to think about how to simplify the presentation of their accounts.

Also it would be better if they could resist the urge to redefine profit multiple times, and create their own TLAs (Three Letter Acronyms).

K3 still has a weak Balance Sheet, with too much debt and negative net tangible assets, so I would still consider this share as high risk. The shares have almost doubled in the last year, so people who tolerated the risk have done well here, as is often the case in bull markets.

Forbidden Technologies (LON:FBT)

Given its £36m market cap, I was expecting much stronger growth from this early stage technology company. Preliminary results for 2013 show that turnover actually went down, and was only £772k. A one off sale in 2012 apparently masked underlying growth of 33%, but it still looks puzzling as to why the market is prepared to value this business at roughly 50 times sales. If they were growing exponentially I could see why, but they are not.

It had £7.8m cash at the bank after a fundraising, and losses tripled to £0.8m in 2013.

I cannot fathom the valuation here at all.

I'll call it a day here. See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.