Good morning. I added 3 more companies to yesterday's report last night, so to review that full report, please click on this link. Lots of results today in smaller caps, so let's get stuck in!

French Connection (LON:FCCN)

Share price: 51.0p (down 16% today)

No. shares: 95.9m

Market Cap: £48.9m

(at the time of writing, I hold a long position in this share)

Preliminary results - for the year ended 31 Jan 2015 are out today. It has to be said that it's really not acceptable for shareholders to be kept waiting until 17 Mar 2015 to find out how Christmas trading went! The last trading update from the company was on 26 Nov 2014, when the company reported trading in line with expectations.

The same trading pattern as reported in Nov 2014 has continued - i.e. weak retail performance, but good performances from the wholesaling and brand licensing divisions.

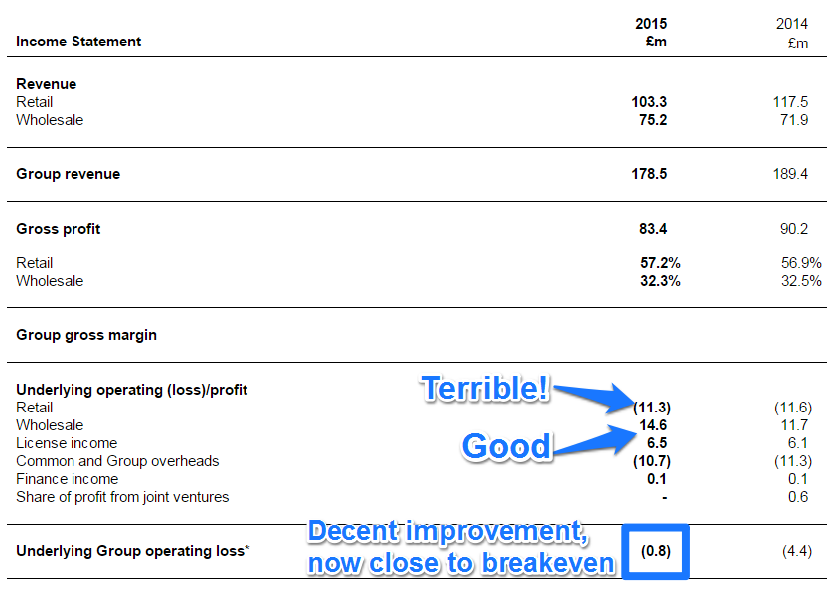

Full year results are in line with market expectations, at an underlying (excluding costs of store closures) loss of £0.8m. That's a good improvement on last year's loss of £4.4m, and a loss of £7.2m the year before that. So the trend is now established of a gradual recovery. Note that the latest results also show it becoming cashflow positive (before working capital movements) for the first time in quite a while.

Given that the 2014/15 results were in line with expectations, and showed a good improvement against prior year, why has the market reacted with a hefty 16% drop in share price this morning? Force of habit, I'm tempted to say, as we are used to being disappointed by this company. But it's actually more about the Directorspeak on current trading;

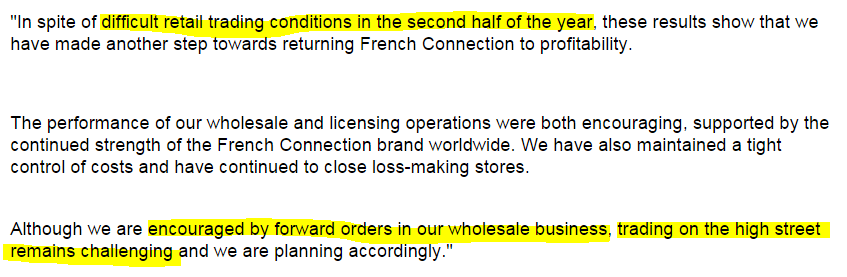

Outlook comments - these sound a bit wobbly, on the retail side of the business, which is the problem area;

Divisional analysis - as you can see from the table below, and as I have commented here many times before, French Connection is actually a very poorly performing retail business, weighing down a successful wholesale and brand licensing business. As you can see, the retail business hasn't really improved much at all, but the brand licensing & wholesale parts have done well;

Note that the retail division has shrunk, which is due to 9 loss-making stores being closed, although the benefit of that has been largely negated from the deteriorating performance from the remaining shops (LFL sales were down 3% for the year - no good at all, when you generally have costs rising).

ecommerce - I am surprised that ecommerce sales have become fairly significant - today's results say that 23% of retail sales were ecommerce sales, mainly click & collect by the looks of it. So some evidence that the company is succeeding on that front. Although one look at their website confirms the ongoing problem that the product is just far too expensive - so will only appeal to affluent, fashion-conscious people. Plus of course, at these high price points, there's no scope for getting the fashions wrong.

Strategy - You could argue this is FCCN's fundamental problem - it's too pricey for the High Street, but not fashionable enough to be really credible at the top end. Therefore it's somewhere in the middle. To my mind, the right direction to take is to largely withdraw from the High Street, since that's the area of the business that quite obviously doesn't work - as it's losing money hand over fist. Easier said than done of course, as shops are usually on 15-year leases.

Short leases - the most interesting number in today's results statement (in my view) is that the average shop lease is now only 4.4 years. At the end of a lease you can either hand the shop back to the landlord, or you can renegotiate a new lease on terms which work for both parties. For FCCN this means that, over the next few years, they should be able to largely eliminate their retail losses - by shrinking the retail estate down to just the profitable shops.

If you remove the retail losses from the above table, then you would have a business that would have made a profit of £10.5m.

Balance sheet - this remains very strong indeed, with net cash of £23.2m at 31 Jan 2015, admittedly near a seasonal high. That is about 47% of the whole market cap. So very safely underpinned, especially now the business has recovered to around breakeven.

At 2.19 the current ratio is excellent.

Net tangible assets are excellent too, at £56.4m, or nearly 59p per share. Most of that is working capital too.

My opinion - the company is steadily making progress. The downside is protected by the balance sheet, and with the company now at breakeven, there are no solvency worries. Further store closures should mean that the retail losses steadily reduce further, and I think progress on wholesale and licensing has been very good in the last year.

For the patient investor, who understands that the key issue is the lease expiry of loss-making shops over the next few years, then this special situation could provide good upside, with little downside risk now. There's also potential upside from a trade sale at some point. Mr Marks won't want to carry on battling away with this business forever. It's an internationally recognised brand, that at some point could surprise people with its value, in my view.

On the downside, it's disappointing that the outlook is lacklustre for the time being for the retail division. Overall, I'm very happy to hold for another year, as I think risk/reward is better now than it has been for a while. I suspect it won't be long for the shares to regain the 60p level where they seem comfortable. Then maybe a move back up to 100p if the company is able to deliver some better trading news later this year? Along the way, the downside risk is nicely protected by the bulletproof balance sheet & cash pile.

WANdisco (LON:WAND)

Share price: 316p (down 12% today)

No. shares: 29.3m

Market Cap: £92.6m

Preliminary results - for the year ended 31 Dec 2014 are published today, headed, "Big Data customer wins gather momentum!". Exciting! Revenue is up 40% to $11.2m, so that's about £7.6m top line, for calendar 2014. On that modest turnover, the company managed to incur an adjusted EBITDA loss of $17.9m. What?! That sounds terrible to me!

It gets worse - the loss on operations on the P&L is a mind-boggling $39.9m! The company seems to be out of cash too - it only had $2.5m of net cash left at 31 Dec 2014, despite customers having paid $19.3m up-front in deferred income.

A Placing on 23 Jan 2015 raised £18m before expenses, but that doesn't look anywhere near enough to maintain such a high level of cash burn. Bear in mind that EBITDA understates the cash burn, due to development costs being capitalised.

My opinion - investing in cash burning companies is very risky, and you need to know for sure that there is enough cash in the kitty to take the company beyond breakeven, and into profit. That doesn't look the case here at all - broker consensus shows higher forecast turnover for 2015, but a similar loss to 2014. If that's the case, then it's inevitable this company will be coming back for more money later this year, or in early 2016. Will investors be prepared to keep funding further losses?

It looks a potentially good short actually. Although having said that, the most perplexing thing is that HSBC extended a $10m credit line to the company. It's very unusual to see a bank lending to a heavily loss-making company. Although I note that WANdisco mentions a major bank as a recent contract win, so perhaps there is some other angle on things?

Anyway whatever, the numbers issued today made me recoil in horror, so I certainly won't be investing here. The chart looks, hmmm, interesting! So investors who got caught up in the hype around this share in 2013 are probably still kicking themselves.

Pennant International (LON:PEN)

Share price: 89.5p (down 9% today)

No. shares: 26.5m

Market Cap: £23.7m

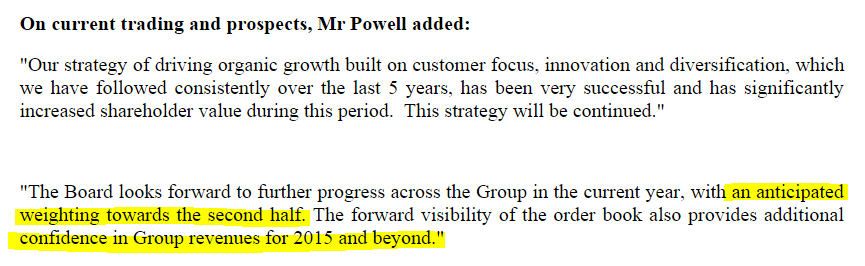

Preliminary results - for calendar 2014 are out today. The headlines look good, so why is the share price down 9% today? Must be a wobbly outlook statement, let's have a look.

Outlook - maybe the H2-weighted comments have spooked people (i.e. could be a deferred profit warning);

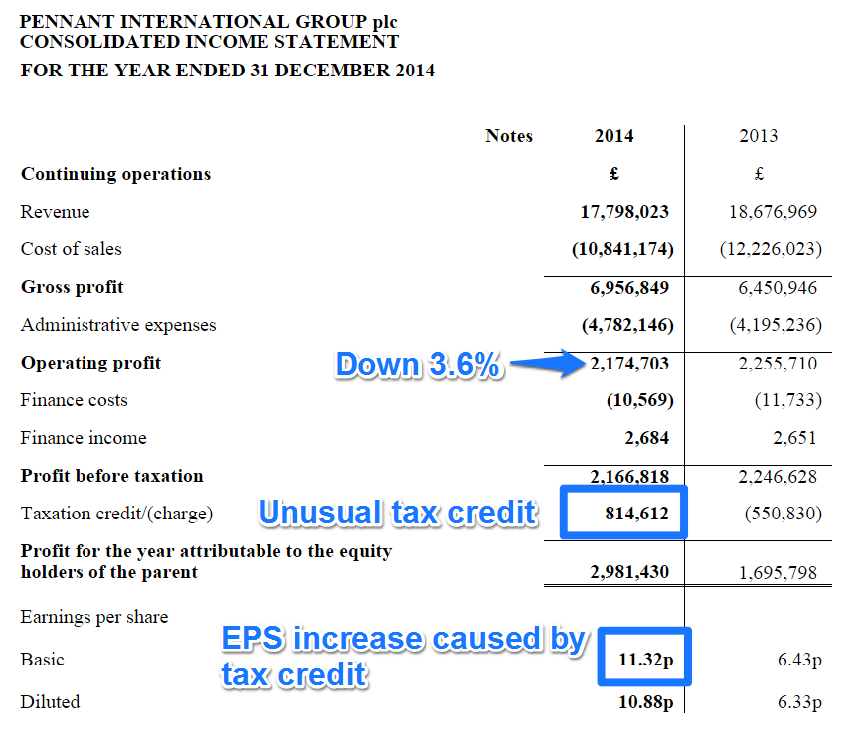

Profit & loss account - looks like I should have ignored the narrative, and just gone straight to the actual figures. It's immediately obvious why the share price has fallen back today - because the increase in EPS is caused entirely by a tax credit (relating to back-dated R&D claims). Operating profit actually fell slightly for the year, so the underlying EPS figure is probably about 6p, which would put it on a PER of 15, which if anything looks a bit expensive for a small company subject to potentially lumpy contracts.

Balance Sheet - this is excellent. Note there is some property within fixed assets, as a £1.1m revaluation gain has been recognised (through reserves, so as not to distort profit).

The current ratio is a smashing 2.98. There is net cash of £1,069k. Debtors look a little high, so that might need checking.

Dividends - the total for the year has risen nicely from 2.6p to 2.9p, so a yield of about 3.2%.

My opinion - it seems a nice enough business, but relying on large, lumpy contracts, it's probably only a matter of time before there's a profit warning. So personally I'd rather keep it on my watch list, and then just wait (years, if necessary) for a disappointment, and then buy on the dip. Why pay a PER of 15, when you don't really know how the company is going to perform in the future?

As things stand, I would price it on a PER of about 8-10, so to me it's worth about 48-60p per share, well below the current price.

EDIT: a couple of broker notes have come through to me, forecasting nearly 10p EPS for 2015. That would make the valuation stack up a lot better, if the company does deliver that sort of performance this year. Although today's comments about it being an H2-weighted year probably rule out me relying on increased forecasts until the figures have actually been achieved.

Fairpoint (LON:FRP)

Share price: 122p

No. shares: 43.8m

Market Cap: £53.4m

(at the time of writing I hold a long position in this share)

Final results - for calendar 2014.

This company has expanded considerably, from its original (but declining) activity of managing consumer debt problems (IVAs, etc), and IVAs are now only 35% of revenue. The group now describes itself like this;

How refreshing to find a company that just lists what it actually does, instead of inventing some unintelligible gobbledygook that leaves you having no idea of what the company actually does! Let's hope this starts a trend for plain English in company announcements, which is badly needed.

Profitability - adjusted EPS for 2014 came in at 17.17p, usefully ahead of broker consensus of 16.6p. Moreover, as quite a large acquisition (of a firm of solicitors called Simpson Millar) occurred half way through the year, in Jun 2014, this means that the 2015 figures should further benefit from inclusion of its full year profits in 2015, as opposed to only half a year in 2014.

Forecasts - there's an updated note out from Equity Development today, which suggests 18.0p+ is possible for 2015, depending on what acquisitions are made (none have been factored in). Fairpoint seems to be doing a good job in finding suitable acquisitions, and has the finances available to do more, so I'm guessing 20p+ might be on the cards for 2015.

Valuation - this share is always cheap, because investors don't like the activities, and the IVA activity was seen as a declining business, since people who got into credit card & loan problems before the credit crunch have now mostly been sorted out, one way or another.

However, I think there is an opportunity here for the shares to re-rate, now the IVA stuff is becoming less important. If you put it on a PER of 10, then we could be looking at a price target of 180-200p per share. Nice upside from the 122p per share they currently sit at.

Dividends - better still, shareholders are paid to wait. Paid very well actually - the total divis for 2014 rose from 6.0p last year to 6.4p this year, for a yield of 5.2%.

Net debt of £7.6m looks fine to me, at less than one year's adjusted profits.

Balance sheet - it's filling up with intangibles, due to the acquisitions being made each year, but as long as they don't overpay, and the acquisitions remain profitable, and NTAV remains positive (which it is, at £12.0m), then it's alright.

My opinion - I find these sort of activities rather unsavoury, in that I don't really want to profit from other peoples' misery - whether it's compensation claims, debt problems, etc. There again, people need these things sorting out, and as long as they're not being ripped off, then I suppose it's OK.

I'm increasingly coming round to thinking that, at some point, these shares could usefully re-rate upwards, so it might be one where I buy the dips from now on.

Regenersis (LON:RGS)

Share price: 193p (down 15% today)

No. shares: 79.0m

Market Cap: £152.5m

Interim results - for the six months to 31 Dec 2014 (so a 30 Jun year end).

Reading results from this company is like going into a new jurisdiction, where you're not really sure what any of the accounting terminology means, and have to check everything. They talk about HOP (headline operating profit), HOCF (headline operating cashflow), etc.. All in all, the presentation is over-complicated (although I like the green and black formatting), and this tends to mean I either don't bother looking at their results at all, or leave them until last.

I also have a general sense of unease about this company, in that it feels as if management are over-promoting it, and my instincts tell me that the business is maybe not as good as they make out.

The company has seen a big impact from currency translation, with about half its business done in Euros and Polish Zlotys. So turnover is only up 2.2% in sterling, but 12.2% in local currency. That's not necessarily the end of the world - if costs are also in local currency, then overall it's only really the net profit that is impacted by translation differences.

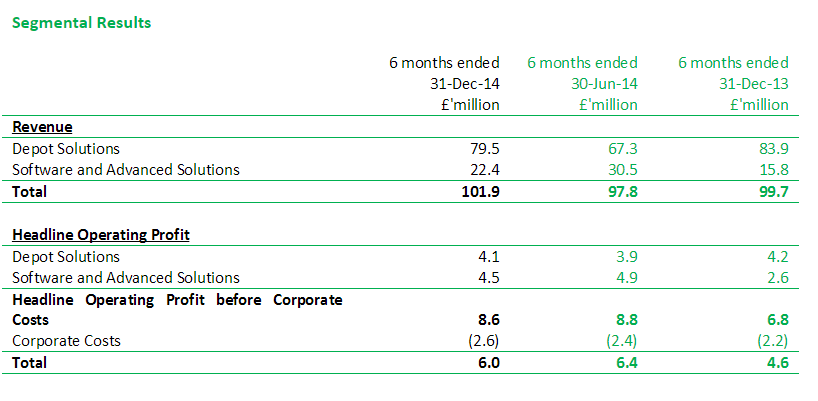

This segmental results table shows the split between low margin depot solutions work (things like refurbishing mobile phones, and repairing set-top boxes in situ), and the much higher margin software division - which I think is mainly (or wholly?) the subsidiary called Blancco, which was quite an expensive acquisition not that long ago, and focuses on certified data deletion. Management seem to think that's a good area to go into, due to cyber security, and legislation requiring secure deletion of old computer records.

The overall HOP of £6.0m shows a good uplift on prior year H1 of £4.6m, but is down on H2 of last year. So it's not clear what the trend is here.

Balance Sheet - net assets were £129.0m, and intangibles of £111.9m needs to come off that, leaving NTAV of £17.1m.

The current ratio at 1.33 looks OK, and there's no significant long term debt, other than £8.2m of provisions, and contingent consideration (for previous acquisitions, presumably).

Overall then, the balance sheet looks alright to me.

Cashflow statement - I won't get into all the detail, but my overall impression is of a not very cash generative business. Also, note that there was £1.6m of physical capex, and £2.3m of capitalised development spend.

Dividends - the forecast yield is just over 2%.

My opinion - as you might have gathered, I'm not convinced this is a bargain. The figures are much too complicated, and the way I look at it, Regenersis is probably best described as a collection of fairly low margin electronics repair businesses, with a potentially interesting software business (Blancco) bolted on. Therefore any upside looks limited from the former, and would really have to come from some serious growth being delivered by Blancco. So I'll pass on this one.

KBC Advanced Technologies (LON:KBC)

Preliminary results for 2014 look quite interesting. I approve of the strong balance sheet, and the very high debtors figure is explained in the narrative as having reduced in Jan 2015.

Trouble is, who really wants to invest in oil services companies at the moment? They're being squeezed so hard by oil producers, that it's perhaps too risky an area to look at yet. I got my fingers (slightly) burned by jumping the gun on a couple of oil services companies a few months ago, buying too early (Pressure Technologies (LON:PRES) - which has remained weak, and Plexus Holdings (LON:POS) - which seems to have found a floor at just under 200p).

Ubisense (LON:UBI)

Audited results for calendar 2014.

Turnover is up, but the company remains loss-making. Bank debt is rising, and I wouldn't invest in a loss-making company which has bank debt - too risky. The company needs to bite the bullet, and do a good-sized equity fundraising, then it might be worth a punt.

The company appointed Numis as its broker in Dec 2014, so maybe a fundraising is on the cards now that results are out of the way? It's a good concept - software to track the movement of physical goods in factories, etc, and Ubisense has a strong client list too. It just doesn't make any money.

That's me done for today. Time for a bath & a glass of red wine!

Regards, Paul.

(as mentioned above, Paul has long positions in FCCN and FRP, and no short positions, in the companies mentioned today, which may also be held by a fund management company with which Paul is associated)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.