Good evening!

I previously put up a holding page, as I overslept (my stockbroker took me out for beers last night, and that never ends well), and then had to dash off for an investor lunch in Reading, which was very interesting.

So, my apologies for today's report being late.

If you haven't already seen it, this is a very interesting article by Ed about StockRanks, in light of a few recent profit warnings, and investor psychology.

If you have any questions for Lord Lee - you can ask them here as Ben will be travelling to the House of Lords to interview Lord Lee.

Cdialogues (LON:CDOG)

Share price: 77.5p (down 55% today)

No, shares: 6.2m

Market cap: £4.8m

Profit warning - the company (which appears to be a Greek mobile network marketing company) blames poor performance, and delays in new business, for a profit warning which says;

...the Board now believes that revenue for the year ending 31 December 2015 will be below current market expectations, with EBITDA for 2015 being materially below current market expectations.

As part of its normal budgeting process, the Board is reviewing its internal forecasts for the year ending 31 December 2016. Whilst this budgeting process has not yet been finalised, it is likely that these forecasts will be lower than current market expectations.

This is not particularly surprising given that there were clear warning signs that things were not going well, with a previous update on 18 Sep 2015, which I reported on here, expressing my doubts about this company. Amazingly the shares have dropped 73% since then - just 2 months ago, which reinforces the general point that it's often best to sell immediately on the first sign of trouble.

The company claims to have net cash, which now represents a significant proportion of its own market cap, so if you think that some shareholder value might arise from this cash, then it might be worth considering for people prepared to take large risks!

For me, it's Greek, and on AIM, so that makes it an automatic bargepole. Why waste any time on looking at things like this, when they nearly all go wrong sooner or later? Although note that, unusually, this one does pay divis.

The Group maintains a strong balance sheet with net cash as of 31 October 2015 above €3.6 million (31.12.2014: € 2.42 million) while it paid dividends of € 280k to its shareholders within the current financial year. Over 90% of Group cash is maintained in banks in the United Kingdom. The Group does not generate any revenues in the Greek market.

This quality offering was launched on AIM in Jun 2014 by Strand Hanson, and Mirabaud Securities, at 212p per share. Since 88.3% of the company is owned by its Directors, you do wonder why they listed it at all? The 11.7% not owned by Directors is now only worth £562k, so it can't make any financial sense to remain listed. Therefore I see the risk of a de-listing as being quite high? Hence the shares are uninvestable in my view, for multiple reasons.

Idox (LON:IDOX)

Share price: 46p (up 1p today)

No. shares: 355.7m

Market cap: £163.6m

Trading update - there's an upbeat-sounding report today from this software group, which is mainly focussed on the public sector. The key paragraph says;

The Company is pleased to report its Adjusted* results for the year are expected to be in line with market expectations, and that it is maintaining its forward guidance.

Note that the group has been making acquisitions, which will obviously drive earnings growth, which needs to be considered when valuing the shares - one really shouldn't put a stock on a growth multiple, if it's just buying in that growth using debt.

Talking of which, debt (which has been problematic in the past here) is creeping up again - net debt is reported at £23.1m as at 31 Oct 2015.

I last reviewed Idox here on 8 Jun 2015, when it published interims, and quite liked it - although the balance sheet is weak, the business is decently cash generative, hence has demonstrated an ability to pay down debt, and make acquisitions without issuing new shares to any great extent, which is clearly a positive thing.

Valuation - this looks a sensible valuation, probably about right in my view, although if the company keeps putting out positive newsflow, then the market might run the share price up a bit higher, who knows?

InternetQ (LON:INTQ)

Share price: 171p (up 5% today)

No. shares: 40.3m

Market cap: £68.9m

Trading update, Q1-Q3 2015 - as always, the update from this company looks very positive. Turnover is said to be up 20% to E105.6m for 9 months of this year to date.

EBITDA is up 30% to E17.5m, although note that adjusted profit is only up 4% to E7.9m - presumably because the previously very heavy capitalisation of costs into intangible assets is now catching up with them, as the amortisation charge balloons.

My opinion - when I last reviewed this AIM listed Greek software company, I felt that its figures looked almost a carbon copy of Globo's. Although I should emphasise that was before the full extent of Globo's fraudulent activities came to light.

The similarities are marked though - in particular, excessive capitalisation of costs into intangibles, high debtors, holding a cash balance whilst simultaneously increasing bank debt, profits that don't turn into cash (because they are essentially fictitious - profit is created by capitalising costs), acquisitions of smaller companies, etc.

Plus of course the biggest red flag simply being that it's a Greek company on AIM. That alone makes it uninvestable, even without all the accounting nasties.

The one thing that has stopped me shorting this share (even though I think shorts will probably do well on this one, in the long run), is that Tosca invested E17m to buy a stake in InternetQ's music streaming business, called Akazoo. It's fair to say that Tosca has a very mixed track record, including some real howlers, like Cupid, Healthcare Locums, and others. So I certainly don't place any reliance on their judgement generally. However, they must have done some due diligence, to put E17m into Akazoo. That's enough of a factor to make me want to steer clear from risking a short on InternetQ.

The outcome with Globo, and the striking similarities between Globo and InternetQ's accounts, as probably enough to mean there's likely to be a dark cloud over this share for a long time to come. For that reason, it's not something that appeals in any way to me.

If it starts to generate real cashflow, and starts paying divis, then I would happily look at it again, but for now this remains on the Bargepole List. Another similarity with Globo is that the forward PER is extremely low, just 4.9. That in itself is another red flag - it tells us that the market doesn't believe the figures.

Lavendon (LON:LVD)

Share price: 140p (up 3.7% today)

No. shares: 169.7m

Market cap: £237.6m

(at the time of writing, I hold a long position in this share)

Trading update - since the share price has been so weak lately, and both Speedy Hire (LON:SDY) and HSS Hire (LON:HSS) issued profit warnings a little while ago, I was bracing myself for bad news from this equipment hire group.

Therefore, the upbeat trading update today made a pleasant surprise, and it's all the more surprising that the shares have only modestly bounced.

The key bit says;

"The Group's trading performance in the first nine months of the year has improved across our markets, driving growth in revenues, profitability and margins. The Board remains confident of delivering on its profit expectations for 2015, and with the delivery of the accelerated fleet investment now almost complete, we are well positioned to respond to market opportunities as we move into 2016."

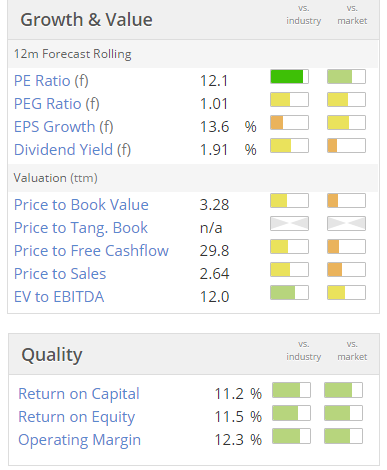

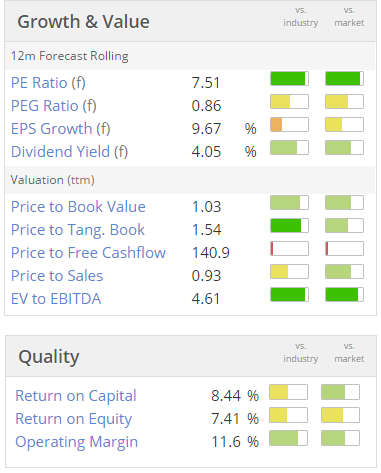

Valuation - given how modest the valuation is, this looks like a potentially good buying opportunity to me:

My opinion - I really like this one. The shares look strikingly cheap. Furthermore, it has a sound balance sheet, pays a generous dividend, is on a very low PER, and we now also know that it's trading fairly well. What's not to like?!

Maybe I've missed something important, but I really can't see why the market has sold this one off so much lately, there doesn't appear to be any fundamental reason for the recent falls. Therefore, I shall probably be increasing my position size here in the next few days.

Mobile Streams (LON:MOS)

Share price: 15.5p (up 1.6% today)

No. shares: 37.1m

Market cap: £5.8m

(at the time of writing, I hold a long position in this share)

AGM statement - this is a very speculative one, so probably shouldn't be in a value report. However, the company has net cash, and reports today that it had £1.75m in net cash a week ago. NTAV is £3.7m, so I suppose that on a balance sheet basis, there is some support to the price in value terms.

However, what interests me is that the company is expanding into new territories, and reports today that its operations in India have started. The company does ad-funded mobile phone games. It operates mainly in Latin America, and also USA, and Nigeria.

Normally of course this would be a bargepole stock, as it's overseas & AIM. However, I think purely as a speculation, there might be the chance of a multibagger here. It has the look & feel of something speculative that possibly might, at some point, catch the market's imagination, and soar. Certainly the shares have, to a certain extent, already done that recently. Whilst very volatile, the higher price appears to be holding, and volume has been high recently.

Imagine if the company's newsflow from India is positive? That could perhaps trigger a re-rating from a miserly £5.6m market cap to something a good bit higher, maybe?

I must stress again, this is a real punt. But I like the fact that it has cash in the bank, and in the past these shares have multibagged twice before - on the back of strong growth, and decent profits. It all went wrong when the Argentinian currency had all those problems, and the cash pile ended up marooned overseas.

However, to my mind this proves that the company has a proper business, which has been decently profitable before, and therefore who knows, might be again?

The long term chart shows that this share languished at 2-4p in 2009-10 but then multibagged to a peak of 33.8p in Mar 2011. It then dropped to a low of 9.8p in Feb 2012, before roaring off again to a new peak of 84p in Mar 2013. The most recent low, in Sep 2015 was about 4p. So at 15.5p it's already nearly 4-bagged in the last 2 months, and the mkt cap is still peanuts. Therefore, I am hoping that there's a chance of another multi-bag move from this share maybe? It's a real punt, but everyone likes a little bit of fizz in their portfolio! Wouldn't it all be boring is we didn't allocate a small chunk of the portfolio to have a bit of fun, which occasionally pays off?!

Note also that the number of shares in issue has only risen slightly during the moves noted above - from 36.3m shares in 2010, to 39.4m now. Therefore, theoretically, there's nothing to stop previous highs being revisited, if the fundamentals and outlook excite the market again.

So, not the sort of thing I normally comment on here, and it may well fail to multi-bag, but I think it looks potentially interesting, as a fun punt.

Blinkx (LON:BLNX)

Share price: 25.25p (down 1.9% today)

No. shares: 403.3m

Market cap: £101.8m

Interim results to 30 Sep 2015 - as expected, these figures are dreadful. The original business model broke, so they are now trying out other related things, to see if they can make the business viable again.

This is the trouble we are seeing over & over again with technology-related marketing companies. They hit a rich vein of profits, float the company at a high valuation, then quite soon afterwards, the wheels come off, and investors end up losing most of their money. We've seen this happen more recently with digital media companies, where ad-blocking software increasingly used by the public has just destroyed a whole sector almost overnight.

In H1 this year, Blinkx had a operating cashflow of minus $10.1m. Plus they spent $2.4m on development spending, so the way I look at it, they're running at an annualised cash loss of about $25m p.a.

The cash pile seems to be dwindling accordingly. So it's now reported at $74.9m, although there is another $7.5m which has appeared in "marketable securities" within fixed assets. I'm not sure what that is. If it was a cash equivalent, then it would be in current assets, not fixed assets.

If you can make sense of this outlook statement, then good for you!

The vision for the Company remains to connect consumers with brands through premium content across devices. With the key portfolio components in place, blinkx expects the second half of the financial year to show continued growth of Core mobile, video and Programmatic products, while actively managing down and potentially divesting Non-Core product lines. Integration, continued cost actions, the launch of new products and a return to profitability remain priorities, with key infrastructure milestones scheduled for completion through the first half of calendar 2016 that will simplify execution of multi-channel advertising campaigns for both advertisers and publishers.

The Company's mission is to democratize access to quality digital content in a way that is respectful of consumer choice, impactful for the advertiser and sustainable for the content owner. Solving this fundamental equation is critical in order for the industry to thrive. These basic tenets will guide blinkx's decision-making in the near- and long-term, and represent a path to sustainable growth for both the Company and industry.

My opinion - I would only take an interest in this share, if it was priced significantly below the company's own net cash, because the existing business appears to be a liability (as it's loss-making), rather than anything of value.

So to my mind it would only begin to look interesting at perhaps 10-12p per share, and then only as a complete punt.

As things stand, they don't have a viable business, but do at least have the luxury of a cash pile, which buys them time to sort things out. So it's not really an investment, it's just a complete punt at the moment, and not one that interests me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.