Good morning! The US political debt crisis seems to have been resolved for the time being, so that's good news, although markets correctly anticipated that a deal would happen. So my Put Options look as if they will be expiring worthless, but as they were purely a Hedge, I'm fine with that - they served their purpose, in enabling me to sleep at night when a major uncertainty overhung the market, and also meant that I was protected if the market had crashed. Although as a colleague pointed out to me, by the time you think about hedging a specific risk, it's too late, it's the things that you don't yet know about that move markets, which is a good point.

Overall, I remain of the view that many small to mid caps are looking pricey right now, although digging around I'm still finding bargains, and the beauty of small caps is that due to liquidity, there will always be the odd clumsy seller, who knocks a price sharply down. So if you're prepared (both in terms of having done your research, and being able to move fast in hitting the buy button when cheap stock becomes available) then there are still plenty of opportunities around. As mentioned yesterday, Spaceandpeople (LON:SAL) was a good example, where I was able to pick up more stock this week at what I think is an excellent price of 107p. That has locked in a growing dividend yield of over 4%, so it always pays to keep some powder dry for unexpected opportunities like that.

I'm also keeping some cash on the sidelines, and in my main account am roughly 70% invested, with no gearing. That seems to me a sensible level, given that we're probably in the late stages of a 5-year bull market. With things like the Royal Mail float happening, and other IPOs, I think we are also beginning to see a lot more interest in the Stock Market from the general public - which again is a classic sign of being not far from the end of a bull market.

Also, I'm finding that many people I talk to in the investing world are suddenly talking about "story stocks" these days - bragging about the multi-baggers they've had, even though the companies are often very poor quality, even insolvent on conventional bases, but nobody's interested because the shares have doubled/tripled. Stuff like that makes me really nervous, as it means people are chasing stories irrespective of value - again, all late stage bull market stuff. So I'm keeping my eyes firmly on the exit, although happy to run with good value stocks, and the odd story stock too, providing the valuation isn't too high.

Identity specialist, GB (LON:GBG) has put out a positive trading update, for the six months to 30 Sep 2013. I thought the shares looked expensive at around a quid, but they're now 135p, for a market cap of a whopping £149m. That looks a very racy valuation to me.

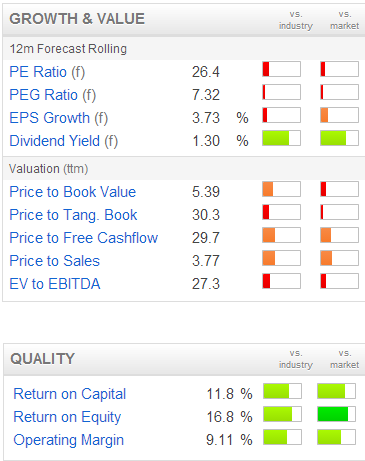

Here is the Stockopedia growth & value graphic, where you can see how the valuation (on forecast profit) is scoring very poorly (i.e. the shares are expensive). So it's not of any interest to me, even though they have reported this morning that H1 adjusted profits are expected to be up over 50% at "not less than £2.3m".

The outlook statement says;

"We enter the second half with confidence and momentum."

So it sounds good for the time being, but what if something goes wrong, or even if future results fall short of expectations? Then you're looking potentially at a big drop in the share price. I don't see how this one stacks up on a risk/reward basis, at this price.

Another point to bear in mind, is that even when the market overall is pricey, you can still find bargains because more boring, safe sectors tend to become unfashionable, and hence cheap. I recall back in 1998-2000 in the TMT* boom, you could pick up housebuilders and good quality small to medium retailers on PERs as low as 4. The reason was that, even though the market overall was booming, people were chasing story stocks & raising the money to buy often complete rubbish, by selling down their holdings in good quality, but boring companies. (* TMT = Technology, Media & Telecoms).

I think we might well see the same happening again now, on a smaller scale, as people speculate more on story stocks, and turn a blind eye to value. That's fine by me, as I'm happy to pick up the unfashionable stuff on the cheap, as well as picking up the odd story stock at the right price, before the hoardes have descended on them. My story stock picks currently are Clean Air Power (LON:CAP) and Seeing Machines (LON:SEE). Although in both cases, they have a real product that is selling, and neither is making heavy losses (Edit: a reader has kindly pointed out that SEE recently moved into profit), so they're more early stage growth companies, rather than story stocks as such.

Paradoxically, it's often easier for blue sky companies to get a higher valuation, especially if they are zero turnover companies, because people can let their imagination run riot over the future potential, whereas if you do actually have turnover, people will forecast the future based on the existing figures, which tend to make those forecasts more grounded.

The other key thing is not to fall in love with the story or the stock. We've all done it before, and need to make sure we don't do it again this time - this is my third major bull market, so one really should be wise to this kind of stuff by now, and it's amazing how the mood of Mr Market can change very quickly from euphoric to depressed - the money needs to be in the Bank before that happens.

Anyway, late stage bull markets become a game of pass the parcel, where everyone knows the stocks they're holding are over-priced, but are all gambling that they won't be the one holding when the music stops. Unless you're a very shrewd trader, I think that's a mug's game, so I'll stick to value and GARP, which should mean that if/when the market does correct downwards, the impact should be small & I'll have cash to pick up the bargains from forced sellers. Remember that a lot of people are in this market using gearing, and we regularly see fashionable stocks plunge as waves of forced sellers are closed out by the SB companies.

Not a great deal of trading statements this morning, hence why I decided to do a more general, strategic bit of commentary this morning. However, let's now return to some more company news.

Regulars will know that one of my least favourite companies (due to very aggressive accounting, inability to generate cash, and excessive hype) is Globo (LON:GBO). They have done another fund-raising, this time a Placing at 71p, to raise £24m before costs. It seems very odd to me that such a highly profitable company has to repeatedly raise cash from the market. Probably because the profits end up in debtors on the Balance Sheet, hence one has to question how real they are?

I might turn out to be wrong on this company, but there are enough red flags in their accounts to make the outcome irrelevant for me - the risk is too high, so it's uninvestable as far as I'm concerned. The key items of concern being that debtors are far too stretched (usually a sign of write-offs to come), and that EBITDA is highlighted as the key performance measure, even though it ignores a large amount of their operating costs (which are capitalised).

Interesting to see that Directors didn't buy any Placing stock, but instead used it as an opportunity to offload 1m shares of their own - another red flag. I'm sure that bulletin board rampers will be taking my name in vain over this, but I just speak as I find, and have no position in the company.

The danger of De-Listings has receded somewhat, as we're in a bull market for small caps, so companies can perhaps see more value in maintaining a Listing once their share price comes alive again. Also, a point that has been made to me several times this year by Directors of small Listed companies, is that there can be major benefits from being Stock Market Listed - primarily in terms of how the company is perceived by customers & suppliers. So it definitely helps some small companies punch well above their weight, and enables them to win contracts that would have been out of reach had they not been Listed. A Listing does therefore give considerable credibliity to a company.

On the other hand, there comes a point where the costs outweigh the benefits, and whenever companies announce their intention to De-List, it's a pretty much instant 50%+ loss for investors. So a massive risk. It's therefore worth checking what type of companies announce an intention to De-List, and avoid other similar companies.

The latest one to announce an intention to De-List is Prime Focus London (LON:PFO). It's market cap is only £1.8m, which is too small to be Listed really. Also, it has a poor track record of mostly being loss-making, and clearly has problem levels of debt. Their largest shareholder holds almost 60%, so another red flag there. Hence overall, there are 4 clear red flags there (too small, loss-making, high debt, and too big major shareholder) which satisfy me that I would never hold shares in anything like this. So no need to adjust any of my usual risk parameters.

Investors outside of London often complain that they can't get to meetings that are nearly always in London. So it's good to see an event being arranged in Manchester (Mon 21 Oct, at the MalMaison Hotel, 1-3 Piccadilly, Manchester) - it's a Private Investor meeting with the Directors of Matchtech (LON:MTEC), a recruitment company. Equity Development are organising it, please email Hannah@equitydevelopment.co.uk if you would like to attend.

Michelmersh Brick Holdings (LON:MBH) announce the completion of their land sale, 15 acres in Telford, for £4.6m, with £3m of that deferred. the last paragraph of their statement today sounds encouraging (my bolding):

"We are, however, principally a brick manufacturer and we continue to compete strongly in a market that is showing signs of price recovery. The upturn in demand we have seen over the past few months is encouraging us to invest in our existing plants to increase capacity and efficiency, which will, in due course, increase Group revenue."

Companies like Speedy Hire (LON:SDY) are interesting to look at, as they can be a good barometer of the economy overall, or at least the construction sector. Their trading update today is surprisingly downbeat. We've been hearing a lot of positive news about economic recovery, but Speedy Hire say:

Whilst we are yet to see any material improvement in construction work ...

The UK market "remains challenging", they say, so perhaps we ought not to get too excited about pricing in too much economic recovery into shares just yet?

That's it for today. There's a good lively debate in the comments section below, which almost got out of hand, but didn't thankfully! So do please feel free to join in - all views are welcomed, providing they are evidence-based, and reasonably courteous.

A lot of people don't seem to realise this, but you can sign up for Stockopedia completely free (not the free trial, but a completely free account), but the link is very small, buried in the Plans page. That enables basic features, and allows you to comment after articles, and create your own threads on the Discussion pages here. Obviously it helps the guys to develop the site further if people take out paid subscriptions, but a free account is a good way to start.

OK, that's me done for today. See you from 8 am again tomorrow morning!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in SAL, SEE, and CAP, and no short positions

A Small Caps Fund to which Paul provides research services also has a long position in SAL)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.