Good morning!

Thank you to ShareSoc for organising, and FinnCap for hosting, last night's investor evening. Four companies presented, but due to time pressures I was only able to attend for the first half.

Avation (LON:AVAP) - (I hold a long position in this share) - this aircraft leasing company sends its finance guy, the affable Richard Wolanski along to numerous investor events, which does make me wonder whether the law of diminishing returns is in play? The narrative always sounds so good, but chatting to investors afterwards, there's a slight sense of unease about this company, that nobody can quite put their finger on. The business model is clearly working well at the moment, but doubts remain about plane residual values in the next recession. That said, I'm tempted to add to my (small) long position on the next dip in price, as there's good growth coming through this year, with 10 new planes being added to the fleet, which will help dilute admin costs more, thus improving profitability.

Somero Enterprises Inc (LON:SOM) - (I hold a long position in this share) - I was very keen to meet the Directors of this laser-guided concrete screeding machine maker. They were over from America, and gave a clear explanation of what the company does, and its history. I particularly liked the Q&A session, led by the CEO, Jack Cooney, who gave very straightforward answers, and didn't try to gloss over the cyclicality of the business. Although his feeling was that the inevitable future economic downturns are not likely to be as savage as 2007-8, and the company's finances are now in much better shape to withstand a downturn (with net cash, instead of net debt as was the shaky position in 2008).

The unknown factor is Chinese demand, but the CEO sounded pretty happy with things, and confirmed what they have said in trading updates this year to date, that the outlook for 2015 is positive, despite Chinese uncertainty. It's the buoyant US market that matters most to Somero anyway.

Right, on to today's results & trading updates.

Indigovision (LON:IND)

Share price: 227p (down 7% today)

No. shares: 7.6m

Market cap: £17.3m

(at the time of writing I hold shares in this company)

Interim results to 30 Jun 2015 - these figures need to be read in the context of a profit warning on 28 Apr 2015, which said that lumpy orders (the company's Achilles Heel unfortunately) meant that H1 would record an operating loss, with an improved performance anticipated in H2.

It struck me that today's results are consistent with that - although the 29% drop in turnover to $22.6m in H1 was bigger than I was expecting. The impact has been mitigated by prompt action to cut costs (overheads are down 19%), so the $1.26m operating loss is obviously a poor result, but not disastrous. A tax credit reduces the loss after tax to $0.92m, or £0.6m.

Narrative & outlook - personally I found this encouraging. Details are given of "major new project wins", and new product launches, such as the body worn video cameras, designed for Police, etc., and software improvements.

The prospects for H2 are positive;

After a disappointing start to 2015, the Group experienced an improving trend in financial results as the first half progressed. The pipeline of large projects for the second half is significantly stronger than the first half and, as a consequence of this and management actions taken to reduce costs, profitability in the second half is expected comfortably to exceed first half losses.

That last sentence is key - clearly current trading is good, and the company is saying it will recoup all of the H1 losses in H2.

Dividends - the H1 divi has been passed, but;

We currently expect to recommend a final dividend to shareholders along with the annual results.

That's fine with me - I wouldn't want the company to stretch the balance sheet by paying out divis that are not covered by earnings. The company reminds us today that it has paid out 108p in total divis since Jan 2012.

Balance Sheet - stock are debtors are both looking a bit heavy - although in the past stock rising has been a positive sign, as it's tended to be a precursor to higher sales.

The cash position has deteriorated sharply, and for the first time the company has net debt, of $464k. Although that doesn't particularly concern me because it should move back into net cash in H2.

Net tangible assets is still strong, at $23.3m, or £15.0m, which is nearly as much as the market cap. So good asset backing overall.

Bull case - I see the glass half full here, and the positive current trading outweighs the disappointing H1 performance, in my view. New product launches, and big recent contract wins, make it clear to me that there's still very much everything to play for here. I can forgive them one poor half year, whilst remaining frustrated at the inconsistent performance, which has caused lots of disappointments in the past.

Bear case - talking to friends this morning, the negative view is that the H1 loss was worse than they expected, and bears don't believe that the company will achieve current full year forecasts (of 19.4p EPS). So bears have seen today's results as a veiled profit warning, with another downgrade in broker forecasts possible or likely, which would then put the shares on an unattractive valuation.

Bears also focus on the deteriorating cash position, and the company's history of missing forecasts.

So there we go, take your pick - your money, your choice!

FW Thorpe (LON:TFW)

Share price: 193p (up 5% today)

No. shares: 115.7m

Market cap: £223.3m

Results year ended 30 Jun 2015 - I hadn't noticed how much these shares have risen in the last year, as they had seemed to be stuck between 100-130p throughout 2013-14, but they've shot up about 50% further this year.

The figures announced today look very good;

- Revenue up 19.9% to £73.5m (of which 14.5% is organic, and the balance due to the acquisition of Lightronics)

- Operating profit up 16.7% to £13.7m, so a slightly lower profit margin, but still a good increase

- Basic EPS on continuing operations up 14.6% to 10.12p

Therefore the PER on 2014/15 earnings is now quite high, at 19.1, which in my view is looking a bit stretched now - historically this company has tended to be valued on a PER in the low teens. So whilst it's not one I hold, if I did then I'd be taking some money off the table at this new, higher rating.

Although two factors make the premium rating less of an issue;

Firstly the company has a tremendously strong balance sheet, with no debt, and £28.5m in cash.

Secondly, the Lightronics acquisition will contribute a full year to profits in 2015/16, whereas it only contributed 3 months in 2014/15. The difference (assuming static profitability) should give a boost of £0.7m to 2015/16 profits.

Outlook comments (below) sound upbeat, and the wording gives an inkling of the homespun style of this family company. That's a strength, not a weakness, in my view - this company seems very well run, from what I've observed from its results over the years.

On the bright side, however, F W Thorpe Plc has numerous new and innovative luminaires and systems which will be brought to the market in coming months. Further, of the two laggards mentioned last year, one has gone and the other appears to be catching up!

This year your company has improved margins on LED products, mentioned as one of our aims last year and we are now almost on a continual basis looking to expand our sales platform.

We will, as always, "try and do better than last year".

My opinion - as mentioned above, I think it looks fully valued for now. But there again, I said that at 150p, and it's now nearly 30% higher, so what do I know?!

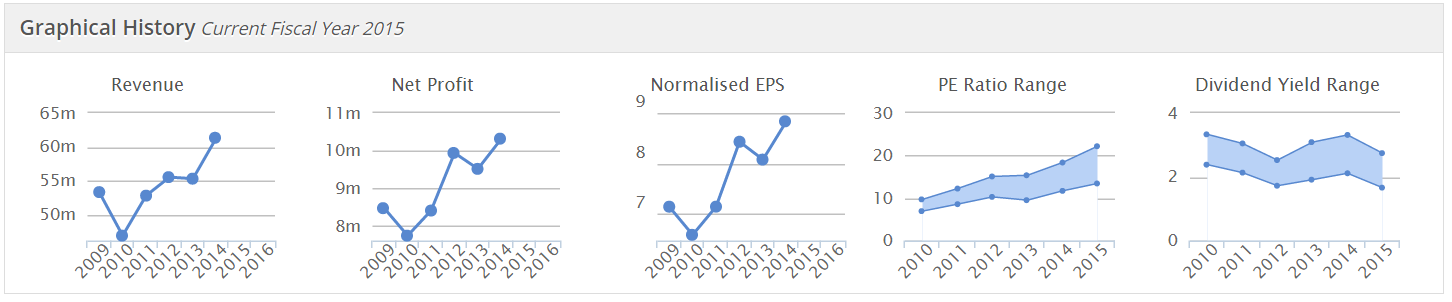

It's a smashing, high quality company though, so overall it's still one I like, but am less comfortable with the valuation now. As you can see from the Stockopedia graphs below, especially the "PE Ratio Range" chart, the shares have been getting steadily more expensive over the last 5 years, which arguably is a one-off re-rating, and doesn't leave any room for manoeuvre now perhaps? Is it really justified to be paying nearly 20 times earnings now, for a company that is very similar to five years ago, when it was on a PER of 10?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.